YY Inc. (NASDAQ:YY) ("YY" or the "Company"), a live streaming

platform, today announced its unaudited financial results for the

second quarter of 2016.

Second Quarter 2016

Highlights

- Net revenues increased by 45.9% to RMB1,980.8 million (US$298.0

million) from RMB1,357.2 million in the corresponding period of

2015.

- Net income attributable to YY increased by 18.1% to RMB343.3

million (US$51.7 million) from RMB290.7 million in the

corresponding period of 2015.

- Non-GAAP net income attributable to YY increased by 27.3% to

RMB384.8 million (US$57.9 million) from RMB302.3 million in the

corresponding period of 2015.

Mr. David Xueling Li, Chairman of YY, stated,

“We are glad to report another strong quarter of both top- and

bottom-line growth across the board. This growth momentum was

primarily driven by solid year-over-year user adoption of over

54.5% to 4.2 million paying users, as well as robust IVAS revenue

growth of 48.7% year over year. More importantly, we continued to

see steady growth in monthly active users (“MAUs”) on the YY

platform increasing by over 16% year over year to 141.9 million

users. Additionally, in June 2016, we revamped our online

music and entertainment branding to YY Live. This rebranding

effort is a key part of YY leveraging our core broadcasting

technology to more broadly support the increasing popularity of

mobile live-broadcasting on our online music and entertainment

platform. With the new brand, we aim to further leverage the

established YY brand and build an even deeper content ecosystem

which will also include the development of PUGC

(Professionally-curated User Generated Content). Meanwhile, we are

excited to announce the promotion of Mr. Zhou Chen as YY’s new CEO

as well as the promotion of Mr. Rongjie Dong to CEO of our Huya

broadcasting division. We firmly believe their deep experience,

creative genius and solid leadership capabilities will help to lead

YY through our next phase of development. Overall, we remain

confident in our ability to stay ahead of our competitors and

further fortify YY’s competitive moat as a leading interactive,

live streaming platform in China.

Mr. Eric He, Chief Financial Officer of YY,

commented, “For the second quarter of 2016, our revenue momentum

continued as total revenues increased by 45.9% year over year to

RMB1.98 billion. The growth in both top and bottom line reflects

the strength of our increasingly large and diverse IVAS revenue

streams. Our online game broadcasting business, Huya, saw continued

strong growth, with a 67.7% year-over-year increase in revenue and

a 111.6% year-over-year increase in the number of paying users to

1.1 million. Our online music and entertainment business, recently

upgraded to YY Live, had a 50.3% year-over-year increase in revenue

and 51.4% year-over-year increase in the number of paying users.

Meanwhile, our leading music and entertainment business for mobile

devices continued its robust growth with a 96.7% year-over-year

increase in revenue and 88.3% year-over-year increase in the number

of paying users to 1.8 million. Going forward, under the leadership

of our new management team, we will continue to drive top- and

bottom-line growth by expanding our innovative content and service

offerings in order to meet the ever-evolving demands of our massive

user community."

Second Quarter 2016 Financial

Results

NET REVENUES Net revenues

increased by 45.9% to RMB1,980.8 million (US$298.0 million) in the

second quarter of 2016 from RMB1,357.2 million in the corresponding

period of 2015, primarily driven by the increase in IVAS revenues.

IVAS revenues, which mainly consisted of revenues from online music

and entertainment, online dating, online games, Huya broadcasting

and YY's membership program, increased by 48.7% to RMB1,933.0

million (US$290.9 million) in the second quarter of 2016 from

RMB1,300.0 million in the corresponding period of 2015. The

increase in IVAS revenues was primarily driven by a 54.5%

year-over-year increase in the number of paying users to 4.2

million.

Revenues from online music and entertainment

increased by 50.3% to RMB1,098.3 million (US$165.3 million) in the

second quarter of 2016 from RMB730.7 million in the corresponding

period of 2015. This increase was driven by a year-over-year

increase of 51.4% in the number of paying users to 2.8 million.

Moreover, the number of mobile paying users grew 88.3% year over

year to 1.8 million in the second quarter of 2016.

Revenues from online dating increased by 72.3%

to RMB271.1 million (US$40.8 million) in the second quarter of 2016

from RMB157.3 million in the corresponding period of 2015. This

increase primarily resulted from a 35.6% year-over-year increase in

the number of paying users to 316,000 and 27.1% year-over-year

increase in ARPU to RMB858 in the second quarter of 2016.

