Pursuant to this prospectus supplement and the accompanying prospectus, we are offering for sale 24,800,000 Series E units, with each Series E unit

consisting of one share of our common stock and one half of one Series I warrant to purchase one share of our common stock. Each full Series I warrant gives the warrant holder the right to purchase one share of our common stock. Each

Series E unit will be sold at a price of $0.55 per unit. The Series E units will not be issued or certificated. The shares of common stock and the warrants are immediately separable and will be issued separately, but will be purchased

together in this offering.

We are also offering to those purchasers whose purchase of Series E units in this offering would result in the purchaser,

together with its affiliates and certain related parties, beneficially owning more than 4.99% of our outstanding common stock following the consummation of this offering, the opportunity to purchase, in lieu of Series E units that would

otherwise result in ownership in excess of 4.99% of our outstanding common stock, 3,700,000 Series F units. Each Series F unit will consist of one pre-funded Series J warrant to purchase one share of our common stock and one half of one

Series I warrants to purchase one share of our common stock. Each full pre-funded Series J warrant gives the warrant holder the right to purchase one share of common stock and each full Series I warrant gives the warrant holder the right

to purchase one share of common stock. Each Series F unit will be sold at a price of $0.54 per unit. The Series F units will not be issued or certificated. The warrants are immediately separable and will be issued separately, but will be

purchased together in this offering.

The shares of our common stock issuable from time to time upon exercise of the pre-funded Series J warrants and the

Series I warrants are also being offered pursuant to this prospectus supplement and the accompanying prospectus.

The Series I warrants will be

exercisable during the period commencing on the date of original issuance and ending on September 13, 2021, the expiration date of the Series I warrants, at an initial exercise price of $0.55 per share of common stock. The pre-funded

Series J warrants will be exercisable during the period commencing on the date of original issuance and ending on September 13, 2017, the expiration date of the pre-funded Series J warrants, at an exercise price of $0.55 per share of

common stock. The exercise price of $0.55 per share will be pre-paid, except for a nominal exercise price of $0.01 per share, upon issuance of the pre-funded Series J warrants and, consequently, no additional payment or other consideration

(other than the nominal exercise price of $0.01 per share) will be required to be delivered to the Company by the holder upon exercise. See “Description of Our Common Stock” and “Description of Our Warrants” for more information

on the securities offered hereby.

Our common stock is traded on the NASDAQ Capital Market under the symbol “GEVO.” On September 7, 2016,

the last reported sale price of our common stock on the NASDAQ Capital Market was $0.70 per share. The warrants are not and will not be listed for trading on the NASDAQ Capital Market, or any other securities exchange.

Delivery of the shares of common stock and warrants is expected to be made on or about September 13, 2016.

ABOUT THIS PROSPECTUS SUPPLEMENT

This prospectus supplement and the accompanying prospectus are part of a registration statement that we filed with the U.S. Securities and

Exchange Commission (the “SEC”) utilizing a “shelf” registration process. This document is in two parts. The first part is this prospectus supplement, including the documents incorporated by reference herein, which describes the

specific terms of this offering. The second part, the accompanying prospectus, including the documents incorporated by reference therein, provides more general information. Generally, when we refer to the prospectus, we are referring to both parts

of this document combined. We urge you to carefully read this prospectus supplement and the accompanying prospectus, and the documents incorporated by reference herein and therein, before buying any of the securities being offered under this

prospectus supplement. This prospectus supplement may add or update information contained in the accompanying prospectus and the documents incorporated by reference therein. To the extent that any statement we make in this prospectus supplement is

inconsistent with statements made in the accompanying prospectus or any documents incorporated by reference therein that were filed before the date of this prospectus supplement, the statements made in this prospectus supplement will be deemed to

modify or supersede those made in the accompanying prospectus and such documents incorporated by reference therein.

You should rely only

on the information contained in this prospectus supplement and the accompanying prospectus or incorporated by reference herein or therein. We have not authorized anyone to provide you with different information. No dealer, salesperson or other

person is authorized to give any information or to represent anything not contained in this prospectus supplement and the accompanying prospectus. You should not rely on any unauthorized information or representation. This prospectus supplement is

an offer to sell only the securities offered hereby, and only under circumstances and in jurisdictions where it is lawful to do so. You should assume that the information in this prospectus supplement and the accompanying prospectus is accurate only

as of the date on the front of the applicable document and that any information we have incorporated by reference is accurate only as of the date of the document incorporated by reference, regardless of the date of delivery of this prospectus

supplement or the accompanying prospectus, or the date of any sale of a security.

Unless otherwise mentioned or unless the context

requires otherwise, all references in this prospectus to “the Company,” “we,” “us,” “our,” and “Gevo” refer to Gevo, Inc., a Delaware corporation, and its consolidated subsidiaries.

S-ii

CONVENTIONS THAT APPLY TO THIS PROSPECTUS SUPPLEMENT

This prospectus supplement and the accompanying prospectus contain estimates and other information concerning our target markets that are

based on industry publications, surveys and forecasts, including those generated by the U.S. Energy Information Association (the “EIA”), the International Energy Agency (the “IEA”), and Nexant, Inc. (“Nexant”). Certain

target market sizes presented in this prospectus supplement have been calculated by us (as further described below) based on such information. This information involves a number of assumptions and limitations and you are cautioned not to give undue

weight to this information. Please read the section of this prospectus supplement entitled “Cautionary Note Regarding Forward-Looking Statements.” The industry in which we operate is subject to a high degree of uncertainty and risk due to

a variety of factors, including those described in the section entitled “Risk Factors” beginning on page S-10. These and other factors could cause actual results to differ materially from those expressed in these publications, surveys

and forecasts.

With respect to calculation of product market volumes:

|

|

•

|

|

product market volumes are provided solely to show the magnitude of the potential markets for isobutanol and the products derived from it. They are not intended to be projections of our actual isobutanol production or

sales;

|

|

|

•

|

|

product market volume calculations for fuels markets are based on data available for the year 2013 (the most current data available to the Company from the IEA);

|

|

|

•

|

|

product market volume calculations for chemicals markets are based on data available for the year 2012 (the most current data available to the Company from Nexant); and

|

|

|

•

|

|

volume data with respect to target market sizes is derived from data included in various industry publications, surveys and forecasts generated by the EIA, the IEA and Nexant.

|

We have converted these market sizes into volumes of isobutanol as follows:

|

|

•

|

|

we calculated the size of the market for isobutanol as a gasoline blendstock and oxygenate by multiplying the world gasoline market volume by an estimated 12.5% by volume isobutanol blend ratio;

|

|

|

•

|

|

we calculated the size of the specialty chemicals markets by substituting volumes of isobutanol equivalent to the volume of products currently used to serve these markets;

|

|

|

•

|

|

we calculated the size of the petrochemicals and hydrocarbon fuels markets by calculating the amount of isobutanol that, if converted into the target products at theoretical yield, would be needed to fully serve these

markets (in substitution for the volume of products currently used to serve these markets); and

|

|

|

•

|

|

for consistency in measurement, where necessary we converted all market sizes into gallons.

|

Conversion into gallons for the fuels markets is based upon fuel densities identified by Air BP Ltd. and the American Petroleum Institute.

