Asian Shares Mixed as Traders Look to Jackson Hole

August 21 2016 - 11:00PM

Dow Jones News

Asian shares were largely mixed Monday with traders expecting

hawkish commentary from U.S. Federal Reserve officials this week at

its annual conference in Jackson Hole, Wyo.

The Nikkei Stock Average traded 0.2% higher after the yen

slipped against the U.S. dollar in early trade in Asia. Bank of

Japan Gov. Haruhiko Kuroda is expected to speak Tuesday and will

likely expand on comments he made to the Sankei newspaper that the

BOJ has room to cut interest rates.

Australia's S&P/ASX 200 is trading 0.1% lower with Korea's

Kospi trading 0.6% down. Hong Kong's Hang Seng was trading 0.1%

higher.

"Half of the market believes there will be another rate increase

[in the U.S.] either in December or January," said Mitsushige

Akino, chief fund manager at Ichiyoshi Asset Management. But the

prospect for September is uncertain, he said. "That means a higher

yen environment is likely to continue."

Also weighing on the markets were oil prices that traded weaker

in early Asia trade Monday.

Data on Friday showed an increase in the number of active oil

rigs in the U.S. last week, spurring fears that the recent rally in

oil prices attracted more U.S. shale gas producers to return to the

oil patch, according to ANZ.

The strong dollar is also keeping oil prices down, the bank

said.

"The market is likely to remain in a tight range this week with

a lack of data providing little insight into China's industrial

activity," ANZ said.

U.S. crude was trading lower at $48.25 a barrel with Brent also

down to $50.41 a barrel.

Bank Indonesia left interest rates unchanged for the

second-consecutive month Friday, waiting for the previous, recent

easing measures to work on the economy. The country's bonds have

attracted a fair bit of foreign-investor interest because of

attractive yields.

In China, Sheng Songcheng, head of the People's Bank of China's

statistics department, said cutting taxes and increasing the fiscal

deficit would be more effective than lowering interest rates in

bolstering the economy. The comments come weeks after an editorial

in the state-run Xinhua media admonished speculators for betting on

an interest-rate cut by China's central bank.

Business sentiment, manufacturing and industrial production data

are due from China later Monday.

Kosaku Narioka, Jenny Hsu and Grace Zhu contributed to this

article.

Write to Kenan Machado at kenan.machado@wsj.com

(END) Dow Jones Newswires

August 21, 2016 22:45 ET (02:45 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

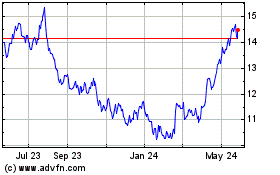

Hang Seng Bank (PK) (USOTC:HSNGY)

Historical Stock Chart

From Mar 2024 to Apr 2024

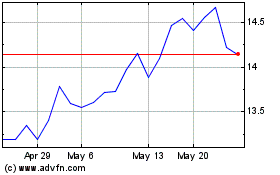

Hang Seng Bank (PK) (USOTC:HSNGY)

Historical Stock Chart

From Apr 2023 to Apr 2024