Estée Lauder Battles Macy's Malaise -- WSJ

August 20 2016 - 3:02AM

Dow Jones News

By Sharon Terlep

The declining fortunes of U.S. department stores have Estée

Lauder Cos. on the defensive.

As one of the world's biggest beauty brands, the maker of

Clinique and MAC has reason to be worried: roughly 30% of its

global sales come from department stores. Macy's Inc., which

recently disclosed it will close 100 stores by early next year, is

Estée Lauder's biggest customer accounting for roughly 9% of its

annual revenue.

Chief Executive Fabrizio Freda said the company felt the impact

of store closures that Macy's has already carried out this year,

but he remains optimistic that his brands will flourish even if the

department store footprint shrinks. He plans to help department

stores lure in more shoppers by offering new products and services

from makeup lessons to makeovers.

"We are working hard to support our partners to go back to

increase this traffic at every level," Mr. Freda said. "If the

projects we are working on work, department store sales will

continue to grow in the U.S."

The New York-based company on Friday provided a

lower-than-expected profit forecast for 2017, anticipating slower

sales in the coming months. In the quarter ended June 30, the

company said sales were hit by declining retail traffic, especially

in midtier U.S. department stores. Sales in the Americas rose just

1% to $1.1 billion.

Shares of the company fell 3.5% to $91.73 on Friday.

Analysts fret that Estée Lauder could respond to the department

store malaise by chasing sales at less prestigious outlets such as

Ulta Salons that would cheapen its brands and irk higher-end

retailers.

"Is there a concern that at some point, you're going to get rid

of the scarcity," Bernstein Research analyst Ali Dibadj asked on a

call to discuss the company's results.

Mr. Freda said branching out to other retailers and online sales

is the only way to reach important and growing demographics such as

millennials.

"The brands that do not evolve their shopping habits to reach

this consumer will basically lose," he said.

Even with the growing popularity of beauty retailers such as

LVMH's Sephora and its more value-oriented rival, Ulta, Cosmetics

& Fragrance Inc., U.S. department stores remain an important

sales driver for the beauty industry.

About one-third of all fragrances and color cosmetics are sold

by department stores in the U.S., according to Euromonitor. Online

sales are growing but still a small part of the business: 10% for

cosmetics and 9% for fragrances.

Department-store sales are growing in other regions, including

the U.K., Western Europe and Australia, Mr. Freda said, which helps

offset weakness in U.S. chains such as Macy's and Nordstrom

Inc.

Coty Inc., whose brands include Calvin Klein and Marc Jacobs

fragrances and a number of other department store names, didn't

discuss the effect of store closings when it released its financial

results earlier this week. Coty's sales fell 6% in its Americas

region in the June quarter, excluding acquisitions, divestitures

and currency swings.

"Clearly we would like to see more top-line growth," Coty

interim CEO Bart Becht said.

Overall, revenue at Estée Lauder rose 5% last quarter over the

same quarter a year earlier to $2.65 billion. Its earnings dropped

39% to $93.5 million because the results didn't includes gains from

divestitures. The company forecasts sales for the coming fiscal

year will rise between 6% and 7%.

Write to Sharon Terlep at sharon.terlep@wsj.com

(END) Dow Jones Newswires

August 20, 2016 02:47 ET (06:47 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

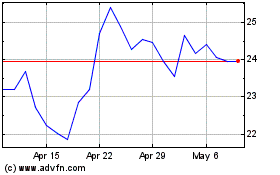

Kohls (NYSE:KSS)

Historical Stock Chart

From Mar 2024 to Apr 2024

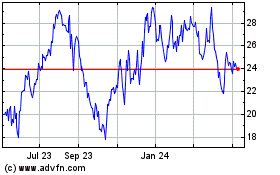

Kohls (NYSE:KSS)

Historical Stock Chart

From Apr 2023 to Apr 2024