S-iii

PROSPECTUS SUPPLEMENT SUMMARY

This summary is not complete and does not contain all of the information that you should consider before investing in the securities

offered by this prospectus. You should read this summary together with the entire prospectus supplement and the accompanying prospectus, including our financial statements, the notes to those financial statements and the other documents that are

incorporated by reference in this prospectus supplement and the accompanying prospectus, before making an investment decision. See the “Risk Factors” section of this prospectus supplement beginning on page S-10 for a discussion of the

risks involved in investing in our securities.

Our Business

We are a renewable chemicals and next generation biofuels company. We have developed proprietary technology that uses a combination of

synthetic biology, metabolic engineering, chemistry and chemical engineering to focus primarily on the production of isobutanol, as well as related products from renewable feedstocks. Isobutanol is a four-carbon alcohol that can be sold directly for

use as a specialty chemical in the production of solvents, paints and coatings or as a value-added gasoline blendstock. Isobutanol can also be converted into butenes using dehydration chemistry deployed in the refining and petrochemicals industries

today. The convertibility of isobutanol into butenes is important because butenes are primary hydrocarbon building blocks used in the production of hydrocarbon fuels, lubricants, polyester, rubber, plastics, fibers and other polymers. We believe

that the products derived from isobutanol have potential applications in substantially all of the global hydrocarbon fuels markets and in approximately 40% of the global petrochemicals markets.

In order to produce and sell isobutanol made from renewable sources, we have developed the Gevo Integrated Fermentation Technology

®

(“GIFT

®

”), an integrated technology platform for the efficient production and separation of renewable isobutanol. GIFT

®

consists of two components, proprietary biocatalysts that convert sugars derived from multiple renewable feedstocks into isobutanol through fermentation, and a proprietary separation unit that is

designed to continuously separate isobutanol during the fermentation process. We developed our technology platform to be compatible with the existing approximately 25 billion gallons per year (“BGPY”) of global operating ethanol production

capacity, as estimated by the Renewable Fuels Association.

GIFT

®

is designed to

permit (i) the retrofit of existing ethanol capacity to produce isobutanol, ethanol or both products simultaneously, or (ii) the addition of renewable isobutanol or ethanol production capabilities to a facility’s existing ethanol

production by adding additional fermentation capacity side-by-side with the facility’s existing ethanol fermentation capacity (collectively referred to as “Retrofit”). Having the flexibility to switch between the production of

isobutanol and ethanol, or produce both products simultaneously, should allow us to optimize asset utilization and cash flows at a facility by taking advantage of fluctuations in market conditions.

GIFT

®

is also designed to allow relatively low capital expenditure Retrofits of existing ethanol facilities, enabling a relatively rapid route to isobutanol production from the fermentation of

renewable feedstocks. We believe that our production route will be cost-efficient, enable relatively rapid deployment of our technology platform and allow our isobutanol and related renewable products to be economically competitive with many of the

petroleum-based products used in the chemicals and fuels markets today.

Recent Developments

On September 7, 2016, we announced that we entered into a heads of agreement with Deutsche Lufthansa AG (“Lufthansa”) to supply

alcohol-to-jet fuel (“ATJ”) from our first commercial hydrocarbons plant intended to be built in Luverne, Minnesota. The terms of the agreement contemplate Lufthansa purchasing up to 8 million gallons of ATJ per year, or 40 million gallons

over the life of a supply agreement. The heads of agreement is non-binding and subject to completion of a binding off-take agreement and other definitive documentation

S-1

between Gevo and Lufthansa. We can make no assurance that a binding, definitive off-take agreement reflecting the terms of the heads of agreement, or at all, will be completed.

On September 7, 2016, we entered into private exchange agreements with certain holders of our 7.5% convertible senior notes due 2022 (the

“2022 Notes”), to exchange an aggregate of $11.4 million of principal amount of 2022 Notes for an aggregate of 13,999,354 shares of our common stock and expect to issue the shares prior to or concurrent with the closing of this

offering. Upon completion, these exchanges will reduce the outstanding principal amount of the 2022 Notes to $11 million.

In June

2016, we entered into an agreement with Musket Corporation (“Musket”) to supply isobutanol for blending with gasoline. Musket is a national fuel distributor under the umbrella of the Love’s Family of Companies. Musket has taken

delivery of its first railcar of isobutanol. As isobutanol production ramps up at our production facility in Luverne, Minnesota, and isobutanol-blended gasoline becomes more established at retail outlets, Musket informed us that it expects to expand

its purchase quantities. Musket is initially targeting retail pumps at Lake Havasu in Arizona, followed by other large marine markets such as Lake Powell, Lake Mead, as well as other large lakes in the western states. Later, Musket also

anticipates expanding distribution into its core Oklahoma market.

In June 2016, the first two commercial flights using our renewable ATJ

were successfully completed from Seattle to San Francisco and Washington D.C., respectively. The event marked a successful step toward new fuels that helps airlines to reduce their greenhouse gas emissions (GHGs). Our alcohol to jet synthetic

paraffinic kerosene (ATJ-SPK) process turns our bio-based isobutanol into jet fuel that meets the requirements of the recently revised ASTM D7566 (Standard Specification for Aviation Turbine Fuel Containing Synthesized Hydrocarbons) for up to a 30%

fuel blend. The two Alaska Airlines flights utilized a 20% fuel blend. When compared to other fuel options, we believe that our renewable ATJ has the potential to offer the most optimized operating cost, capital cost, feedstock availability,

scalability, and translation across geographies. These two commercial flights represent an important advance in biofuels for an industry that contributes about two percent of the total GHG emissions worldwide, according to the International Civil

Aviation Organization, a United Nations agency. The agency also expects growth in air travel worldwide will result in double the number of passengers and flights by 2030. These additional flights would dramatically increase jet fuel consumption and

GHG emissions.

In May 2016, we commenced a review of strategic alternatives. Our board of directors and its advisors have

established a process for outreach to, and engagement with, interested strategic and financial parties and creditors.

On

September 6, 2016, we entered into a transaction bonus agreement with Michael J. Willis, our Chief Financial Officer. The bonus agreement provides that we will pay Mr. Willis a $150,000 cash bonus upon the completion of a successful

restructuring transaction (as defined in the bonus agreement).

