UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the

Registrant

x

Filed by

a Party other than the Registrant

¨

Check the appropriate box:

|

|

|

|

|

¨

|

|

Preliminary Proxy Statement

|

|

|

|

|

¨

|

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

|

|

|

¨

|

|

Definitive Proxy Statement

|

|

|

|

|

¨

|

|

Definitive Additional Materials

|

|

|

|

|

x

|

|

Soliciting Material under §240.14a-12

|

The Williams

Companies, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

|

|

|

|

|

|

|

|

|

x

|

|

No fee required.

|

|

|

|

|

¨

|

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

|

|

|

|

|

(1)

|

|

Title of each class of securities to which transaction applies:

|

|

|

|

(2)

|

|

Aggregate number of securities to which transaction applies:

|

|

|

|

(3)

|

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing

fee is calculated and state how it was determined):

|

|

|

|

(4)

|

|

Proposed maximum aggregate value of transaction:

|

|

|

|

(5)

|

|

Total fee paid:

|

|

|

|

|

¨

|

|

Fee paid previously with preliminary materials.

|

|

|

|

|

¨

|

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement

number, or the Form or Schedule and the date of its filing.

|

|

|

|

|

|

|

|

(1)

|

|

Amount Previously Paid:

|

|

|

|

(2)

|

|

Form, Schedule or Registration Statement No.:

|

|

|

|

(3)

|

|

Filing Party:

|

|

|

|

(4)

|

|

Date Filed:

|

On August 24, 2016, Alan Armstrong, Chief Executive Officer of The Williams Companies, Inc. (the

“Company”), delivered an email to all employees of the Company that, among other things, discusses the determination by Corvex Management LP (“Corvex”) to nominate ten Corvex employees to stand for election to the Company’s

Board of Directors at the 2016 Annual Meeting of Stockholders to be held on Wednesday, November 23, 2016. Below is a copy of such email. References in the email below to a press release refer to the press release filed by the Company under Rule

14a-12 on August 24, 2016.

WILLIAMS CONFIRMS RECEIPT OF CORVEX DIRECTOR NOMINATIONS

Colleagues,

I am writing to follow-up on some recent news

regarding our company and one of our stockholders, Corvex Management.

You’re likely aware that earlier this week, Corvex disclosed its intent to

nominate ten of its own employees to stand for election to the Williams Board of Directors at our 2016 Annual Meeting on November 23. Today, as expected, Corvex formally submitted its nominations.

The press release Williams issued today in response is attached to this email for your reference. I’ve also included a brief FAQ at the end of this

message to help answer any questions you may have. At this time, there is no action needed from Williams stockholders, many of whom are employees. It is not appropriate for anyone to speculate on any actions or outcomes associated with this proxy

contest.

Any attacks on our Board are unfounded or without merit – the Williams Board is and always has been committed to acting in the best

interests of stockholders, and will continue to take appropriate actions to drive industry-leading performance and position Williams for the future. Additionally, as a company, we are committed to maintaining a highly regarded Board and are

currently in the process of recruiting new directors to further enhance our Board’s already strong composition. The market appears to agree with our direction. Since early July, Williams’ stock price has increased by approximately 39

percent.

Today’s announcement, as well as any future announcements, should have no impact on our operations or your day-to-day responsibilities. The

most important thing you can do is continue to focus daily on safe execution while crisply delivering on our project and customer commitments. Your hard work, focus and commitment are key to our continued success, and have already resulted in a

number of additional impressive accomplishments:

|

|

•

|

|

A conditional commitment to execute a new gas gathering agreement with a new private company producer customer – a successor to Chesapeake Energy – in the Barnett Shale, as well as an agreement to revise our

contract with Chesapeake in the Mid-Continent region. Both of these measures will reduce our customer concentration risk while resulting in additional drilling and volumes in these basins.

|

|

|

•

|

|

The pending sale of our Canadian businesses for combined cash proceeds of $1.35 billion CAD.

|

|

|

•

|

|

Successful cost-reduction initiatives resulting in $55 million, or approximately $200 million on an annualized basis, in lower adjusted costs during 2Q 2016 versus the prior year, despite having brought additional

assets online.

|

|

|

•

|

|

Fee-based revenues grew 75% from 2013 to 2015 and continue to grow, now representing approximately 93% of our gross margin.

