By Jenny Strasburg and Eyk Henning

Executives at Deutsche Bank AG are contemplating dramatic

options for the German lender, including selling all or part of a

key business, a sign of growing pressure to speed up a flagging

overhaul.

This weekend, senior executives are meeting to debate some of

these options, according to people familiar with the plans. One has

already been floated: a merger with Germany's second-largest bank

by market value, Commerzbank AG, the people said. Deutsche Bank and

Commerzbank held preliminary discussions about a tie-up in August,

before concluding last week it wasn't viable.

Chief Executive John Cryan, who was named co-CEO in July 2015,

has set out a long-term plan of shrinking Deutsche Bank and cutting

costs. But the merger discussions and the weekend summit signify

that the bank may not have the luxury of a drawn-out revamp. On

Wednesday, Mr. Cryan found himself on stage at a financial

conference in Frankfurt batting back speculation about a

merger.

For Deutsche Bank, 2016 has been an annus horribilis. Its shares

are off 41% this year and now trade where they did in the

mid-1980s. It has a long list of regulatory troubles compounded by

a thin capital cushion and flagging performance in many key

business lines that leave it more vulnerable than its peers.

To make matters worse, Britain's vote to leave the European

Union rattled confidence across Europe's financial sector and posed

problems for banks with large London workforces. Deutsche Bank runs

big trading, advisory and asset-management operations from London

and has more than 8,000 employees in the U.K., where it books

almost 20% of its revenue, more than many non-U.K. peers.

Since the June 23 vote, Deutsche Bank's shares are down 15%,

more than twice the decline of eurozone banks broadly. Shares in

troubled rival Credit Suisse Group AG are down 2% since Brexit.

Deutsche Bank's market value is around $20 billion, a bit bigger

than Buffalo, N.Y.-based M&T Bank Corp. Its profit in the

second quarter fell 98%, to EUR20 million ($22.3 million), or

around $200 per employee.

Deutsche Bank was once an ambitious powerhouse. It was a top

deal maker across the continent and one of the few big European

players competing head-on with the biggest U.S. banks on their

turf. But this year has been humbling -- and Deutsche Bank seems to

have few good options.

Mr. Cryan and other top executives have expressed aversion to a

merger, people familiar with internal bank discussions said. He,

like many analysts and investors, has said that regulatory hurdles

alone could make such a tie-up far-fetched.

Instead, Mr. Cryan, who became sole CEO earlier this year, has

pushed to go it alone. In October, he unveiled new financial

targets and a five-year overhaul plan.

That was before European banks had to face the increasing pain

of lower and negative interest rates. That squeezes profits in

retail banking.

As part of a continuing review of strategic options, the bank in

recent weeks has analyzed possibilities including selling all or

part of its asset-management business, people close to the matter

said. Deutsche Bank executives want to keep most of the business,

the people say. They see the steady returns as ballast against

volatile profits from the bigger trading and investment-banking

businesses.

But small pieces of the asset-management division could be

deemed ripe for sale, people briefed on internal discussions

said.

Deutsche Bank executives also are discussing whether to adjust

Mr. Cryan's October financial targets, such as profit goals, the

people said.

"We do have confidence in the management team," says Laurie

Mayers, a European banking analyst with Moody's Investors Service.

"But Brexit is unwelcome additional pressure when they already have

quite important issues to address."

Moody's rates Deutsche Bank Baa 2, two notches above junk level.

One factor: the lender's heavy dependence on its trading

business.

That business has been under pressure this year. In May, the

bank's finance chief told a large investor that about two dozen

trading clients had capped the volume of their trades with the

bank, according to a person familiar with the conversation.

Deutsche Bank said client activity subsequently picked up.

Deutsche Bank is a tough ship to turn around. It has big

business lines in sales and trading of stocks and bonds --

once-lucrative zones that have shrunk amid regulatory change and

stiff competition. Its retail-banking business is concentrated in

Germany, a cutthroat market full of regional savings banks.

And Deutsche Bank has a massive book of hard-to-value

derivatives. The riskier derivatives have become harder to sell

after Brexit, analysts say. Since 2007, the bank has culled its

so-called "Level 3" assets, which include distressed debt and

complex derivatives, to EUR29 billion as of the second quarter, a

67% decrease from 2007.

But Level 3 assets still equate to about 47% of shareholder

equity, a ratio much higher than at the biggest U.S. investment

banks.

Thanks in part to these exposures, the International Monetary

Fund this summer called Deutsche Bank the No. 1 contributor to

systemic risk among the biggest global banks. And soon after, in

stress tests, European regulators concluded that Deutsche Bank

would have enough capital to withstand a severe downturn -- but

only barely.

Such developments have led investors to ask: Will Deutsche Bank

have enough capital to absorb possible trading losses or

outstanding fines? And is it moving fast enough to reach that

point?

Deutsche Bank needs to generate about EUR7 billion in capital by

2019, analysts say. Building capital "organically," as Mr. Cryan's

team wants to do, is hard work: The bank must improve earnings and

conserve them. Shareholders also have been put off by the

elimination of two years of dividends.

Bank executives don't want to sell new shares to raise capital,

Citigroup banking analyst Andrew Coombs said in a recent note, but

there might not be a choice. "Capital concerns won't go away," he

wrote.

--Madeleine Nissen contributed to this article.

Write to Jenny Strasburg at jenny.strasburg@wsj.com and Eyk

Henning at eyk.henning@wsj.com

(END) Dow Jones Newswires

August 31, 2016 16:59 ET (20:59 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

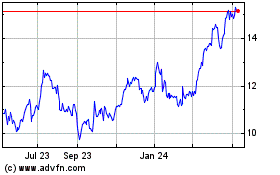

Commerzbank (PK) (USOTC:CRZBY)

Historical Stock Chart

From Mar 2024 to Apr 2024

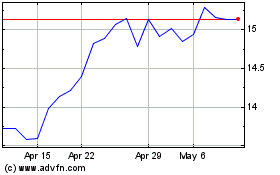

Commerzbank (PK) (USOTC:CRZBY)

Historical Stock Chart

From Apr 2023 to Apr 2024