Information Regarding Liquidity

For the six months ended June 30, 2016, we incurred a consolidated net loss of $25.1 million and had an accumulated deficit of $364.6

million at June 30, 2016. Our cash and cash equivalents at June 30, 2016 totaled $22.6 million, which will be used for the following: (i) operating activities at the Agri-Energy Facility; (ii) operating activities at our

corporate headquarters in Colorado, including research and development; (iii) capital improvements primarily associated with the Agri-Energy Facility; (iv) costs associated with optimizing isobutanol production technology;

(v) exploration of restructuring, strategic alternatives and new financings; and (vi) debt service and repayment obligations.

S-2

We expect to incur future net losses as we continue to fund the development and

commercialization of our product candidates. To date, we have financed our operations primarily with proceeds from multiple sales of equity and debt securities, borrowings under debt facilities and product sales. Our audited financial statements for

the year ended December 31, 2015, were prepared under the assumption that we would continue our operations as a going concern. Our independent registered public accounting firm for the year ended December 31, 2015 included a going concern

emphasis of matter paragraph in its report on our financial statements as of, and for the year ended, December 31, 2015, indicating that the amount of working capital at December 31, 2015 was not sufficient to meet the cash requirements to

fund planned operations through December 31, 2016 without additional sources of cash, which raises substantial doubt about our ability to continue as a going concern. Our inability to continue as a going concern may potentially affect our

rights and obligations under our debt obligations and may lead to bankruptcy.

Our transition to profitability is dependent upon, among

other things, the successful development and commercialization of our products and product candidates and the achievement of a level of revenues adequate to support our existing cost structure. We may never achieve profitability or generate positive

cash flows, and unless and until we do, we will continue to need to raise additional cash. We intend to fund future operations through additional private and/or public offerings of debt or equity securities. In addition, we may seek additional

capital through arrangements with strategic partners or from other sources. We will seek to restructure our debt and we will continue to address our cost structure. Notwithstanding these efforts, there can be no assurance that we will be able to

raise additional funds, restructure our indebtedness or achieve or sustain profitability or positive cash flows from operations.

Debt Maturities and Exchanges

As of June 30, 2016, the outstanding principal on our 10% convertible senior secured notes due 2017 (the “2017 Notes” and

together with the 2022 Notes, the “Convertible Notes”), was $26.1 million. The 2017 Notes are scheduled to mature on March 15, 2017.

As of June 30, 2016, the principal balance of our 2022 Notes was $22.4 million. The 2022 Notes are scheduled to mature on July 1,

2022, unless earlier repurchased, redeemed or converted. Additionally, on July 1, 2017, each holder will have the right to require us to repurchase all of such holder’s 2022 Notes, or any portion thereof that is an integral multiple of

$1,000 principal amount, for cash at a repurchase price of 100% of the principal amount of such 2022 Notes plus any accrued and unpaid interest thereon through, but excluding, the repurchase date.

On September 7, 2016, we entered into private exchange agreements with certain holders of our 2022 Notes to exchange an aggregate of

$11.4 million of principal amount of 2022 Notes for an aggregate of 13,999,354 shares of our common stock and expect to issue the shares prior to or concurrent with the closing of this offering. Upon completion, these exchanges will reduce the

outstanding principal amount of the 2022 Notes to $11 million.

Restructuring/Recapitalization Discussions

As noted above, in May 2016, we commenced a review of strategic alternatives. Our board of directors and its advisors have established a

process for outreach to, and engagement with, interested strategic and financial parties and creditors. As part of that process, we and our advisors have engaged in discussions with Whitebox Advisors, LLC (“Whitebox”), the administrative

agent for the holders of our 2017 Notes, and with some of the holders of our 2022 Notes with respect to a recapitalization of the Company that would involve the 2017 Notes and the 2022 Notes. We believe that a recapitalization transaction whereby

the Company’s debt is reduced (and/or the maturity date is extended) and a sufficient amount of working capital is provided to fund operations would reduce the current liquidity risks for the Company.

S-3

There can be no assurances that the Company will implement a recapitalization transaction.

If the Company is unable to implement a recapitalization or restructuring transaction involving Whitebox and the holders of the 2022 Notes, the Company will have to seek other strategic alternatives, including other sources of financing and, if

unsuccessful, may be forced to seek the protection of bankruptcy court by filing for bankruptcy.

Reverse Stock Split

On April 15, 2015, our Board of Directors approved a reverse split of our common stock, par value $0.01, at a ratio of one-for-fifteen.

This reverse stock split became effective on April 20, 2015 and, unless otherwise indicated, all share amounts, per share data, share prices, exercise prices and conversion rates set forth in this prospectus supplement have, where applicable,

been adjusted retroactively to reflect this reverse stock split.

Our Corporate Information

We were incorporated in Delaware in June 2005 under the name Methanotech, Inc. and filed an amendment to our certificate of incorporation

changing our name to Gevo, Inc. on March 29, 2006. Our principal executive offices are located at 345 Inverness Drive South, Building C, Suite 310, Englewood, Colorado 80112, and our telephone number is (303) 858-8358. We maintain an

internet website at

www.gevo.com

. Information contained in or accessible through our website does not constitute part of this prospectus supplement or the accompanying prospectus.

S-4

The Offering

|

|

|

|

|

|

|

|

|

Common stock offered by us

|

|

|

|

|

|

24,800,000 shares of common stock.

|

|

|

|

|

|

Warrants offered by us

|

|

|

|

|

|

Series I warrants to purchase up to 14,250,000 shares of common stock. Each full Series I warrant will entitle the holder to

purchase one share of common stock. The Series I warrants will be exercisable during the period commencing on the date of original issuance and ending on September 13, 2021, the expiration date of the Series I warrants, at an exercise

price of $0.55 per share of common stock.

Pre-funded Series J warrants to

purchase up to 3,700,000 shares of common stock. Each full pre-funded Series J warrant will entitle the holder to purchase one share of common stock. The pre-funded Series J warrants will be exercisable during the period commencing on the

date of original issuance and ending on September 13, 2017, the expiration date of the pre-funded Series J warrants, at an exercise price of $0.55 per share of common stock. The exercise price of $0.55 per share will be pre-paid,

except for a nominal exercise price of $0.01 per share, upon issuance of the pre-funded Series J warrants and, consequently, no additional payment or other consideration (other than the nominal exercise price of $0.01 per share) will be

required to be delivered to us by the holder upon exercise.

This prospectus also

relates to the offering of the shares of common stock issuable upon exercise of the warrants. The exercise price of the warrants and the number of shares into which the warrants may be exercised are subject to adjustment in certain

circumstances.

|

|

|

|

|

|

Common stock outstanding after this

offering

(1)

|

|

|

|

|

|

128,069,984 shares of common stock.

|

|

|

|

|

|

Limitation on ownership of warrants

|

|

|

|

|

|

A holder (together with its affiliates) may not exercise any portion of the warrant to the extent that the holder would beneficially own more than 4.99% of our outstanding common stock after exercise. The holder may increase or

decrease this beneficial ownership limitation to any other percentage not in excess of 9.99%, upon, in the case of an increase, not less than 61 days’ prior written notice to us.

|

|

|

|

|

|

Use of proceeds

|

|

|

|

|

|

We expect the net proceeds from this offering to be approximately $14.1 million, after deducting underwriting discounts and commissions, as described in “Underwriting,” and estimated offering expenses payable by us.

