Sack Lunch Productions, Inc. (OTC Pink: SAKL) Q2 Revenue up 278% to $5.6M – Strong Growth, Plus Additional $2M Pre-Sales Bo...

August 24 2016 - 7:00AM

InvestorsHub NewsWire

Sack Lunch Productions, Inc. (OTC

Pink: SAKL) Q2 Revenue up 278% to $5.6M – Strong Growth, Plus

Additional $2M Pre-Sales Booked

Miami, FL -- August 24, 2016 --

InvestorsHub NewsWire -- EmergingGrowth.com, a leading

independent small cap media portal with an extensive history of

providing unparalleled content for the Emerging Growth markets and

companies, reports on Sack Lunch Productions, Inc. (OTC

Pink: SAKL) with reports of Announces Q2 Revenues Up 278% to

$5.6M

SAKL May not be at

these levels much longer

View the Full Press Release & Reports on SAKL on EmergingGrowth.com here:

http://emerginggrowth.com/?s=SAKL

Some Sack Lunch Productions, Inc. (OTC

Pink: SAKL)’s Financial Statement Highlights:

- Gross revenues of $5.6 million and $6.9

million for the three and six months ended June 30, 2016, compared

to $1.5 million and $2.4 million, increases of $4.1 million or 278%

and $4.5 million or 189%, over the comparable periods in

2015;

- Deferred revenues of $2.0 million, compared

to $1.8 million for the comparable period ended June 30, 2015, an

increase of $163,972 or 9%;

CEO, Richard Surber, commented, “We made what is in my opinion a

substantial improvement to the balance sheet and working capital

position of SAKL, but due to the way we report ticket sales, these

improvements are obfuscated by a $2.0 million deferred revenue

liability. At the time of this press release, it is a near

certainty that SAKL will recognize nearly 100% of those revenues by

December 31, 2016, which means that close to the entire $2.0

million will be removed from the liability section of the balance

sheet and added to top line revenues on our income statement.”

Sack Lunch Productions, Inc. (OTC

Pink: SAKL) also recently confirmed news reports that Slide the

City® will be coming to California this year. Slide the City®

is scheduled for Tahoe on August 27 and Redding on September

17.

More recently, Sack Lunch Productions, Inc.

(OTC

PINK: SAKL), reported total sales of $1,354,741 across all

corporate and franchised events in North America for the month of

July. Ticket sales for all North American corporate and franchised

events were $1,032,547 and $322,194, respectively.

Richard Surber, CEO of SAKL, commented, “During the month of July

we held 39 events directly or through franchisees including: 31

Slide the City®, 1 Lantern Fest®, 3 Dirty Dash® and 4 Color Me

Rad®. Shareholders can expect to see a spike in realized

revenues for Q3 based upon the number of events being held

including a spike in franchise fees collected.”

Surber, continued, “Some additional bright spots in this report are

a high proportion of corporate ticket sales versus franchisee

ticket sales as well as ticket sales for The Lantern Fest trending

up. The last 4 days in July The Lantern Fest sold over

$100,000 in tickets, the result of opening events for the

fall.”

The company’s modest $12.1 million

market capitalization according to OTC markets implies a

price-sales multiple of just 1.3x, which is significantly lower

than the industry’s 2.0-2.4x average, according to Morningstar

data. If the company’s shares were to trade with a 2.0x ratio, it

would translate to a $21.4 million market capitalization that’s

nearly double its current valuation – and that would be on the low

end of the industry average range.

Over the coming quarters, the company

also plans to complete an audit and become more fully compliant

with regulators. These moves could open the door to a potential

up-listing and encourage more institutional investors to become

involved with the stock. In turn, this could reduce the high level

of volatility and potentially bring shares closer to their fair

value.

Sack Lunch Productions Inc. (OTC

Pink: SAKL)'s current event portfolio includes:

- Slide the

City – A 1,000-foot

vinyl slide that’s placed in the center of a city to create a fun

and exciting block party event for the entire family.

