Vivendi Posts Decline in Core Earnings

August 25 2016 - 1:30PM

Dow Jones News

PARIS—European media group Vivendi SA reported a decline in its

second-quarter core earnings Thursday, as its French pay-TV group

Canal Plus continued to post losses in France.

Vivendi, which is run by its chairman and largest shareholder

Vincent Bolloré , said its adjusted net income dropped 3.1% to €187

million ($211 million) despite an improving performance at its

music business Universal Music Group.

The company reported a 41.5% drop in earnings before interest,

taxes, depreciation and amortization to €174 million as Canal Plus

continued to struggle. Vivendi said it had implemented a plan to

reduce costs by €300 million at Canal Plus, €60 million to €80

million of which would be realized this year.

Second-quarter revenue fell 1.9% to €2.55 billion on a

comparable basis from the same period last year.

Vivendi has made several acquisitions this year as it seeks to

build an integrated media group to challenge Sky PLC and Netflix

Inc. in Europe.

In April, the Paris-based company agreed to acquire Mediaset

SpA's pay-TV unit as part of a deal that included a 3.5% share swap

between the two companies. But Vivendi has been seeking to amend

the agreement after "significant differences in the analysis" of

the results of the unit, Mediaset Premium, emerged following the

deal.

On Thursday, Vivendi said the agreement could become void

September 30 as the two parties were unlikely to gain the European

Commission's clearance before that date.

The Italian company last week asked a Milan tribunal to enforce

its pact with Vivendi for the sale of its pay-TV unit, saying that

it could seek damages of more than €1.5 billion if Vivendi fails to

respect the accord.

Write to Nick Kostov at Nick.Kostov@wsj.com

(END) Dow Jones Newswires

August 25, 2016 13:15 ET (17:15 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

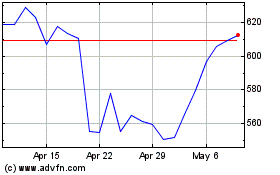

Netflix (NASDAQ:NFLX)

Historical Stock Chart

From Mar 2024 to Apr 2024

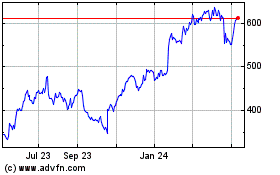

Netflix (NASDAQ:NFLX)

Historical Stock Chart

From Apr 2023 to Apr 2024