We currently intend to use the net proceeds from this offering to fund working capital and for other general corporate purposes, which may include the repayment of outstanding

indebtedness.

|

S-5

|

|

|

|

|

|

|

|

|

NASDAQ Capital Market symbol

|

|

|

|

|

|

“GEVO”. The warrants are not and will not be listed for trading on the NASDAQ Capital Market, or any other securities exchange.

|

|

|

|

|

|

Transfer agent

|

|

|

|

|

|

American Stock Transfer & Trust Company

|

|

|

|

|

|

Risk factors

|

|

|

|

|

|

This investment involves a high degree of risk. See “Risk Factors” beginning on page S-10 of this prospectus supplement for a discussion of factors you should carefully consider before deciding to invest in our

securities.

|

|

(1)

|

The number of shares of our common stock to be outstanding immediately after the closing of this offering is based on 89,270,630 shares of common stock outstanding as of August 31, 2016. The number of shares

of common stock to be outstanding immediately after this offering also includes 13,999,354 shares of common stock issuable upon exchange of the 2022 Notes. As noted above, we entered into private exchange agreements with certain holders of 2022

Notes and expect to issue the shares subject to such exchanges prior to or concurrent with the closing of this offering. The number of shares of common stock to be outstanding immediately after this offering excludes:

|

|

|

•

|

|

19,462,331 shares reserved for issuance pursuant to outstanding options, warrants or rights to acquire from us, or instruments convertible into or exchangeable for, or agreements or understandings with respect to

the sale or issuance by us of, common stock;

|

|

|

•

|

|

3,041,099 shares of common stock available for future grant under our 2010 Stock Incentive Plan (as amended, the “2010 Plan”);

|

|

|

•

|

|

76,029 shares of common stock available for issuance pursuant to our Employee Stock Purchase Plan; and

|

|

|

•

|

|

17,950,000 shares of common stock issuable upon the exercise of the warrants offered hereby.

|

S-6

Summary Financial Information

In the tables below, we provide you with a summary of our historical consolidated financial information. The information is only a summary, and

you should read it together with the financial information incorporated by reference in this document. See “Incorporation of Certain Documents by Reference” on page S-43 of this prospectus supplement and “Where You Can Find

Additional Information” on page S-43 of this prospectus supplement. The consolidated statements of operations data for the years ended December 31, 2013, 2014 and 2015 is derived from our audited financial statements included in our

Annual Report on Form 10-K for the year ended December 31, 2015, and incorporated by reference herein. The consolidated statements of operations data for the six months ended June 30, 2015 and 2016 and the consolidated balance sheet data

as of June 30, 2016 is derived from our unaudited financial statements included in our Quarterly Report on Form 10-Q for the quarterly period ended June 30, 2016, and incorporated by reference herein. These unaudited financial statements have

been prepared on a basis consistent with our audited financial statements and include, in the opinion of management, all adjustments, consisting only of normal recurring adjustments, necessary for the fair statement of the financial information in

those statements.

Our consolidated subsidiary Agri-Energy, LLC, a Minnesota limited liability company (“Agri-Energy”),

commenced the Retrofit of the Agri-Energy Facility in 2011 and commenced initial startup operations for the production of isobutanol at this facility in May 2012. In September 2012, we made the strategic decision to pause isobutanol production at

the Agri-Energy Facility to focus on optimizing specific parts of the process to further enhance isobutanol production rates. In 2013, we modified our Agri-Energy Facility in order to increase the isobutanol production rate. In June 2013, we resumed

the limited production of isobutanol operating one fermenter and one GIFT

®

separation system in order to (i) verify that the modifications had significantly reduced the previously

identified infections, (ii) demonstrate that our biocatalyst performs in the one million liter fermenters at the Agri-Energy Facility, and (iii) confirm GIFT

®

efficacy at commercial

scale at the Agri-Energy Facility. In August 2013, we expanded production capacity at the Agri-Energy Facility by adding a second fermenter and second GIFT

®

system to further verify our

results with a second configuration of equipment. In October 2013, we began commissioning the Agri-Energy Facility on corn mash to test isobutanol production run rates and to optimize biocatalyst production, fermentation separation and water

management systems. In March 2014, we decided to leverage the flexibility of our GIFT

®

technology and further modify the Agri-Energy Facility to enable the simultaneous production of

isobutanol and ethanol. In July 2014, we began more consistent co-production of isobutanol and ethanol at the Agri-Energy Facility, with one fermenter utilized for isobutanol production and three fermenters utilized for ethanol production. In line

with our strategy to maximize asset utilization and site cash flows, we believe that this configuration of the plant should allow us to continue to optimize our isobutanol technology at a commercial scale, while taking advantage of potentially

superior contribution margins from the production of ethanol. Also with a view to maximizing site cash flows, over certain periods of time, we may and have operated the plant for the sole production of ethanol across all four fermenters. Our

long-term goal is to maximize margins at the Agri-Energy Facility.

Following our acquisition of Agri-Energy on September 22, 2010,

we have derived substantially all of our revenue from the sale of ethanol, distiller’s grains and other related products produced as part of the ethanol production process at the Agri-Energy Facility. The production of ethanol alone is not our

intended business and our future strategy is expected to depend on our ability to produce and market isobutanol and products derived from isobutanol. Given that the production of ethanol alone is not our intended business, and we are only beginning

to achieve more consistent production and revenue from the sale of isobutanol, the historical operating results of Agri-Energy may not be indicative of future operating results for Agri-Energy or Gevo.

S-7

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Consolidated statements of operations data:

|

|

Years Ended December 31,

|

|

|

Six Months Ended

June 30,

|

|

|

|

2013

|

|

|

2014

|

|

|

2015

|

|

|

2015

|

|

|

2016

|

|

|

(in thousands, except share and per share amounts)

|

|

|

|

|

|

|

|

|

|

|

(Unaudited)

|

|

|

Revenue and cost of goods sold:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ethanol sales and related products, net

|

|

$

|

—

|

|

|

$

|

23,549

|

|

|

$

|

27,125

|

|

|

$

|

13,053

|

|

|

$

|

12,925

|

|

|

Hydrocarbon revenue

|

|

|

2,157

|

|

|

|

3,949

|

|

|

|

1,694

|

|

|

|

1,257

|

|

|

|

1,011

|

|

|

Grant and other revenue

|

|

|

2,722

|

|

|

|

768

|

|

|

|

1,318

|

|

|

|

513

|

|

|

|

497

|

|

|

Corn sales

|

|

|

3,345

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total revenues

|

|

|

8,224

|

|

|

|

28,266

|

|

|

|

30,137

|

|

|

|

14,823

|

|

|

|

14,433

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of corn sales

|

|

|

3,391

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

Cost of goods sold

|

|

|

14,522

|

|

|

|

35,582

|

|

|

|

38,762

|

|

|

|

19,132

|

|

|

|

19,212

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross (loss) margin

|

|

|

(9,689

|

)