- The Lantern

Fest – An unforgettable

nighttime party that’s lit up with thousands of lanterns lit by

participants and released into the sky.

- Color Me

Rad – A 5K race where

participants are coated with liquids, powders, and gels of blue,

green, pink, purple, and yellow until they’re tie-dyed on every

side.

- The Dirty

Dash – A mud run

obstacle course where a military boot camp meets an inner

five-year-old fantasy.

- Trike

Riot – A race on Razor

tricycles that takes participants down city streets and through

obstacles to the finish line.

For more information, visit the

company’s website at www.sacklunchproductions.com.

Overall, Sack Lunch Productions,

Inc. (OTC

Pink: SAKL) stands in a formidable position within the active

entertainment industry. The Company continues to expand its

presence and brand across North America and reach the 2017 earnings

forecasts, and the company could easy see its market

cap jump into the mid-teen

millions over the next year.

SAKL May not be at

these levels much longer

View the Full Press Release & Reports on SAKL on EmergingGrowth.com here:

http://emerginggrowth.com/?s=SAKL

About Sack Lunch Productions, Inc.:

Sack Lunch Productions, Inc. (OTC

PINK: SAKL) is an entertainment company that operates and

franchises action oriented events in the U.S. and internationally.

SAKL's events include: Slide the City™ (1,000 foot long water slide

for families and kids), Color Me Rad™ (5k color race), The Dirty

Dash™ (mud and obstacle run), The Lantern Fest™ (nighttime party

with lantern lighting and launch) and Trike Riot. Learn more about

SAKL's operations at www.sacklunchproductions.com,

www.slidethecity.com, www.thelanternfest.com, www.thedirtydash.com, www.colormerad.com, www.trikeriot.com and www.green-endeavors.com.

Other Emerging Growth

News

Optex Systems Holdings,

Inc.

Optex

Systems Holdings, Inc. (OTCQB:

OPXS) creates optical sights and assembly accessories to U.S.

Department of Defense, foreign militaries, and various commercial

security firms. The defense company is seeing shares dive 48% on

heavy volume, during early trading on Tuesday, August 23, 2016.

Over the past three months, Optex Systems Holdings, Inc has seen

average daily volume of around 34,278 shares. However, nearly

360,000 shares or dollar volume of around $360,000 has already

exchanged hands during early trading Tuesday.

Shares of Opted Systems Holdings, Inc. are

facing considerable pressure today, after the company released news

that the company has priced its underwriting public offering, which

will yield gross proceeds of around $4.75 million. Class A units

contained one share of common stock at $1.20 and one warrant with

five year life span and strike price of $1.50. In addition, Class B

units were offered, which contained one preferred share with a

strike price of $1.20 and warrants that allow for purchase of 4,167

shares of common stock. The Class B units have an offering price of

$5,000. See the full story on EmergingGrowth.com

here: http://emerginggrowth.com/optex-systems-holdings-inc-otcqb-opxs-dives-48-public-offering/

Dominovas Energy

Corporation

Dominovas Energy Corporation (OTCQB:

DNRG) is an early stage company that engages in a comprehensive

approach to deploy multi-megawatt power plants. The company also

specializes in NextGen clean energy, solid oxide fuels, and a

proprietary Rubicon fuel cell system. Shares of the energy company

are soaring 61%, during early trading on Tuesday, August 23, 2016.

Over the past three months, Dominovas Energy Corporation has seen

average daily volume of around 7.42 million shares. However, nearly

18.5 million shares or dollar volume of around $75,850 has already

exchanged hands during trading on Tuesday.

