Amendment No. 3 dated August 26, 2016 to

Prospectus Supplement dated March 3, 2016

|

Filed Pursuant to Rule 424(b)(5)

Registration Nos. 333-207976 and 333-209895

|

|

(To the Prospectus dated November 13, 2015)

|

|

5,882,353 Shares of Common Stock

Series A Warrants to purchase 2,941,177

Shares of Common Stock

Series B Warrants to purchase 5,882,353

Shares of Common Stock

This

Amendment No. 3 to Prospectus Supplement (the “Third Amendment”) amends the Prospectus Supplement dated March 3, 2016,

as amended by Amendment No.1 dated May 2, 2016 (the “First Amendment”), and as further amended by Amendment No. 2 dated

May 19, 2016 and should be read in conjunction with such Prospectus Supplement, the First Amendment, the Second Amendment, and

the prospectus dated November 13, 2015, each of which are to be delivered with this Third Amendment to Prospectus Supplement. This

Third Amendment amends only those sections of the Prospectus Supplement, as amended, listed in this Third Amendment; all other

sections of the Prospectus Supplement remain as is.

We are only filing this Third Amendment

because we agreed with certain holders (the “Holders”) of our Series A Common Stock Purchase Warrants (the “Series

A Warrants”) to amend the exercise price of the Series A Warrants for the purchase of up to 2,205,882 shares of our common

stock, par value $0.001 per share (the “Common Stock”) to $0.35 per share and to amend the Initial Exercise Date of

the Series A Warrant August 22, 2016. The Series A Warrants were originally exercisable at $2.25 per share of Common Stock and

were not exercisable until September 3, 2016.

In consideration

for amending the exercise price of the Series A Warrants, we agreed to issue the Holders a new class of Series E Common Stock Purchase

Warrants (the “Series E Warrants”) to purchase up to 2,205,882 shares of Common Stock at an exercise price of $0.41

per share. The Initial Exercise Date of the Series E Warrants is six months from the date hereof and the Series E Warrants expire

on the five (5) year anniversary of the Initial Exercise Date.

In connection with issuance

of the Series E Warrants, we also agreed to enter into a registration rights agreement (the “Registration Rights Agreement”)

governing the registration of the Series E Warrants.

Our Common Stock is listed on The NASDAQ

Capital Market under the symbol “NWBO”. Our Warrants are listed on the Nasdaq Capital Market under the symbol “NWBOW”.

On August 22, 2016, the closing sale price of our common stock was $0.41 per share.

We have retained H.C. Wainwright &

Co., LLC as placement agent in connection with this offering. The placement agent has no obligation to buy any of the securities

from us or to arrange for this purchase or sale of any specific number or dollar amount of securities. See “Plan of Distribution”

on page S-3 of this prospectus supplement for more information regarding these arrangements.

Investing in our securities involves

a high degree of risk. See “Risk Factors” beginning on page A-3 of this Amendment and page S-3 of the accompanying

prospectus and the documents incorporated by reference herein for a discussion of information that should be considered in connection

with an investment in our securities.

Neither the Securities and Exchange

Commission nor any state securities commission has approved or disapproved of these securities or determined whether this prospectus

supplement or the accompanying prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

H.C. Wainwright & Co.

The date of this amendment No. 3 to prospectus

supplement is August 26, 2016.

TABLE OF CONTENTS

Amendment No. 3 to Prospectus Supplement

ABOUT THIS AMENDMENT NO. 3 TO PROSPECTUS

SUPPLEMENT

On March 3, 2016 we filed a Prospectus

Supplement in accordance with Rule 424(b)(5) of the Securities Act of 1933, as amended. We offered for sale, directly to selected

investors, 5,882,353 shares (the “Shares”) of our common stock par value $0.001, per share (the “Common Stock”)

at a price of $1.70 per share, plus Series A Warrants (the “Series A Warrants”) to purchase up to 2,941,177 shares

of Common Stock at an exercise price of $2.25 per share and Series B Warrants, which originally expired in sixty (60) days (the

“Series B Warrants”, and collectively with the Series A Warrants, the “Offered Warrants”) to purchase up

to 5,882,353 shares of Common Stock at an exercise price of $3.00 per share.