|

|

|

(7,316

|

)

|

|

|

(8,625

|

)

|

|

|

(4,309

|

)

|

|

|

(4,779

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development

|

|

|

20,179

|

|

|

|

14,120

|

|

|

|

6,610

|

|

|

|

3,487

|

|

|

|

2,513

|

|

|

Selling, general and administrative

|

|

|

25,548

|

|

|

|

18,341

|

|

|

|

16,692

|

|

|

|

8,271

|

|

|

|

4,066

|

|

|

Other operating expenses

|

|

|

99

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total operating expenses

|

|

|

45,826

|

|

|

|

32,461

|

|

|

|

23,302

|

|

|

|

11,758

|

|

|

|

6,579

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss from operations

|

|

|

(55,515

|

)

|

|

|

(39,777

|

)

|

|

|

(31,927

|

)

|

|

|

(16,067

|

)

|

|

|

(11,358

|

)

|

|

Other (expense) income:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense

|

|

$

|

(9,301

|

)

|

|

$

|

(8,255

|

)

|

|

$

|

(8,243

|

)

|

|

$

|

(4,064

|

)

|

|

$

|

(4,396

|

)

|

|

Interest expense—debt issuance cost

|

|

|

—

|

|

|

|

(3,769

|

)

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

Gain (loss) on extinguishment/conversion of debt

|

|

|

(2,038

|

)

|

|

|

—

|

|

|

|

232

|

|

|

|

285

|

|

|

|

—

|

|

|

Gain (loss) on extinguishment of warrant liability

|

|

|

—

|

|

|

|

—

|

|

|

|

1,775

|

|

|

|

1,775

|

|

|

|

(923

|

)

|

|

Gain (loss) from change in fair value of embedded derivative of the 2022 Notes

|

|

|

3,114

|

|

|

|

3,470

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

Gain (loss) from change in fair value of derivative warrant liability

|

|

|

(3,195

|

)

|

|

|

6,530

|

|

|

|

577

|

|

|

|

(7,080

|

)

|

|

|

(5,325

|

)

|

|

Gain (loss) from change in fair value of 2017 Notes

|

|

|

—

|

|

|

|

648

|

|

|

|

3,895

|

|

|

|

3,425

|

|

|

|

(1,775

|

)

|

|

Gain (loss) on issuance of equity

|

|

|

—

|

|

|

|

—

|

|

|

|

(2,523

|

)

|

|

|

—

|

|

|

|

(1,519

|

)

|

|

Other income

|

|

|

129

|

|

|

|

8

|

|

|

|

20

|

|

|

|

13

|

|

|

|

206

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total other (expense) income

|

|

|

(11,291

|

)

|

|

|

(1,368

|

)

|

|

|

(4,267

|

)

|

|

|

(5,646

|

)

|

|

|

(13,732

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss

|

|

|

(66,806

|

)

|

|

|

(41,145

|

)

|

|

|

(36,194

|

)

|

|

|

(21,713

|

)

|

|

|

(25,090

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss attributable to Gevo, Inc. common stockholders

|

|

$

|

(66,806

|

)

|

|

$

|

(41,145

|

)

|

|

$

|

(36,194

|

)

|

|

$

|

(21,713

|

)

|

|

$

|

(25,090

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss per share of common stock attributable to Gevo, Inc. stockholders, basic and

diluted

|

|

$

|

(22.23

|

)

|

|

$

|

(7.67

|

)

|

|

$

|

(2.58

|

)

|

|

$

|

(2.03

|

)

|

|

$

|

(0.70

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted-average number of common shares used in computing net loss per share of common stock,

basic and diluted

|

|

|

3,004,775

|

|

|

|

5,366,162

|

|

|

|

14,025,048

|

|

|

|

10,673,891

|

|

|

|

36,050,983

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

S-8

|

|

|

|

|

|

|

|

|

|

|

|

|

As of June 30, 2016

|

|

|

Consolidated balance sheet data:

|

|

Actual

|

|

|

As Adjusted

(1)

|

|

|

(in thousands)

|

|

(Unaudited)

|

|

|

Cash and cash equivalents

|

|

$

|

22,617

|

|

|

$

|

36,760

|

|

|

Total assets

|

|

|

109,247

|

|

|

|

123,390

|

|

|

Secured debt, net of debt discounts

|

|

|

324

|

|

|

|

324

|

|

|

Convertible Notes, net

|

|

|

39,885

|

|

|

|

31,465

|

|

|

Other long-term liabilities

|

|

|

—

|

|

|

|

—

|

|

|

Total liabilities

|

|

|

51,062

|

|

|

|

42,642

|

|

|

Deficit accumulated

|

|

|

(364,583

|

)

|

|

|

(366,102

|

)

|

|

Total stockholders’ equity

|

|

|

58,185

|

|

|

|

80,748

|

|

|

(1)

|

The as adjusted consolidated balance sheet data gives effect to (i) this offering and the receipt of the net proceeds therefrom, after deducting underwriting discounts and commissions and estimated offering

expenses and (ii) the expected issuance of 13,999,354 shares of our common stock upon exchange of a portion of our 2022 Notes as described in this prospectus supplement.

|

S-9

RISK FACTORS

An investment in our securities involves a high degree of risk. Prior to making a decision about investing in our securities, you should

carefully consider the following risks and uncertainties, as well as those discussed under the caption “Risk Factors” in the accompanying prospectus, in our Annual Report on

Form 10-K

for the

year ended December 31, 2015 and our Quarterly Report on

Form 10-Q

for the quarterly period ended June 30, 2016. If any of the risks described in this prospectus supplement or accompanying

prospectus, or the risks described in any documents incorporated by reference in this prospectus supplement or the accompanying prospectus, actually occur, our business, prospects, financial condition or operating results could be harmed. In that

case, the trading price of our common stock and warrants could decline, and you may lose all or part of your investment. Additional risks and uncertainties not presently known to us or that we currently believe are immaterial may also impair our

business operations and our liquidity. You should also refer to the other information contained in this prospectus supplement and the accompanying prospectus or incorporated by reference herein or therein, including our financial statements and the

notes to those statements and the information set forth under the heading “Cautionary Note Regarding Forward-Looking Statements.”

Certain Risks Related to Owning Our Securities

We have broad discretion in the use of the net proceeds from this offering and may not use them effectively, which could cause the value of your

investment to decline.

Our management will have broad discretion in the application of the net proceeds of this offering. You will

not have the opportunity to influence our decisions on how to use our net proceeds from this offering. Our failure to apply the net proceeds effectively could affect our ability to continue to develop and sell our products and grow our business,

which could cause the value of your investment to decline.

