Current Report Filing (8-k)

August 19 2016 - 9:11AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 15, 2016

Diebold, Incorporated

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Ohio

|

|

1-4879

|

|

34-0183970

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

|

|

|

|

|

|

|

|

5995 Mayfair Road, P.O. Box 3077,

North Canton, Ohio

|

|

44720-8077

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code: (330) 490-4000

Not Applicable

(Former

name or former address, if changed since last report)

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

¨

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Introductory Note

On August 15, 2016, Diebold, Incorporated (“Diebold” or the “Company”), completed its voluntary public takeover offer (the

“Offer”) to exchange each ordinary share of Wincor Nixdorf Aktiengesellschaft, a German public stock corporation (“Wincor Nixdorf”) for €38.98 in cash and 0.434 new common shares of the Company (the “Offer

Consideration”). The completion of the Offer is herein referred to as the “Closing”.

At the Closing and pursuant to the

terms of the Offer, the Company delivered the Offer Consideration to Wincor Nixdorf shareholders who validly tendered, and did not withdraw, their Wincor Nixdorf ordinary shares in the Offer. Concurrently, the ownership of the tendered shares was

transferred to Diebold Holding Germany Inc. & Co. KGaA, a German partnership limited by shares and a wholly-owned subsidiary of the Company (“Diebold KGaA”). To the extent that former Wincor Nixdorf shareholders are entitled to

fractional shares, those fractional entitlements have been aggregated and sold in the market and the proceeds of such sale will be distributed pro rata no later than August 29, 2016.

As previously disclosed, the Company commenced the Offer pursuant to a business combination agreement (the “Business Combination

Agreement”), dated November 23, 2015, between the Company and Wincor Nixdorf. The acceptance period for the Offer began on February 5, 2016, and expired on March 22, 2016, 24:00 hours (Central European Time), and a statutory additional

acceptance period pursuant to the German Takeover Act expired on April 12, 2016, 24:00 hours (Central European Summer Time). On August 4, 2016, the Company announced that it had received all of the requisite antitrust clearances required under the

regulatory condition of the Offer and, accordingly, all closing conditions to the Offer had been satisfied. Withdrawal rights for the Offer ceased at the end of the acceptance period on March 22, 2016.

In connection with the Closing, the Company issued 9,928,514 common shares (the “New Shares”). At the Closing, the Company (through

Diebold KGaA) acquired 22,876,760 Wincor Nixdorf ordinary shares, representing 69.15 percent of the total number of issued Wincor Nixdorf ordinary shares inclusive of treasury shares (76.73 percent of all Wincor Nixdorf ordinary shares outstanding)

in exchange for an aggregate Offer Consideration of approximately €891.7 million in cash and the New Shares.

The cash portion of the

Offer Consideration, together with transaction costs, was financed with a combination of: (1) a portion of the proceeds from the issuance of $400,000,000 aggregate principal amount of senior unsecured notes due 2024 (the “Notes”) by the

Company (guaranteed by certain of its subsidiaries) in an offering exempt from the registration requirements of the Securities Act of 1933 that closed on April 19, 2016; and (2) a portion of the proceeds from the Company’s Term Loan B facility

provided under the existing credit agreement, dated as of November 23, 2015 (as amended or otherwise modified from time to time, the “Credit Agreement”), among the Company and certain of the Company’s subsidiaries, as borrowers,

JPMorgan Chase Bank, N.A., as administrative agent, and the lenders named therein, each as previously disclosed in the Company’s reports filed with the Securities and Exchange Commission (“SEC”).

The New Shares have commenced trading on the New York Stock Exchange under the symbol “DBD” and all common shares of the Company

(the New Shares and all other issued common shares of the Company) have commenced trading on the Frankfurt Stock Exchange under the symbol “DBD”.

On August 16, 2016, the board of directors of the Company (the “Board”) and the supervisory and management boards of Wincor Nixdorf

approved the conclusion of a proposed domination and profit and loss transfer agreement (the “Domination and Profit and Loss Transfer Agreement”) between Diebold KGaA, as the controlling company, and Wincor Nixdorf, as the controlled

company. The parties expect to execute the agreement prior to or immediately after a meeting of shareholders of Wincor Nixdorf that is expected to vote on the Domination and Profit and Loss Transfer Agreement on September 26, 2016.

