Table of Contents

As filed with the Securities and Exchange Commission on August 23, 2016

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

GOLDEN MINERALS COMPANY

(Exact name of registrant as specified in its charter)

|

DELAWARE

(State or other jurisdiction of incorporation or organization)

|

|

26-4413382

(I.R.S. Employer Identification No.)

|

350 Indiana Street, Suite 800

Golden, Colorado 80401

(303) 839-5060

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Robert P. Vogels

Senior Vice President, Chief Financial Officer

350 Indiana Street, Suite 800

Golden, Colorado 80401

(303) 839-5060

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Deborah J. Friedman

Davis Graham & Stubbs LLP

1550 Seventeenth Street, Suite 500

Denver, Colorado 80202

(303) 892-9400

APPROXIMATE DATE OF COMMENCEMENT OF PROPOSED SALE TO THE PUBLIC:

From time to time after the effective date of this registration statement as determined by market conditions.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box.

o

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box.

x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

o

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box.

o

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box.

o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large Accelerated filer

o

|

|

Accelerated filer

o

|

|

Non-accelerated filer

o

(Do not check if a

smaller reporting company)

|

|

Smaller Reporting Company

x

|

CALCULATION OF REGISTRATION FEE

|

|

|

|

|

|

|

|

|

|

|

|

Title of Each Class of Securities

to be Registered

|

|

Amount to be

Registered(1)

|

|

Proposed Maximum

Offering Price Per

Unit(2)

|

|

Proposed Maximum

Aggregate Offering

Price(2)

|

|

Amount of

Registration Fee

|

|

|

Common Stock, $.01 par value

|

|

33,366,740

|

(3)

|

$

|

0.77

|

|

$

|

25,692,390

|

|

$

|

2,587.22

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1)

In the event of a stock split, stock dividend or similar transaction involving our common stock, in order to prevent dilution, the number of shares registered shall automatically be increased to cover the additional shares in accordance with Rule 416(a) under the Securities Act of 1933, as amended.

(2)

In accordance with Rule 457(c), the aggregate offering price of our common stock is estimated solely for calculating the registration fees due for this filing. For the initial filing of this registration statement, this estimate is based on the average of the high and low sales price of our common stock reported by NYSE MKT on August 19, 2016 which was $0.77 per share.

(3)

Represents 27,366,740 shares of common stock that may be sold by the Sentient Selling Stockholder (defined below) and 6,000,000 shares of common stock issuable upon exercise of warrants that may be sold by the Warrant Holder Selling Stockholders (defined below).

THE REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(a) OF THE SECURITIES ACT OF 1933 OR UNTIL THE REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON SUCH DATE AS THE COMMISSION, ACTING PURSUANT TO SAID SECTION 8(a), MAY DETERMINE.

Table of Contents

THE INFORMATION IN THIS PROSPECTUS IS NOT COMPLETE AND MAY BE CHANGED. THE SELLING STOCKHOLDERS MAY NOT SELL THESE SECURITIES UNTIL THE REGISTRATION STATEMENT FILED WITH THE SECURITIES AND EXCHANGE COMMISSION IS EFFECTIVE. THIS PROSPECTUS IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT SOLICITING AN OFFER TO BUY THESE SECURITIES IN ANY STATE WHERE THE OFFER OR SALE IS NOT PERMITTED.

Subject to Completion, dated August 23, 2016

PROSPECTUS

33,366,740 Shares

Common Stock

The Selling Stockholders named herein (defined below) may use this prospectus in connection with sales of up to 33,366,740 shares of common stock of Golden Minerals Company (“Golden Minerals,” “we,” “us,” or “our”), which includes 27,366,740 shares of common stock that may be sold by Sentient Global Resources Fund IV, L.P. (the “Sentient Selling Stockholder”) and 6,000,000 shares of common stock issuable upon exercise of warrants that may be sold by Anson Investments Master Fund LP, CVI Investments, Inc., Hudson Master Fund Ltd. and Intracoastal Capital LLC (collectively, the “Warrant Holder Selling Stockholders,” and together with the Sentient Selling Stockholder, the “Selling Stockholders”).

The Selling Stockholders may sell the common stock at prices and on terms determined by the market, in negotiated transactions or through underwriters. We will not receive any proceeds from the sale of shares by the Selling Stockholders.

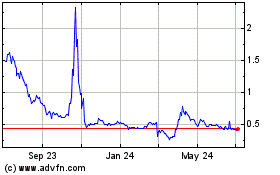

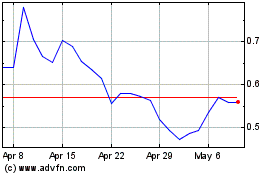

Our common stock is listed on the NYSE MKT LLC (the “NYSE MKT”) under the symbol “AUMN.” On August 19, 2016, the last reported sale price of our common stock on the NYSE MKT was $0.76 per share. Our common stock is also listed on the Toronto Stock Exchange (the “TSX”) under the symbol “AUM”. The closing price for our common stock on August 19, 2016, as quoted on the TSX, was Cdn$0.99.

The securities offered in this prospectus involve a high degree of risk. You should carefully consider the matters set forth in “RISK FACTORS” on page 6 of this prospectus or incorporated by reference herein in determining whether to purchase our securities.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities, or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is [*].

Table of Contents

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements within the meaning of the United States Private Securities Litigation Reform Act of 1995 and “forward-looking information” within the meaning of applicable Canadian securities legislation. These statements include statements relating to our plans, expectations and assumptions concerning anticipated care and maintenance costs at the Velardeña Properties (as defined in this prospectus); expectations regarding the oxide plant lease including anticipated net cash payments; planned exploration of certain properties in Mexico and other planned exploration activities and the planned costs of exploration; plans and anticipated costs related to our El Quevar project; anticipated 2016 expenditures; expected need for external financing; and statements concerning our financial condition, business strategies and business and legal risks.

We use the words “anticipate,” “continue,” “likely,” “estimate,” “expect,” “may,” “could,” “will,” “project,” “should,” “believe” and similar expressions to identify forward-looking statements. Statements that contain these words discuss our future expectations, contain projections or state other forward-looking information. Although we believe the expectations and assumptions reflected in those forward-looking statements are reasonable, we cannot assure you that these expectations and assumptions will prove to be correct. Our actual results could differ materially from those expressed or implied in these forward-looking statements as a result of the factors described under “RISK FACTORS” in this prospectus and other factors set forth in this prospectus, including:

·

Higher than anticipated care and maintenance costs at the Velardeña Properties in Mexico or at El Quevar in Argentina;

·

Lower revenue than anticipated from the oxide lease, which could result from delays or problems at the third party’s mine or at the oxide plant, permitting problems at the third party’s mine or the oxide plant, delays in constructing additional tailings capacity at the oxide plant, earlier than expected termination of the lease or other causes;

·

Continued decreases or insufficient increases in silver and gold prices;

·

Whether we are able to raise the necessary capital required to continue our business on terms acceptable to us or at all, and the likely negative effect of continued low silver and gold prices or unfavorable exploration results;