The sale

of shares and warrants pursuant to the March 3, 2016 Prospectus Supplement closed on March 3, 2016. The Series B Warrants that

were issued at that closing currently have an exercise period that expires on May 2, 2016. On May 2, 2016 we filed Amendment No.

1 to the March 3, 2016 Prospectus Supplement to disclose the extension of the exercise period of the Series B Warrants by twenty-one

(21) days to May 23, 2016. On May 19, 2016, we filed Amendment No. 2

to the March 3, 2016

Prospectus Supplement to disclose

the amendment of the exercise price of the Series B Warrants

to $0.96 per share, the amendment of the Initial Exercise Date of the Series C Warrants to November 16, 2016 and the Termination

Date extension to the five (5) year anniversary of the Initial Exercise Date.

The sole purpose of this Amendment No.

3 to the March 3, 2016 Prospectus Supplement is to disclose the amendment of the exercise price of the Series A Warrants to $0.35

per share and the amendment of the Initial Exercise Date of the Series A Warrants to August 22, 2016.

On November 13, 2015, we filed with the

Securities and Exchange Commission, or SEC, a registration statement on Form S-3 (File No. 333-207976) utilizing a shelf registration

process and a Form S-3 MEF (Registration File No. 333-209895) relating to the securities described in this prospectus supplement.

Under this shelf registration process, we may, from time to time, sell up to $156.7 million in the aggregate of common stock, preferred

stock, warrants, various series of debt securities and/or warrants to purchase any of such securities, either individually or in

units.

The prospectus supplement is part of a

registration statement, and the amendments thereto, that we have filed with the Securities and Exchange Commission on November

13, 2015 (Registration File No. 333-207976) utilizing a “shelf” registration process, which registration statement,

as amended, was declared effective on December 22, 2015 and a Form S-3MEF (Registration File No. 333-209895) filed with the Commission

on March 3, 2016 to register an additional amount of securities pursuant to Rule 462(b) of the Securities Act of 1933, as amended.

Under this shelf registration process,

we have offered to sell Common Stock, the Offered Warrants, and shares of Common Stock issuable upon exercise of the Offered Warrants

using this prospectus supplement, as amended, and the accompanying prospectus. In this prospectus supplement, we provide you with

specific information about the securities that we sold in the offering, and about the amendment of the exercise period of the Series

B Warrants issued in the offering. Both this prospectus supplement, as amended, and the accompanying prospectus include important

information about us, our securities being offered and other information you should know before investing. This prospectus supplement,

as amended, also adds updates and changes information contained in the accompanying prospectus. You should read this prospectus

supplement, as amended, and the accompanying prospectus as well as additional information described under “Incorporation

of Certain Documents by Reference” on page A-6 of this Amendment No. 3 to prospectus supplement and S-25 of the prospectus

supplement before investing in our securities.

Our primary executive offices are located

at 4800 Montgomery Lane, Suite 800, Bethesda, MD 20814, and our telephone number is (240) 497-9024. Our website address is http://www.nwbio.com.

The information contained on our website is not a part of, and should not be construed as being incorporated by reference into,

this Amendment No. 3 to prospectus supplement.

Unless the context otherwise requires,

“Northwest,” the “company,” “we,” “us,” “our” and similar names refer

to Northwest Biotherapeutics, Inc.

Prospective investors may rely only

on the information contained in this Amendment No. 3 to prospectus supplement. We have not authorized anyone to provide prospective

investors with different or additional information. This prospectus supplement is not an offer to sell nor is it seeking an offer

to buy these securities in any jurisdiction where the offer or sale is not permitted. The information contained in this Amendment

No. 3 to prospectus supplement is correct only as of the date of this Amendment No. 2 to prospectus supplement, regardless of the

time of the delivery of this prospectus supplement or any sale of these securities.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING

STATEMENTS

The SEC encourages companies to disclose

forward-looking information so that investors can better understand a company’s future prospects and make informed investment

decisions. This amendment to prospectus supplement, the prospectus supplement and the prospectus and the documents we have filed

with the SEC that are incorporated herein and therein by reference, contain such “forward-looking statements” within

the meaning of the Private Securities Litigation Reform Act of 1995.

