Current Report Filing (8-k)

August 23 2016 - 1:01PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

PURSUANT

TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): August 23, 2016 (August 19, 2016)

SOTHERLY HOTELS INC.

SOTHERLY HOTELS LP

(Exact Name of Registrant as Specified in its Charter)

|

|

|

|

|

|

|

Maryland (Sotherly Hotels Inc.)

|

|

001-32379 (Sotherly Hotels Inc.)

|

|

20-1531029 (Sotherly Hotels Inc.)

|

|

Delaware (Sotherly Hotels LP)

|

|

001-36091 (Sotherly Hotels LP)

|

|

20-1965427 (Sotherly Hotels LP)

|

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

410 W. Francis Street

Williamsburg, Virginia 23185

(757) 229-5648

(Address,

including Zip Code and Telephone Number, including

Area Code, of Principal Executive Offices)

Not Applicable

(Former

name or former address, if changed since last report)

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

¨

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

Item 1.01.

|

Entry into a Material Definitive Agreement.

|

On August 23, 2016, Sotherly Hotels Inc. (the

“Company”), in its capacity as general partner of Sotherly Hotels LP, a Delaware limited partnership (the “Operating Partnership”), entered into amendment No. 3 (the “Partnership Amendment”) to the Partnership

Agreement (as defined below). The Partnership Amendment amends the Amended and Restated Agreement of Limited Partnership of the Operating Partnership, dated as of December 21, 2004 (the “Partnership Agreement”), as amended, to

designate the Series B preferred units of limited partnership interest (the “Series B Preferred Units”) that mirror the rights and preferences of the Series B Preferred Stock described below.

A copy of the Partnership Amendment is attached to this Current Report on Form 8-K as Exhibit 3.1 and it is incorporated by reference herein. The foregoing

summary of the Partnership Amendment is not intended to be complete and it is qualified in its entirety by the complete text of the Partnership Amendment.

|

Item 3.02.

|

Unregistered Sale of Equity Securities

|

Information about the issuance by the Operating Partnership of

Series B Preferred Units under Items 1.01 and 8.01 of this Current Report on Form 8-K are incorporated by reference into this Item 3.02.

|

Item 3.03.

|

Material Modifications to Rights of Security Holders.

|

On August 19, 2016, the Company filed, with

the State Department of Assessments and Taxation of the State of Maryland, Articles Supplementary (the “Articles Supplementary”) to the Articles of Amendment and Restatement of the Company, as amended and supplemented, pursuant to which

the Company has classified and designated 1,610,000 of the Company’s authorized shares of preferred stock, $0.01 par value per share, as 8.0% Series B cumulative redeemable perpetual preferred stock, $0.01 par value per share (“Series B

Preferred Stock”). A summary of the material terms of the Series B Preferred Stock is set forth under the caption “Description of the Series B Preferred Stock” in the Company’s prospectus supplement, dated

August 16, 2016 and filed with the Securities and Exchange Commission (the “SEC”) on August 17, 2016 (the “Prospectus Supplement”).

The Company filed the Articles Supplementary in connection with its previously announced underwritten public offering of Series B Preferred Stock, as

further described below under Item 8.01.

The Series B Preferred Stock ranks senior to the Company’s common stock, $0.01 par value per share (the

“Common Stock”), with respect to distribution rights and rights upon the voluntary or involuntary liquidation, dissolution or winding up of the Company.

In addition to other preferential rights, each holder of Series B Preferred Stock is entitled to receive a liquidation preference, which is equal to

$25.00 per share of Series B Preferred Stock, plus any accrued and unpaid distributions to, but not including, the date of the payment, before the holders of shares of Common Stock, in the event of any voluntary or involuntary liquidation,

dissolution or winding-up of the Company. Furthermore, subject to certain exceptions, including to the extent necessary to maintain the Company’s status as a real estate investment trust for U.S. federal income tax purposes, the Company is

restricted from declaring or paying any distributions, or setting aside any funds for the payment of distributions, on shares of Common Stock unless full cumulative distributions on the Series B Preferred Stock have been declared and either

paid or set aside for payment in full for all past distribution periods.

The summary of the Series B Preferred Stock in the Prospectus Supplement

and the foregoing description of the Series B Preferred Stock are qualified in their entirety by reference to the Articles Supplementary, incorporated by reference into this Item 3.03 as Exhibit 3.2 to this Current Report on Form 8-K. A

specimen certificate for the Series B Preferred Stock is incorporated by reference into this Item 3.03 as Exhibit 4.1 to this Current Report on Form 8-K.

|

Item 5.03.

|

Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

|

Information about the

Articles Supplementary under Item 3.03 of this Current Report on Form 8-K is incorporated by reference into this Item 5.03.

|

Item 7.01.

|

Regulation FD Disclosure.

|

On August 23, 2016, the Company issued a press release announcing the

closing of the Offering (as defined below), which press release is attached to the Current Report on Form 8-K as Exhibit 99.1 and incorporated by reference into this Item 7.01.

In accordance with General Instructions B.2 and B.6 of Form 8-K, the information included in this Item 7.01 of this Current Report on Form 8-K (including

Exhibit 99.1), shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be

deemed incorporated by reference into any filing made by the Company or the Operating Partnership under the Exchange Act or the Securities Act of 1933, as amended (the “Act”) except as shall be expressly set forth by specific reference in

such a filing.