·

Unfavorable results from exploration at the Santa Maria, Rodeo or other exploration properties and whether we will be able to advance these or other exploration properties;

·

Risks related to the El Quevar project in Argentina, including whether we will be able to find a joint venture partner to advance the project, the feasibility and economic viability and unexpected costs of maintaining the project;

·

Variations in the nature, quality and quantity of any mineral deposits that are or may be located at the Velardeña Properties or the Company’s exploration properties, changes in interpretations of geological information, and unfavorable results of metallurgical and other tests;

·

Whether we will be able to mine and sell minerals successfully or profitably at any of our current properties at current or future silver and gold prices and achieve our objective of becoming a mid-tier mining company;

·

Potential delays in our exploration activities or other activities to advance properties towards mining resulting from environmental consents or permitting delays or problems, accidents, problems with contractors, disputes under agreements related to exploration properties, unanticipated costs and other unexpected events;

·

Our ability to retain key management and mining personnel necessary to successfully operate and grow our business;

·

Economic and political events affecting the market prices for gold, silver, zinc, lead and other minerals that may be found on our exploration properties;

2

Table of Contents

·

Political and economic instability in Mexico, Argentina, and other countries in which we conduct our business and future actions of any of these governments with respect to nationalization of natural resources or other changes in mining or taxation policies;

·

Volatility in the market price of our common stock; and

·

The factors set forth in “RISK FACTORS” on page 6 of this prospectus.

These factors are not intended to represent a complete list of the general or specific factors that could affect us. We may note additional factors elsewhere in this prospectus and in any documents incorporated by reference herein. Many of those factors are beyond our ability to control or predict. You should not unduly rely on any of our forward-looking statements or information. These statements speak only as of the date of this prospectus. Except as required by law, we are not obligated to publicly release any revisions to these forward-looking statements to reflect future events or developments. All subsequent written and oral forward-looking statements and information attributable to us and persons acting on our behalf are qualified in their entirety by the cautionary statements contained in this section and elsewhere in this prospectus.

Although we believe that the expectations reflected in our forward-looking statements are based on reasonable assumptions, such expectations may prove to be materially incorrect due to known and unknown risks and uncertainties.

All forward-looking statements speak only as of the date made. All subsequent written and oral forward-looking statements attributable to us, or persons acting on our behalf, are expressly qualified in their entirety by the cautionary statements. Except as required by law, we undertake no obligation to update any forward-looking statement to reflect events or circumstances after the date on which it is made or to reflect the occurrence of anticipated or unanticipated events or circumstances.

CAUTIONARY STATEMENT REGARDING MINERALIZED MATERIAL

“Mineralized material” as used in this prospectus and the documents incorporated by reference herein and therein, although permissible under the SEC’s Industry Guide 7, does not indicate “reserves” by SEC standards. We cannot be certain that any deposits at the Velardeña Properties or at the El Quevar project or any of our other exploration properties will ever be confirmed or converted into SEC Industry Guide 7 compliant “reserves.” Investors are cautioned not to assume that all or any part of the disclosed mineralized material estimates will ever be confirmed or converted into reserves or that mineralized material can be economically or legally extracted.

NON-GAAP FINANCIAL MEASURES

In this prospectus, we use the term “cash cost per payable silver ounce, net of by-product credits” which is considered a Non-GAAP financial measure as defined in SEC Regulation S-K Item 10 and applicable Canadian securities law and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with U.S. generally accepted accounting principles (“GAAP”). There are material limitations associated with the use of such non-GAAP measures. Since these measures do not incorporate revenues, changes in working capital and non-operating cash costs, they are not necessarily indicative of operating profit or cash flow from operations as determined under GAAP. Changes in numerous factors including, but not limited to, mining rates, milling rates, ore grade, recoveries, costs of labor, consumables and mine site general and administrative activities can cause these measures to increase or decrease. We believe that these measures are similar to the measures of other silver mining companies, but may not be comparable to similarly titled measures in every instance.

“Cash costs per payable silver ounce, after by-product credits,” is a non GAAP financial measure that is widely used in the mining industry. Under GAAP, there is no standardized definition of cash cost per payable silver ounce, after by-product credits, and therefore the Company’s forecasted cash costs may not be comparable to similar measures reported by other companies.

Forecasted cash costs per payable silver ounce, after by-product credits, for the Velardeña Properties were calculated based on the mining plan, and include all forecasted direct and indirect costs associated with the physical activities that would generate concentrate products for sale to customers, including mining to gain access to mineralized materials, mining of mineralized materials and waste, milling, third-party related treatment, refining and transportation costs, on-site administrative costs, and royalties. Forecasted cash costs do not include depreciation, depletion, amortization, exploration expenditures, reclamation and remediation costs, sustaining capital, financing costs, income taxes, or corporate general and administrative costs not directly or indirectly related to the Velardeña Properties. By-product credits include forecasted

3

Table of Contents

revenues from gold, lead, and zinc contained in the products sold to customers. Cash costs, after by-product credits, were divided by the quantity of payable silver forecasted to be produced during the period to arrive at cash costs per payable silver ounce, after by-product credits. Cost of sales is the most comparable financial measure, calculated in accordance with GAAP, to cash costs. As compared to cash costs, cost of sales includes adjustments for changes in inventory and excludes net revenue from by-products and third-party related treatment, refining and transportation costs, which are reported as part of revenue in accordance with GAAP.

4

Table of Contents

PROSPECTUS SUMMARY

The following is a summary of the pertinent information regarding this offering. This summary is qualified in its entirety by the more detailed information and financial statements and related notes incorporated by reference into this prospectus.

The Offering

|

Securities Offered

|

33,366,740 shares of our common stock compiled of 27,366,740 shares of our common stock offered by the Sentient Selling Stockholder, which shares were acquired in a private placement and 6,000,000 shares of our common stock issuable upon exercise of warrants offered by the Warrant Holder Selling Stockholders, which warrants were acquired in a private placement.

|

|

|

|

|

Offering Price

|

The Selling Stockholders may sell the common stock at prices and on terms determined by the market, in negotiated transactions or through underwriters.

|

|

|

|

|

Common Stock Outstanding

|

88,920,041 shares of common stock, $.01 par value per share, were outstanding as of, August 19, 2016.

|

|

|

|

|

Dividend Policy

|

We do not anticipate paying dividends on our common stock in the foreseeable future.

|

|

|

|

|

Use of Proceeds

|

The common stock offered pursuant to this prospectus is being sold by the Selling Stockholders, and we will not receive any proceeds of the offering.

|

Our principal offices are located in Golden, Colorado at 350 Indiana Street, Suite 800, Golden, CO 80401, and our registered office is the Corporation Trust Company, 1209 Orange Street, Wilmington, DE 19801. Our telephone number is (303) 839-5060. We also maintain a mining office at the Velardeña Properties in Mexico and exploration offices in Argentina and Mexico. We maintain a website at

www.goldenminerals.com

, which contains information about us. Our website and the information contained in and connected to it are not a part of this prospectus.