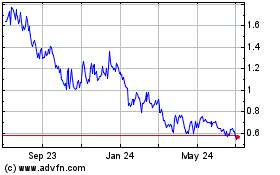

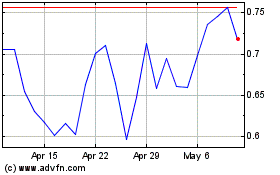

Our stock price may be volatile, and your investment in our securities could suffer a

decline in value.

The market price of shares of our common stock has experienced significant price and volume fluctuations. For

example, since February 19, 2011, when we became a public company, the closing sales price for one share of our common stock has reached a high of $383.25 and a low of $0.22.

We cannot predict whether the price of our common stock will rise or fall. A variety of factors may have a significant effect on our stock

price, including:

|

|

•

|

|

actual or anticipated fluctuations in our financial condition and operating results;

|

|

|

•

|

|

the position of our cash and cash equivalents;

|

|

|

•

|

|

actual or anticipated changes in our growth rate relative to our competitors;

|

|

|

•

|

|

actual or anticipated fluctuations in our competitors’ operating results or changes in their growth rate;

|

|

|

•

|

|

announcements of technological innovations by us, our partners or our competitors;

|

|

|

•

|

|

announcements by us, our partners or our competitors of significant acquisitions, strategic partnerships, joint ventures or capital commitments;

|

|

|

•

|

|

the entry into, modification or termination of licensing arrangements, marketing arrangements, and/or research, development, commercialization, supply, off-take or distribution arrangements;

|

|

|

•

|

|

our ability to consistently produce commercial quantities of isobutanol at the Agri-Energy Facility and ramp up production to nameplate capacity;

|

|

|

•

|

|

our ability to repay our indebtedness when it becomes due;

|

|

|

•

|

|

our ability to refinance, restructure or convert our current and future indebtedness;

|

|

|

•

|

|

additions or losses of customers;

|

S-10

|

|

•

|

|

our ability to obtain certain regulatory approvals for the use of our isobutanol in various fuels and chemicals markets;

|

|

|

•

|

|

commodity prices, including oil, ethanol and corn prices;

|

|

|

•

|

|

additions or departures of key management or scientific personnel;

|

|

|

•

|

|

competition from existing products or new products that may emerge;

|

|

|

•

|

|

issuance of new or updated research reports by securities or industry analysts;

|

|

|

•

|

|

fluctuations in the valuation of companies perceived by investors to be comparable to us;

|

|

|

•

|

|

litigation involving us, our general industry or both;

|

|

|

•

|

|

disputes or other developments related to proprietary rights, including patents, litigation matters and our ability to obtain patent protection for our technologies;

|

|

|

•

|

|

announcements or expectations of additional financing efforts (including restructuring our indebtedness) or the pursuit of strategic alternatives;

|

|

|

•

|

|

changes in existing laws, regulations and policies applicable to our business and products, including the Renewable Fuel Standard (“RFS”) program, and the adoption of or failure to adopt carbon emissions

regulation;

|

|

|

•

|

|

sales of our common stock or equity-linked securities, such as warrants, by us or our stockholders;

|

|

|

•

|

|

share price and volume fluctuations attributable to inconsistent trading volume levels of our shares;

|

|

|

•

|

|

general market conditions in our industry; and

|

|

|

•

|

|

general economic and market conditions, including the recent financial crisis.

|

Furthermore,

the stock markets have experienced extreme price and volume fluctuations that have affected and continue to affect the market prices of equity securities of many companies. These fluctuations often have been unrelated or disproportionate to the

operating performance of those companies. These broad market and industry fluctuations, as well as general economic, political and market conditions such as recessions, interest rate changes or international currency fluctuations, may negatively

impact the market price of shares of our common stock, regardless of our operating performance, and cause the value of your investment to decline. Because the warrants are exercisable into our common stock, volatility or a reduction in the market

price of our common stock could have an adverse effect on the trading price of the warrants. Holders who receive common stock upon exercise of the warrants will also be subject to the risk of volatility and a reduction in the market price of our

common stock. In addition, the existence of the Convertible Notes and our outstanding warrants, together with the warrants being offered hereby, may encourage short selling in our common stock by market participants because the conversion of the

Convertible Notes or exercise of the warrants could depress the price of our common stock.

Additionally, in the past, companies that have

experienced volatility in the market price of their stock have been subject to securities class action litigation or other derivative shareholder lawsuits. We may be the target of this type of litigation in the future. Securities litigation against

us could result in substantial costs and divert our management’s attention from other business concerns, which could seriously harm our business regardless of the outcome.

The price of our common stock could also be affected by possible sales of common stock by investors who view the Convertible Notes or warrants

as a more attractive means of equity participation in us and by hedging or arbitrage activity involving our common stock. The hedging or arbitrage could, in turn, affect the trading prices of the warrants, or any common stock that holders receive

upon exercise of the warrants.

Sales of a substantial number of shares of our common stock or securities linked to our common stock, such

as the Convertible Notes and warrants (should an established market for such securities then exist), in the public

S-11

market could occur at any time. These sales, or the perception in the market that such sales may occur, could reduce the market price of our common stock.

In addition, certain holders of our outstanding common stock (including shares of our common stock issuable upon the conversion of certain

Convertible Notes or upon exercise of certain outstanding warrants) have rights, subject to certain conditions, to require us to file registration statements covering their shares and to include their shares in registration statements that we may

file for ourselves or other stockholders.

We have substantial indebtedness outstanding and may incur additional indebtedness in the future. Our

indebtedness exposes us to risks that could adversely affect our business, financial condition and results of operations.

As of

June 30, 2016, the aggregate amount of the outstanding principal and final payments under our amended and restated loan and security agreement with TriplePoint Capital LLC (“TriplePoint”) was approximately $0.3 million and we had

$26.1 million in outstanding 2017 Notes, and $22.4 million in outstanding 2022 Notes. In addition, we and any current and future subsidiaries of ours may incur substantial additional debt in the future, subject to the specified limitations

in our existing financing documents and the indentures governing the Convertible Notes. If new debt is added to our or any of our subsidiaries’ debt levels, the risks described in herein and in the documents incorporated by reference herein

could intensify.

