Medtronic Files 8K - Increased Financial Obligation

August 26 2016 - 9:18AM

Dow Jones News

Medtronic PLC (MDT) filed a Form 8K - Increase in Direct or

off-Balance Sheet Financial Obligation - with the U.S Securities

and Exchange Commission on August 23, 2016.

As a result of the consummation of the Offer, the completion of

the Merger and the delisting of the Shares from The Nasdaq Stock

Market LLC, a "Fundamental Change" and a "Make-Whole Fundamental

Change," each as defined under the First Supplemental Indenture and

the Second Supplemental Indenture, as applicable, occurred on

August 23, 2016 with respect to the Notes. As a result, each holder

of the Notes (each, a "Holder") has the right (the "Fundamental

Change Repurchase Right"), at the Holder's option, to require the

Company to repurchase for cash such Holder's Notes, or any portion

of the principal amount thereof that is equal to $1,000 or an

integral multiple of $1,000, on September 27, 2016 (the

"Fundamental Change Repurchase Date"). The repurchase price to be

paid by the Company for Notes validly surrendered and not validly

withdrawn is equal to 100% of the principal amount of the Notes to

be repurchased, plus accrued and unpaid interest thereon, if any,

to, but excluding, the Fundamental Change Repurchase Date.

In addition, and notwithstanding the Fundamental Change

Repurchase Right, pursuant to the terms and conditions of the

Indenture, the Notes are convertible, at the option of the Holder,

at any time until 5:00 p.m. Eastern time on September 27, 2016 (the

"Conversion Period"). The Company's conversion obligation with

respect to Notes that are converted prior to the end of the

Conversion Period will be fixed at an amount in cash equal to the

Conversion Rate (as defined with respect to each series of Notes in

the applicable Supplemental Indenture) of 10.0000 for each of the

2017 Notes and 2021 Notes, multiplied by $58.00. Based on the per

share cash consideration paid in the Merger, the Conversion Rate

will not change as a result of the Merger. Accordingly, the value

that a Holder will receive if such Holder converts the Notes prior

to the end of the Conversion Period will be substantially less than

the funds such Holder would receive if such Holder validly

exercised the Fundamental Change Repurchase Right.

Assuming that each Holder exercised the Fundamental Change

Repurchase Right, the Company would be obligated to make aggregate

payments of approximately $244.3 million.

Assuming that each Holder exercised the conversion right in

connection with the Fundamental Change, the Company would be

obligated to make aggregate payments of approximately $142.0

million.

The right of Holders to convert their Notes is separate from the

Fundamental Change Repurchase Right. Holders may only exercise one

of either the Fundamental Change Repurchase Right or the conversion

right.

This filing is for informational purposes only and does not

constitute an offer to buy or the solicitation of an offer to sell

the Notes. The offer to repurchase the Notes pursuant to the

Fundamental Change Repurchase Right is being made only pursuant to

a Tender Offer Statement on Schedule TO (including a Fundamental

Change Repurchase Right Notice, Notice of Right to Convert, Notice

of Entry into Supplemental Indenture and Offer to Repurchase, dated

August 26, 2016) that the Company has filed with the SEC and will

distribute to Holders. Holders and investors should read carefully

the Tender Offer Statement on Schedule TO because it contains

important information, including the various terms of, and

conditions to, the Fundamental Change Repurchase Right. Holders may

obtain these documents free of charge from the SEC's website at

www.sec.gov or by contacting Parent at

investor.relations@medtronic.com.

The full text of this SEC filing can be retrieved at:

http://www.sec.gov/Archives/edgar/data/1389072/000119312516692563/d241053d8k.htm

Any exhibits and associated documents for this SEC filing can be

retrieved at:

http://www.sec.gov/Archives/edgar/data/1389072/000119312516692563/0001193125-16-692563-index.htm

Public companies must file a Form 8-K, or current report, with

the SEC generally within four days of any event that could

materially affect a company's financial position or the value of

its shares.

(END) Dow Jones Newswires

August 26, 2016 09:03 ET (13:03 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

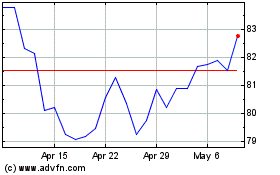

Medtronic (NYSE:MDT)

Historical Stock Chart

From Mar 2024 to Apr 2024

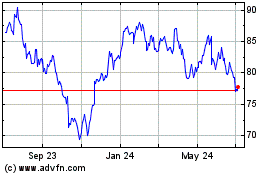

Medtronic (NYSE:MDT)

Historical Stock Chart

From Apr 2023 to Apr 2024