A Surprising New Boost for Dollar Stores -- Ahead of the Tape

August 24 2016 - 3:41PM

Dow Jones News

By Steven Russolillo

A dollar goes a long way these days.

Dollar General Corp. and Dollar Tree Inc. have been big winners

in the stock market, up more than 20% over the past year on strong

sales growth and higher store traffic. Rising wages among their

core clientele suggest the good times may continue as both

companies gear up to release second-quarter earnings reports,

expected Thursday.

The dollar chains thrived during and after the recession and

have built on those days. Dollar General has added more items

priced between $1 and $5, boosting its margins. And Dollar Tree

bought rival Family Dollar, which it is still integrating a year

after the $9 billion deal was completed.

Both have embraced the smaller-store format, which typically

generates positive cash flow at a faster rate than other retail

locations. And they don't seem to be threatened as much by the

likes of Amazon.com Inc., or even Wal-Mart Stores Inc., as other

retailers.

The tight job market is providing another boost. Weekly wages

for full-time American workers in the bottom quarter of the income

scale rose 3.1% in the second quarter from a year ago. That marked

the sharpest increase since 2009, according to the Labor

Department. Dollar General chief Todd Vasos acknowledged this on an

earnings call in May, saying shoppers are "probably feeling a

little more confident and spending a little bit more."

Both companies have expanded their selection of discretionary

products, such as home goods and beauty products. This is a sign of

confidence that they see their customers being more able and

willing to spend.

The risk is the customers move to more mainstream retailers.

That is unlikely because dollar chains typically serve lower-income

neighborhoods whose residents make frequent, small purchases.

The question now is whether these stocks have rallied too far.

Both surged to records following their previous earnings reports in

May and have added to gains since. And both sport premium multiples

relative to the S&P 500. Dollar General fetches about 19 times

projected earnings over the next 12 months, a 20% discount to

Dollar Tree.

Hefty valuations shouldn't scare investors. It doesn't look like

this buck will break anytime soon.

(END) Dow Jones Newswires

August 24, 2016 15:26 ET (19:26 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

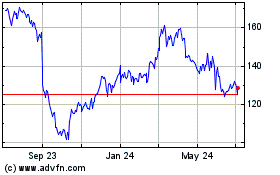

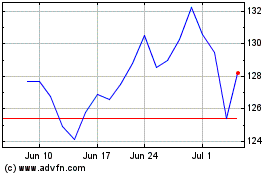

Dollar General (NYSE:DG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Dollar General (NYSE:DG)

Historical Stock Chart

From Apr 2023 to Apr 2024