Words such as “may,” “might,”

“should,” “anticipate,” “estimate,” “expect,” “projects,” “intends,”

“plans,” “believes” and words and terms of similar substance used in connection with any discussion of

future operating or financial performance, identify forward-looking statements. Forward-looking statements represent management’s

current judgment regarding future events and are subject to a number of risks and uncertainties that could cause actual results

to differ materially from those described in the forward-looking statements. These risks include, but are not limited to:

|

|

•

|

risks related to our abilities to carry out intended manufacturing expansions;

|

|

|

•

|

our ability to raise additional capital;

|

|

|

•

|

risks related to our ability to enroll patients in its clinical trials and complete the trials on a timely basis;

|

|

|

•

|

risks related to the progress, timing and results of clinical trials and research and development efforts involving our product candidates generally;

|

|

|

•

|

uncertainties about the clinical trials process;

|

|

|

•

|

uncertainties about the timely performance of third parties;

|

|

|

•

|

risks related to whether our products will demonstrate safety and efficacy;

|

|

|

•

|

risks related to our commercialization efforts and commercial opportunity for our DCVax product candidates;

|

|

|

•

|

risks related to the submission of applications for and receipt of regulatory clearances and approvals;

|

|

|

•

|

risks related to our plans to conduct future clinical trials or research and development efforts;

|

|

|

•

|

risks related to our ability to carry out our Hospital Exemption program (in Germany);

|

|

|

•

|

risks related to possible reimbursement and pricing;

|

|

|

•

|

uncertainties about estimates of the potential market opportunity for our product candidates;

|

|

|

•

|

uncertainties about our estimated expenditures and projected cash needs;

|

|

|

•

|

uncertainties about our expectations about partnering, licensing and marketing; and

|

|

|

•

|

the use of proceeds from this offering.

|

Please also see the discussion of risks

and uncertainties under “Risk Factors” beginning on page 3 of the prospectus, in our most recent Annual Report on Form

10-K, and reports on Form 8-K, as filed with the SEC and which are incorporated herein by reference.

We believe these forward-looking statements

are reasonable; however, you should not place undue reliance on any forward-looking statements, which are based on current expectations.

Furthermore, forward-looking statements speak only as of the date they are made. If any of these risks or uncertainties materialize,

or if any of our underlying assumptions are incorrect, our actual results may differ significantly from the results that we express

in or imply by any of our forward-looking statements. These and other risks are detailed in this prospectus supplement, in the

accompanying prospectus, in the documents that we incorporate by reference into this prospectus supplement and the accompanying

prospectus and in other documents that we file with the Securities and Exchange Commission (the “Commission”). We do

not undertake any obligation to publicly update or revise these forward-looking statements after the date of this prospectus supplement

to reflect future events or circumstances. We qualify any and all of our forward-looking statements by these cautionary factors.

In light of these assumptions, risks and

uncertainties, the results and events discussed in the forward-looking statements contained in this prospectus supplement or the

accompanying prospectus or in any document incorporated herein or therein by reference might not occur. Investors are cautioned

not to place undue reliance on the forward-looking statements, which speak only as of the date of this prospectus supplement or

the accompanying prospectus or the date of the document incorporated by reference herein or therein. We are not under any obligation,

and we expressly disclaim any obligation, to update or alter any forward-looking statements, whether as a result of new information,

future events or otherwise, except as required by law. All subsequent forward-looking statements attributable to us or to any person

acting on our behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this section.