Revenues from online games were RMB188.3 million

(US$28.3 million) in the second quarter of 2016, as compared to

RMB199.4 million in the corresponding period of 2015. This decline

was primarily caused by a 29.2% year-over-year decrease in the

number of paying users to 303,000, which reflects the continued

softness in China’s web game market, but was partially offset by a

33.3% year-over-year increase in the average revenue per user

(“ARPU”) of online games.

Other IVAS revenues, mainly including Huya

broadcasting, PK Show, membership subscription fees and ME App,

increased by 76.6% to RMB375.3 million (US$56.5 million) in the

second quarter of 2016 from RMB212.6 million in the corresponding

period of 2015. Revenues from Huya broadcasting increased by 67.7%

to RMB143.1 million (US$21.5 million) in the second quarter of 2016

from RMB85.3 million in the corresponding period of 2015, primarily

driven by the 111.6% year-over-year increase in the number of

paying users to 1.1 million.

Other revenues, mainly including revenues from

the Company's online education platform, Huanqiu Education Online,

and online advertising revenues from Duowan.com, were RMB47.8

million (US$7.2 million) in the second quarter of 2016, compared

with RMB57.2 million in the corresponding period of 2015.

COST OF REVENUES AND GROSS

PROFIT Cost of revenues increased by 45.0% to RMB1,208.3

million (US$181.8 million) in the second quarter of 2016 from

RMB833.3 million in the corresponding period of 2015, primarily

attributable to an increase in revenue-sharing fees and content

costs to RMB893.3 million (US$134.4 million) in the second quarter

of 2016 from RMB551.5 million in the corresponding period of 2015.

The increase in revenue-sharing fees and content costs paid to

performers, channel owners and content providers was in line with

the increase in revenues and was primarily due to the higher level

of user engagement and spending driven by promotional activities,

as well as the Company’s investments in expanding the amount of new

and innovative content it provides to users. In addition, bandwidth

costs increased to RMB150.7 million (US$22.7 million) in the second

quarter of 2016 from RMB132.2 million in the corresponding period

of 2015, primarily reflecting the continued user base expansion and

video quality improvements, but partially offset by the Company’s

improved efficiency and pricing terms.

Gross profit increased by 47.4% to RMB772.4

million (US$116.2 million) in the second quarter of 2016 from

RMB523.9 million in the corresponding period of 2015. Gross margin

increased to 39.0% in the second quarter of 2016 from 38.6% in the

corresponding period of 2015.

OPERATING INCOMEOperating

expenses for the second quarter of 2016 increased by 41.7% to

RMB351.1 million (US$52.8 million) from RMB247.8 million in the

corresponding period of 2015. This increase was primarily

attributable to the Company’s overall business expansion and its

investments in providing more rich and diversified content to

users.

Operating income in the second quarter of 2016

increased by 44.2% to RMB443.9 million (US$66.8 million), as

compared to RMB307.7 million in the corresponding period of 2015.

Operating margin in the second quarter of 2016 was 22.4%, as

compared to 22.7% in the corresponding period of 2015.

Non-GAAP operating income1 increased by

52.0% to RMB485.4 million (US$73.0 million) in the second quarter

of 2016 from RMB319.3 million in the corresponding period of 2015.

Non-GAAP operating margin2 increased to 24.5% in the second

quarter of 2016 from 23.5% in the corresponding period of 2015.

NET INCOMENet income

attributable to YY Inc. increased by 18.1% to RMB343.3 million

(US$51.7 million) in the second quarter of 2016 from RMB290.7

million in the corresponding period of 2015. Net margin in

the second quarter of 2016 was 17.3%, as compared to 21.4% in the

corresponding period of 2015. Excluding a one-time non-operating

expense of RMB23.5 million for the disposal of a subsidiary company

of YY, net income attributable to YY Inc. was RMB366.8 million

(US$55.2 million), representing an increase of 26.2% year over

year.

Non-GAAP net income attributable to YY

Inc.3 increased by 27.3% to RMB384.8 million (US$57.9 million)

from RMB302.3 million in the corresponding period of 2015. Non-GAAP

net margin4 was 19.4% in the second quarter of 2016, as

compared to 22.3% in the corresponding period of 2015.