Effectiveness of the Domination and Profit and Loss Transfer Agreement will be subject, among other things, to approval by at least 75 percent of

all outstanding Wincor Nixdorf shares entitled to vote, including those held by Diebold KGaA, and subsequent registration with the commercial register (

Handelsregister

) of the local court

(

Amtsgericht

) at the registered offices of Wincor Nixdorf. Please refer to the disclosures under Item 8.01 of this Current Report on Form 8-K for a more detailed discussion.

The foregoing summary does not purport to be complete and is qualified in its entirety by reference to the Contract Report (as defined below),

an English translation of which is attached to this Current Report on Form 8-K as Exhibit 99.2, the German exchange offer document, an English translation of which was filed by the Company with the SEC, and the Business Combination Agreement, a copy

of which was filed as Exhibit 2.1 to the Current Report on Form 8-K on November 23, 2015, and is incorporated herein by reference.

Item 2.01 Completion of Acquisition or Disposition of Assets.

The information contained in the Introductory Note of this Current Report on Form 8-K is incorporated by reference into this Item 2.01.

On August 15, 2016, the Company issued a press release concerning certain events relating to this Item 2.01. A copy of the press release

is attached to this Current Report on Form 8-K as Exhibit 99.1 and is incorporated herein by reference.

Item 5.02 Departure of

Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On August 15, 2016, in accordance with the Business Combination Agreement, the Board elected Dr. Alexander Dibelius, Chairman of the

supervisory board of Wincor Nixdorf, and Dr. Dieter Düsedau, member of the supervisory board of Wincor Nixdorf, to the Board effective on August 16, 2016. Dr. Dibelius and Dr. Düsedau fill the positions created by the increase of

the size of the Board, which is disclosed in Item 5.03 of this Current Report on Form 8-K. The Board further determined that each of Dr. Dibelius and Dr. Düsedau qualifies as an independent director under the Company’s director

independence standards and the NYSE director independence standards, as applicable and as currently in effect.

In addition, on August 15,

2016, effective as of the Closing and in accordance with the Business Combination Agreement and the related service agreement thereunder, the Board elected Wincor Nixdorf’s Chief Executive Officer, Mr. Eckard Heidloff to the position of

President of the Company, reporting to Mr. Andy Mattes who will continue to serve as Chief Executive Officer of the Company.

Mr.

Heidloff.

Mr. Heidloff, age 59, has served as Wincor Nixdorf’s President and Chief Executive Officer since 2007. Previously,

he served as Wincor Nixdorf’s Chief Financial Officer and Chief Operating Officer, with responsibility for worldwide production and logistics. Prior to this, he served as Executive Vice President and Chief Financial Officer of Wincor Nixdorf

Holding GmbH. Earlier in his career, Mr. Heidloff served as the head of business administration for Wincor Nixdorf’s predecessor, Siemens Nixdorf Retail and Banking Systems GmbH. Mr. Heidloff is a member of several supervisory boards of Wincor

Nixdorf subsidiaries.

Mr. Heidloff’s existing employment contract with Wincor Nixdorf will continue in effect for the remainder of

its term, which expires on February 28, 2019. Pursuant to his existing employment contract, for Wincor Nixdorf’s fiscal year ended September 30, 2015, Mr. Heidloff received base compensation of €700,000.00, non-performance-based fringe

benefits of €39,379.59, performance-based short-term variable compensation of €700,000.00, performance-based long-term variable compensation in the form of his participation in Wincor Nixdorf’s share option program 2015 of

€893,266.07, and pension accruals of

€126,082.00. Mr. Heidloff is also entitled to certain pension commitments, the total amount of which was €1,254,871.00 at September 30, 2015. In the event that Mr. Heidloff’s term

in office is terminated early (other than due to disability or for cause), his existing employment contract provides for a settlement payment that meets the requirements of the German corporate governance code (

Deutscher Corporate Governance

Kodex

). This payment is limited to either two years’ annual compensation, including fringe benefits, or compensation for the remaining term of the employment contract, whichever is lower.

Dr.

Dibelius and Dr.

Düsedau.

