Current Report Filing (8-k)

September 09 2016 - 4:33PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

Current Report

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) September 6, 2016

Universal Logistics Holdings, Inc.

(Exact name of registrant as specified in its charter)

|

Michigan

|

0-51142

|

38-3640097

|

|

(State or other jurisdiction

of incorporation)

|

(Commission

File Number)

|

(I.R.S. Employer

Identification No.)

|

12755 E. Nine Mile Road, Warren, Michigan

(Address of principal executive offices)

48089

(Zip Code)

(586) 920-0100

(Registrant’s telephone number, including area code)

(Former name, former address and former fiscal year, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

o

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 1.01

Entry

into

a

Material Definitive Agreement

.

On September 6, 2016, UTSI Finance, Inc. (“Borrower”), a wholly-owned subsidiary of Universal Logistics Holdings, Inc. (the “Company”), entered into a loan and financing agreement (the “Loan Agreement”) with Flagstar Bank (“Flagstar”), along with a promissory note (the “Secured Note”) and commercial mortgage (the “Mortgage”). Under the Loan Agreement and Note, Flagstar loaned $18,975,000 to Borrower in order for Borrower to repay a portion of Borrower’s previously reported, unsecured promissory note in the principal amount of $22.5 million dated August 8, 2016 (the “Unsecured Note”) issued to Crown Enterprises, Inc. (“Crown”). Crown is a subsidiary of CenTra, Inc., a related party, and Borrower issued the Unsecured Note in connection with its purchase from Crown on August 8, 2016 of a multi-building, cross-dock logistics terminal located in Romulus, Michigan (the “Terminal”). The Secured Note bears interest at a rate of LIBOR plus 2.25%, and will be repaid in consecutive monthly installment payments of principal and accrued interest beginning October 1, 2016. The Secured Note matures on September 5, 2026. Borrower granted to Flagstar a first priority mortgage on the Terminal pursuant to the Mortgage as security for Borrower’s obligations under the Loan Agreement and Note. Except for obligations subject to any interest rate swap agreement, Borrower may prepay all or a portion of the Secured Note, plus applicable breakage charges and fees. The Loan Agreement also contains customary affirmative and negative covenants and events of default, and requires Borrower to maintain a debt service coverage ratio of not less than 1.02:1. As of September 6, 2016, the remaining principal balance on the Unsecured Note was approximately $3.7 million, and such is amount due on or before August 15, 2026.

The foregoing summary does not purport to be complete and is subject to, and qualified in its entirety by, the full text of the Loan Agreement, Secured Note and Mortgage, which are filed as Exhibits 10.1, 10.2 and 10.3, respectively, and incorporated by reference into this current report.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The information set forth under Item 1.01 of this current report on Form 8-K is hereby incorporated by reference into this Item 2.03.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

|

|

|

|

10.1

|

|

Loan and Financing Agreement dated September 6, 2016 between UTSI Finance and Flagstar.

|

|

|

|

|

|

10.2

|

|

Promissory Note dated September 6, 2016 by UTSI Finance in favor of Flagstar.

|

|

|

|

|

|

10.3

|

|

Commercial Mortgage dated September 6, 2016 between UTSI Finance and Flagstar.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

|

UNIVERSAL LOGISTICS HOLDINGS, INC.

|

|

|

|

|

|

|

|

|

Date: September 9, 2016

|

|

|

/s/ Steven Fitzpatrick

|

|

|

|

|

|

Steven Fitzpatrick

|

|

|

|

|

|

Secretary

|

|

EXHIBIT INDEX

|

|

|

|

|

Exhibit No.

|

|

Description of Exhibit

|

|

|

|

|

|

10.1

|

|

Loan and Financing Agreement dated September 6, 2016 between UTSI Finance and Flagstar.

|

|

|

|

|

|

10.2

|

|

Promissory Note dated September 6, 2016 by UTSI Finance in favor of Flagstar.

|

|

|

|

|

|

10.3

|

|

Commercial Mortgage dated September 6, 2016 between UTSI Finance and Flagstar.

|

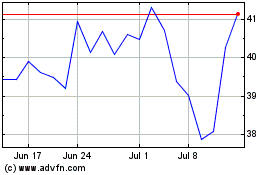

Universal Logistics (NASDAQ:ULH)

Historical Stock Chart

From Mar 2024 to Apr 2024

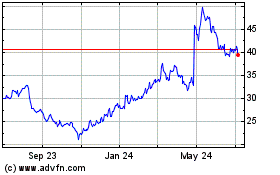

Universal Logistics (NASDAQ:ULH)

Historical Stock Chart

From Apr 2023 to Apr 2024