NET INCOME PER ADSDiluted net

income per ADS5 increased by 17.1% to RMB5.97 (US$0.90) in the

second quarter of 2016 from RMB5.10 in the corresponding period of

2015.

Non-GAAP diluted net income per

ADS6 increased by 25.7% to RMB6.65 (US$1.00) in the second

quarter of 2016 from RMB5.29 in the corresponding period of

2015.

BALANCE SHEET AND CASH FLOWS As

of June 30, 2016, the Company had cash and cash equivalents of

RMB679.1 million (US$102.2 million) and short-term deposits of

RMB3,134.7 million (US$471.7 million). For the second quarter of

2016, net cash from operating activities was RMB573.8 million

(US$86.3 million).

SHARES OUTSTANDING As of June

30, 2016, the Company had a total of 1,101.9 million common shares

outstanding, or the equivalent of 55.1 million ADSs

outstanding.

Recent DevelopmentOn June 22,

2016, YY announced it has upgraded its online music and

entertainment brand to YY Live. With the new brand, the Company

will expand into pan-entertainment market and increase its focus on

the increasingly popular live broadcasting segment. On the content

side, YY will focus on PUGC offerings as it is expected to become

one of the most important content generation models to the Company.

YY will also enhance its PUGC offerings through cooperation with

entertainment industry partners. The Company also announced the

launch of “YY Live Broadcasting Box,” a fully HD codec live

broadcasting machine.

Business Outlook

For the third quarter of 2016, the Company

expects its net revenues to be between RMB2.00 billion and RMB2.10

billion, representing a year-over-year growth of approximately 34%

to 41%. These forecasts reflect the Company's current and

preliminary view on the market and operational conditions, which

are subject to change.

Conference Call InformationThe

Company will hold a conference call on August 18, 2016 at 8:00 am

Eastern Time or 8:00 pm Beijing Time to discuss the financial

results. Participants may access the call by dialing the following

numbers:

| United States: |

|

+1-845-675-0438 |

| International Toll

Free: |

|

+1-855-500-8701 |

| China Domestic: |

|

400-1200-654 |

| Hong Kong: |

|

+852-3018-6776 |

| Conference

ID: |

|

# 49135813 |

The replay will be accessible through August 26, 2016 by dialing

the following numbers:

| United States Toll

Free: |

|

+1-855-452-5696 |

|

International: |

|

+61-2-9003-4211 |

| Conference

ID: |

|

# 49135813 |

A live and archived webcast of the conference call will also be

available at the Company's investor relations website at

http://investors.yy.com/.

Exchange RateThis press release

contains translations of certain Renminbi amounts into U.S. dollars

at specified rates solely for the convenience of readers. Unless

otherwise noted, all translations from Renminbi to U.S. dollars, in

this press release, were made at a rate of RMB6.6459 to US$1.00,

the noon buying rate in effect on June 30, 2016 in the City of New

York for cable transfers in Renminbi per U.S. dollar as certified

for customs purposes by the Federal Reserve Bank of New York.

About YY Inc.YY Inc. (“YY” or

the “Company”) is a live streaming platform that enables users to

interact in live online group activities through voice, text and

video. Launched in July 2008, YY Client, the Company’s core

product, empowers users to create and organize groups of varying

sizes to discover and participate in a wide range of activities,

including online music and entertainment, online games, online

dating, live game broadcasting and education. YY Inc. was listed on

NASDAQ in November 2012 and generated revenues of US$910 million in

the fiscal year 2015.

Safe Harbor StatementThis

announcement contains forward-looking statements. These statements

are made under the “safe harbor” provisions of the U.S. Private

Securities Litigation Reform Act of 1995. These forward-looking

statements can be identified by terminology such as “will,”

“expects,” “anticipates,” “future,” “intends,” “plans,” “believes,”

“estimates” and similar statements. Among other things, the

business outlook and quotations from management in this

announcement, as well as YY's strategic and operational plans,

contain forward-looking statements. YY may also make written or

oral forward-looking statements in its periodic reports to the U.S.

