Signet Reports Sales Decline, Cuts Guidance

August 25 2016 - 8:50AM

Dow Jones News

Signet Jewelers Ltd. said second-quarter sales at its stores

open at least a year unexpectedly fell for the first time in more

than six years amid concerns that the jeweler has been swapping

expensive diamonds for lesser-quality stones.

The company signaled that sales would remain weak for the rest

of the year and cut its earnings outlook, sending shares down 13%

in premarket trading.

The owner of namesake stores in addition to the Kay Jewelers,

Zales and Jared chains has said it hasn't found evidence of a

systemic effort to swap out diamonds. The company has been

investigating the matter after allegations were raised by some

customers. In June, Chief Executive Mark Light told The Wall Street

Journal that Signet had yet to see any sales declines it can

attribute to the diamond-swapping charges.

But on Thursday, the company said sales at its existing stores

slid 2.3% on declines across segments. The decrease was

unexpected—analysts polled by FactSet expected a 0.3% increase—and

it is the first quarterly fall since the third quarter of 2009. A

year earlier, same-store sales climbed 4.2%.

Signet signaled that the sales weakness would continue, cutting

its outlook for the year and predicting a same-store sales decline

of 1% to 2.5% after in May predicting a 2% to 3.5% increase. Mr.

Light didn't mention the investigation in Thursday's news release.

"We are disappointed by our Q2 results and market conditions have

been challenging particularly in the energy-dependent regions," he

said.

In a move to support the company's stock, which has dropped 23%

this year through Wednesday's close, Signet on Thursday said it had

secured a $625 million investment from private-equity firm Leonard

Green & Partners. The infusion, expected to close in the

current quarter, is in the form of convertible preferred shares and

the company said it would use the proceeds to buy back shares. As

part of the deal, Signet is adding Jonathan Sokoloff, managing

partner at Leonard Green, to its board.

For the quarter ended July 30, Signet reported a profit of $81.9

million, or $1.06 a share, up from $62.2 million, or 78 cents a

share, a year earlier. Excluding integration and purchase

accounting costs, per-share profit rose to $1.14.

Revenue fell 2.6% to $1.37 billion. Analysts projected $1.45 in

adjusted earnings per share and $1.44 billion in sales, according

to Thomson Reuters.

Signet said it now expects to post $7.25 to $7.55 in adjusted

per-share profit this year, down from an earlier view of $8.25 to

$8.55 and sharply below the $8.22 average analyst estimate. For the

current quarter ending in October, the company predicts 17 cents to

25 cents an adjusted share, far short of the 50 cents analysts have

been looking for and on a same-store sales decline of 3% to 5%.

Write to Lisa Beilfuss at lisa.beilfuss@wsj.com

(END) Dow Jones Newswires

August 25, 2016 08:35 ET (12:35 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

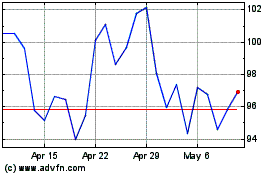

Signet Jewelers (NYSE:SIG)

Historical Stock Chart

From Mar 2024 to Apr 2024

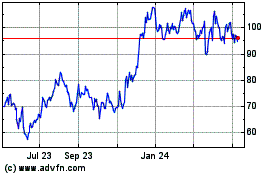

Signet Jewelers (NYSE:SIG)

Historical Stock Chart

From Apr 2023 to Apr 2024