EOG Resources Agrees to Acquire Yates Petroleum for $2.34 Billion -- Update

September 06 2016 - 2:14PM

Dow Jones News

By Lynn Cook and Tess Stynes

EOG Resources Inc., one of the most prolific shale drillers in

the U.S., agreed to acquire privately owned Yates Petroleum Corp.

for roughly $2.34 billion in a deal that expands its presence from

Texas and New Mexico to Colorado and Wyoming.

Houston-based EOG's shares, up 32% so far this year, rose 6.7%

to $94.89 in midday trade.

EOG management has famously shunned deals in recent years,

saying the company's best prospects for growth came directly

through the drill-bit by tapping new oil-and-gas wells. But Yates,

one of the nation's biggest privately held oil firms, has land in

prime oil basins that is too good to pass up, Bill Thomas, EOG's

chief executive, told investors Tuesday.

Yates, which is controlled by descendants of Martin Yates Jr.,

an early wildcatter who helped discover New Mexico's oil reserves,

has been the target of multiple corporate inquiries over the years.

It has assembled vast acreage in some of the sweetest oil drilling

prospects. Even though Yates's oil production is relatively low,

the company's tracts, combined with EOG's cutting-edge technology,

will be transformational to the company and the development of

several big fields, Mr. Thomas said.

"This really isn't about getting bigger. It's about getting

better," he said.

Much of the acreage that Yates controls borders EOG's existing

leases in places like the Delaware Basin in West Texas, which has

emerged as one of the hottest drilling spots even during a

two-year-long oil bust. Joining the companies' acreage together

will allow EOG to drill longer horizontal wells, ultimately

unlocking more crude oil.

Typical oil-and-gas leases measure one square mile, or 640

acres. But as energy companies try to reduce the cost of their

operations that footprint is often considered too small, experts

say. For U.S. producers to drill down vertically and then out

horizontally for more than a mile, more tracts of land need to be

cobbled together. Some companies are swapping acreage in West Texas

in an effort to create larger contiguous blocks of land they can

control.

EOG said the Yates deal will give it adjoining acreage in some

of the best plays around the U.S.

"It's no secret any more that the Delaware Basin is one of the

best resource plays in the country," Mr. Thomas said. "EOG's

acreage position will increase by 78% through this transaction to a

whopping 424,000 net acres."

Yates's extensive holdings in New Mexico also establish a new

play in the state for EOG, Mr. Thomas said.

Including the assumption of $245 million of debt, partly offset

by $131 million of cash on hand, the enterprise value of the deal

is estimated at $2.5 billion. The transaction, expected to close in

October, includes 26.06 million newly issued EOG shares valued at

roughly $2.3 billion and $37 million in cash.

EOG is one of top shale producers in the U.S., operating in

areas such as the Eagle Ford formation in South Texas and the

Delaware Basin in West Texas. The company has been realigning its

assets to create a premium inventory of drilling acreage that can

generate strong returns even when oil prices are weak.

The addition of Artesia, N.M.-based Yates's premium drilling

locations in the Delaware Basin in New Mexico and Powder River

Basin in Wyoming will increase EOG's premium drilling locations by

40%. EOG defines premium drilling locations as those with an

after-tax rate of return of at least 30%, assuming a $40 flat crude

oil price.

Last month EOG swung to a second-quarter loss and posted a sharp

revenue decline, though the company also increased its target for

2016 well completions amid cost cuts and improved efficiency.

Write to Lynn Cook at lynn.cook@wsj.com and Tess Stynes at

tess.stynes@wsj.com

(END) Dow Jones Newswires

September 06, 2016 13:59 ET (17:59 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

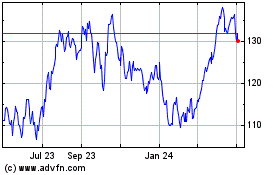

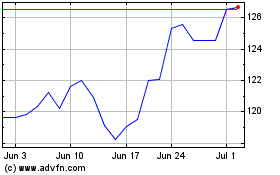

EOG Resources (NYSE:EOG)

Historical Stock Chart

From Mar 2024 to Apr 2024

EOG Resources (NYSE:EOG)

Historical Stock Chart

From Apr 2023 to Apr 2024