Current Report Filing (8-k)

August 22 2016 - 4:14PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported)

August 19, 2016

METABOLIX, INC.

(Exact Name of Registrant as Specified in Its Charter)

DELAWARE

(State or Other Jurisdiction of Incorporation)

|

|

|

|

|

|

|

001-33133

|

|

04-3158289

|

|

(Commission File Number)

|

|

(IRS Employer Identification No.)

|

|

|

|

|

|

19 Presidential Way, Woburn, Massachusetts

|

|

01801

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

(617) 583-1700

(Registrant’s Telephone Number, Including Area Code)

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (

see

General Instruction A.2. below):

o

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 1.01

Entry into a Material Definitive Agreement.

On August 19, 2016, Metabolix, Inc. (“Metabolix” or the “Company”) entered into a binding letter of intent (“LOI”) with CJ CheilJedang Corporation (“CJ”) for the sale of its biopolymer intellectual property and certain laboratory equipment for a total purchase price of $10 million. The first $2 million of the purchase price was paid by CJ on execution of the LOI and the remaining balance is payable on closing of the transaction, which is anticipated in mid-September. Completion of the transaction is subject to the negotiation of definitive agreements and other customary conditions.

Under the definitive agreements, Metabolix will transfer to CJ a portfolio of intellectual property including the platform microbial strains used to produce the Company’s fermentation based products, as well as patent rights covering the production and use of PHA biopolymers. CJ will also acquire certain laboratory equipment associated with the biopolymers business. The arrangement is also expected to include a sublease to CJ of a portion of Metabolix’s Woburn, MA facility. Metabolix will retain all assets and rights of its Yield10 Bioscience crop science program.

The Company previously announced its plan to pursue the sale of its biopolymers business assets and implement a strategic restructuring under which Yield10 Bioscience will become its core business with a focus on developing disruptive technologies for step-change improvements in crop yield to enhance global food security.

The LOI contains a standstill provision, subject to customary exceptions for the fiduciary duties of the Company’s directors and officers, as well as other customary terms and conditions. The LOI also provides that if the parties have not entered into definitive agreements by September 16, 2016, CJ may elect to require the transfer of the purchased assets to CJ upon payment to Metabolix of $8 million. Under certain limited circumstances, if the LOI is terminated prior to completion of the transaction, the initial payment of $2 million must be returned to CJ.

Cautions About Forward-Looking Statements

This report contains forward-looking statements, including statements regarding the planned sale of assets and sublease to CJ. The transactions contemplated by the LOI are subject to certain covenants and closing conditions, including obtaining the consent of the landlord to the proposed sublease. If the sale of biopolymer assets to CJ is not completed, or if the closing of the sale does not occur in a timely manner, other capital resources will be required to fund the Company’s operations. If the Company is not able to secure such additional capital resources or otherwise fund its operations, it will be forced to wind down its remaining operations, including the Yield10 program, and pursue options for liquidating the Company’s remaining assets, including intellectual property and equipment.

Item 7.01.

Regulation FD Disclosure

On August 22, 2016, the Company issued a press release relating to the LOI. The full text of the press release is furnished as Exhibit 99.1 hereto. The information in this Item 7.01 and Exhibit 99.1 attached hereto is intended to be furnished and shall not be deemed “filed” for the purposes of Section 18 of the Exchange Act, or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d)

Exhibits.

The following exhibit is furnished with this report on Form 8-K:

Exhibit No.

Description

99.1 Press release dated August 22, 2016, entitled “Metabolix Announces $10 Million Binding Letter of Intent for Sale of Biopolymer Assets to CJ CheilJedang.”

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

METABOLIX, INC.

Date: August 22, 2016

By:

/s/ Joseph H. Shaulson

Joseph H. Shaulson

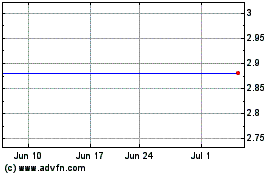

Yield10 Bioscience (NASDAQ:YTEN)

Historical Stock Chart

From Mar 2024 to Apr 2024

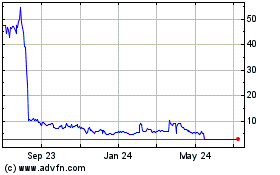

Yield10 Bioscience (NASDAQ:YTEN)

Historical Stock Chart

From Apr 2023 to Apr 2024