By Andrew Ackerman and Patrick O'Connor

WASHINGTON -- American mutual funds estimate they spend more

than $300 million every year chewing up 2 million trees to print

and send investors 440 million densely written reports -- which

many recipients promptly toss out unread.

"If they were to come on days the trash cans were out, I

wouldn't even bring them inside the house," said Ben Perlman, 35,

an employee at Emory University in Atlanta, who invests in four

mutual funds with his wife and receives eight such reports in the

mail each year.

So last year, regulators proposed what to them was an obvious

adaptation to the age of Venmo, bitcoin and mobile banking: make it

easier for funds to provide certain records electronically.

But what was logical progress to some loomed as a menace to

others -- notably the American Forest & Paper Association and

the Envelope Manufacturers Association. The two industries' jointly

funded group Consumers for Paper Options rallied retiree and

consumer groups to join their campaign, decrying what they call the

government's "rush to digitize." They persuaded a bipartisan

coalition of politicians -- especially from the paper-heavy state

of Maine -- to threaten legislation blocking the rule.

They prevailed, beating back the forces of the 21st century, at

least for a few more years. At a mid-July public hearing on the

issue, Mary Jo White, the chairman of the Securities and Exchange

Commission, noted the proposal had drawn "considerable attention."

She ultimately decided to drop the plan, according to people

familiar with the matter. A formal announcement is planned this

fall.

"Millions of our fellow Americans will be left out in an

information desert," Rep. Bruce Poliquin, a Maine Republican

leading the pro-paper faction, warned on the House floor July 6,

should regulators curtail the mass dissemination of 1,000-page

semiannual and annual reports detailing things like "Affiliated

Broker Transactions" and "Basis for Approval of Investment Advisory

Contracts."

Republican Susan Collins, the senior senator from the Pine Tree

State, earlier this month issued a statement warning of "confusion

and potential financial discord among the Americans who receive

these financial disclosures."

Yet receipt of such disclosures can also foment confusion and

discord.

Lee McGowan, a Concord, Mass., investment adviser, has to prod

his customers to open the reports. "So many clients ask, 'What do I

do with this?'" he said.

As part of the research justifying the rule change, the SEC

highlighted a 2011 survey in which 59.5% of respondents said they

would look at their mutual fund's annual report on its website,

compared with 24.5% who said they would request a mailed hard

copy.

It is easy to see why the average retail investor may choose not

to delve into the thick documents stuffing their mailboxes. In

February, AXA Equitable Life Insurance Co. sent out thousands of

copies of a 1,463-page 2015 annual report (six months after mailing

its 1,337-page semiannual report), including the requisite details

of dozens of various combinations of investment products.

Mutual funds have sought to cut back the mailings to save costs.

The SEC included a provision making it easier to do so in a broader

package of rules requiring more industry disclosure. The paper part

seemed modest, since current rules already allow funds to transmit

reports electronically, and 43% of investors currently opt for that

instead of paper reports, according to Broadridge Financial

Solutions Inc., which distributes fund reports.

Under the SEC's plan, investors would still have the option of

receiving paper versions, but the default choice would have flipped

from paper to electronic. Investors who don't indicate a preference

still would get a mailed notice every time a fund posts a new

report online. Specifically, the SEC envisioned applying the switch

to annual and semiannual reports, which detail fund performance,

fees and asset holdings amid a sea of legalese.

But that flip was enough to rile up the forces of paper and

envelope makers fighting the forces of digitization. Consumers for

Paper Options got its start in 2010 battling banks charging fees to

customers who chose to receive paper statements. In 2014, the group

quashed an attempt by the Social Security Administration to scrap

paper statements that calculate workers' expected retirement

benefits. They are now pushing legislation to force the Internal

Revenue Service to resume mailing out 100-page tax-preparation

guides it largely stopped sending in 2011.

During a public-comment period that began last summer, the SEC's

package of mutual-fund regulation changes generated more than 1,000

online responses. These included: A Kentucky Democratic congressman

worried about harm to a commercial printer in his district; 12 from

people identifying themselves as letter carriers; and 35 from

employees and executives of Glatfelter, a York, Pa., maker of

specialty papers. "Paper records of my personal investments have

survived the crashing of hard drives," wrote one of the company's

senior product managers.

Luann Waddell, an investor and retired letter carrier from Mesa,

Ariz., wrote: "I am deeply concerned about the security of the

internet," citing recent government hacking cases.

"We still need to have a right to have something to read off of

a computer screen," wrote Kimberly Bennett, who didn't identify her

affiliation or location. "DO NOT TAKE THIS RIGHT AWAY FROM

PEOPLE!"

As often happens in such Washington scrapes, the rhetoric turned

overheated and high-minded. The pro-paper faction portrayed itself

as the protector of the aging and indigent most vulnerable to being

left behind in the technological rush.

"It's easy to think the world has gone digital," said John

Runyan, a former lobbyist for International Paper Co. who now runs

Consumers for Paper Options. "The trend lines are in that

direction, but why do we want to disadvantage the people who are

least likely to manage that transition?"

Mutual funds depicted themselves as progressives countering

Luddites, and as ardent environmentalists. Paper mailings are a

vestige of "a bygone era" when people used to go to stores to rent

VHS tapes, David Blass, general counsel for the Investment Company

Institute, an industry group, said in a March speech. "Count all

the harmful compounds emitted during paper manufacturing -- along

with the massive amounts of waste that discarded paper produces,"

he said, "and we're absolutely crushing the environment here."

In the end, big paper scissored big mutual funds. The SEC has

decided that when it finalizes the broader package of industry

disclosure rules in October, the digital default will end up on the

cutting-room floor.

(END) Dow Jones Newswires

August 24, 2016 15:04 ET (19:04 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

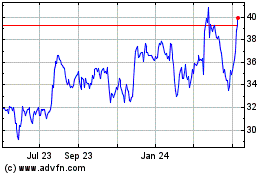

International Paper (NYSE:IP)

Historical Stock Chart

From Mar 2024 to Apr 2024

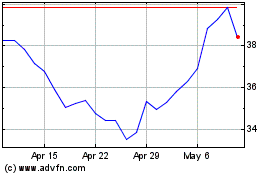

International Paper (NYSE:IP)

Historical Stock Chart

From Apr 2023 to Apr 2024