Written Communication by the Subject Company Relating to a Third Party Tender Offer (sc14d9c)

September 02 2016 - 1:36PM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14D-9

Solicitation/Recommendation Statement

under Section 14(d)(4) of the Securities Exchange Act of 1934

SIEBERT FINANCIAL CORP.

(Name of Subject Company (Issuer))

SIEBERT FINANCIAL CORP.

(Name of Entity Filing Statement)

Common Stock, Par Value $.01 Per Share

(Title of Class of Securities)

826176109

(CUSIP Number of Class of Securities

Joseph M. Ramos, Jr.

Executive Vice President, Chief Operating Officer,

Chief Financial Officer and Secretary

Siebert Financial Corp.

885 Third Avenue, New York, New York 10022

Telephone Number: (212) 644-2400

(Name, Address and Telephone Number of Person Authorized to Receive

Notices and Communications on Behalf of Filing Persons)

Norton Rose Fulbright US LLP

666 Fifth Avenue

New York, New York 10103

Attn: Warren J. Nimetz, Esq.

Telephone Number: (212) 318-3000

|

ý

|

Check the box if the filing relates solely to preliminary communications made before the

commencement of a tender offer.

|

This Schedule 14D-9C consists of the following documents relating to the proposed acquisition of a majority of the outstanding capital stock of Siebert Financial Corp., a New York corporation (“

Siebert Financial

”), pursuant to the terms of an Acquisition Agreement dated September 1, 2016, among Siebert Financial, the Estate of Muriel F. Siebert (the “

Siebert Estate

”) and Kennedy Cabot Acquisition, LLC, a Nevada limited liability company (“

Purchaser

”):

(1)

a joint press release issued by Siebert Financial and Purchaser dated September 2, 2016, a copy of which is attached hereto as Exhibit 99.1 and incorporated herein by reference;

(2)

a form of communication to Siebert Financial’s employees first used or made available on September 2, 2016, a copy of which is attached hereto as Exhibit 99.2 and incorporated herein by reference; and

(3)

a form of communication to Siebert Financial’s customers, first used or made available on September 2, 2016, a copy of which is attached hereto as Exhibit 99.3 and incorporated herein by reference.

The information set forth under Items 1.01 and 9.01 of the Current Report on Forms 8-K filed by Siebert Financial on September 2, 2016 (including all exhibits attached thereto) is incorporated herein by reference.

Notice to Investors

This communication is provided for informational purposes only and is neither an offer to purchase nor a solicitation of an offer to sell any securities of Siebert Financial. No tender offer for the outstanding common stock of Siebert Financial has yet commenced. Any offers to purchase or solicitation of offers to sell will be made only pursuant to the tender offer statement (including the offer to purchase, the letter of transmittal and other documents relating to the tender offer) which will be filed on Schedule TO by Purchaser with the SEC, and soon thereafter the Siebert Financial will file a Solicitation/Recommendation Statement on Schedule 14D-9 with respect to the tender offer. Siebert Financial’s shareholders are advised to read these documents and any other documents relating to the tender offer that will be filed with the SEC carefully and in their entirety because they contain important information. Siebert Financial’s shareholders may obtain copies of these documents for free at the SEC’s website at www.sec.gov or by contacting Siebert Financial’s investor relations department at Siebert Financial Corp., 885 Third Avenue, New York, New York 10022, Attention: Investor Relations.

Forward Looking Statements

This communication contains “forward-looking statements” (as defined in the Securities Litigation Reform Act of 1995) regarding, among other things, future events. Words such as “anticipate,” “expect,” “intend,” “believe,” and words and terms of similar substance used in connection with any discussion of future plans, actions or events identify forward-looking statements. Forward-looking statements relating to the proposed transaction include, but are not limited to: statements about the benefits of the proposed transaction; Siebert Financial’s and Kennedy Cabot’s plans, objectives, expectations and intentions; the expected timing of completion of the proposed transaction; and other statements relating to the transaction that are not historical facts. Forward-looking statements are based on information currently available to Siebert Financial and involve estimates, expectations and projections. Investors are cautioned that all such forward-looking statements are subject to risks and uncertainties, and important factors could cause actual events or results to differ materially from those indicated by such forward-looking statements. With respect to the proposed transaction between Siebert Financial and Kennedy Cabot, these factors could include, but are not limited to: regulatory approval being a condition of the transaction; the risk that a condition to closing of the transaction may not be satisfied; the length of time necessary to consummate the proposed transaction, which may be longer than anticipated for various reasons; the diversion of management time on transaction-related issues; changes in the general economic environment, or social or political conditions, that could affect the businesses; and the potential impact of the announcement or consummation of the proposed transaction on relationships with customers, competitors, management and other employees.

Additional information concerning other risk factors is also contained in Siebert Financial’s most recently filed Annual Reports on Form 10-K, subsequent Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and other SEC filings.

EXHIBIT INDEX

|

|

Joint press release issued by Siebert Financial and Purchaser dated September 2, 2016

|

|

|

Form of communication to Siebert Financial’s employees first used or made available on September 2, 2016

|

|

|

Form of communication to Siebert Financial’s customers, first used or made available on September 2, 2016

|

-3-

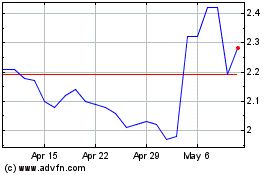

Siebert Financial (NASDAQ:SIEB)

Historical Stock Chart

From Mar 2024 to Apr 2024

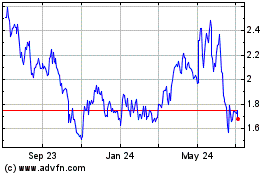

Siebert Financial (NASDAQ:SIEB)

Historical Stock Chart

From Apr 2023 to Apr 2024