On August 23, 2016, the Company completed an underwritten public offering of

1,610,000 shares of Series B Preferred Stock (the “Offering”), for net proceeds of approximately $38.1 million after deducting underwriting discounts and commissions and estimated offering expenses, payable to the Company. At the closing

of the Offering, the Company contributed the net proceeds of the Offering to the Operating Partnership in exchange for 1,610,000 Series B Preferred Units. The offering of the Series B Preferred Units to the Company is exempt from registration

pursuant to Section 4(2) of the Act.

The Operating Partnership intends to use the net proceeds from the Offering to repay in full the outstanding

balance of its 8.0% Senior Unsecured Notes due 2018 plus any premium associated therewith with the remaining net proceeds to be used for general corporate purposes.

The Offering was made pursuant to the Company’s effective registration statement on Form S-3 (File No. 333-199256), dated October 10, 2014,

previously jointly filed by the Company and the Operating Partnership with the SEC under the Act, as supplemented by a preliminary prospectus supplement, dated August 15, 2016 and the Prospectus Supplement, each filed by the Company with the SEC

pursuant to Rule 424(b)(5) under the Act. The opinion of Baker & McKenzie LLP relating to the legality of the Series B Preferred Stock offered by the Prospectus Supplement is attached as Exhibit 5.1 to this Current Report on Form 8-K, and

the opinion of Baker & McKenzie LLP with respect to tax matters is attached as Exhibit 8.1 to this Current Report on Form 8-K.

|

Item 9.01

|

Financial Statements and Exhibits.

|

(d) Exhibits

|

|

|

|

|

3.1

|

|

Amendment No. 3 to the Amended and Restated Agreement of Limited Partnership of Sotherly Hotels LP.

|

|

|

|

|

3.2

|

|

Articles Supplementary designating the Series B Preferred Stock of Sotherly Hotels Inc. (incorporated by reference to Exhibit 3.5 to the Company’s Registration Statement on Form 8-A filed with the SEC on August 22,

2016).

|

|

|

|

|

4.1

|

|

Form of Specimen Certificate of Series B Preferred Stock of Sotherly Hotels Inc. (incorporated by reference to Exhibit 4.1 to the Company’s Registration Statement on Form 8-A filed with the SEC on August 22, 2016).

|

|

|

|

|

5.1

|

|

Opinion of Baker & McKenzie LLP with respect to the legality of the Series B Preferred Stock.

|

|

|

|

|

8.1

|

|

Opinion of Baker & McKenzie LLP with respect to tax matters.

|

|

|

|

|

23.1

|

|

Consent of Baker & McKenzie LLP (included in Exhibits 5.1 and 8.1).

|

|

|

|

|

99.1

|

|

Press Release of Sotherly Hotels Inc., dated August 23, 2016.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrants have duly caused this report to be signed on their behalf by the

undersigned hereunto duly authorized.

Date: August 23, 2016

|

|

|

|

|

SOTHERLY HOTELS INC.

|

|

|

|

|

By:

|

|

/s/ David R. Folsom

|

|

|

|

David R. Folsom

Chief Operating

Officer

|

|

|

|

|

|

SOTHERLY HOTELS LP

|

|

|

|

|

|

|

by its General Partner,

SOTHERLY

HOTELS INC.

|

|

|

|

|

By:

|

|

/s/ David R. Folsom

|

|

|

|

David R. Folsom

Chief Operating

Officer

|

Exhibit List

|

|

|

|

|

3.1

|

|

Amendment No. 3 to the Amended and Restated Agreement of Limited Partnership of Sotherly Hotels LP.

|

|

|

|

|

3.2

|

|

Articles Supplementary designating the Series B Preferred Stock of Sotherly Hotels Inc . (incorporated by reference to Exhibit 3.5 to the Company’s Registration Statement on Form 8-A filed with the SEC on August 22,

2016).

|

|

|

|

|

4.1

|

|

Form of Specimen Certificate of Series B Preferred Stock of Sotherly Hotels Inc. (incorporated by reference to Exhibit 4.1 to the Company’s Registration Statement on Form 8-A filed with the SEC on August 22, 2016).

|

|

|

|

|

5.1

|

|

Opinion of Baker & McKenzie LLP with respect to the legality of the Series B Preferred Stock.

|

|

|

|

|

8.1

|

|

Opinion of Baker & McKenzie LLP with respect to tax matters.

|

|

|

|

|

23.1

|

|

Consent of Baker & McKenzie LLP (included in Exhibits 5.1 and 8.1).

|

|

|

|

|

99.1

|

|

Press Release of Sotherly Hotels Inc., dated August 23, 2016.

|

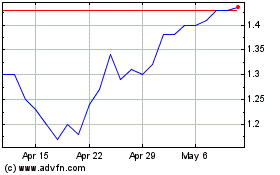

Sotherly Hotels (NASDAQ:SOHO)

Historical Stock Chart

From Mar 2024 to Apr 2024

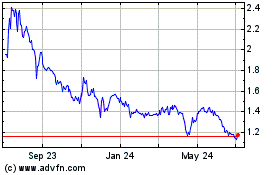

Sotherly Hotels (NASDAQ:SOHO)

Historical Stock Chart

From Apr 2023 to Apr 2024