Securities and Exchange Commission (“SEC”), in its annual report to

shareholders, in press releases and other written materials and in

oral statements made by its officers, directors or employees to

third parties. Statements that are not historical facts, including

statements about YY’s beliefs and expectations, are forward-looking

statements. Forward-looking statements involve inherent risks and

uncertainties. A number of factors could cause actual results to

differ materially from those contained in any forward-looking

statement, including but not limited to the following: YY’s goals

and strategies; YY's future business development, results of

operations and financial condition; the expected growth of the

online communication social platform market in China; the

expectation regarding the rate at which to gain registered user

accounts, active users, especially paying users; YY’s ability to

monetize the user base; YY’s ability to continue attracting

advertisers and offering popular online games; fluctuations in

general economic and business conditions in China and assumptions

underlying or related to any of the foregoing, as well as

uncertainties relating to the proposed “going-private” transaction.

Further information regarding these and other risks is included in

YY’s filings with the SEC. All information provided in this press

release and in the attachments is as of the date of this press

release, and YY does not undertake any obligation to update any

forward-looking statement, except as required under applicable

law.

Use of Non-GAAP Financial

MeasuresThe unaudited condensed consolidated financial

information is prepared in conformity with accounting principles

generally accepted in the United States of America (“U.S. GAAP”),

except that the consolidated statement of changes in shareholders’

equity, consolidated statements of cash flows, and the detailed

notes have not been presented. YY uses non-GAAP operating income,

non-GAAP operating margin, non-GAAP net income attributable to YY

Inc., non-GAAP net margin, non-GAAP net income

attributable to common shareholders, and basic and diluted non-GAAP

net income per ADS, which are non-GAAP financial measures. Non-GAAP

operating income is operating income excluding share-based

compensation expenses. Non-GAAP operating margin is non-GAAP

operating income as a percentage of net revenues. Non-GAAP net

income attributable to YY Inc. is net income attributable to YY

Inc. excluding share-based compensation expenses. Non-GAAP net

margin is non-GAAP net income attributable to YY Inc. as a

percentage of net revenues. Non-GAAP net income attributable to

common shareholders is net income attributable to common

shareholders excluding share-based compensation expenses. Basic and

diluted non-GAAP net income per ADS is non-GAAP net income

attributable to common shareholders divided by weighted average

number of ADS used in the calculation of basic and diluted net

income per ADS. The Company believes that separate analysis and

exclusion of the non-cash impact of share-based compensation adds

clarity to the constituent parts of its performance. The Company

reviews these non-GAAP financial measures together with GAAP

financial measures to obtain a better understanding of its

operating performance. It uses the non-GAAP financial measure for

planning, forecasting and measuring results against the forecast.

The Company believes that non-GAAP financial measure is useful

supplemental information for investors and analysts to assess its

operating performance without the effect of non-cash share-based

compensation expenses, which have been and will continue to be

significant recurring expenses in its business. However, the use of

non-GAAP financial measures has material limitations as an

analytical tool. One of the limitations of using non-GAAP financial

measures is that they do not include all items that impact the

Company’s net income for the period. In addition, because non-GAAP

financial measures are not measured in the same manner by all

companies, they may not be comparable to other similar titled

measures used by other companies. In light of the foregoing

limitations, you should not consider non-GAAP financial measure in

isolation from or as an alternative to the financial measure

prepared in accordance with U.S. GAAP.

The presentation of these non-GAAP financial

measures is not intended to be considered in isolation from, or as

a substitute for, the financial information prepared and presented

in accordance with U.S. GAAP. For more information on these

non-GAAP financial measures, please see the table captioned “YY

Inc. Reconciliations of GAAP and Non-GAAP Results” at the end of

this release.

1Non-GAAP operating income is a non-GAAP financial measure,

which is defined as operating income excluding share-based

compensation expenses.

2Non-GAAP operating margin is a non-GAAP financial measure,

which is defined as non-GAAP operating income as a percentage of

net revenues.

3Non-GAAP net income attributable to YY Inc. is a non-GAAP

financial measure, which is defined as net income attributable to

YY Inc. excluding share-based compensation expenses.

4Non-GAAP net margin is a non-GAAP financial measure, which is

defined as non-GAAP net income attributable to YY Inc. as a

percentage of net revenues.

5ADS is American Depositary Share. Each ADS represents twenty

Class A common shares of the Company. Diluted net income per ADS is

net income attributable to common shareholders divided by weighted

average number of diluted ADS.

