Airline Stocks Soar on Revenue Outlook

September 07 2016 - 2:42PM

Dow Jones News

U.S. airline stocks rose sharply Wednesday as executives flagged

an improving revenue outlook for the domestic market, combined with

rising fuel costs, as providing more scope to boost ticket

prices.

Shares in American Airlines Group Inc., Delta Air Lines Inc. and

United Continental Holdings Inc. all gained more than 5% in morning

trade on expectations that carriers would keep capacity growth in

check and boost average fares and profits.

Investor sentiment has been battered over the past 18 months as

a series of fare wars weighed on average ticket prices and

overshadowed the cost-cutting and sale of ancillary perks and

products that have helped airlines generate record profits.

Delta Chief Financial Officer Paul Jacobson led a parade of

bullish comments about capacity and revenue trends from executives

at an industry conference on Wednesday.

He said Delta would be the first of the three network carriers

to report a positive year-over-year increase in unit revenue, a

closely watched metric of how much an airline takes in for each

passenger flown a mile. Negative unit revenue trends have been

central to investor sentiment.

Mr. Jacobson pointed to an improving domestic fares environment

that is been replicated in its Pacific and Latin American markets,

though capacity additions on trans-Atlantic routes remained a

challenge.

He said the tailwind to profits from lower fuel prices was over,

and predicted that the fourth quarter of 2016 would be the first

time in two years that airlines experienced a year-over-year rise

in market fuel prices, excluding hedges.

Investors have remained wary of carriers diluting the benefits

of cheaper fuel with pricier labor deals and expanded flying, but

Mr. Jacobson said higher fuel "traditionally" allowed carriers to

boost ticket prices and average revenue.

Delta shares were recently up 5.4% at $38.80, recouping most of

the losses over the past month since the airline suffered a huge

computer-system outage that grounded hundreds of flights. The

shares are still down more than 20% year to date.

Atlanta-based Delta also said Wednesday that the outage would

trim $150 million from its pretax profits in the third quarter and

leave its unit revenue down around 7% from the same period a year

earlier, instead of 4% to 6% decline previously forecast. Mr.

Jacobson didn't say when Delta expected the metric to turn

positive, but the No. 3 U.S. airline by traffic in July said it

hoped that could occur by the end of this year.

Shares in American led the gains among the big network carriers,

recently up 6% at $39.17. Robert Isom, the carrier's new president,

laid out plans to boost revenue with more segmentation of its

aircraft to attract fliers willing to pay different ticket

prices.

Shares in United and Southwest Airlines Co. also gained,

outpacing rises among the discount carriers such as Spirit Airlines

Co. that have driven much of the capacity growth across the

industry in recent months.

Southwest said this week that it expected to expand capacity by

less than 4% next year compared with 2016, less than most analysts

expected and a move that could give carriers more flexibility to

boost fares as fuel prices increase.

Write to Doug Cameron at doug.cameron@wsj.com

Corrections & Amplifications: Delta Chief Financial Officer

Paul Jacobson predicted that the fourth quarter of 2016 would be

the first time in two years that airlines experienced a

year-over-year rise in market fuel prices, excluding hedges. An

earlier version of this article incorrectly stated the prediction

was for the fourth quarter of 2017. (Sept. 7, 2016)

(END) Dow Jones Newswires

September 07, 2016 14:27 ET (18:27 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

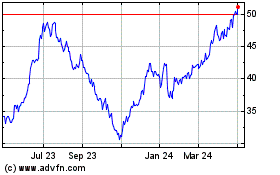

Delta Air Lines (NYSE:DAL)

Historical Stock Chart

From Mar 2024 to Apr 2024

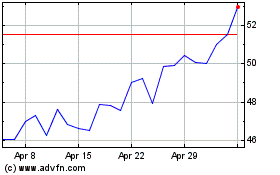

Delta Air Lines (NYSE:DAL)

Historical Stock Chart

From Apr 2023 to Apr 2024