By Heather Haddon and Julie Jargon

The U.S. is on track this year to post the longest stretch of

falling food prices in more than 50 years, a streak that is

cheering U.S. shoppers at the checkout line but putting a financial

strain on farmers, grocery stores and restaurants.

The trend is being fueled by an excess supply of dairy products,

meat, grains and other staples and less demand for many of those

same products from China and elsewhere due to the strong dollar.

Lower energy costs for transportation and refrigeration also are

contributing to sagging food prices, say economists.

"Deflation is a godsend for consumers," said Bob Goldin, vice

chairman of food consultancy Technomic Inc.

Nationwide, the price of a gallon of whole milk on average was

off 11% to $3.06 in July over a year ago; the price of a dozen

large eggs fell 40% to $1.55 in the same period.

Those great bargains at the grocery store are spreading pain

across the Farm Belt. Farmers and ranchers are getting less money

for raw milk, cheese and cattle, forcing them to slash spending.

Tractor suppliers like Deere & Co. are cutting production due

to the farming slump.

Economists and food analysts say the supermarket price declines

could last at least through year-end. The drop comes as weaker

demand from China is broadly resetting commodities prices in

everything from cheese to iron ore. The current food-price slump

soon could beat the nine months of year-to-year declines

experienced in 2009 and 2010 -- the longest stretch since 1960,

according to the Bureau of Labor Statistics.

The price of food at home is down 1.6% on a seasonally

unadjusted basis in the 12 months ended in July, according to the

BLS.

Stephanie Hegre, a 46-year-old nanny in Thousand Oaks, Calif.,

has noticed an about 10% drop in her weekly food shopping bill. Her

16-year-old twin daughters go through a lot of milk, meat and

bread, adding up to an average weekly grocery bill of about

$200.

"I feel it has dropped by $20 a week which, when you're on a

budget, is noticeable," said Ms. Hegre, who has been stockpiling

staples in case prices increase. "We freeze bread and buy two

weeks' worth of bacon at a time," she said.

The glut is so severe in some places that dairy farmers have

been dumping millions of pounds of excess milk onto fields. The

U.S. Department of Agriculture just bought $20 million worth of

cheese in response to hard-hit dairy farmers' requests. The cheese

was given to food banks and others through USDA

nutrition-assistance programs.

Ben Moore, a sixth-generation farmer who grows corn and soybeans

on some 5,000 acres in Indiana and Ohio, said 2016 is shaping up to

be his least profitable year in 20 years. Facing weak crop prices,

he is making do with his current tractors and combines rather than

upgrading his equipment, and is pushing for lower prices on

pesticides, seeds and fertilizer.

On Friday, corn futures, which peaked in 2012 at more than $8 a

bushel, closed at $3.16 a bushel, a seven-year low, on the Chicago

Board of Trade.

"We cannot withstand $4 a bushel corn," Mr. Moore said.

Farmers who had built a nest egg after a robust period earlier

this decade now have exhausted those reserves, said Karl Setzer, a

market analyst for MaxYield Cooperative, a West Bend, Iowa, grain

marketer. "The guys that are heavily leveraged and those who don't

have a plan of action will suffer for a while."

Falling costs are taking a toll on many food retailers. Grocery

stores already have thin profit margins and deflation tends to

reduce the value of their inventory. To stay competitive, they must

cut prices on existing goods before lower-priced stables land on

the loading dock, and have fewer opportunities to raise prices.

At least six national food retailers, including Costco Wholesale

Corp. and Whole Foods Market Inc., and four of the five largest

publicly traded food distributors, including Sysco Corp. and US

Foods Holding Corp., have reported that their margins suffered in

the last quarter because of food deflation, the first time analysts

can recall so many grocers singling out deflation as a big

problem.

"Deflation is kind of the elephant in the room," Dennis Eidson,

chief executive of SpartanNash Co., which operates 160 grocery

stores from Colorado to Ohio and distributes food to 1,900

retailers across the country, told investors this month.

Grocers such as Supervalu Inc. and Smart & Final Stores Inc.

have been hit particularly hard. Even when the volume of products

increased, profits have decreased in some categories because the

price declines were so steep. Smart & Final's division catering

to restaurants sold 42% more packages of eggs during its most

recent quarter but recorded a 34% drop in egg revenue because of

the lower prices, Chief Executive David Hirz told investors.

Not all food has gotten cheaper. Total fruits and vegetables

prices were up 1.4% in July from a year earlier in part due to the

drought in California.

Wal-Mart Stores Inc., the nation's largest food retailer, has

been one of the few to benefit from the falling prices, partly

because it attracted more customers after slashing prices earlier

this year. It reported strong second-quarter results this month

despite "ongoing deflationary impacts in food."

Normally, falling food prices would be good for restaurants, but

with higher labor costs, they have had to raise menu prices,

resulting in lost business. The second quarter was the industry's

weakest since the first quarter of 2010.

Three restaurant types posted declining sales in the quarter --

fast casual, casual dining and family dining -- and sales growth in

every other restaurant category slowed except pizza, according to

equity researcher William Blair & Co.

It has gotten a lot cheaper "to get beef at your local butcher

and go home and grill," said Todd Penegor, chief executive of

burger chain Wendy's Co., which reported second-quarter sales below

expectations.

--Kelsey Gee and Jesse Newman contributed to this article.

(END) Dow Jones Newswires

August 29, 2016 13:28 ET (17:28 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

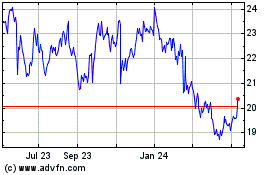

SpartanNash (NASDAQ:SPTN)

Historical Stock Chart

From Mar 2024 to Apr 2024

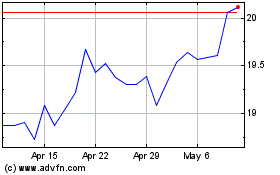

SpartanNash (NASDAQ:SPTN)

Historical Stock Chart

From Apr 2023 to Apr 2024