6Non-GAAP diluted net income per ADS is a non-GAAP financial

measure, which is defined as non-GAAP net income attributable to

common shareholders divided by weighted average number of ADS used

in the calculation of diluted net income per ADS.

| |

| YY

INC. |

|

UNAUDITED CONDENSED CONSOLIDATED BALANCE

SHEETS |

| (All amounts in

thousands, except share, ADS and per ADS data) |

| |

| |

|

December

31,2015 |

|

June

30,2016 |

|

June

30,2016 |

| |

|

RMB |

|

RMB |

|

US$ |

|

Assets |

|

|

|

|

|

|

| Current

assets |

|

|

|

|

|

|

| Cash and cash equivalents |

|

928,934 |

|

679,139 |

|

102,189 |

| Short-term deposits |

|

1,894,946 |

|

3,134,711 |

|

471,676 |

| Restricted short-term deposits |

|

389,221 |

|

- |

|

- |

| Accounts receivable, net |

|

132,353 |

|

160,160 |

|

24,099 |

| Inventory |

|

14,385 |

|

3,357 |

|

505 |

| Amount due from related

parties |

|

5,297 |

|

23,236 |

|

3,496 |

| Prepayments and other current

assets |

|

147,823 |

|

178,781 |

|

26,901 |

| Deferred tax assets |

|

116,921 |

|

92,645 |

|

13,940 |

| |

|

|

|

|

|

|

| Total current

assets |

|

3,629,880 |

|

4,272,029 |

|

642,806 |

| |

|

|

|

|

|

|

| Non-current

assets |

|

|

|

|

|

|

| Deferred tax assets |

|

3,363 |

|

5,547 |

|

835 |

| Investments |

|

567,557 |

|

806,018 |

|

121,280 |

| Property and equipment, net |

|

843,449 |

|

834,632 |

|

125,586 |

| Land use rights, net |

|

- |

|

1,896,348 |

|

285,341 |

| Intangible assets, net |

|

146,437 |

|

111,313 |

|

16,749 |

| Goodwill |

|

151,638 |

|

132,304 |

|

19,908 |

| Other non-current assets |

|

1,960,430 |

|

87,495 |

|

13,165 |

| |

|

|

|

|

|

|

| Total non-current

assets |

|

3,672,874 |

|

3,873,657 |

|

582,864 |

| |

|

|

|

|

|

|

|

Total assets |

|

7,302,754 |

|

8,145,686 |

|

1,225,670 |

|

|

|

|

|

|

|

|

| Liabilities

,mezzanine equity and shareholders’ equity |

|

|

|

|

|

|

| Current

liabilities |

|

|

|

|

|

|

| Accounts payable |

|

129,819 |

|

122,286 |

|

18,400 |

| Deferred revenue |

|

385,300 |

|

394,680 |

|

59,387 |

| Advances from customers |

|

55,086 |

|

77,074 |

|

11,597 |

| Income taxes payable |

|

107,403 |

|

94,688 |

|

14,248 |

| Accrued liabilities and other

current liabilities |

|

681,889 |

|

635,195 |

|

95,577 |

| Amounts due to related parties |

|

24,917 |

|

27,313 |

|

4,110 |

| |

|

|

|

|

|

|

| Total current

liabilities |

|

1,384,414 |

|

1,351,236 |

|

203,319 |

| |

|

|

|

|

|

|

| Non-current

liabilities |

|

|

|

|

|

|

| Convertible bonds* |

|

2,572,119 |

|

2,636,867 |

|

396,766 |

| Deferred revenue |

|

20,752 |

|

26,045 |

|

3,919 |

| Deferred tax liabilities |

|

16,817 |

|

15,162 |

|

2,281 |

| |

|

|

|

|

|

|

| Total non-current

liabilities |

|

2,609,688 |

|

2,678,074 |

|

402,966 |

| |

|

|

|

|

|

|

| Total

liabilities |

|

3,994,102 |

|

4,029,310 |

|

606,285 |

| YY

INC. |

| UNAUDITED

CONDENSED CONSOLIDATED BALANCE SHEETS (CONTINUED) |

| (All amounts in

thousands, except share, ADS and per ADS data) |

| |

| |

|

December 31,2015 |

|

June

30,2016 |

|

June

30,2016 |

| |

|

RMB |

|

RMB |

|

US$ |

|

|

|

|

|

|

|

|

| Mezzanine

equity |

|

|

61,833 |

|

|

43,390 |

|

6,529 |

|

|

|

|

|

|

|

|

| Shareholders’