Our current and future indebtedness could have significant negative consequences for our business, results of operations

and financial condition, including:

|

|

•

|

|

increasing our vulnerability to adverse economic and industry conditions;

|

|

|

•

|

|

limiting our ability to obtain additional financing;

|

|

|

•

|

|

requiring the dedication of a substantial portion of our cash flow from operations and financings, including this offering, to service our indebtedness, thereby reducing the amount of our cash flow available for other

purposes;

|

|

|

•

|

|

limiting our flexibility in planning for, or reacting to, changes in our business; and

|

|

|

•

|

|

placing us at a possible competitive disadvantage with less leveraged competitors and competitors that may have better access to capital resources.

|

We cannot assure you that we will continue to maintain sufficient cash reserves or that our business will generate cash flow from operations

at levels sufficient to permit us to pay principal, premium, if any, and interest on our indebtedness, or that our cash needs will not increase. If we are unable to generate sufficient cash flow or otherwise obtain funds necessary to make required

payments, or if we fail to comply with or renegotiate the various requirements of our existing indebtedness or any other indebtedness which we may incur in the future, we would be in default, which could permit the holders of our indebtedness,

including the Convertible Notes, to accelerate the maturity of such indebtedness. Any default under such indebtedness could have a material adverse effect on our business, financial condition and results of operations.

In particular, we do not anticipate generating sufficient cash from operations to repay either the 2017 Notes at maturity on March 31,

2017 or the 2022 Notes on the put date of July 1, 2017. Accordingly, we will need to refinance or restructure such indebtedness or raise significant additional capital and our failure to do so would have a material adverse effect on our

business, financial condition and results of operations. For example, in the event that we are forced to seek the protection of bankruptcy court by filing for bankruptcy, it would likely have a material adverse effect on the value of the holdings of

all stockholders, potentially rendering their investment in our company worthless or of little value.

Our indebtedness with Whitebox and

TriplePoint is secured by liens on substantially all of our assets, including our intellectual property. If we are unable to satisfy our obligations under such instruments, Whitebox

S-12

or TriplePoint, as applicable, could foreclose on our assets, including our intellectual property. Any such foreclosure could force us to substantially curtail or cease our operations which could

have a material adverse effect on our business, financial condition and results of operations.

We will require substantial additional financing to

achieve our goals, and a failure to obtain this capital when needed or on acceptable terms could force us to delay, limit, reduce or terminate our development and commercialization efforts.

Significant portions of our resources have been dedicated to research and development, as well as demonstrating the effectiveness of our

technology through the Retrofit of the Agri-Energy Facility. We believe that we will continue to expend substantial resources for the foreseeable future on further developing our technologies, developing future markets for our isobutanol and

accessing and Retrofitting facilities necessary for the production of isobutanol on a commercial scale. These expenditures may include costs associated with research and development, accessing existing ethanol plants, Retrofitting or otherwise

modifying the plants to produce isobutanol, obtaining government and regulatory approvals, acquiring or constructing storage facilities and negotiating supply agreements for the isobutanol we produce. In addition, other unanticipated costs may

arise. Because the costs of developing our technology at a commercial scale are highly uncertain, we cannot reasonably estimate the amounts necessary to successfully commercialize our production.

To date, we have funded our operations primarily through equity offerings, issuances of debt, borrowing under our secured debt financing

arrangements and revenues earned primarily from the sale of ethanol. Based on our current plans and expectations, we will require additional funding to achieve our goals. In addition, the cost of preparing, filing, prosecuting, maintaining and

enforcing patent, trademark and other intellectual property rights and defending against claims by others that we may be violating their intellectual property rights may be significant. Moreover, our plans and expectations may change as a

result of factors currently unknown to us, and we may need additional funds sooner than planned and may seek to raise additional funds through public or private debt or equity financings in the near future. We may also choose to seek additional

capital sooner than required due to favorable market conditions or strategic considerations.

Our future capital requirements will depend

on many factors, including:

|

|

•

|

|

the timing of, and costs involved in developing and optimizing our technologies for full-scale commercial production of isobutanol;

|

|

|

•

|

|

the timing of, and costs involved in accessing existing ethanol plants;

|

|

|

•

|

|

the timing of, and costs involved in Retrofitting the plants we access with our technologies;

|

|

|

•

|

|

the costs involved in establishing enhanced yeast seed trains, including at the Agri-Energy Facility;

|

|

|

•

|

|

the costs involved in acquiring and deploying additional equipment to attain final product specifications including at the Agri-Energy Facility, that may be required by future customers;

|

|

|

•

|

|

the costs involved in increasing our isobutanol production capacity, including at the Agri-Energy Facility;

|

|

|

•

|

|

the cost of operating, maintaining and increasing production capacity of the Retrofitted plants;

|

|

|

•

|

|

our ability to negotiate agreements supplying suitable biomass to our plants, and the timing and terms of those agreements;

|

|

|

•

|

|

the timing of, and the costs involved in developing adequate storage facilities for the isobutanol we produce;

|

|

|

•

|

|

our ability to gain market acceptance for isobutanol as a specialty chemical, gasoline blendstock and as a raw material for the production of hydrocarbons;

|

|

|

•

|

|

our ability to negotiate supply agreements for the isobutanol we produce, and the timing and terms of those agreements, including terms related to sales price;

|

S-13

|

|

•

|

|

our ability to negotiate sales of our isobutanol for full-scale production of butenes and other industrially useful chemicals and fuels, and the timing and terms of those sales, including terms related to sales price;

|

|

|

•

|

|

our ability to sell the iDGs™ left as a co-product of fermenting isobutanol from corn as animal feedstock;

|

|

|

•

|

|

our ability to establish and maintain strategic partnerships, licensing or other arrangements and the timing and terms of those arrangements;

|

|

|

•

|

|

the cost of preparing, filing, prosecuting, maintaining, defending and enforcing patent, trademark and other intellectual property claims, including litigation costs and the outcome of such litigation; and

|

|

|

•

|

|

our ability to refinance or restructure the 2017 and 2022 Notes prior to the maturity of the 2017 Notes and the put date of the 2022 Notes in 2017, respectively.

|

Additional funds may not be available when we need them, on terms that are acceptable to us, or at all. In addition, our ability to raise

additional funds will be subject to certain limitations in the agreements governing our indebtedness, including our secured indebtedness with Whitebox and/or TriplePoint. If needed funds are not available to us on a timely basis, we may be required

to delay, limit, reduce or terminate:

|

|

•

|

|

our research and development activities;

|

|

|

•

|

|

our plans to access and/or Retrofit existing ethanol facilities;

|

|

|

•

|

|

our production of isobutanol at Retrofitted plants;

|

|

|

•

|

|

our production of hydrocarbons at our demonstration plant located at the South Hampton facility near Houston, TX, or any other future facilities;

|

|

|

•

|

|

our efforts to prepare, file, prosecute, maintain and enforce patent, trademark and other intellectual property rights and defend against claims by others that we may be violating their intellectual property rights;

|

|

|

•

|

|

our activities in developing storage capacity and negotiating supply agreements that may be necessary for the commercialization of our isobutanol production; and/or

|

|

|

•

|

|

our ordinary course business activities generally.

|

We may not be able to comply with all applicable

listing requirements or standards of The NASDAQ Capital Market and NASDAQ could delist our common stock.

Our common stock is

listed on The NASDAQ Capital Market. In order to maintain that listing, we must satisfy minimum financial and other continued listing requirements and standards.