Each of Dr. Dibelius and Dr. Düsedau is entitled to receive director compensation consistent with Diebold’s compensation

policy for non-employee directors, prorated as appropriate. Under Diebold’s current compensation policy, non-employee directors receive an annual retainer for their service as directors. In addition to cash compensation, each non-employee

director may receive equity awards under Diebold’s Amended and Restated 1991 Equity and Performance Incentive Plan, as amended and restated on February 12, 2014. No decisions have been made regarding committee assignments for Dr. Dibelius

or Dr. Düsedau. If such assignments are made, Dr. Dibelius and Dr. Düsedau, respectively, will be entitled to annual committee fees consistent with Diebold’s compensation policy for non-employee directors. Information

on Diebold’s compensation policy for the fiscal year ended December 31, 2015 is disclosed in Diebold’s definitive proxy statement, filed with the SEC on March 10, 2016.

In accordance with the terms of the Business Combination Agreement, the Company intends to nominate and recommend Dr. Dibelius and

Dr. Düsedau for election to the Board at the Company’s ensuing annual meeting of shareholders and to continue to nominate and recommend them for election to the Board. Each of Dr. Dibelius and Dr. Düsedau will serve in

his respective position until his successor has been chosen and elected or until his earlier resignation or removal.

Item 5.03

Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

Amendment to Bylaws

On August 15, 2016, in accordance with the Business Combination Agreement, the Board resolved to amend Section 1 of Article III of the Amended

and Restated Code of Regulations (the “Regulations”) of the Company, by increasing the size of the Board from ten (10) directors to a total of twelve (12) directors effective on August 16, 2016. Specifically, the entire first paragraph of

Section 1 of Article III of the Regulations is stricken in its entirety and replaced as follows:

“Section 1 - Number,

Election and Term of Office

Except as otherwise expressly provided in the Articles of Incorporation, the Board of

Directors shall be composed of not more than twelve (12) persons nor less than five (5) persons unless this number is changed by: (1) the shareholders in accordance with the law of Ohio, or (2) the vote of the majority of the Directors in office.

The Directors may increase the number to not more than twelve (12) persons and may decrease the number to not less than five (5) persons. Any Director’s office created by the Directors by reason of an increase in their number may be filled by

action of a majority of the Directors in office.”

Except as stated above, the Regulations are unchanged.

The foregoing is a summary of the change introduced by the amendment. A copy of the Regulations, as amended, is included as Exhibit 3.1(ii) of

this Current Report on Form 8-K and is incorporated herein by reference.

Item 8.01 Other Events

Approval of Proposed Domination and Profit and Loss Transfer Agreement; Contract Report

On August 16, 2016, the Board and the management and supervisory boards of Wincor Nixdorf approved the conclusion of a Domination and Profit

and Loss Transfer Agreement between Diebold KGaA, as the controlling company, and Wincor Nixdorf, as the controlled company. The parties expect to execute the agreement prior to or immediately after a meeting of shareholders of Wincor Nixdorf that

is expected to vote on the Domination and Profit and Loss Transfer Agreement on September 26, 2016. Effectiveness of the proposed Domination and Profit and Loss Transfer Agreement will be subject, among other things, to approval by at least 75

percent of all outstanding Wincor Nixdorf shares entitled to vote, including those held by Diebold KGaA, and subsequent registration of the Domination and Profit and Loss Transfer Agreement with the commercial register (

Handelsregister

) of

the local court (

Amtsgericht

) at the registered offices of Wincor Nixdorf. While the Company plans to apply for registration of the Domination and Profit and Loss Transfer Agreement without undue delay following approval of the Domination and

Profit and Loss Transfer Agreement by Wincor Nixdorf’s shareholders (but no earlier than October 1, 2016), registration may be delayed considerably pending potential shareholder litigation, if any, in Germany.

Under the proposed Domination and Profit and Loss Transfer Agreement, when effective and subject to certain limitations pursuant to applicable

law, (i) Diebold KGaA will be entitled to issue binding instructions to the management board of Wincor Nixdorf, (ii) Wincor Nixdorf will transfer all of its annual profits to Diebold KGaA, subject to, among other things, the creation or

dissolution of certain reserves, and (iii) Diebold KGaA will generally absorb all annual losses incurred by Wincor Nixdorf. In addition, when effective and subject to certain limitations pursuant to applicable law, the Domination and Profit and Loss