equity |

|

|

|

|

|

|

| Class A common shares

(US$0.00001 par value; 10,000,000,000 and 10,000,000,000 shares

authorized, 728,227,848 and 732,331,788 shares issued and

outstanding as of December 31, 2015 and June 30, 2016,

respectively) |

|

|

43 |

|

|

43 |

|

6 |

| Class B common shares

(US$0.00001 par value; 1,000,000,000 and 1,000,000,000 shares

authorized, 369,557,976 and 369,557,976 shares issued and

outstanding as of December 31, 2015 and June 30, 2016,

respectively) |

|

|

27 |

|

|

27 |

|

4 |

| Additional paid-in

capital |

|

|

2,011,799 |

|

|

2,107,329 |

|

317,087 |

| Statutory reserves |

|

|

56,507 |

|

|

56,507 |

|

8,503 |

| Retained earnings |

|

|

1,207,168 |

|

|

1,758,793 |

|

264,643 |

| Accumulated other

comprehensive (losses) income |

|

|

(36,385 |

) |

|

139,658 |

|

21,014 |

| Non-controlling

interests |

|

|

7,660 |

|

|

10,629 |

|

1,599 |

| |

|

|

|

|

|

|

| Total

shareholders’ equity |

|

|

3,246,819 |

|

|

4,072,986 |

|

612,856 |

| |

|

|

|

|

|

|

| Total

liabilities, mezzanine equity

and shareholders’ equity |

|

|

7,302,754 |

|

|

8,145,686 |

|

1,225,670 |

| |

|

|

|

|

|

|

* Effectively January 2016, ASU 2015-3 issued by FASB requires

entities to present the issuance costs of bonds in the balance

sheet as a direct deduction from the related bonds rather than

assets. Accordingly, the Company retrospectively reclassified

RMB25.3 million of issuance cost of bonds from other non-current

assets into convertible bonds as of December 31, 2015.

