CEMEX Announces Divestment of Its Fairborn Cement Plant in the U.S.

September 12 2016 - 6:30AM

Business Wire

CEMEX, S.A.B. de C.V. (“CEMEX”) (NYSE: CX) announced today that

one of its subsidiaries in the U.S. has signed a definitive

agreement for the sale of its Fairborn, Ohio cement plant and

cement terminal in Columbus, Ohio to Eagle Materials Inc. for

approximately U.S.$400 million. 2016 EBITDA for the divested assets

is estimated to be U.S.$33 million.

The proceeds obtained from this transaction will be used mainly

for debt reduction and for general corporate purposes.

The closing of this transaction is subject to the satisfaction

of certain conditions, including approval from regulators. We

currently expect to finalize this divestiture during the fourth

quarter of 2016 or soon thereafter.

Bank of America Merrill Lynch is acting as financial advisor to

CEMEX in this transaction.

CEMEX is a global building materials company that provides high

quality products and reliable service to customers and communities

in more than 50 countries. Celebrating its 110th anniversary, CEMEX

has a rich history of improving the well-being of those it serves

through innovative building solutions, efficiency advancements, and

efforts to promote a sustainable future.

This press release contains forward-looking statements and

information that are necessarily subject to risks, uncertainties

and assumptions. Many factors could cause the actual results,

performance or achievements of CEMEX to be materially different

from those expressed or implied in this release, including, among

others, not satisfying the conditions to sell the above described

assets, changes in general economic, political, governmental and

business conditions globally and in the countries in which CEMEX

does business, changes in interest rates, changes in inflation

rates, changes in exchange rates, the level of construction

generally, changes in cement demand and prices, changes in raw

material and energy prices, changes in business strategy and

various other factors. Should one or more of these risks or

uncertainties materialize, or should underlying assumptions prove

incorrect, actual results may vary materially from those described

herein. CEMEX assumes no obligation to update or correct the

information contained in this press release.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160912005492/en/

CEMEXMedia RelationsJorge Pérez, +52(81)

8888-4334mr@cemex.comorInvestor RelationsEduardo

Rendón, +52(81) 8888-4256ir@cemex.comorAnalyst

RelationsLucy Rodriguez, +1-212-317-6007ir@cemex.com

Cemex SaB De Cv (NYSE:CX)

Historical Stock Chart

From Mar 2024 to Apr 2024

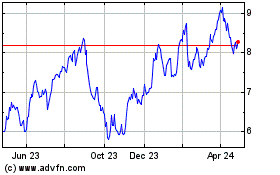

Cemex SaB De Cv (NYSE:CX)

Historical Stock Chart

From Apr 2023 to Apr 2024