NetApp Swings to a Profit

August 17 2016 - 5:15PM

Dow Jones News

By Maria Armental

NetApp Inc. swung to a quarterly profit, boosted by cost-cutting

that helped offset a 3% revenue decline.

Shares, up 9% this year, rose 6% in after-hours trading to

$30.47.

The Silicon Valley data storage company, which has reported

lower profit for the past two years and falling sales for three

years running, is trying to revamp operations as part of the latest

restructuring that targets some $400 million in cost-savings.

In the latest period, it reported $704 million in operating

expenses, a 16% decline from the year-ago period, which included

$27 million in restructuring charges.

Over all, NetApp reported a first-quarter profit of $64 million,

or 23 cents a share, compared with a loss of $30 million, or 10

cents a share, a year earlier. Excluding stock-based compensation

and other items, profit rose to 46 cents a share from 29 cents a

share.

The most recent results are based on 7% fewer shares

outstanding.

Net revenue fell to $1.29 billion from $1.34 billion as product

revenue, which accounts for the bulk of its business, declined

0.6%.

NetApp, which cut operating expenses by 16%, had projected 34

cents to 39 cents a share in adjusted profit on $1.20 billion to

$1.35 billion in revenue.

Gross profit margin improved to 61.6% from 61.1% a year

earlier.

For the current quarter, it expects to make 51 cents to 56 cents

a share in adjusted profit on $1.27 billion to $1.42 billion in

revenue, compared with analysts' projected 54 cents a share on

$1.33 billion in revenue, according to Thomson Reuters.

NetApp ended the year with $5.3 billion in cash, the bulk of it

abroad, and $2.34 billion in debt.

Write to Maria Armental at maria.armental@wsj.com

(END) Dow Jones Newswires

August 17, 2016 17:00 ET (21:00 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

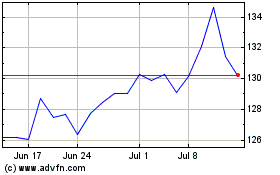

NetApp (NASDAQ:NTAP)

Historical Stock Chart

From Mar 2024 to Apr 2024

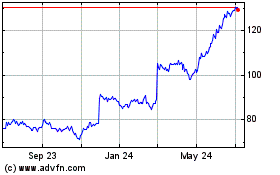

NetApp (NASDAQ:NTAP)

Historical Stock Chart

From Apr 2023 to Apr 2024