| YY

INC. |

| UNAUDITED

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE

INCOME |

| (All amounts in

thousands, except share, ADS and per ADS data) |

|

|

| |

|

Three Months Ended |

|

Six Months Ended |

| |

|

June

30,2015 |

March

31,2016 |

June

30,2016 |

June

30,2016 |

|

June 30,2015 |

June 30,2016 |

June 30,2016 |

| |

|

RMB |

RMB |

RMB |

US$ |

|

RMB |

RMB |

US$ |

| |

|

|

|

|

|

|

|

|

|

| Net

revenues |

|

|

|

|

|

|

|

|

|

| Internet value-added

service |

|

|

|

|

|

|

|

|

|

| —Online music and

entertainment |

|

|

730,693 |

|

|

919,084 |

|

|

1,098,311 |

|

|

165,261 |

|

|

|

1,320,748 |

|

|

2,017,395 |

|

|

303,555 |

|

| —Online dating |

|

|

157,348 |

|

|

211,226 |

|

|

271,116 |

|

|

40,794 |

|

|

|

289,184 |

|

|

482,342 |

|

|

72,577 |

|

| —Online games |

|

|

199,404 |

|

|

171,110 |

|

|

188,261 |

|

|

28,327 |

|

|

|

431,152 |

|

|

359,371 |

|

|

54,074 |

|

| —Other IVAS |

|

|

212,585 |

|

|

310,428 |

|

|

375,321 |

|

|

56,474 |

|

|

|

369,782 |

|

|

685,749 |

|

|

103,184 |

|

| Other

revenues |

|

|

57,151 |

|

|

37,470 |

|

|

47,768 |

|

|

7,188 |

|

|

|

96,577 |

|

|

85,238 |

|

|

12,826 |

|

| |

|

|

|

|

|

|

|

|

|

| Total net

revenue |

|

|

1,357,181 |

|

|

1,649,318 |

|

|

1,980,777 |

|

|

298,044 |

|

|

|

2,507,443 |

|

|

3,630,095 |

|

|

546,216 |

|

| |

|

|

|

|

|

|

|

|

|

| Cost of revenues(1) |

|

|

(833,281 |

) |

|

(1,060,531 |

) |

|

(1,208,340 |

) |

|

(181,817 |

) |

|

|

(1,506,016 |

) |

|

(2,268,871 |

) |

|

(341,394 |

) |

| |

|

|

|

|

|

|

|

|

|

| Gross

profit |

|

|

523,900 |

|

|

588,787 |

|

|

772,437 |

|

|

116,227 |

|

|

|

1,001,427 |

|

|

1,361,224 |

|

|

204,822 |

|

| |

|

|

|

|

|

|

|

|

|

| Operating

expenses(1) |

|

|

|

|

|

|

|

|

|

| Research and development

expenses |

|

|

(120,125 |

) |

|

(179,648 |

) |

|

(172,228 |

) |

|

(25,915 |

) |

|

|

(243,113 |

) |

|

(351,876 |

) |

|

(52,946 |

) |

| Sales and marketing

expenses |

|

|

(63,079 |

) |

|

(77,961 |

) |

|

(88,699 |

) |

|

(13,346 |

) |

|

|

(114,622 |

) |

|

(166,660 |

) |

|

(25,077 |

) |

| General and administrative

expenses |

|

|

(63,843 |

) |

|

(83,407 |

) |

|

(90,155 |

) |

|

(13,566 |

) |

|

|

(123,374 |

) |

|

(173,562 |

) |

|

(26,116 |

) |

| Goodwill impairment |

|

|

(110,699 |

) |

|

- |

|

|

- |

|

|

- |

|

|

|

(110,699 |

) |

|

- |

|

|

- |

|

| Fair value change of

contingent consideration |

|

|

109,995 |

|

|

- |

|

|

- |

|

|

- |

|

|

|

109,995 |

|

|

- |

|

|

- |

|

| |

|

|

|

|

|

|

|

|

|

| Total operating

expenses |

|

|

(247,751 |

) |

|

(341,016 |

) |

|

(351,082 |

) |

|

(52,827 |

) |

|

|

(481,813 |

) |

|

(692,098 |

) |

|

(104,139 |

) |

| |

|

|

|

|

|

|

|

|

|

| Other income |

|

|

31,570 |

|

|

8,905 |

|

|

22,507 |

|

|

3,387 |

|

|

|

32,330 |

|

|

31,412 |

|

|

4,727 |

|

| |

|

|

|

|

|

|

|

|

|

| Operating

income |

|

|

307,719 |

|

|

256,676 |

|

|

443,862 |

|

|

66,787 |

|

|

|

551,944 |

|

|

700,538 |

|

|

105,410 |

|

| |

|

|

|

|

|

|

|

|

|

| Foreign currency exchange

gains (losses), net |

|

|

3,917 |

|

|

237 |

|

|

552 |

|

|

83 |

|

|

|

(1,167 |

) |

|

789 |

|

|

119 |

|

| Interest expense |

|

|

(21,941 |

) |

|

(20,394 |

) |

|

(19,576 |

) |

|

(2,946 |

) |

|

|

(40,126 |

) |

|

(39,970 |

) |

|

(6,014 |

) |

| Interest income |

|

|

33,884 |

|

|

13,649 |

|

|

9,902 |

|

|

1,490 |

|

|

|

81,152 |

|

|

23,551 |

|

|

3,544 |

|

| Other non-operating

expense |

|

|

- |

|

|

- |

|

|

(23,474 |

) |

|

(3,532 |

) |

|

|

(2,165 |

) |

|

(23,474 |

) |

|

(3,532 |

) |

| |

|

|

|

|

|

|

|

|

|

| Income before

