Workday Posts Higher Revenue, Though Loss Widens

August 24 2016 - 5:30PM

Dow Jones News

Business software provider Workday Inc. reported revenue climbed

more than a third, but the company's loss was wider than expected

in the face of rising expenses.

Shares of Workday, up 15% over the past year, rose 2.1% to

$81.39 in after-hours trading Wednesday.

For the current quarter the company said it expects total

revenue between $398 million and $400 million, less than the $401

million analysts cited by Thomson Reuters forecast. The company

projects subscription sales during the period in the range of $331

million to $333 million.

The provider of human-resource and finance software has been

posting losses in recent quarters as the company has sought to

expand. For the three-month period ended July 31, total costs and

expenses rose to $464.6 million from $350.3 million a year

earlier.

Subscription service sales during the same period rose 37% to

$306.2 million.

Overall, the company posted a loss of $108 million, or 55 cents

a share, compared with a loss of $69.4 million, or 37 cents a

share, a year earlier.

Excluding certain items, the company posted a loss of 4 cents a

share, compared with 2 cents a year earlier. Analysts, on average,

were expecting an adjusted loss of 2 cents a share, according to

Thomson Reuters.

Revenue rose 34% to $377.7 million from $282.7 million a year

ago. Sales were stronger than expected, with the company previously

projecting revenue of $371 million to $373 million, and analysts

were expecting $373 million, on average.

Write to Ezequiel Minaya at ezequiel.minaya@wsj.com

(END) Dow Jones Newswires

August 24, 2016 17:15 ET (21:15 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

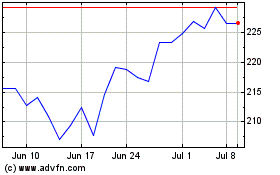

Workday (NASDAQ:WDAY)

Historical Stock Chart

From Mar 2024 to Apr 2024

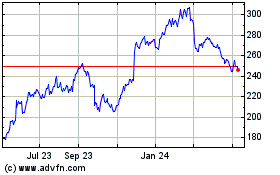

Workday (NASDAQ:WDAY)

Historical Stock Chart

From Apr 2023 to Apr 2024