5

Table of Contents

RISK FACTORS

An investment in the securities offered in this prospectus involves a high degree of risk.

We have historically incurred operating losses and operating cash flow deficits and we expect to incur operating losses and operating cash flow deficits through 2016; our potential profitability in the foreseeable future would depend on our ability to identify, acquire and mine properties to generate sufficient revenues to fund our continuing activities.

We have a history of operating losses and we expect that we will continue to incur operating losses unless and until such time as our Velardeña Properties, our El Quevar project, or another of our exploration properties, which may include the Santa Maria Mine or the Rodeo property, generates sufficient revenue to fund our continuing business activities. In the fourth quarter 2015 we shut down the mines at our Velardeña Properties due to our inability to establish profitability with current mining methods at current prices, and borrowed $5.0 million from the Sentient Selling Stockholder to fund cash deficits. In the second quarter 2016, we issued shares of our common stock and warrants for gross proceeds of $4.0 million. Although we have leased the oxide plant at the Velardeña Properties to a subsidiary of Hecla Mining Company, the cash that we expect will be generated from that lease will be insufficient to fund all of our continuing business activities long term. In addition, the oxide plant lease may terminate sooner or produce less revenue than we anticipate if Hecla experiences mining problems or delays at its nearby mine, if there are disputes between Hecla and us, or for other reasons. There is no assurance that we will develop additional sources of revenue.

In addition, the potential profitability of mining and processing at any of our properties would be based on a number of assumptions. For example, profitability would depend on metal prices, costs of materials and supplies, costs at the mines and processing plants and the amounts and timing of expenditures, including expenditures to maintain our Velardeña Properties and the El Quevar project and to continue exploration at other exploration properties, and potential strategic acquisitions or other transactions, in addition to other factors, many of which are and will be beyond our control. We cannot be certain we will be able to generate sufficient revenue from any source to achieve profitability and eliminate operating cash flow deficits, or to cease to require additional funding.

We may require additional external financing to fund our continuing business activities in the future.

As of June 30, 2016, we had $3.9 million in cash and cash equivalents. With anticipated costs during the remainder of 2016, including costs related to shut down and care and maintenance costs at the Velardeña Properties, exploration expenditures, property holding costs at the El Quevar project, and general and administrative expenses, offset by anticipated revenue from the lease of the oxide plant and the sale of non-strategic exploration properties, we expect that our current cash and cash equivalent balance will be depleted to approximately $3.0 million by the end of 2016. Even with the anticipated revenue from the oxide lease and potential sale of non-strategic exploration properties in 2016, our cash balance going into 2017 might not be sufficient to provide adequate cash reserves in the event of decreasing metals prices or other factors, including variations from anticipated care and maintenance costs at the Velardeña Properties and costs for continued exploration, project assessment, and development at our other exploration properties, including Santa Maria and Rodeo, requiring us to seek additional funding from equity or debt or from monetization of non-core assets.

We do not have a credit, off-take or other commercial financing arrangement in place that would finance our general and administrative costs and other working capital needs to fund our continuing business activities in the future, and we believe that securing credit for these purposes may be difficult given our limited history and the continuing volatility in global credit and commodity markets. In addition, commercial financing arrangements may not be available on favorable terms or on terms that would not further restrict our flexibility and ongoing ability to meet our cash requirements over a reasonable period of time. Access to public financing has been negatively impacted by the volatility in the credit markets and metals prices, which may affect our ability to obtain equity or debt financing in the future and, if obtained, to do so on favorable terms. We also may not be able to obtain funding by monetizing additional non-core exploration or other assets at an acceptable price. We cannot assure you that we will be able to obtain financing to fund our general and administrative costs and other working capital needs to fund our continuing business activities in the future on favorable terms or at all.

If we commence mining in Mexico, we will likely enter into a collective bargaining agreement with a union that, together with labor and employment regulations, could adversely affect our mining activities and financial condition.

As was the case at our Velardeña Properties, mine employees in Mexico are typically represented by a union, and our relationship with our employees was, and we expect in the future will be, governed by collective bargaining agreements.

6

Table of Contents

Any collective bargaining agreement that we enter into with a union is likely to restrict our mining flexibility in and impose additional costs on our mining activities. In addition, relations between us and our employees in Mexico may be affected by changes in regulations or labor union requirements regarding labor relations that may be introduced by the Mexican authorities or by labor unions. Changes in legislation or in the relationship between us and our employees may have a material adverse effect on our mining activities and financial condition.

We may not mine the Velardeña Properties again.

In mid-November 2015, we shut down the mines and sulfide processing plant at our Velardeña Properties and placed them on care and maintenance. Commencing mining again is subject to numerous risks and uncertainties, including:

·

whether we are able to create mine plans or gold recovery improvements that can achieve sustainable cash positive results at current and future metals prices;

·

unexpected events, including difficulties in maintaining the properties on a care and maintenance basis, potential sabotage or damage to the assets related to the suspension of mining, and variations in ore grade and relative amounts, grades and metallurgical characteristics of oxide and sulfide ores;

·

continued decreases or insufficient increases in gold and silver prices to permit us to achieve sustainable cash positive results;

·

actual holding and care and maintenance costs resulting from the shutdown exceeding current estimates or including unanticipated costs;

·

loss of and inability to adequately replace skilled mining and management personnel;

·

strikes or other labor problems; and

·

our ability to obtain additional funding for general and administrative costs and other working capital needs to fund our continuing business activities as currently conducted and possibly for a potential restart of our Velardeña Properties.

Based on these risks and uncertainties, there can be no assurance that we will restart mining activities at the Velardeña Properties.

Our ability to successfully conduct mining and processing activities resulting in long-term cash flow and profitability will be affected by changes in prices of silver, gold and other metals.

Our ability to successfully conduct mining and processing activities in Mexico, Argentina or other countries, to establish reserves and advance our exploration properties, and to become profitable in the future, as well as our long-term viability, depend, in large part, on the market prices of silver, gold, zinc, copper and other metals. The market prices for these metals are volatile and are affected by numerous factors beyond our control, including:

·

global or regional consumption patterns;

·

supply of, and demand for, silver, gold, zinc, lead, copper and other metals;

·

speculative activities and hedging activities;

·

expectations for inflation;

·

political and economic conditions; and

·

supply of, and demand for, consumables required for extraction and processing of metals.

7

Table of Contents

The declines in silver and gold prices in 2013, 2014 and 2015 have had a significant impact on our mining activities, resulting in shutdowns in 2013 and 2015 of mining at our Velardeña Properties, and could negatively affect mining opportunities at our other properties. Additionally, future weakness in the global economy could increase volatility in metals prices or depress metals prices, which could also affect our mining and processing plans at our Velardeña Properties or make it uneconomic for us to engage in mining or exploration activities. Volatility or sustained price declines may also adversely affect our ability to build or continue our business.

Products processed from our Velardeña Properties or other mines could contain higher than expected contaminants, thereby negatively impacting our financial condition.

