Valero Energy Corporation Announces Pricing of Notes Offering

September 07 2016 - 5:30PM

Valero Energy Corporation (NYSE:VLO) announced today that it has

priced a public offering of $1,250,000,000 aggregate principal

amount of 3.400% senior notes due 2026. The offering is expected to

close on September 12, 2016, subject to customary closing

conditions. Valero intends to use the net proceeds from the

offering for general corporate purposes, including the funding of

the redemption of $750 million aggregate principal amount of its

6.125% Senior Notes due 2017 and $200 million aggregate principal

amount of its 7.2% Senior Notes due 2017.

Citigroup Global Markets Inc., Barclays Capital

Inc., Mizuho Securities USA Inc., RBC Capital Markets, LLC, J.P.

Morgan Securities LLC, Morgan Stanley & Co. LLC, MUFG

Securities Americas Inc. and Wells Fargo Securities, LLC acted as

joint book-running managers for the notes.

Copies of the prospectus supplement and

accompanying base prospectus relating to the offering may be

obtained from Citigroup Global Markets Inc. at 1-800-831-9146;

Barclays Capital Inc. at 1-888-603-5847; Mizuho Securities USA Inc.

at 1-866-271-7403; and RBC Capital Markets, LLC at 1-866-375-6829,

and online at www.sec.gov.

About Valero

Valero Energy Corporation, through its

subsidiaries, is an international manufacturer and marketer of

transportation fuels, other petrochemical products and power.

Valero subsidiaries employ approximately 10,000 people, and its

assets include 15 petroleum refineries with a combined throughput

capacity of approximately 3.0 million barrels per day, 11 ethanol

plants with a combined production capacity of 1.4 billion gallons

per year, a 50-megawatt wind farm, and renewable diesel production

from a joint venture. Through subsidiaries, Valero owns the general

partner of Valero Energy Partners LP (NYSE:VLP), a midstream master

limited partnership. Approximately 7,500 outlets carry the Valero,

Diamond Shamrock, Shamrock, and Beacon brands in the United States

and the Caribbean; Ultramar in Canada; and Texaco in the United

Kingdom and Ireland. Valero is a Fortune 500 company based in San

Antonio.

The notes were offered and sold pursuant to an

effective shelf registration statement on Form S-3 previously filed

with the Securities and Exchange Commission, and only by means of a

prospectus supplement and accompanying base prospectus. This news

release does not constitute an offer to sell or a solicitation of

an offer to buy the securities described herein, nor shall there be

any sale of these securities in any state or jurisdiction in which

such an offer, solicitation or sale would be unlawful prior to

registration or qualification under the securities laws of any such

state or jurisdiction.

Valero Contacts

Investors: John Locke, Vice President –

Investor Relations, 1-210-345-3077

Karen Ngo, Manager – Investor Relations,

1-210-345-4574

Media: Lillian Riojas, Director – Media

Relations and Communications, 1-210-345-5002

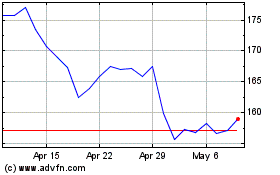

Valero Energy (NYSE:VLO)

Historical Stock Chart

From Mar 2024 to Apr 2024

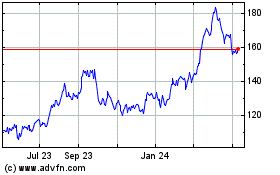

Valero Energy (NYSE:VLO)

Historical Stock Chart

From Apr 2023 to Apr 2024