Transfer Agreement will provide that Wincor Nixdorf shareholders be offered, at their election, (i) to put their Wincor Nixdorf Shares to Diebold KGaA in exchange for a compensation in cash of €53.34 per Wincor Nixdorf Share, subject to

certain adjustments (the “Exit Compensation”) and (ii) to remain Wincor Nixdorf shareholders and receive a recurring compensation in cash of €3.17 (€2.85 net under the current taxation regime) for each full fiscal year of

Wincor Nixdorf and for each Wincor Nixdorf Share, subject to certain adjustments (the “Recurring Compensation”), provided that depending on the further development of the risk-free rate (which takes into account the current interest rates

as well as interest structure data published by the German Federal Bank (

Deutsche Bundesbank

)) (which currently is 0.7 percent), the final Exit Compensation and Recurring Compensation will be adjusted as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Risk-free Rate

|

|

0.5%

|

|

|

0.6%

|

|

|

0.7%

|

|

|

0.8%

|

|

|

Exit Compensation (in €)

|

|

|

55.02

|

|

|

|

54.17

|

|

|

|

53.34

|

|

|

|

52.54

|

|

|

Recurring Compensation (in €)

|

|

|

3.13 (2.82 net)

|

|

|

|

3.15 (2.83 net)

|

|

|

|

3.17 (2.85 net)

|

|

|

|

3.18 (2.87 net)

|

|

In connection with the proposed Domination and Profit and Loss Transfer Agreement and pursuant to the German

stock corporation act (

Aktiengesetz

), Diebold KGaA and Wincor Nixdorf published a joint contract report (

Vertragsbericht

), dated August 16, 2016, of the management board of Wincor Nixdorf and the management of Diebold KGaA that

includes a description of the transactions contemplated by the Domination and Profit and Loss Transfer Agreement and other information (the “Contract Report”), attaching the form of the proposed Domination and Profit and Loss Transfer

Agreement and a valuation report of PricewaterhouseCoopers AG Wirtschaftsprüfungsgesellschaft, dated August 16, 2016, regarding the enterprise value of Wincor Nixdorf as of September 26, 2016, and other information. In connection with the

proposed Domination and Profit and Loss Transfer Agreement, Diebold KGaA and Wincor Nixdorf also obtained an audit report by an independent court-appointed auditor, ADKL AG, dated August 16, 2016 (the “Audit Report”). Diebold KGaA’s

obligations under the Domination and Profit and Loss Transfer Agreement will be fully guaranteed by the Company.

This summary of the

proposed Domination and Profit and Loss Transfer Agreement and related documents does not purport to be complete. Please refer to Diebold’s website at

www.dieboldnixdorf.com

under

Company/Investor Relations

to obtain a copy of the

Contract Report, including attachments, and the Audit Report, English translations of which are attached as Exhibit 99.2 and Exhibit 99.3, respectively, to this Current Report on Form 8-K.

Item 9.01 Financial Statements and Exhibits.

(a)

Financial Statements of Businesses Acquired

. The Company will file the financial statements of Wincor Nixdorf required by Item

9.01(a) by amendment not later than 71 calendar days after the date this Current Report on Form 8-K is required to be filed.

(b)

Pro

Forma Financial Information

. The Company will file the pro forma financial information required by Item 9.01(b) by amendment not later than 71 calendar days after the date this Current Report on Form 8-K is required to be filed.

(d)

Exhibits

. The following exhibits are filed with this report:

2.1 Business Combination Agreement, dated November 23, 2015, by and among Diebold, Incorporated and Wincor Nixdorf AG

(incorporated by reference to Exhibit 2.1 to the Current Report on Form 8-K filed by the Company, dated November 23, 2015).

3.1(ii) Amended and Restated Code of Regulations of Diebold, Incorporated.

99.1 Press release issued by the Company, dated August 15, 2016, concerning certain events relating to Item 2.01 in this

Current Report on Form 8-K.

99.2 Joint Contract Report (

Vertragsbericht

), dated August 16, 2016, of the Management

Board of Wincor Nixdorf AG and the Management of Diebold Holding Germany Inc. & Co. KGaA.

99.3 Audit Report by ADKL

AG, dated August 16, 2016, in connection with the Domination and Profit and Loss Transfer Agreement (excluding attachments).

