Snack Maker Mondelez Drops Pursuit of Hershey -- Update

August 29 2016 - 5:41PM

Dow Jones News

By Tess Stynes and Dana Cimilluca

Mondelez International Inc. ended its bid to acquire Hershey Co.

after the famed chocolate-bar maker rebuffed a new takeover offer

and indicated it would be difficult to strike a deal before next

year.

Mondelez said in a statement after the market closed Monday that

it determined there was "no actionable path forward" its bid to buy

its smaller rival.

The Wall Street Journal reported in June that Mondelez made a

roughly $23 billion bid for Hershey, a tie-up that would create the

world's largest candy maker. Hershey rejected the offer, which

amounted to $107 a share, half in cash and half in stock.

Mondelez Chief Executive Irene Rosenfeld privately indicated to

Hershey officials a willingness to raise the bid to $115 a share

last week, according to a person familiar with the matter. Hershey

responded that the starting point for discussions would need to be

$125 a share. Hershey also indicated that the trust that controls

the company, which has been in turmoil, would need to complete a

reconstitution before there could be a deal--something unlikely to

happen until next year, this person added.

Both Hershey and Mondelez, which is based in Deerfield, Ill.,

have been under pressure amid a trend toward more-healthy eating

and other factors.

Any takeover of Hershey, known for its namesake Kisses and

chocolate bars, faced multiple obstacles. A deal would require the

approval of the Hershey Trust, its largest shareholder, which has

opposed a sale in the past.

Ms. Rosenfeld said in prepared remarks Monday that while the

company was disappointed, it remains focused on its efforts to

deliver sustainable sales growth and stronger margins. Mondelez

will be disciplined in its approach to generating value, including

through acquisitions, she added. Indeed, Mondelez called off the

pursuit because the deal was attractive but not essential and

because it was eager to avoid overpaying, the person said.

Hershey shares slumped on the news, falling more than 10% after

hours to under $100 a share after closing at $111.67. Mondelez,

meanwhile, rose 3.6% after closing at $43.04.

The maker of Oreo cookies and Cadbury chocolate plans to provide

more details at an upcoming industry conference on Sept. 7.

The Journal reported last month that the Hershey Trust, which

oversees billions of dollars for a local, nonprofit school had

agreed to make significant governance changes that could affect the

future of the chocolate company, citing people familiar with the

matter. The trust agreed on terms of a settlement with

Pennsylvania's top law-enforcement officer, which has been

investigating the trust board over allegations of excessive

compensation and conflicts of interest.

Earlier in July a board member of the trust controlling Hershey

resigned, another sign of uncertainty at the famous chocolate

maker.

--Annie Gasparro contributed to this article.

Write to Tess Stynes at tess.stynes@wsj.com and Dana Cimilluca

at dana.cimilluca@wsj.com

(END) Dow Jones Newswires

August 29, 2016 17:26 ET (21:26 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

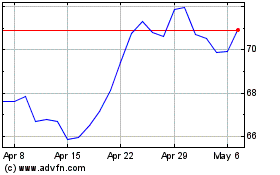

Mondelez (NASDAQ:MDLZ)

Historical Stock Chart

From Mar 2024 to Apr 2024

Mondelez (NASDAQ:MDLZ)

Historical Stock Chart

From Apr 2023 to Apr 2024