RISK FACTORS

Investing in our securities involves

significant risks. Please see the risk factors under the heading “Risk Factors” in our most recent Annual Report on

Form 10-K, as revised or supplemented by our Quarterly Reports on Form 10-Q and reports on Form 8-K filed with the SEC since the

filing of our most recent Annual Report on Form 10-K, each of which are on file with the SEC and are incorporated by reference

in this prospectus. Before making an investment decision, you should carefully consider these risks as well as other information

we include or incorporate by reference in this prospectus and any prospectus supplement. The risks and uncertainties we have described

are not the only ones facing our company. Additional risks and uncertainties not presently known to us or that we currently deem

immaterial may also affect our business operations, results of operation, financial condition or prospects.

DILUTION

In purchasing shares in this offering,

the buyer’s interest will be diluted to the extent of the difference between the offering price per share and the net tangible

book value per share of our common stock after this offering. Our net tangible book value as of September 30, 2015 was ($57.4)

million, or ($0.73) per share of common stock. “Net tangible book value” is total assets minus the sum of liabilities

and intangible assets. “Net tangible book value per share” is net tangible book value divided by the total number of

shares of common stock outstanding.

After giving effect to the sale by us of

5,882,353 shares of our common stock in this offering at the offering price of $1.70 per share, and after deducting the placement

agent’s fees, and $100,000 of estimated offering expenses payable by us, our net tangible book value as of September 30,

2015 would have been approximately (48.1) million or ($0.57) per share of common stock. This amount represents an immediate increase

in net tangible book value of $0.16 per share to existing stockholders and an immediate dilution of $2.27 per share to purchaser

in this offering.

The following table illustrates the dilution:

|

Offering price per share

|

|

|

|

|

|

$

|

1.70

|

|

|

Net tangible book value per share as of September 30, 2015

|

|

$

|

(0.73

|

)

|

|

|

|

|

|

Increase in net tangible book value per share after this offering

|

|

$

|

0.16

|

|

|

|

|

|

|

Pro forma net tangible book value per share after this offering

|

|

|

|

|

|

$

|

(0.57

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Dilution per share to the investor in this offering

|

|

|

|

|

|

$

|

2.27

|

|

The above table is based on 92,358,087

shares outstanding, including redeemable shares, as of September 30, 2015 and excludes, as of that date:

|

|

•

|

294,118 shares of our common stock issuable upon exercise of the warrants that may be issued to the placement agent in this offering;

|

|

|

•

|

1,551,000 shares of our common stock subject to outstanding options having a weighted average exercise price of $10.56 per share;

|

|

|

•

|

16,920,618 shares of our common stock reserved for issuance in connection with future awards under our Amended and Restated 2007 Stock Option Plan; and

|

|

|

•

|

25,549,641 shares of our common stock that have been reserved for issuance upon exercise of outstanding warrants at a weighted average exercise price of $4.41 per share.

|

To the extent that any outstanding options

or warrants are exercised, new options are issued under our Amended and Restated 2007 Stock Option Plan, or we otherwise issue

additional shares of common stock in the future, at a price less than the public offering price, there will be further dilution

to the investor.

PLAN OF DISTRIBUTION

On August 19, 2016, we engaged H.C. Wainwright

& Co., LLC (“Wainwright” or the “Placement Agent”) as our exclusive placement agent in connection with

the amendment of exercise price and initial exercise date of the Offered Warrants and subsequent exercise by such holder. We previously

entered into an engagement agreement with Wainwright on February 29, 2016. Wainwright is not purchasing or selling any securities,

nor is Wainwright required to arrange for the purchase and sale of any specific number or dollar amount of securities, other than

to use its “reasonable best efforts” to arrange for the sale of securities by us. Wainwright may engage one or more

sub-placement agents or selected dealers to assist with the offering.

Upon the closing of this offering, we paid

to Wainwright a cash fee equal to 7% of the gross proceeds to use from the sale of the securities in this offering and a cash fee

equal to 7% of the gross proceeds received by the Company in respect of the exercise of the Series B Warrants, if any. In addition,

we paid to Wainwright a non-accountable expense allowance equal to $50,000.