In 2015 we processed mined material to make gold and silver bearing lead, zinc and pyrite concentrates. Concentrate treatment charges paid to smelters and refineries include penalties for certain elements, including arsenic and antimony that exceed contract limits. It is possible that our concentrates will contain higher amounts of these elements than we anticipate. This can occur due to unexpected variations in the occurrence of these elements in the material mined, problems that occur during blending of material from various locations in the mine prior to processing and other unanticipated events. In the future, if our concentrates include higher than expected contaminants, we would incur higher treatment expenses and penalty charges, which could increase our costs and negatively impact our business, financial condition and results of operations.

As a result of our business combination with ECU, we have assumed all historical ECU liabilities, some of which are known or which may become known by Golden Minerals.

In September 2011, we completed a business combination with ECU Silver Mining Inc. (“ECU”), which at that time owned the Velardeña Properties. As a result of this transaction, we are subject to the environmental, contractual, tax and other obligations and liabilities of ECU, some of which may be unknown. There can be no assurance that we are aware of all obligations and liabilities related to the historical business of ECU. These liabilities, and other liabilities related to ECU’s business not currently known to us or that prove to be more significant than we currently anticipate, could negatively impact our business, financial condition and results of operations.

The Velardeña Properties, the El Quevar project and our other properties may not contain mineral reserves.

We are considered an exploration stage company under SEC Industry Guide 7, and none of the properties at our Velardeña Properties, the El Quevar project, or any of our other properties have been shown to contain proven or probable mineral reserves. Expenditures made in mining at the Velardeña Properties or the exploration and advancement of our El Quevar project or other properties may not result in positive cash flow or in discoveries of commercially recoverable quantities of ore. Most exploration projects do not result in the discovery of commercially mineable ore deposits, and we cannot assure you that any mineral deposit we identify will qualify as an orebody that can be legally and economically exploited or that any particular level of recovery from discovered mineralization will in fact be realized.

Tetra Tech, Inc. (“Tetra Tech”) completed a technical report on our Velardeña Properties, which indicated the presence of mineralized material, and RungePincockMinarco completed a technical report on our El Quevar property, which indicated the presence of mineralized material. Mineralized material figures based on estimates made by geologists are inherently imprecise and depend on geological interpretation and statistical inferences drawn from drilling and sampling that may prove to be unreliable or inaccurate. We cannot assure you that these estimates are accurate or that proven and probable mineral reserves will be identified at the Velardeña Properties, El Quevar or any of our other properties. Even if the presence of reserves is established at a project, the economic viability of the project may not justify exploitation. We have spent significant amounts on the evaluation of El Quevar prior to establishing the economic viability of that project.

Estimates of reserves, mineral deposits and mining costs also can be affected by factors such as governmental regulations and requirements, fluctuations in metals prices or costs of essential materials or supplies, environmental factors, unforeseen technical difficulties and unusual or unexpected geological formations. In addition, the grades of ore or material ultimately mined may differ from that indicated by drilling results, sampling, feasibility studies or technical reports. Short-term factors relating to reserves, such as the need for orderly development of ore bodies or the processing of new or different grades, may also have an adverse effect on mining and on the results of operations. Silver, gold or other minerals recovered in small-scale laboratory tests may not be duplicated in large-scale tests under on-site processing conditions.

The Velardeña Properties, the El Quevar project and our other properties are subject to foreign environmental laws and regulations which could materially adversely affect our business.

8

Table of Contents

We have conducted mining activities in Mexico and conduct mineral exploration activities primarily in Mexico. Mexico and Argentina, where our El Quevar project is located, have laws and regulations that control the exploration and mining of mineral properties and their effects on the environment, including air and water quality, mine reclamation, waste generation, handling and disposal, the protection of different species of flora and fauna and the preservation of lands. These laws and regulations require us to acquire permits and other authorizations for conducting certain activities. In many countries, there is relatively new comprehensive environmental legislation, and the permitting and authorization process may not be established or predictable. We may not be able to acquire necessary permits or authorizations on a timely basis, if at all. Delays in acquiring any permit or authorization could increase the cost of our projects and could suspend or delay the commencement of extraction and processing of mineralized material.

Our Velardeña Properties are subject to regulation by SEMARNAT, the environmental protection agency of Mexico. In order to permit new facilities at or expand existing facilities, regulations require that an environmental impact statement, known in Mexico as a Manifestación de Impacto Ambiental, be prepared by a third-party contractor for submission to SEMARNAT. Studies required to support the Manifestación de Impacto Ambiental include a detailed analysis of soil, water, vegetation, wildlife, cultural resources and socio-economic impacts. The Manifestación is then published on SEMARNAT’s web page and in its official gazette in a national and local newspaper. The Manifestación is discussed at various open hearings, including hearings in the local communities, at which third parties may voice their views. We would be required to provide proof of local community support of the Manifestación as a condition to final approval. We may not be able to obtain community support of future projects.

Environmental legislation in Mexico is evolving in a manner which will require stricter standards and enforcement, increased fines and penalties for non-compliance, more stringent environmental assessments of proposed projects, and a heightened degree of responsibility for companies and their officers, directors and employees. For example, in January 2011, Article 180 of the Mexican Federal General Law of Ecological Balance and Environmental Protection was amended. Among other things, this amendment extended the term during which an individual or entity having a legitimate interest may contest administrative acts, including environmental authorizations, permits or concessions granted, without the need to demonstrate the actual existence of harm to the environment, natural resources, flora, fauna or human health, making it sufficient to argue that harm may be caused. Further, the amendment permits the contesting party to challenge a Manifestación de Impacto Ambiental through a variety of administrative or court procedures. As a result of the amendment, more legal actions supported or sponsored by non-governmental groups interested in halting projects may be filed against companies operating in all industrial sectors, including the mining sector. Mexican operations are also subject to the environmental agreements entered into by Mexico, the United States and Canada in connection with the North American Free Trade Agreement. Further, in August 2011, certain amendments to the Civil Federal Procedures Code of Mexico (“CFPC”) were published in the Official Daily of the Federation. The amendments establish three categories of collective actions by which 30 or more people claiming injury resulting from, among other things, environmental harm, will be deemed to have a sufficient and legitimate interest in seeking, through a civil procedure, restitution, economic compensation or suspension of the activities from which the alleged injury derived. These amendments to the CFPC may result in more litigation by plaintiffs seeking remedies for alleged environmental harms, including suspension of the activities alleged to cause harm. Future changes in environmental regulation in the jurisdictions where the Velardeña Properties are located may adversely affect our business, make our business prohibitively expensive, or prohibit it altogether.

Environmental legislation in many other countries, in addition to Mexico, is evolving in a manner that will likely require stricter standards and enforcement, increased fines and penalties for non-compliance, more stringent environmental assessments of proposed projects and a heightened degree of responsibility for companies and their officers, directors and employees. We cannot predict what environmental legislation or regulations will be enacted or adopted in the future or how future laws and regulations will be administered or interpreted. For example, in September 2010, the Argentine National Congress passed legislation which prohibits mining activity in glacial and surrounding areas. Although we do not currently anticipate that this legislation will impact the El Quevar project, the legislation provides an example of the evolving environmental legislation in the areas in which we operate. Compliance with more stringent laws and regulations, as well as potentially more vigorous enforcement policies or regulatory agencies or stricter interpretation of existing laws, may (i) necessitate significant capital outlays, (ii) cause us to delay, terminate or otherwise change our intended activities with respect to one or more projects, or (iii) materially adversely affect our future exploration activities.