On January 25, 2016, we received a deficiency letter from the Listing Qualifications Department of the NASDAQ Stock Market), notifying us

that, for the prior 30 consecutive business days, the closing bid price of our common stock was not maintained at the minimum required closing bid price of at least $1.00 per share as required for continued listing on the NASDAQ Capital Market. In

accordance with NASDAQ Listing Rules, we had an initial compliance period of 180 calendar days, to regain compliance with this requirement. On July 26, 2016, the NASDAQ Stock Market granted us an additional 180 calendar days, or until January 23,

2017, to regain compliance. To regain compliance, the closing bid price of our common stock must be $1.00 per share or more for a minimum of 10 consecutive business days at any time before January 23, 2017. The NASDAQ determination to grant the

second compliance period was based on our meeting of the continued listing requirement for market value of publicly held shares and all other applicable requirements for initial listing on the NASDAQ Capital Market, with the exception of the bid

price requirement, and our written notice of our intention to cure the deficiency during the second compliance period by effecting a reverse stock split, if necessary.

S-14

We cannot provide any assurance that our stock price will recover within the permitted grace

period. In the event that our common stock is not eligible for quotation on another market or exchange, trading of our common stock could be conducted in the over-the-counter market or on an electronic bulletin board established for unlisted

securities such as the Pink Sheets or the OTC Bulletin Board. In such event, it could become more difficult to dispose of, or obtain accurate price quotations for, our common stock, and there would likely be a reduction in our coverage by security

analysts and the news media, which could cause the price of our common stock to decline further. In addition, it may be difficult for us to raise additional capital if we are not listed on a major exchange.

Furthermore, it would be a fundamental change under the indentures governing our convertible notes if our common stock is not listed on a

national securities exchange. In such circumstance we would be required to offer to repurchase our convertible notes at 100% of principal plus accrued and unpaid interest to, but not including, the repurchase date. We would also be required to pay

the holders of the 2017 Notes a fundamental change make-whole payment equal to the aggregate amount of interest that would have otherwise been payable on such notes, to, but not including, the maturity date of such notes. Repurchase offers for the

2022 Notes would be prohibited by the agreements governing our secured indebtedness with TriplePoint.

Future issuances of our common stock or

instruments convertible or exercisable into our common stock, including in connection with conversions of our convertible notes or exercises of warrants, may materially and adversely affect the price of our common stock and cause dilution to our

existing stockholders.

We may obtain additional funds through public or private debt or equity financings in the near future,

subject to certain limitations in the agreements governing our indebtedness, including our secured indebtedness. If we issue additional shares of common stock or instruments convertible into common stock, it may materially and adversely affect the

price of our common stock. In addition, the conversion of some or all of our convertible notes and/or the exercise of some or all of our warrants may dilute the ownership interests of our stockholders, and any sales in the public market of any of

our common stock issuable upon such conversion or exercise could adversely affect prevailing market prices of our common stock. Additionally, under the terms of certain warrants (including the warrants being offered hereby), in the event that a

warrant is exercised at a time when we do not have an effective registration statement covering the underlying shares of common stock on file with the SEC, such warrant may be net exercised, which will dilute the ownership interests of existing

stockholders without any corresponding benefit to us of a cash payment for the exercise price of such warrant.

As of June 30, 2016,

we had $22.4 million in outstanding 2022 Notes, which were convertible into 3,399,677 shares of common stock at the conversion rate in effect on June 30, 2016 (which amount includes 3,137,344 shares of common stock issuable in

full satisfaction of the coupon make-whole payments due in connection therewith). As noted above, on September 7, 2016, we entered into private exchange agreements with certain holders of our 2022 Notes to exchange an aggregate of $11.4 million

of principal amount of 2022 Notes for an aggregate of 13,999,354 shares of our common stock. The anticipated conversion of the remaining $11.0 million in outstanding 2022 Notes into shares of our common stock could depress the trading price of

our common stock. In addition, we have the option to issue common stock to any converting holder in lieu of making any required coupon make-whole payment in cash. If we elect to issue our common stock for such payment, the stock will be valued at

90% of the simple average of the daily volume weighted average prices of our common stock for the 10 trading days ending on and including the trading day immediately preceding the conversion date. If our stock price decreases, the number of shares

we would be required to deliver in connection with the coupon make-whole payments would increase. Given that the agreements governing our indebtedness, including our secured indebtedness with TriplePoint, may prohibit us from paying, repurchasing or

redeeming the 2022 Notes or making cash payments in respect of the coupon make-whole payments due upon a conversion, we may be unable to make such payment in cash. If we issue additional shares of our common stock in satisfaction of such payments,

this may cause significant additional dilution to our existing stockholders.

As of June 30, 2016, we had $26.1 million in

outstanding 2017 Notes, which were convertible into 1,611,171 shares of our common stock at the conversion rate in effect on June 30, 2016. The 1,611,171 shares

S-15

includes 107,350 shares of common stock that may be issuable from time to time in the event that the Company pays a portion of the interest on the 2017 Notes in kind or elects to pay

make-whole payments due upon conversion of the 2017 Notes, if any, in shares of common stock. The anticipated conversion of the outstanding 2017 Notes (including any interest that is paid in kind) into shares of our common stock could depress the

trading price of our common stock. In addition, subject to certain restrictions, we have the option to issue common stock to any converting holder in lieu of making any required make-whole payment in cash. If we elect to issue our common stock for

such payment, it will be at the same conversion rate that is applicable to conversions of the principal amount of the 2017 Notes. If we elect to issue additional shares of our common stock for such payments, this may cause significant additional

dilution to our existing stockholders.

In addition, we issued common stock and warrants during the three months ended June 30, 2016

to finance operations and may do so again in the future. Such issuances diluted the ownership interests of our existing shareholders and adversely affected the price of our common stock.

As of June 30, 2016, we had $26.1 million in outstanding 10% Convertible Senior Notes, due 2017, which were issued in June 2014 (the

“2017 Notes”), which were convertible into 1,611,171 shares of our common stock at the conversion rate in effect on June 30, 2016. The 1,611,171 shares includes 107,350 shares of common stock that may be issuable from time

to time in the event that the Company pays a portion of the interest on the 2017 Notes in kind or elects to pay make-whole payments due upon conversion of the 2017 Notes, if any, in shares of common stock. The anticipated conversion of the

outstanding 2017 Notes (including any interest that is paid in kind) into shares of our common stock could depress the trading price of our common stock. In addition, subject to certain restrictions, we have the option to issue common stock to any

converting holder in lieu of making any required make-whole payment in cash. If we elect to issue our common stock for such payment, it will be at the same conversion rate that is applicable to conversions of the principal amount of the 2017 Notes.

If we elect to issue additional shares of our common stock for such payments, this may cause significant additional dilution to our existing stockholders.

In addition, we issued common stock and warrants during the three months ended June 30, 2016 to finance operations and may do so again in the