Simulations Plus Reports Preliminary Revenues for Fourth Quarter and Fiscal Year 2016

September 12 2016 - 8:30AM

Business Wire

Company Reports Record Fourth-Quarter and

Full-Year Revenues

Simulations Plus, Inc. (NASDAQ: SLP), a leading provider of

consulting services and software for pharmaceutical discovery and

development, today released preliminary revenues for its fiscal

fourth quarter (4QFY16) and full fiscal year 2016 (FY2016) ended

August 31, 2016.

Mr. John R. Kneisel, chief financial officer of Simulations

Plus, stated: “We have completed our second year of operations

following our September 2014 acquisition of Cognigen Corporation;

an acquisition which delivered the expected benefits such as

expanded addressable market, synergies across our software and

consulting business, increased scale, and greater profitability. In

accordance with our policy to release timely financial information

to our shareholders, we are releasing preliminary consolidated

annual and fourth quarter revenues. Net income will not be released

until completion of our annual audit and review of our Annual

Report on Form 10-K. We expect to file our 10-K with the U.S.

Securities and Exchange Commission on or before the November 14,

2016 deadline.”

Preliminary results for the fiscal year:

- Consolidated software and

software-related services increased 10.7% to a record $13.85

million for FY2016 compared to $12.5 million in FY2015

- Consolidated consulting revenues

increased 4.1%, or $238,000, to $6.04 million compared to $5.80

million in FY2015

- Total preliminary consolidated revenues

for FY2016 increased 8.6%, or $1.57 million, to a record $19.89

million, compared to $18.31 million for FY2015

- For FY2016, approximately 69.5% of

revenues came from software licenses and software-related services

and approximately 30.5% of revenues came from consulting studies

and collaborations

- Cash remains strong. As of August 31,

2016, cash was $8.0 million after distributing approximately

$861,000 in dividends to shareholders on August 18, 2016 (for a

total of $3.41 million in dividends distributed during FY2016),

along with payments to TSRL and the final payment of $720,000 for

the Cognigen acquisition made in July. Cash as of today is $8.5

million.

Preliminary results for the quarter:

- Consolidated software and

software-related services increased 19.1% to a record $2.60 million

for 4QFY16 compared to $2.18 million in 4QFY15

- Consolidated 4QFY16 consulting revenues

decreased 16.6%, or $225,000, to $1.28 million from $1.53 million

in 4QFY15, impacted by several customers’ failed clinical trials

and delayed trials that we noted last quarter

- Total preliminary revenues for 4QFY16

increased 4.4% to $3.87 million, a new fourth quarter record,

compared to $3.71 million reported for 4QFY15

- For the quarter, approximately 66.3% of

revenues came from software and software-related services, and

approximately 33.7% of revenues came from consulting studies and

collaborations

- During 4QFY16, the company added 21 new

software customers and a total of 76 for FY2016

- Annual recurring customer renewal rate

was 88% (total accounts) and 95% based on revenue.

John DiBella, vice president for marketing and sales of

Simulations Plus, said: “As anticipated, FY2016 finished on a solid

note, with a substantial percentage of software revenue growth

coming from new clients, including several licenses from

non-pharmaceutical markets subscribing to our tools. The pipeline

for PBPK and pharmacometric modeling projects is strong and

continues to improve as we head into FY2017, helping to offset a

modest decrease in consulting revenue in the fourth quarter of

fiscal year 2016. We have a busy fall season ahead of us, as we are

attending numerous conferences to promote several new product

releases, including PKPlus™, and hosting trainings and workshops

around the globe to continue to educate industry and regulatory

scientists on mechanistic modeling & simulation. We believe

these efforts should help us maintain our longstanding revenue

growth momentum.”

Walt Woltosz, chairman and chief executive officer of

Simulations Plus, added: “We’re very pleased with a 19% increase in

software and software-related services revenues. Of course, we’re

not satisfied with the negative growth in consulting revenues for

the fourth quarter, but we are pleased that for the fiscal year,

consulting revenues showed over four percent increase in spite of

the negative impact of the third and fourth quarter effects when

some of our customers’ clinical trials failed and some were

delayed. With our announcement of the launch of PKPlus™ two weeks

ago and continued growth in our other software revenues and in our

consulting business, we are expecting a strong new fiscal

year.”

About Simulations Plus, Inc.

Simulations Plus, Inc., is a premier developer of drug discovery

and development software as well as a leading provider of both

preclinical and clinical pharmacometric consulting services for

regulatory submissions. The company is a global leader focused on

improving the ways scientists use knowledge and data to predict the

properties and outcomes of pharmaceutical and biotechnology agents.

Our software is licensed to and used in the conduct of drug

research by major pharmaceutical and biotechnology companies and

regulatory agencies worldwide. Our innovations in integrating new

and existing science in medicinal chemistry, computational

chemistry, pharmaceutical science, biology, and physiology into our

software have made us the leading software provider for

physiologically based pharmacokinetic modeling and simulation. For

more information, visit our website at

www.simulations-plus.com.

Follow Us on Twitter

Safe Harbor Statement Under the Private Securities Litigation

Reform Act of 1995 – With the exception of historical

information, the matters discussed in this press release are

forward-looking statements that involve a number of risks and

uncertainties. Words like “believe,” “expect” and “anticipate” mean

that these are our best estimates as of this writing, but that

there can be no assurances that expected or anticipated results or

events will actually take place, so our actual future results could

differ significantly from those statements. Factors that could

cause or contribute to such differences include, but are not

limited to: our ability to maintain our competitive advantages,

acceptance of new software and improved versions of our existing

software by our customers, the general economics of the

pharmaceutical industry, our ability to finance growth, our ability

to continue to attract and retain highly qualified technical staff,

our ability to identify and close acquisitions on terms favorable

to the Company, and a sustainable market. Further information on

our risk factors is contained in our quarterly and annual reports

as filed with the U.S. Securities and Exchange Commission.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160912005294/en/

Simulations Plus Investor

RelationsMs. Renee Bouche,

661-723-7723renee@simulations-plus.comorHayden IRMr. Cameron Donahue,

651-653-1854cameron@haydenir.com

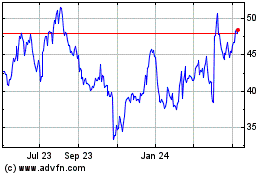

Simulations Plus (NASDAQ:SLP)

Historical Stock Chart

From Mar 2024 to Apr 2024

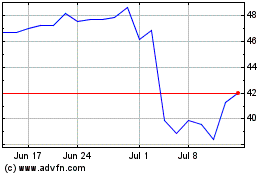

Simulations Plus (NASDAQ:SLP)

Historical Stock Chart

From Apr 2023 to Apr 2024