The Velardeña Properties and many of our exploration properties are located in historic mining districts where prior owners, including ECU in the case of the Velardeña Properties, may have caused environmental damage that may not be known to us or to the regulators. At the Velardeña Properties and in most other cases, we have not sought complete environmental analyses of our mineral properties. We have not conducted comprehensive reviews of the environmental laws and regulations in every jurisdiction in which we own or control mineral properties. Insurance fully covering many

9

Table of Contents

environmental risks (including potential liability for pollution or other hazards as a result of disposal of waste products occurring from exploration and mining) is not generally available. To the extent environmental hazards may exist on the properties in which we currently hold interests, or may hold interests in the future, that are unknown to us at present and that have been caused by us, or previous owners or operators, or that may have occurred naturally, and to the extent we are subject to environmental requirements or liabilities, the cost of compliance with these requirements and satisfaction of these liabilities could have a material adverse effect on our financial condition and results of operations. If we are unable to fully fund the cost of remediation of any environmental condition, we may be required to suspend activities or enter into interim compliance measures pending completion of the required remediation.

In addition, U.S. or international legislative or regulatory action to address concerns about climate change and greenhouse gas emissions could negatively impact our business.

Title to the Velardeña Properties and our other properties and rights may be defective or may be challenged.

Our policy is to seek to confirm the validity of our rights to, title to, or contract rights with respect to, each mineral property in which we have a material interest. However, we cannot guarantee that title to our properties will not be challenged. Title insurance is not available for our mineral properties, and our ability to ensure that we have obtained secure rights to individual mineral properties or mining concessions may be severely constrained. Accordingly, the Velardeña Properties and our other mineral properties may be subject to prior unregistered agreements, transfers or claims, and title may be affected by, among other things, undetected defects. In addition, we may be unable to conduct activities on our properties as permitted or to enforce our rights with respect to our properties, and the title to our mineral properties may also be impacted by state action. We have not conducted surveys of all of the exploration properties in which we hold direct or indirect interests and, therefore, the precise area and location of these exploration properties may be in doubt.

In most of the countries in which we operate, failure to comply with applicable laws and regulations relating to mineral right applications and tenure could result in loss, reduction or expropriation of entitlements, or the imposition of additional local or foreign parties as joint venture partners. Any such loss, reduction or imposition of partners could have a material adverse effect on our financial condition, results of operations and prospects.

Under the laws of Mexico, mineral resources belong to the state, and government concessions are required to explore for or exploit mineral reserves. Mineral rights derive from concessions granted, on a discretionary basis, by the Ministry of Economy, pursuant to the Mexican mining law and regulations thereunder. We hold title to the Velardeña Properties and our other properties in Mexico through these government concessions, but there is no assurance that title to the concessions comprising the Velardeña Properties and other properties will not be challenged or impaired. The Velardeña Properties and other properties may be subject to prior unregistered agreements, interests or native land claims, and title may be affected by undetected defects. There could be valid challenges to the title of any of the claims comprising the Velardeña Properties that, if successful, could impair mining with respect to such properties in the future. A defect could result in our losing all or a portion of our right, title, and interest in and to the properties to which the title defect relates.

Our Velardeña Properties mining concessions and our other mining concessions in Mexico may be terminated if our obligations to maintain the concessions in good standing are not satisfied, including obligations to explore or exploit the relevant concession, to pay any relevant fees, to comply with all environmental and safety standards, to provide information to the Ministry of Economy and to allow inspections by the Ministry of Economy. In addition to termination, failure to make timely concession maintenance payments and otherwise comply strictly with applicable laws, regulations and local practices relating to mineral right applications and tenure could result in reduction or expropriation of entitlements. Additionally, in 2014, new mining concessions became subject to additional review and approval by the Mexico Ministry of Energy.

Mining concessions in Mexico give exclusive exploration and exploitation rights to the minerals located in the concessions but do not include surface rights to the real property, which requires that we negotiate the necessary agreements with surface landowners. Many of our mining properties are subject to the Mexican ejido system requiring us to contract with the local communities surrounding the properties in order to obtain surface rights to land needed in connection with our mining exploration activities. In connection with our Velardeña Properties, we have contracts with two ejidos to secure surface rights with a total annual cost of approximately $25,000. The first contract is a ten-year contract with the Velardeña ejido, which provides surface rights to certain roads and other infrastructure at the Velardeña Properties through 2021. The second contract is a 25-year contract with the Vista Hermosa ejido signed in March 2013, which provides exploration access and access rights for roads and utilities for our Velardeña Properties. Our inability to maintain and periodically renew or

10

Table of Contents

expand these surface rights on favorable terms or otherwise could have a material adverse effect on our business and financial condition.

Mining and processing activities are dependent on the availability of sufficient water supplies to support our mining activities.

Mining and processing at the Velardeña Properties, as at most mines, requires significant amounts of water. At the Velardeña Properties, our ability to have sufficient water is dependent on our ability to maintain our water rights and claims. Water is provided for all of the mines comprising our Velardeña Properties by wells located in the valley adjacent to the Velardeña Properties. We hold title to three wells located near the sulfide plant and hold certificates of registration to three wells located near the oxide plant. We are licensed to pump water from all six wells up to a permitted amount. We are currently only using water from the three wells associated with the oxide plant. We are required to make annual payments to the Mexican government to maintain our rights to these wells. We are required to pay a fine to the Mexican Government each year if we use too much water from a particular well or alternatively if we do not use a minimum amount of water from a particular well. In addition to these fines, the Mexican Government reserves the right to cancel our title to the wells for abuse of these rules.

We currently have a sufficient amount of water for the third party processing activities at the oxide plant. However, if we began processing material from both the sulfide and oxide plants in the future, we may face shortages in our water supply, and therefore will need to obtain water from outside sources at higher costs. The loss of some or all water rights for any of our wells, in whole or in part, or shortages of water to which we have rights would require us to seek water from outside sources at higher costs and could require us to curtail or shut down mining and processing in the future. Laws and regulations may be introduced in the future which could limit our access to sufficient water resources in mining activities, thus adversely affecting our business.

There are significant hazards involved in underground mining and processing activities at our Velardeña Properties, not all of which are fully covered by insurance. To the extent we must pay the costs associated with such risks, our business may be negatively affected.

