Adaptive Ad Systems, Inc. (OTC Pink: AATV), 400% Growth Over 2016 Projected $9 Million Revenue, $3.2 Million Net Profit

August 18 2016 - 7:30AM

InvestorsHub NewsWire

Adaptive Ad Systems, Inc. (OTC Pink:

AATV), 400% Growth Over 2016 Projected $9 Million Revenue, $3.2

Million Net Profit

Miami, FL-- (InvestorsHub NewsWire

–August 18, 2016) - EmergingGrowth.com, a leading

independent small cap media portal with an extensive history of

providing unparalleled content for the Emerging Growth markets and

companies, reports on Adaptive Ad Systems, Inc. (OTC Pink:

AATV).

2016: revenues of $9 Million and net income of $3.21

Million

2017: revenues of $36 Million and net income will expand to

$11.9 Million

2018: revenues of $72 Million, on net income of $26.64

Million.

AATV May not be at these levels much

longer

See the Full Report on Adaptive Ad Systems, Inc. (OTC

Pink: AATV) on EmergingGrowth.com

http://emerginggrowth.com/adaptive-ad-systems-inc-otcqb-aatv-400-growth-2016-9-million-revenue-3-2-million-net-profit/

Adaptive Ad Systems, Inc. (OTC Pink:

AATV), new to EmergingGrowth.com has contracted ad

systems and services with over 200 cable TV systems, which serves

approximately 1.1 Million households, across 45 States.

Through management’s plans to further expand their ad-insertion

network to reach 3 Million households, while keeping costs minimal,

Adaptive Ad Systems, Inc. (OTC

Pink: AATV) is forecasting the following earnings:

2016: revenues of $9 Million and net income of $3.21

Million

2017: revenues of $36 Million and net income will expand to

$11.9 Million

2018: revenues of $72 Million, on net income of $26.64

Million.

Adaptive Ad Systems, Inc. (OTC

Pink: AATV) is able to strategically increase our footprint and

develop ad sales revenue, while staying far more cost efficient

operationally, compared to the industry average.

During the second quarter ending on June 30, 2016, Adaptive Ad

Systems, Inc. (OTC

Pink: AATV) reported total revenue of $892,814 and a

net profit of $289,947 or $0.006 per common stock share. During the

first six months of 2016, the company reported total revenues of

nearly $1.91 million and a net profit of $624,121 or $0.0130 per

common stock share.

Due to Adaptive Ad Systems, Inc. (OTC

Pink: AATV)’s unique, proprietary ad-insertion technology and

catering to niche cable and network markets throughout the United

States, the company does not have any real direct competition

within the markets that it operates.

Adaptive Ad Systems, Inc. (OTC

Pink: AATV) continue to be among the stalwarts of the ad

insertion industry, as other ad rivals carry net losses and heavy

leverage. With continued expansion into niche markets planned over

the next several years, Adaptive Ad Systems, Inc. (OTC

Pink: AATV) could see its market cap expand into the hundreds

of millions in the near future.

AATV May not be at

these levels much longer

See the Full Report on Adaptive Ad Systems, Inc. (OTC

Pink: AATV) on EmergingGrowth.com

http://emerginggrowth.com/adaptive-ad-systems-inc-otcqb-aatv-400-growth-2016-9-million-revenue-3-2-million-net-profit/

About Adaptive Ad Systems, Inc. (OTC

Pink: AATV)

Adaptive Ad Systems and its years of

professional services and ability to lead in advertising technology

breeds success for companies interested in increasing revenue and

improving brand recognition while offering the advantage of

reaching highly-targeted TV markets and targeted

demographics

Ad Systems, Inc.

is the exclusive hardware manufacturer

for Adaptive Ad Systems and their subsidiary companies. This

technology has evolved into the latest digital platform. With

patent pending technology it is the next generation of ad insertion

equipment, and only available through Ad Systems, Inc.