Shares of Dominovas Energy Corporation are

rallying today, after the company released an update on its Rubicon

fuel cell system and the technology’s deliver for use at the

University of Johannesburg in South Africa. The new partnership

between engineering academics and experts and corporate engineers

at Dominovas Energy Corporation, will help expand technology and

efficiency. See the full story on EmergingGrowth.com

here: http://emerginggrowth.com/dominovas-energy-corporation-otcqb-dnrg-soars-61-rubicon-showcase/

Amedica

Corporation

Amedica Corporation (NASDAQ:

AMDA) announced on August 17, 2016, the Company received

a letter from the Nasdaq Listings Qualifications department of the

Nasdaq Capital Market ("Nasdaq") notifying the Company that the

minimum bid price per share for its common stock was below $1.00

for a period of thirty (30) consecutive business days and that the

Company did not meet the minimum bid price requirement set forth in

Nasdaq Listing Rule 5550(a)(2).

Simultaneously, the company filed an 8K

– material event disclosure. There has been no news since.

However, over the past two trading sessions, the volume picked up

while the shares noticed an 87 % rise.

About EmergingGrowth.com

EmergingGrowth.com is a leading

independent small cap media portal with an extensive history of

providing unparalleled content for the Emerging Growth markets and

companies. Through its evolution, EmergingGrowth.com found a niche in

identifying companies that can be overlooked by the markets due to,

among other reasons, trading price or market capitalization.

We look for strong management, innovation, strategy, execution, and

the overall potential for long- term growth. Aside from being

a trusted resource for the Emerging Growth info-seekers, we are

well known for discovering undervalued companies and bringing them

to the attention of the investment community. Through our

parent Company, we also have the ability to facilitate road shows

to present your products and services to the most influential

investment banks in the space.

SAKL strongly encourages the public to read the above information

in conjunction with its reports filed at www.otcmarkets.com. The

actual results that SAKL may achieve could differ materially from

any forward-looking statements due to a number of risks and

uncertainties, including but not limited to adverse weather

conditions, equipment failure, state and local health code laws

which may impact obtaining permits and other risks associated with

judgment calls made by various government officials.

Investors should not invest more than they can afford to lose.

IR CONTACT:

Bruce Haase

RedChip Companies, Inc.

800.733.2447, ext. 131

bruce@redchip.com

Disclosure:

All information contained herein as

well as on the EmergingGrowth.com website is

obtained from sources believed to be reliable but not guaranteed to

be accurate or all-inclusive.

Source:

RedChip.com - https://www.redchip.com/pages/sakl/

TheOTCInvestor.com - http://www.theotcinvestor.com/sack-lunch-sakl-represents-a-compelling-value-for-those-buying-the-dip/

All material is for informational

purposes only, is only the opinion of EmergingGrowth.com and should not

be construed as an offer or solicitation to buy or sell securities.

The information may include certain forward-looking statements,

which may be affected by unforeseen circumstances and / or certain

risks. This report is not without bias. EmergingGrowth.com has motivation

by means of either self-marketing or EmergingGrowth.com has been

compensated by or for a company or companies discussed in this

article. Full details about which can be found in our full

disclosure, which can be found here, http://www.emerginggrowth.com/disclosure-7255/.

Please consult an investment professional before investing in

anything viewed within. When EmergingGrowth.com is long shares

it will sell those shares. In addition, please make sure you read

and understand the Terms of Use, Privacy Policy and the Disclosure

posted on the EmergingGrowth.com

website.

CONTACT:

Company: EmergingGrowth.com

- http://www.EmergingGrowth.com

Contact Email: EmergingGrowth1@gmail.com

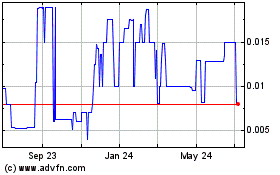

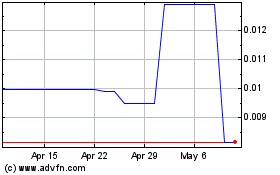

Sack Lunch Productions (PK) (USOTC:SAKL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Sack Lunch Productions (PK) (USOTC:SAKL)

Historical Stock Chart

From Apr 2023 to Apr 2024