Amtrak is naming Norfolk Southern Corp. veteran Charles "Wick"

Moorman as its next chief executive as the national passenger

railroad confronts big projects amid growing demand.

Mr. Moorman will succeed Joe Boardman, who is due to retire this

fall as president and chief executive officer, a post he has held

for eight years.

Mr. Moorman, who served as Norfolk Southern's chairman and CEO

before retiring last year, is expected to serve as a "transitional"

leader of the passenger railroad, Amtrak Chairman Anthony Coscia

said. Amtrak didn't immediately make Mr. Moorman available for

comment on Friday.

Mr. Coscia praised Mr. Moorman's record on financial

performance, customer service and safety—skills he said would help

the railroad reduce operational losses, expand service and improve

reliability to meet growing demand.

"Amtrak is a company that spent decades just surviving," Mr.

Coscia said. "We have moved out of that period, thankfully, and

we've moved into a period where there is tremendous opportunity for

us to make this a viable part of the country's transportation

system."

Mr. Moorman is expected to start on Sept. 1, earning a salary of

$1 a year, with an annual bonus of $500,000 tied to performance

goals, Mr. Coscia said.

Mr. Moorman will take over Amtrak as it embarks on what

transportation officials say is the largest public works project in

the U.S. once it gets under way: the construction of two new Hudson

River rail tunnels connecting northern New Jersey and

Manhattan.

Amtrak's leaders have tried to reduce the taxpayer-funded

railroad's reliance on public subsidies amid pressure from Congress

and generally increasing ridership, particularly on its heavily

traveled Northeast Corridor service between Washington, D.C., and

Boston.

To increase the railroad's reliability, Amtrak has quarreled

with freight railroads over regulations that give the passenger

railroad "preference" to go first on those carriers' rail networks

around the country.

But Mr. Coscia said he hoped Mr. Moorman would improve the

railroad's relationship with freight carriers, which own the tracks

that carry Amtrak passengers nationwide. Amtrak owns much of its

network in the Northeast.

"He clearly understands both worlds, and he's going to be in a

position to try to get us all to a much better place," Mr. Coscia

said of Mr. Moorman.

Amtrak has suffered a series of safety lapses in recent years.

Among the most tragic came in May 2015, when a New York-bound train

derailed in Philadelphia as it sped through a tight curve, killing

eight passengers.

More recently, in April, two of its own workers were struck and

killed on the tracks near Chester, Pa. An investigation indicated

the workers didn't deploy a basic safety device that experts say

would have stopped the train.

The incident also highlighted a rift between Amtrak management

and a key union representing workers who maintain the railroad's

tracks.

Mr. Boardman, who is expected to leave Amtrak at the end of

September, has led the railroad since November 2008. He previously

held the top posts at the Federal Railroad Administration and New

York's Department of Transportation.

Mr. Moorman, who joined Norfolk Southern's predecessor in 1970

and took the helm in 2006, was considered one of the great railroad

CEOs and an operational expert thanks to his years of experience at

the company. He led Norfolk Southern through a period of rapid

growth into 2014, as crude-by-rail and the transportation of cargo

traditionally carried by truck increasingly moved to the

tracks.

At the time Mr. Moorman stepped down as Norfolk Southern CEO in

mid-2015, that major freight rail boom was winding down and volumes

were starting to fall. The railroad was struggling to figure out

efficiency as traffic fell that year and reported the worst

operating ratio, a key profitability metric, of the major North

American railroads in the second quarter of 2015.

That gave fuel to Canadian Pacific's attempt at acquiring its

U.S. neighbor late last year, as executives there touted a plan to

streamline and improve operating efficiencies for the combined

railroads.

Current Norfolk Southern CEO Jim Squires outlined an aggressive

plan to cut costs and improve efficiency, and Canadian Pacific

eventually dropped its bid.

Write to Andrew Tangel at Andrew.Tangel@wsj.com and Laura

Stevens at laura.stevens@wsj.com

(END) Dow Jones Newswires

August 19, 2016 13:05 ET (17:05 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

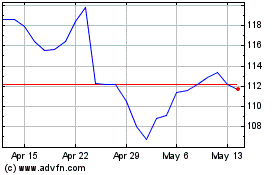

Canadian Pacific Kansas ... (TSX:CP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Canadian Pacific Kansas ... (TSX:CP)

Historical Stock Chart

From Apr 2023 to Apr 2024