|

|

|

•

|

|

The announcement of a 2017 $3.1 billion growth capital program, three-fourths of which is related to Transco expansions in high-growth demand markets under long-term contracts.

|

|

|

•

|

|

The announcement of measures aimed to enhance the value of both WMB and WPZ, strengthen their credit profile and fund the development of a large number of fee-based growth projects, all while maintaining flexibility as

financial and operational plans are reviewed, including the expected implementation of a Distribution Reinvestment Program (DRIP) in which Williams will reinvest around $1.7 billion into WPZ through 2017.

|

Each of these measures supports our strategic plan to increase stockholder value through delivery on growth projects and strengthening our balance sheet.

There will likely be continued attention on and speculation about Williams, our Board and the leadership team. If you receive any calls from the media or any

other external parties, please immediately forward them to Lance Latham at 918-573-9675 or lance.latham@williams.com, who will respond on the company’s behalf.

Thank you for your continued dedication to our organization.

Alan

2

Who is Corvex?

|

|

•

|

|

Corvex Management is a hedge fund based in New York City and a Williams stockholder.

|

|

|

•

|

|

Keith Meister, managing partner and chief investment Officer of Corvex, served on the Williams Board from November 2014 through June 2016.

|

What does Corvex want?

|

|

•

|

|

Stockholders of public companies may express their views and opinions to boards of directors and management teams in a variety of ways.

|

|

|

•

|

|

Corvex has nominated ten Corvex employees to stand for election to the Company’s Board of Directors at the 2016 Annual Meeting of Stockholders to be held on Wednesday, November 23, 2016.

|

|

|

•

|

|

While we can’t speak to the intentions of Corvex, Williams’ Board and management team are open to the views and perspectives of Corvex and all Williams stockholders.

|

How much of Williams stock does Corvex currently own?

|

|

•

|

|

According to publicly available information, Corvex currently owns 4.1% of Williams stock.

|

What does this

all of this mean for employees?

|

|

•

|

|

You will likely hear and see a lot of media coverage and outside communications about the company, including rumors, misinformation or disparaging comments. Williams does not comment on rumors and speculation.

|

|

|

•

|

|

Remember that anything other than an official statement made by Williams is merely speculation.

|

|

|

•

|

|

Employees should do their best to ignore the noise associated with this process, as it has no impact on our operations or your day-to-day responsibilities.

|

What do I do if an investor, analyst or member of the media contacts me?

|

|

•

|

|

Consistent with our communications guidelines, if you receive any inquiries from the media, please forward them to Lance Latham at

lance.latham@williams.com

. If you receive any inquiries from stockholders or

investors, please forward them to John Porter at

john.porter@williams.com

.

|

What happens next?

|

|

•

|

|

It would not be appropriate to speculate.

|

|

|

•

|

|

The most important thing you can do is continue to focus on safely executing on our projects and customer commitments.

|

Additional Information

Williams intends to file a proxy

statement with the U.S. Securities and Exchange Commission (the “SEC”) with respect to the 2016 Annual Meeting. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ ANY SUCH PROXY STATEMENT, THE ACCOMPANYING WHITE PROXY CARD AND OTHER

DOCUMENTS THAT HAVE BEEN OR MAY BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY AS THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE 2016 ANNUAL MEETING. Investors and security holders should read the proxy statement carefully

before making any voting or investment decisions. Investors and security holders may obtain free copies of these documents and other documents filed with the SEC by Williams through the website maintained by the SEC at

http://www.sec.gov

.

Copies of the documents filed by Williams with the SEC will be available on Williams’ website at

investor.williams.com

.

Participants in

the Solicitation

Williams and its directors, executive officers and other members of management and employees may be deemed to be participants in the

solicitation of proxies in connection with the matters to be considered at Williams’ 2016 Annual Meeting. Information regarding the directors and officers of Williams is contained in Williams’ Annual Report on Form 10-K filed with the SEC

on February 26, 2016 (as it may be amended from time to time). Additional information regarding the interests of such potential participants is or will be included in the proxy statement and other relevant documents filed with the SEC.