The mining of the underground mines and processing of mined material at our Velardeña Properties, as well as the conduct of our exploration programs that frequently require rehabilitation of and drilling in underground mine workings, are subject to numerous risks and hazards, including, but not limited to, environmental hazards, industrial accidents, encountering unusual or unexpected geological formations, formation pressures, cave-ins, underground fires or floods, power outages, labor disruptions, seismic activity, rock bursts, accidents relating to historical workings, landslides and periodic interruptions due to inclement or hazardous weather conditions. These occurrences could result in damage to, or destruction of, mineral properties or processing facilities, personal injury or death, environmental damage, reduced extraction and processing and delays in mining, asset write-downs, monetary losses and possible legal liability. Although we maintain insurance against risks inherent in the conduct of our business in amounts that we consider reasonable, this insurance contains, as in the case of our Velardeña Properties, exclusions and limitations on coverage, and will not cover all potential risks associated with mining and exploration activities, and related liabilities might exceed policy limits. As a result of any or all of the forgoing, particularly if the facilities are older, we could incur significant liabilities and costs that could adversely affect our results of operation and financial condition.

Our Velardeña Properties and most of our exploration properties are located in Mexico and are subject to various levels of political, economic, legal and other risks.

Our Velardeña Properties are located in Mexico, and, as such, are exposed to various levels of political, economic, legal and other risks and uncertainties, including local acts of violence, such as violence from drug cartels; military repression; extreme fluctuations in currency exchange rates; high rates of inflation; labor unrest; the risks of war or civil unrest; expropriation and nationalization; renegotiation or nullification of existing concessions, licenses, permits and contracts; illegal mining; acts of political corruption; changes in taxation policies; restrictions on foreign exchange and repatriation; and changing political conditions, currency controls and governmental regulations that favor or require the awarding of contracts to local contractors or require foreign contractors to employ citizens of, or purchase supplies from, a particular jurisdiction.

In the past, Mexico has been subject to political instability, changes and uncertainties, which have resulted in changes to existing governmental regulations affecting mineral exploration and mining activities. Mexico’s status as a

11

Table of Contents

developing country may make it more difficult for us to obtain any required funding for our Velardeña Properties or other projects in Mexico in the future.

Our Mexican properties are subject to a variety of governmental regulations governing health and worker safety, employment standards, waste disposal, protection of historic and archaeological sites, mine development, protection of endangered and protected species, purchase, storage and use of explosives and other matters. Specifically, our activities related to the Velardeña Properties are subject to regulation by SEMARNAT, the Comision Nacional del Agua, which regulates water rights, and Mexican mining laws. Mexican regulators have broad authority to shut down and levy fines against facilities that do not comply with regulations or standards.

Our Velardeña Properties and mineral exploration activities in Mexico may be adversely affected in varying degrees by changing government regulations relating to the mining industry or shifts in political conditions that increase the costs related to our mining and exploration activities or the maintenance of our properties. For example, in January 2014, amendments to the Mexico federal corporate income tax law require titleholders of mining concessions to pay annually a 7.5% duty of their mining related profits and a 0.5% duty on revenues obtained from the sale of gold, silver and platinum that were effective March 2015. These additional duties applicable to Mexico mining concession titleholders will have a significant impact on the annual costs applicable to the Velardeña Properties if we have mining related profits or significant revenues in the future.

Changes, if any, in mining or investment policies, changes or increases in the legal rights of indigenous populations or in the difficulty or expense of obtaining rights from them that are necessary for our Velardeña Properties or shifts in political attitude may adversely affect our business and financial condition. Our mining and exploration activities may be affected in varying degrees by government regulations with respect to restrictions on extraction, price controls, export controls, currency remittance, income and other taxes, expropriation of property, foreign investment, maintenance of claims, environmental legislation, land use, land claims of local people, water use and mine safety. Restart of mining or use of both the oxide and sulfide plant may also require us to assure the availability of adequate supplies of water and power, which could be affected by government policy and competing businesses in the area. The occurrence of these various factors and uncertainties cannot be accurately predicted and could have an adverse effect on our mining and exploration activities and financial condition.

Future changes in applicable laws and regulations or changes in their enforcement or regulatory interpretation could negatively impact current or planned exploration or mining activities at our Velardeña Properties or in respect of any of our other projects in Mexico or with which we become involved in Mexico. Any failure to comply with applicable laws and regulations, even if inadvertent, could result in the interruption of mining and exploration or material fines, penalties or other liabilities.

Most of our costs are subject to exchange control policies, the effects of inflation and currency fluctuations between the U.S. dollar and the Mexican peso.

Our revenue and external funding are primarily denominated in U.S. dollars. However, mining, processing, maintenance and exploration costs at the Velardeña Properties and most of our exploration properties are denominated principally in Mexican pesos. These costs principally include electricity, labor, water, maintenance, local contractors and fuel. When inflation in Mexico increases without a corresponding devaluation of the Mexican peso, our financial position, results of operations and cash flows could be adversely affected. The annual inflation rate in Mexico was 2.1% in 2015, 4.1% in 2014 and 4.0% in 2013. At the same time, the peso has been subject to significant fluctuation, which may not have been proportionate to the inflation rate and may not be proportionate to the inflation rate in the future. The value of the peso decreased by 17% in 2015, decreased by 13% in 2014 and decreased by 0.6% in 2013. In addition, fluctuations in currency exchange rates may have a significant impact on our financial results. There can be no assurance that the Mexican government will maintain its current policies with regard to the peso or that the peso’s value will not fluctuate significantly in the future. We cannot assure you that currency fluctuations, inflation and exchange control policies will not have an adverse impact on our financial condition, results of operations, earnings and cash flows.

If we are unable to obtain all of our required governmental permits or obtain property rights on favorable terms or at all, our business could be negatively impacted.

Future mining and current processing at our Velardeña Properties, the continued evaluation of the El Quevar project and other exploration activities will require additional permits from various governmental authorities. Our business is and

12

Table of Contents

will continue to be governed by laws and regulations governing mining, exploration, prospecting, exports, taxes, labor standards, occupational health, waste disposal, toxic substances, land use, environmental protection, mine safety, mining royalties and other matters. We may also be required to obtain certain property rights to access or use our properties. Obtaining or renewing licenses and permits, and acquiring property rights, can be complex and time-consuming processes. There can be no assurance that we will be able to acquire all required

licenses, permits or property rights on reasonable terms or in a timely manner, or at all, and that such terms will not be adversely changed, that required extensions will be granted, or that the issuance of such licenses, permits or property rights will not be challenged by third parties. Delays in obtaining or a failure to obtain any licenses, permits or property rights or any required extensions; challenges to the issuance of licenses, permits or property rights, whether successful or unsuccessful; changes to the terms of licenses, permits or property rights; or a failure to comply with the terms of any licenses, permits or property rights that have been obtained could have a material adverse effect on our business by delaying, preventing or making future mining and processing at our Velardeña Properties and other continued processing activities economically unfeasible. U.S. or international legislative or regulatory action to address concerns about climate change and greenhouse gas emissions could also negatively impact our business. While we will continue to monitor and assess any new policies, legislation or regulations regarding such matters, we currently believe that the impact of such legislation on our business will not be significant.

We depend on the services of key executives.

Our business strategy is based on leveraging the experience and skill of our management team. We are dependent on the services of key executives, including Warren Rehn and Robert Vogels. Due to our relatively small size, the loss of any of these persons or our inability to attract and retain additional highly skilled employees may have a material adverse effect on our business and our ability to manage and succeed in our mining and exploration activities.