In addition, we agreed to grant compensation

warrants to the placement agent to purchase a number of shares of Common Stock equal to five percent of the number of shares sold

by us in the offering and five percent of the number of shares sold by us in respect of the exercise of the Series B Warrants,

if any. The compensation warrants have an exercise price equal to $2.125 or 125% of the public offering price per share of Common

Stock, will be exercisable beginning six months after issuance and will terminate on February 29, 2021. The compensation warrants

issued to the placement agent are not registered pursuant to this prospectus supplement.

We negotiated the price for the shares

offered in this offering with the purchasers. The factors considered in determining the price included the recent market price

of our common stock, the general condition of the securities market at the time of this offering, the history of, and the prospects,

for the industry in which we compete, our past and present operations, and our prospects for future revenues.

We have also agreed to provide the placement

agent with a tail fee for a period of 3 months following the termination of the engagement agreement with respect to certain investors

and to pay the cash and warrant compensation described above in connection with further investments by such investors during the

tail period.

The placement agent may be deemed to be

an underwriter within the meaning of Section 2(a)(11) of the Securities Act of 1933, as amended (the “Securities Act”),

and any fees or commissions received by it and any profit realized on the resale of the securities sold by it while acting as principal

might be deemed to be underwriting discounts or commissions under the Securities Act. As underwriter, the placement agent would

be required to comply with the requirements of the Securities Act and the Exchange Act, including, without limitation, Rule 415(a)(4)

under the Securities Act and Rule 10b-5 and Regulation M under the Exchange Act.

These rules and regulations may limit the

timing of purchases and sales of shares of common stock by the placement agent. Under these rules and regulations, the placement

agent (i) may not engage in any stabilization activity in connection with our securities and (ii) may not bid for or purchase any

of our securities or attempt to induce any person to purchase any of our securities, other than as permitted under the Exchange

Act, until it has completed its participation in the distribution.

We have agreed to indemnify the placement

agent against certain liabilities, including liabilities under the Securities Act of 1933, as amended, and liabilities arising

from breaches and representations and warranties contained in the placement agent agreement. We have also agreed to contribute

to payments the placement agent may be required to make in respect of such liabilities.

LEGAL MATTERS

The validity of the securities being offered

hereby will be passed upon by Kane Kessler, P.C., New York, New York. H.C. Wainwright & Co., LLC is being represented in connection

with this offering Ellenoff Grossman & Schole LLP, New York, New York.

WHERE YOU CAN FIND MORE INFORMATION

We are subject to the reporting requirements

of the Securities Exchange Act of 1934, as amended, and file annual, quarterly and current reports, proxy statements and other

information with the SEC. You may read and copy these reports, proxy statements and other information at the SEC’s public

reference facilities at 100 F Street, N.E., Room 1580, Washington, D.C. 20549. You can request copies of these documents by writing

to the SEC and paying a fee for the copying cost. Please call the SEC at 1-800-SEC-0330 for more information about the operation

of the public reference facilities. SEC filings are also available at the SEC’s web site at http://www.sec.gov. Our common

stock is listed on The NASDAQ Capital Market, and you can read and inspect our filings at the offices of the Financial Industry

Regulatory Authority, Inc. at 1735 K Street, Washington, D.C. 20006.

This prospectus supplement is only part

of a registration statement on Form S-3 that we have filed with the SEC under the Securities Act of 1933, as amended, and therefore

omits certain information contained in the registration statement. We have also filed exhibits and schedules with the registration

statement that are excluded from this prospectus supplement and the accompanying prospectus, and you should refer to the applicable

exhibit or schedule for a complete description of any statement referring to any contract or other document. You may inspect a

copy of the registration statement, including the exhibits and schedules, without charge, at the public reference room or obtain

a copy from the SEC upon payment of the fees prescribed by the SEC.

INCORPORATION OF CERTAIN INFORMATION

BY REFERENCE

The SEC allows us to “incorporate

by reference” information that we file with them. Incorporation by reference allows us to disclose important information

to you by referring you to those other documents. The information incorporated by reference is an important part of this prospectus,

and information that we file later with the SEC will automatically update and supersede this information. We filed a registration

statement on Form S-3 under the Securities Act of 1933, as amended, with the SEC with respect to the securities being offered pursuant

to this prospectus. This prospectus omits certain information contained in the registration statement, as permitted by the SEC.

