Current Report Filing (8-k)

August 17 2016 - 5:02PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT

TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of report/(Date of earliest event reported)

August 15, 2016

PATTERSON

COMPANIES, INC.

(Exact Name of Registrant as Specified in Its Charter)

|

|

|

|

|

|

|

Minnesota

|

|

0-20572

|

|

41-0886515

|

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

1031 Mendota Heights Road

St. Paul, Minnesota 55120

(Address of Principal Executive Offices, including Zip Code)

(651) 686-1600

(Registrant’s Telephone Number, including Area Code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions:

|

¨

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Item 3.01 NOTICE OF DELISTING OR FAILURE TO SATISFY A CONTINUED LISTING RULE OR STANDARD; TRANSFER OF

LISTING.

The information from Item 8.01 is incorporated herein by reference.

Item 8.01 OTHER EVENTS.

On August 2, 2016, the Board

of Directors (the “Board”) of Patterson Companies, Inc. (the “Company”) received two demand letters, each on behalf of purported shareholders of the Company. The letters allege that equity awards granted on July 1, 2015 to

Scott P. Anderson, our Chairman, President and Chief Executive Officer, exceeded the annual limit under our Amended and Restated Equity Incentive Plan (the “2012 Incentive Plan”).

As previously reported, Mr. Anderson was granted the following equity awards under the 2012 Incentive Plan on July 1, 2015: (1) nonqualified

stock options to purchase up to 42,698 shares of common stock, vesting 100% after three years, at an exercise price of $49.27 per share, (2) one-time special nonqualified stock options to purchase up to 250,000 shares of common stock, vesting

25% after three years, another 25% after four years and the remaining 50% after five years, at an exercise price of $56.66 per share (15% above the closing price on the date of grant), (3) a restricted stock award for 10,148 shares of common

stock, vesting 20% each year, starting one year after the date of grant, and (4) performance units having a maximum estimated future payout of 35,216 shares of common stock, which vest only if performance criteria are met three years after the

date of grant. The terms of the 2012 Incentive Plan limit the number of shares subject to equity awards that may be granted to any individual participant in any calendar year to 300,000 shares, irrespective of when the awards vest. Assuming the

maximum payout on the performance units awarded, Mr. Anderson was granted equity awards for a total of 338,062 shares in calendar year 2015, which exceeded the annual limit in the 2012 Incentive Plan by 38,062 shares.

Upon this issue being brought to the Board’s attention, the Board appointed three independent and disinterested directors to investigate and remediate

the matter. Such directors promptly commenced a thorough investigation and took corrective action. They determined that 38,062 of the 250,000 non-qualified stock options would be rescinded and canceled, resulting in an option for the purchase of

211,938 shares of common stock, vesting 25% after three years, another 25% after four years and the remaining 50% after five years, at an exercise price of $56.66 per share. In addition, they reviewed past executive equity awards under the 2012

Incentive Plan and determined that there were no other instances in which such limit was exceeded.

On August 15, 2016, the Company notified the

Nasdaq Stock Market that it had made an equity award in excess of the limit of the 2012 Incentive Plan without obtaining shareholder approval, which is required by Listing Rule 5635(c). The Company has informed NASDAQ of the corrective actions it

has taken to comply with Listing Rule 5635(c).

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

PATTERSON COMPANIES, INC.

|

|

|

|

|

|

|

Date: August 17, 2016

|

|

|

|

By:

|

|

/s/ Les B. Korsh

|

|

|

|

|

|

|

|

Les B. Korsh

|

|

|

|

|

|

|

|

Vice President, General Counsel and Secretary

|

3

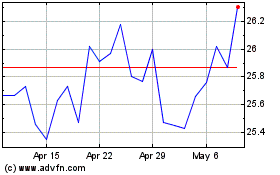

Patterson Companies (NASDAQ:PDCO)

Historical Stock Chart

From Mar 2024 to Apr 2024

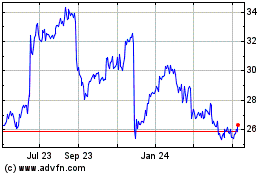

Patterson Companies (NASDAQ:PDCO)

Historical Stock Chart

From Apr 2023 to Apr 2024