The exploration of our mineral properties is highly speculative in nature, involves substantial expenditures and is frequently non-productive.

Mineral exploration is highly speculative in nature and is frequently non-productive. Substantial expenditures are required to:

·

establish mineral reserves through drilling and metallurgical and other testing techniques;

·

determine metal content and metallurgical recovery processes to process metal from the ore;

·

determine the feasibility of mine development and production; and

·

construct, renovate or expand mining and processing facilities.

If we discover a deposit or ore at a property, it usually takes several years from the initial phases of exploration until production is possible. During this time, the economic feasibility of a project may change because of increased costs, lower metal prices or other factors. As a result of these uncertainties, we may not successfully acquire additional mineral rights, or our exploration programs may not result in proven and probable reserves at all or in sufficient quantities to justify developing the El Quevar project or any of our exploration properties.

The decisions about future advancement of exploration projects may be based on feasibility studies, which derive estimates of mineral reserves, operating costs and project economic returns. Estimates of economic returns are based, in part, on assumptions about future metal prices and estimates of average cash operating costs based upon, among other things:

·

anticipated tonnage, grades and metallurgical characteristics of ore to be mined and processed;

·

anticipated recovery rates of silver and other metals from the ore;

·

cash operating costs of comparable facilities and equipment; and

·

anticipated climatic conditions.

13

Table of Contents

Actual cash operating costs, production and economic returns may differ significantly from those anticipated by our studies and estimates.

Lack of infrastructure could forestall or prevent further exploration and advancement.

Exploration activities, as well as any advancement activities, depend on adequate infrastructure. Reliable roads, bridges, power sources and water supply are important factors that affect capital and operating costs and the feasibility and economic viability of a project. Unanticipated or higher than expected costs and unusual or infrequent weather phenomena, or government or other interference in the maintenance or provision of such infrastructure, could adversely affect our business, financial condition and results of operations.

Our exploration activities are in countries with developing economies and are subject to the risks of political and economic instability associated with these countries.

We currently conduct exploration activities almost exclusively in countries with developing economies, including Argentina and Mexico. These countries and other emerging markets in which we may conduct business have from time to time experienced economic or political instability. We may be materially adversely affected by risks associated with conducting exploration activities in countries with developing economies, including:

·

political instability and violence;

·

war and civil disturbance;

·

acts of terrorism or other criminal activity;

·

expropriation or nationalization;

·

changing fiscal, royalty and tax regimes;

·

fluctuations in currency exchange rates;

·

high rates of inflation;

·

uncertain or changing legal requirements respecting the ownership and maintenance of mineral properties, mines and mining activities, and inconsistent or arbitrary application of such legal requirements;

·

underdeveloped industrial and economic infrastructure;

·

corruption; and

·

unenforceability of contractual rights.

Changes in mining or investment policies or shifts in the prevailing political climate in any of the countries in which we conduct exploration activities could adversely affect our business.

We conduct our business in countries that may be adversely affected by changes in the local government’s policies toward or laws governing the mining industry.

We have exploration activities primarily in Mexico and Argentina. In these regions there exist uncertainties regarding future changes in applicable law related to mining and exploration. For instance, in January 2014, amendments to the Mexico federal corporate income tax law require titleholders of mining concessions to pay annually a 7.5% duty of their mining related profits and a 0.5% duty on revenues obtained from the sale of gold, silver and platinum that were effective March 2015. These additional duties applicable to Mexico mining concession titleholders will have a significant impact on the annual costs applicable to the Velardeña Properties if we have mining related profits or significant revenues in the future.

14

Table of Contents

Additionally, effective January 2015, the Argentina National Mining Code was amended, increasing the annual canon payment by approximately four times. In 2014 and 2015, our annual canon fees payable to the Argentine government was $35,000 and $74,000 respectively, and we expect to pay approximately $114,000 in 2016.

Furthermore, as a result of the termination of a bilateral tax treaty among Spain and Argentina (terminated January 2013), certain beneficial tax treatment arising from equity ownership between our Spain and Argentina subsidiaries was eliminated. The Company was assessed and has paid additional equity tax for years 2009 through 2012 but we could be liable for an additional approximately $0.2 million in interest and fines stemming from the failure to timely pay the equity tax for those years.

In addition to the risk of increased transaction costs, we do not maintain political risk insurance to cover losses that we may incur as a result of nationalization, expropriation or similar events in Mexico or Argentina where we explore or have mining and processing activities.

We compete against larger and more experienced companies.

The mining industry is intensely competitive. Many large mining companies are primarily makers of precious or base metals and may become interested in the types of deposits on which we are focused, which include silver, gold and other precious metals deposits or polymetallic deposits containing significant quantities of base metals, including zinc, lead and copper. Many of these companies have greater financial resources, experience and technical capabilities than we do. We may encounter increasing competition from other mining companies in our efforts to acquire mineral properties and hire experienced mining professionals. Increased competition in our business could adversely affect our ability to attract necessary capital funding or acquire suitable mining properties or prospects for mineral exploration in the future.

We are dependent on information technology systems, which are subject to certain risks, including cybersecurity risks and data leakage risks.

We are dependent upon information technology systems in the conduct of our business. Any significant breakdown, invasion, virus, cyber attack, security breach, destruction or interruption of these systems by employees, others with authorized access to our systems, or unauthorized persons could negatively impact our business. To the extent any invasion, cyber attack or security breach results in disruption to our business, loss or disclosure of, or damage to, our data or confidential information, our reputation, business, results of operations and financial condition could be materially adversely affected. Our systems and insurance coverage for protecting against cyber security risks may not be sufficient. Although to date we have not experienced any material losses relating to cyber attacks, we may suffer such losses in the future. We may be required to expend significant additional resources to continue to modify or enhance our protective measures or to investigate and remediate any information security vulnerabilities.

The issuance of a significant number of shares of common stock upon the conversion of approximately $5.0 million of the principal and accrued interest under the Sentient Note in February and June 2016 resulted in a change of control of the Company.

As a result of the February and June 2016 loan conversions described under “SELLING STOCKHOLDERS” in this prospectus, Sentient’s ownership increased from approximately 27% to approximately 47% of the Company’s outstanding common stock. The ownership increase to approximately 47% effectively resulted in a change of control of the Company. With this increased ownership, Sentient could exert significant control over the Company, including over the election of directors, changes in the size or the composition of the board of directors, and mergers and other business combinations involving the Company. Through control of the board of directors and increased voting power, including an ability to prevent a quorum at stockholders meetings, Sentient could control certain decisions, including decisions regarding qualification and appointment of officers, operations of the business including acquisition or disposition of our assets or purchases and sales of mining or exploration properties, dividend policy, and access to capital (including borrowing from third-party lenders and the issuance of equity or debt securities).

The existence of a significant number of warrants may have a negative effect on the market price of our common stock.