For additional information, please

visit:

www.aatv.co

www.adsystemscatv.com

Other Emerging Growth

News

TubeMogul,

Inc.

As opposed to Adaptive Ad Systems,

Inc., (OTC

Pink: AATV) who’s management’s plans to further expand

their ad-insertion network to reach 3 Million households, while

keeping costs minimal, TubeMogul, Inc. (NASDAQ:

TUBE) saw its second quarter losses widen.

Costs for this company grew 33% year over year to $130

million. Granted, the company saw sales grow over 20%, but

the market’s almost 25% drop over the past seven trading sessions

paint a different picture.

MGT Capital Investments,

Inc.

MGT Capital Investments, Inc.

(NYSE MKT: MGT)

is in the process of acquiring a diverse portfolio of cyber

security technologies. With cyber security industry pioneer, John

McAfee, at its helm, MGT Capital is positioned to address various

cyber threats through advanced protection technologies for mobile

and personal tech devices, including tablets and smart

phones.

The stock has been trading around

the $3-4.00 mark as volume has been slowly

diminishing. The

company however released it’s quarterly corporate update outlining

both product and corporate highlights. The upcoming vote on September 8, should tell

a lot.

Intellipharmaceutics International

Inc.

Intellipharmaceutics International

Inc. (NASDAQ:

IPCI) has seen shares have seen a nice 20% rise before giving

back about 10 if it recently. Moreover, it appears it may have

taken the market to come to terms with the company’s second quarter

results which aired last Sunday.

The company regained the 10% it

lost just yesterday as it traded over 200,000 shares and saw the

stock close at the high of the day of 1.96 per share.

About EmergingGrowth.com

EmergingGrowth.com is a leading

independent small cap media portal with an extensive history of

providing unparalleled content for the Emerging Growth markets and

companies. Through its evolution, EmergingGrowth.com found a niche in identifying

companies that can be overlooked by the markets due to, among other

reasons, trading price or market capitalization. We look for

strong management, innovation, strategy, execution, and the overall

potential for long- term growth. Aside from being a trusted

resource for the Emerging Growth info-seekers, we are well known

for discovering undervalued companies and bringing them to the

attention of the investment community. Through our parent

Company, we also have the ability to facilitate road shows to

present your products and services to the most influential

investment banks in the space.

Disclosure:

All information contained herein as

well as on the EmergingGrowth.com website is obtained from

sources believed to be reliable but not guaranteed to be accurate

or all-inclusive. All material is for informational purposes only,

is only the opinion of EmergingGrowth.com and should not be

construed as an offer or solicitation to buy or sell securities.

The information may include certain forward-looking statements,

which may be affected by unforeseen circumstances and / or certain

risks. This report is not without bias. EmergingGrowth.com has motivation by means of either

self-marketing or EmergingGrowth.com has been

compensated by or for a company or companies discussed in this

article. Full details about which can be found in our full

disclosure, which can be found here, http://www.emerginggrowth.com/disclosure-2288/.

Please consult an investment professional before investing in

anything viewed within. When EmergingGrowth.com is long

shares it will sell those shares. In addition, please make sure you

read and understand the Terms of Use, Privacy Policy and the

Disclosure posted on the EmergingGrowth.com

website.

CONTACT:

Company: EmergingGrowth.com - http://www.EmergingGrowth.com

Contact Email: EmergingGrowth1@gmail.com

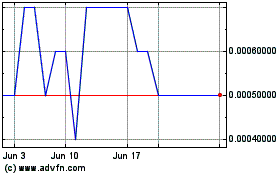

MGT Capital Investments (PK) (USOTC:MGTI)

Historical Stock Chart

From Mar 2024 to Apr 2024

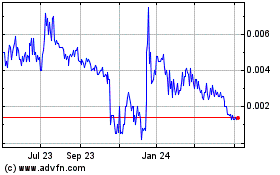

MGT Capital Investments (PK) (USOTC:MGTI)

Historical Stock Chart

From Apr 2023 to Apr 2024