CAUTIONARY STATEMENT ABOUT FORWARD LOOKING STATEMENTS

Certain statements contained in this document regarding matters that are not historical facts are forward-looking statements (as defined in the

Private Securities Litigation Reform Act of 1995). These include statements regarding management’s intentions, plans, beliefs, expectations or forecasts for the future including, without limitation, the business combination with Wincor Nixdorf,

the entry into and consummation of the proposed Domination and Profit and Loss Transfer Agreement and related transactions. Such forward-looking statements are based on the current expectations of Diebold and involve risks and uncertainties because

such statements relate to events and depend on circumstances that may or may not occur in the future; consequently, actual results may differ materially from those expressed or implied in the statements. Such forward-looking statements may include

statements about the business combination with Wincor Nixdorf, the effects of any transaction on the businesses and financial conditions of Diebold or Wincor Nixdorf, including synergies, pro forma revenue, targeted operating margin, net debt to

EBITDA ratios, accretion to earnings and other financial or operating measures. By their nature, forward-looking statements involve risks and uncertainties because they relate to events and depend on circumstances that may or may not occur in the

future. Forward-looking statements are not guarantees of future performance. In addition, risks and uncertainties related to the proposed Domination and Profit and Loss Transfer Agreement include, but are not limited to, the risk that it may not be

approved or its effectiveness be delayed as a result of litigation or otherwise or may not occur, and risks associated with any appraisal proceedings. Risks and uncertainties may also include, but are not limited to, the occurrence of any event,

change or other circumstances that could give rise to the termination of the Business Combination

Agreement or the Domination and Profit and Loss Transfer Agreement, the timing, receipt and terms and conditions of any governmental and regulatory approvals that could reduce anticipated

benefits of the business combination, and risks associated with the impact the Business Combination Agreement, the proposed Domination and Profit and Loss Transfer Agreement and any related litigation may have on the business and operations of the

combined company, including on the ability of the combined company to retain and hire key personnel, and maintain relationships with its suppliers and customers. These risks, as well as other risks are more fully discussed in Diebold’s reports

filed with the SEC and available at the SEC’s website at www.sec.gov. Any forward-looking statements speak only as at the date of this document. Except as required by applicable law, neither Diebold nor Wincor Nixdorf undertakes any obligation

to update or revise publicly any forward-looking statement, whether as a result of new information, future events or otherwise.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

Diebold, Incorporated

|

|

Date: August 19, 2016

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

|

/s/ Jonathan B. Leiken

|

|

|

|

|

|

Name:

|

|

Jonathan B. Leiken

|

|

|

|

|

|

Title:

|

|

Senior Vice President, Chief Legal Officer and Secretary

|

EXHIBIT INDEX

|

|

|

|

|

Exhibit

Number

|

|

Description

|

|

|

|

|

2.1

|

|

Business Combination Agreement, dated November 23, 2015, by and among Diebold, Incorporated and Wincor Nixdorf AG (incorporated by reference to Exhibit 2.1 to the Current Report on Form 8-K filed by the Company on November 23,

2015).

|

|

|

|

|

3.1(ii)

|

|

Amended and Restated Code of Regulations of Diebold, Incorporated.

|

|

|

|

|

99.1

|

|

Press release issued by the Company, dated August 15, 2016, concerning certain events relating to Item 2.01 in this Current Report on Form 8-K.

|

|

|

|

|

99.2

|

|

Joint Contract Report (

Vertragsbericht

), dated August 16, 2016, of the Management Board of Wincor Nixdorf AG and the Management of Diebold Holding Germany Inc. & Co. KGaA.

|

|

|

|

|

99.3

|

|

Audit Report by ADKL AG, dated August 16, 2016, in connection with the Domination and Profit and Loss Transfer Agreement (excluding attachments).

|

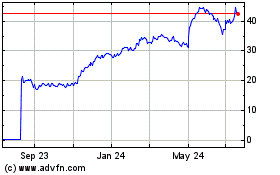

Diebold Nixdorf (NYSE:DBD)

Historical Stock Chart

From Mar 2024 to Apr 2024

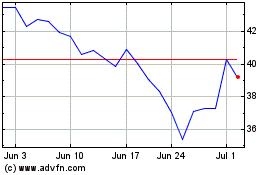

Diebold Nixdorf (NYSE:DBD)

Historical Stock Chart

From Apr 2023 to Apr 2024