In connection with our financing in May 2016, we issued five year warrants to acquire 6,000,000 shares of our common stock at $0.75 per share expiring in May 2021. In connection with our financing in September 2014, we issued five year warrants to acquire 4,746,000 shares of our common stock at $1.21 per share expiring in September 2019. In connection

15

Table of Contents

with our financing in September 2012, we issued five year warrants to purchase 3,431,649 shares of our common stock at an exercise price of $8.42 per share expiring September 2017. Pursuant to the anti-dilution clauses in the September 2012 and 2014 warrant agreements, the exercise price of the warrants has been adjusted downward as a result of the subsequent issuance of the Company’s common stock in separate transactions, including the May 2016 financing, the September 2014 financing and the conversion of the Sentient Note. As a result of these transactions, the number of shares of common stock issuable upon exercise of the September 2012 warrants was increased from the original 3,431,649 shares to 6,120,573 shares (2,688,924 share increase) and the exercise price was reduced from the original $8.42 per share to $4.72 per share. The number of shares of common stock issuable upon exercise of the September 2014 warrants was increased from the original 4,746,000 shares to 5,458,377 shares (712,377 share increase) and the exercise price was reduced from the original $1.21 per share to $0.87 per share. The existence of securities available for exercise and resale is referred to as an “overhang,” and, particularly if the warrants are “in the money,” the anticipation of potential sales could exert downward pressure on the market price of our common stock.

Failure to meet the maintenance criteria of the NYSE MKT may result in the delisting of our common stock, which could result in lower trading volumes and liquidity, lower prices of our common shares and make it more difficult for us to raise capital.

Our common stock is listed on the NYSE MKT, and we are subject to its continued listing requirements, including maintaining certain share prices and a minimum amount of shareholders equity. The market price of our common stock has been recently and may continue to be subject to significant fluctuation. If we are unable to comply with the NYSE MKT continued listing requirements, including its trading price requirements, our common stock may be suspended from trading on and/or delisted from the NYSE MKT. Alternatively, in order to avoid delisting by the NYSE MKT, we may be required to effect a reverse split of our common stock. Although we have not been notified of any delisting proceedings, there is no assurance that we will not receive such notice in the future or that we will be able to then comply with NYSE MKT listing standards. The delisting of our common stock from the NYSE MKT may materially impair our stockholders’ ability to buy and sell our common stock and could have an adverse effect on the market price of, and the efficiency of the trading market for, our common stock. In addition, the delisting of our common stock could significantly impair our ability to raise capital.

If our common stock were delisted and determined to be a “penny stock,” a broker-dealer could find it more difficult to trade our common stock and an investor may find it more difficult to acquire or dispose of our common stock in the secondary market.

If our common stock were removed from listing on the NYSE MKT, it may be subject to the so-called “penny stock” rules. The Securities and Exchange Commission (the “SEC”) has adopted regulations that define a “penny stock” to be any equity security that has a market price per share of less than $5.00, subject to certain exceptions, such as any securities listed on a national securities exchange. For any transaction involving a “penny stock,” unless exempt, the rules impose additional sales practice requirements on broker-dealers, subject to certain exceptions. If our common stock were delisted and determined to be a “penny stock,” a broker-dealer may find it more difficult to trade our common stock and an investor may find it more difficult to acquire or dispose of our common stock on the secondary market. These factors could significantly negatively affect the market price of our common stock and our ability to raise capital.

Our stockholders may suffer additional dilution to their equity and voting interests as a result of future financing transactions.

We could require additional funding to support our business, including for general and administrative costs and other working capital needs to fund our continuing business activities as currently conducted. Because debt financing is difficult to obtain for early stage mining companies, it is likely that we will seek such financing in the equity markets. If we were to engage in any type of equity financing the current ownership interest of our stockholders would be diluted.

16

Table of Contents

THE COMPANY

We are a mining company with the Velardeña and Chicago precious metals mining properties and associated oxide and sulfide processing plants in the State of Durango, Mexico (the “Velardeña Properties”), the El Quevar advanced exploration silver property in the province of Salta, Argentina, and a diversified portfolio of precious metals and other mineral exploration properties located primarily in or near historical precious metals producing regions of Mexico. Our management team is comprised of experienced mining professionals with extensive expertise in mineral exploration, mine construction and development and mine operations. Our principal offices are located in Golden, Colorado at 350 Indiana Street, Suite 800, Golden, CO 80401, and our registered office is the Corporation Trust Company, 1209 Orange Street, Wilmington, DE 19801. We also maintain an office at the Velardeña Properties in Mexico and exploration offices in Argentina and Mexico.

We are primarily focused on evaluating and searching for mining opportunities in North America (including Mexico) with near term prospects of mining, and particularly for properties within reasonable haulage distances of our Velardeña Properties. The Company is also reviewing strategic opportunities, focusing primarily on development or operating properties in North America, including Mexico. The Company is continuing its exploration efforts on selected properties in its portfolio of approximately 10 exploration properties located primarily in Mexico. It continues to hold its El Quevar advanced exploration property in Argentina on care and maintenance until it can find a partner to further advance the project. We are considered an exploration stage company under SEC criteria since we have not yet demonstrated the existence of proven or probable mineral reserves, as defined by SEC Industry Guide 7, at the Velardeña Properties, or any of our other properties. Until such time, if ever, that we demonstrate the existence of proven or probable reserves pursuant to SEC Industry Guide 7 we expect to remain as an exploration stage company.

Velardeña Properties

Care and maintenance activities at the Velardeña Properties

Due to continuing net operating losses, we suspended mining and sulfide processing activities at the Velardeña Properties during the first half of November 2015 in order to conserve the future value of the asset. We have placed the mine and sulfide processing plant on care and maintenance to enable a re-start of either the mine or the mill when mining and processing plans and metals prices support a cash positive outlook for the property. We incurred approximately $1.1 million of costs during the six months ended June 30, 2016 on remaining shutdown expenditures and for care and maintenance activities and we expect to incur approximately $0.3 million in quarterly holding costs going forward while mining and processing remain suspended.

Velardeña Oxide Plant Lease Agreement

In July 2015 a wholly-owned subsidiary of Hecla Mining Company leased our Velardeña oxide plant for an initial term of 18 months beginning July 1, 2015. Hecla may extend the initial 18 month term for six additional months at its option. We have agreed to permit Hecla at its option to extend the lease for an additional 18 months following the initial six month extension until December 31, 2018 in exchange for constructing, at its own cost, an expansion of the tailings impoundment. It is not known at this time if Hecla will exercise its options to extend the lease. Hecla is responsible for ongoing operation and maintenance of the oxide plant. During the six months ended June 30, 2016, Hecla processed approximately 62,000 tonnes of material through the oxide plant, resulting in revenues to us of approximately $1.4 million plus fixed fees and net reimbursable costs totaling approximately $1.6 million. Now that Hecla has reached its intended processing throughput of approximately 400 tonnes per day, net cash payments to us, net of reimbursable costs, should total approximately $400,000 per month, including variable and fixed fees, or nearly $5.0 million annually. The Company expects to receive net cash flow under the lease of approximately $4.5 million in 2016.

Santa Maria