You should refer to the registration statement, including the exhibits, for further information about us and the securities being

offered pursuant to this prospectus. Statements in this prospectus regarding the provisions of certain documents filed with, or

incorporated by reference in, the registration statement are not necessarily complete and each statement is qualified in all respects

by that reference. Copies of all or any part of the registration statement, including the documents incorporated by reference or

the exhibits, may be obtained upon payment of the prescribed rates at the offices of the SEC listed above in “Where You Can

Find More Information.” The documents we are incorporating by reference are:

|

|

•

|

Our Annual Report on Form 10-K for the fiscal year ended December 31, 2015, filed on March 16, 2016 as amended on Form 10-K/A filed on April 29, 2016;

|

|

|

•

|

Our Quarterly Reports on Form 10-Q for the Fiscal quarters ended June 30, 2016, March 31, 2016, September 30, 2015 and June 30, 2015, filed on August 9, 2016, May 11, 2016, November 9, 2015, and August 10, 2015, respectively;

|

|

|

•

|

Our Current Reports on Form 8-K filed with the SEC on February 10, 2015, February 23, 2015, March 30, 2015, April 8, 2015, April 14, 2015, July 6, 2015, August 25, 2015, October 8, 2015, October 23, 2015, December 14, 2015, December 22, 2015, December 24, 2015, December 29, 2015, March 3, 2016, May 2, 2016, May 3, 2016 and May 16, 2016, June 30, 2016, July 11, 2016 and August 23, 2016;

|

|

|

•

|

All of our filings pursuant to the Exchange Act after the date of filing this initial registration statement and prior to the effectiveness of this registration statement; and

|

|

|

•

|

The description of our common stock contained in our Registration Statement on Form 8-A filed on November 14, 2012, including any amendments or reports filed for the purpose of updating that description.

|

In addition, all documents (other than

current reports furnished under Item 2.02 or Item 7.01 of Form 8-K and exhibits filed in such forms that are related to such items

unless such Form 8-K expressly provides to the contrary) subsequently filed by us pursuant to Section 13(a), 13(c), 14 or 15(d)

of the Securities Exchange Act of 1934, as amended, before the date our offering is terminated or completed are deemed to be incorporated

by reference into, and to be a part of, this prospectus supplement.

Any statement contained in this prospectus

supplement or in a document incorporated or deemed to be incorporated by reference into the prospectus supplement, as amended,

will be deemed to be modified or superseded for purposes of this prospectus to the extent that a statement contained in this Amendment

No. 3 to prospectus supplement or any other subsequently filed document that is deemed to be incorporated by reference into this

prospectus supplement modifies or supersedes the statement. Any statement so modified or superseded will not be deemed, except

as so modified or superseded, to constitute a part of this Amendment No. 3 to prospectus supplement.

We will furnish without charge to you,

on written or oral request, a copy of any or all of the documents incorporated by reference, including exhibits to these documents.

You should direct any requests for documents to Northwest Biotherapeutics, Inc., 4800 Montgomery Lane, Suite 800, Bethesda, MD

20814, (240) 497-9024.

You should rely only on information contained

in, or incorporated by reference into, this prospectus supplement, the accompanying prospectus and any other prospectus supplement.

We have not authorized anyone to provide you with information different from that contained in this prospectus supplement or the

accompanying prospectus or incorporated by reference in this prospectus supplement or the accompanying prospectus. We are not making

offers to sell the securities in any jurisdiction in which such an offer or solicitation is not authorized or in which the person

making such offer or solicitation is not qualified to do so or to anyone to whom it is unlawful to make such offer or solicitation.

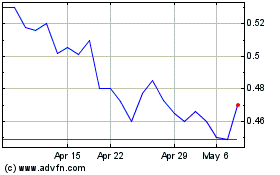

Northwest Biotherapeutics (QB) (USOTC:NWBO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Northwest Biotherapeutics (QB) (USOTC:NWBO)

Historical Stock Chart

From Apr 2023 to Apr 2024