3

Forward-looking Statements

This communication may contain forward-looking statements. The forward-looking statements relate to anticipated financial performance, management’s plans

and objectives for future operations, business prospects, outcome of regulatory proceedings, market conditions and other matters. Forward-looking statements can be identified by various forms of words such as “anticipates,”

“believes,” “seeks,” “could,” “may,” “should,” “continues,” “estimates,” “expects,” “forecasts,” “intends,” “might,” “goals,”

“objectives,” “targets,” “planned,” “potential,” “projects,” “scheduled,” “will,” “assumes,” “guidance,” “outlook,” “in service date” or

other similar expressions. The forward-looking statements are based upon the current expectations and beliefs of management and are subject to numerous assumptions, risks and uncertainties that change over time and could cause actual results to

differ materially from those described in the forward-looking statements. These assumptions, risks and uncertainties include, but are not limited to, assumptions, risks and uncertainties discussed in the most recent Annual Report on Form 10-K for

each of Williams and Williams Partners L.P. (“WPZ”) filed with the SEC and assumptions, risks and uncertainties relating to the proposed transaction, as detailed from time to time in Williams’ and WPZ’s filings with the SEC,

which factors are incorporated herein by reference Forward-looking statements are based on numerous assumptions, uncertainties and risks that could cause future events or results to be materially different from those stated or implied in this

communication. Many of the factors that will determine these results are beyond our ability to control or predict. Specific factors that could cause actual results to differ from results contemplated by the forward-looking statements include, among

others, the following: whether WPZ will produce sufficient cash flows to provide the level of cash distributions, including incentive distribution rights, that we expect; whether Williams is able to pay current and expected levels of dividends;

whether we will be able to effectively execute our financing plan including WPZ’s establishment of a distribution reinvestment plan and the receipt of anticipated levels of proceeds from planned asset sales; availability of supplies, including

lower than anticipated volumes from third parties served by our midstream business, and market demand; volatility of pricing including the effect of lower than anticipated energy commodity prices and margins; inflation, interest rates, fluctuation

in foreign exchange rates and general economic conditions (including future disruptions and volatility in the global credit markets and the impact of these events on customers and suppliers); the strength and financial resources of our competitors

and the effects of competition; whether we are able to successfully identify, evaluate and timely execute our capital projects and other investment opportunities in accordance with our forecasted capital expenditures budget; our ability to

successfully expand our facilities and operations; development of alternative energy sources; availability of adequate insurance coverage and the impact of operational and developmental hazards and unforeseen interruptions; the impact of existing

and future laws, regulations, the regulatory environment, environmental liabilities, and litigation, as well as our ability to obtain permits and achieve favorable rate proceeding outcomes; Williams’ costs and funding obligations for defined

benefit pension plans and other postretirement benefit plans; changes in maintenance and construction costs; changes in the current geopolitical situation; our exposure to the credit risk of our customers and counterparties; risks related to

financing, including restrictions stemming from debt agreements, future changes in credit ratings as determined by nationally-recognized credit rating agencies and the availability and cost of capital; the amount of cash distributions from and

capital requirements of our investments and joint ventures in which we participate; risks associated with weather and natural phenomena, including climate conditions and physical damage to our facilities; and acts of terrorism, including

cybersecurity threats and related disruptions. Given the uncertainties and risk factors that could cause our actual results to differ materially from those contained in any forward-looking statement, we caution investors and security holders not to

unduly rely on our forward-looking statements. The forward-looking statements speak only as of the date hereof. We disclaim any obligations to and do not intend to update the above list or announce publicly the result of any revisions to any of

the forward-looking statements to reflect future events or developments. Because forward-looking statements involve risks and uncertainties, we caution that there are important factors, in addition to those listed above, that may cause actual

results to differ materially from those contained in the forward-looking statements. For a detailed discussion of those factors, see the risks described in the most recent Annual Report on Form 10-K and Quarterly Report on Form 10-Q for each of

Williams and WPZ filed with the SEC.

4

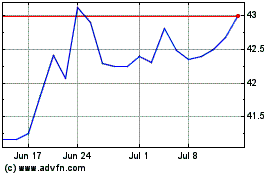

Williams Companies (NYSE:WMB)

Historical Stock Chart

From Mar 2024 to Apr 2024

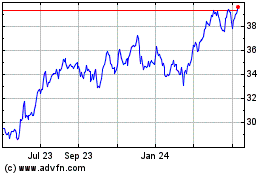

Williams Companies (NYSE:WMB)

Historical Stock Chart

From Apr 2023 to Apr 2024