income tax expenses |

|

|

323,579 |

|

|

250,168 |

|

|

411,266 |

|

|

61,882 |

|

|

|

589,638 |

|

|

661,434 |

|

|

99,527 |

|

| |

|

|

|

|

|

|

|

|

|

| Income tax expenses |

|

|

(36,430 |

) |

|

(49,622 |

) |

|

(75,179 |

) |

|

(11,312 |

) |

|

|

(80,904 |

) |

|

(124,801 |

) |

|

(18,779 |

) |

| |

|

|

|

|

|

|

|

|

|

| Income before

share of income (loss) in equity method investments, net of income

taxes |

|

|

287,149 |

|

|

200,546 |

|

|

336,087 |

|

|

50,570 |

|

|

|

508,734 |

|

|

536,633 |

|

|

80,748 |

|

| |

|

|

|

|

|

|

|

|

|

| Share of income (loss) in

equity method investments, net of income taxes |

|

|

2,319 |

|

|

5,774 |

|

|

(28 |

) |

|

(4 |

) |

|

|

7,320 |

|

|

5,746 |

|

|

865 |

|

| |

|

|

|

|

|

|

|

|

|

| Net

Income |

|

|

289,468 |

|

|

206,320 |

|

|

336,059 |

|

|

50,566 |

|

|

|

516,054 |

|

|

542,379 |

|

|

81,613 |

|

| |

|

|

|

|

|

|

|

|

|

| Less: Net loss

attributable to the non-controlling interest shareholders and the

mezzanine classified non-controlling interest shareholders |

|

|

(1,223 |

) |

|

(2,019 |

) |

|

(7,227 |

) |

|

(1,087 |

) |

|

|

(1,599 |

) |

|

(9,246 |

) |

|

(1,391 |

) |

|

|

|

|

|

|

|

|

|

|

|

| Net income

attributable to YY Inc. |

|

|

290,691 |

|

|

208,339 |

|

|

343,286 |

|

|

51,653 |

|

|

|

517,653 |

|

|

551,625 |

|

|

83,004 |

|

| YY

INC. |

| UNAUDITED

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE

INCOME (CONTINUED) |

| (All amounts in

thousands, except share, ADS and per ADS data) |

|

|

| |

|

Three Months Ended |

|

Six Months Ended |

| |

|

June

30,2015 |

|

March

31,2016 |

June

30,2016 |

June

30,2016 |

|

June 30,2015 |

June 30,2016 |

June 30,2016 |

| |

|

RMB |

|

RMB |

RMB |

US$ |

|

RMB |

RMB |

US$ |

| |

|

|

|

|

|

|

|

|

|

|

| Net income

attributable to YY Inc. |

|

290,691 |

|

208,339 |

|

343,286 |

|

|

51,653 |

|

|

517,653 |

|

551,625 |

|

|

83,004 |

|

| |

|

|

|

|

|

|

|

|

|

|

| Other comprehensive

income: |

|

|

|

|

|

|

|

|

|

|

| Unrealized gain of

available-for-sales securities |

|

- |

|

- |

|

177,152 |

|

|

26,656 |

|

|

- |

|

177,152 |

|

|

26,656 |

|

| Foreign currency

translation adjustments, net of nil tax |

|

30 |

|

350 |

|

(1,459 |

) |

|

(220 |

) |

|

4,101 |

|

(1,109 |

) |

|

(167 |

) |

| |

|

|

|

|

|

|

|

|

|

|

| Comprehensive

income attributable to YY Inc. |

|

290,721 |

|

208,689 |

|

518,979 |

|

|

78,089 |

|

|

521,754 |

|

727,668 |

|

|

109,493 |

|

| |

|

|

|

|

|

|

|

|

|

|

| Net income

per ADS |

|

|

|

|

|

|

|

|

|

|

| —Basic |

|

5.23 |

|

3.72 |

|

6.10 |

|

|

0.92 |

|

|

9.15 |

|

9.82 |

|

|

1.48 |

|

| —Diluted |

|

5.10 |

|

3.65 |

|

5.97 |

|

|

0.90 |

|

|

8.91 |

|

9.65 |

|

|

1.45 |

|

| Weighted average number of

ADS used in calculating net income per ADS |

|

|

|

|

|

|

|

|

|

|

| —Basic |

|

55,629,042 |

|

56,063,449 |

|

56,244,094 |

|

|

56,244,094 |

|

|

56,603,338 |

|

56,153,766 |

|

|

56,153,766 |

|

| —Diluted |

|

60,544,579 |

|

57,137,915 |

|

60,761,097 |

|

|

60,761,097 |

|

|

58,106,597 |

|

57,141,627 |

|

|

57,141,627 |

|

(1) Share-based compensation was allocated in cost of

revenues and operating expenses as follows:

| |

|

Three Months Ended |

|

Six Months Ended |

| |

|

June

30,2015 |

March

31,2016 |

June

30,2016 |

June

30,2016 |

|

June 30,2015 |

June 30,2016 |

June 30,2016 |

| |

|

RMB |

RMB |

RMB |

US$ |

|

RMB |

RMB |

US$ |

| |

|

|

|

|

|

|

|

|

|

| Cost of revenues |

|

1,937 |

8,612 |

141 |

21 |

|

6,369 |

8,753 |

1,317 |

| Research and development

expenses |

|

2,650 |

27,300 |

26,473 |

3,983 |

|

14,590 |

53,773 |

8,091 |

| Sales and marketing

expenses |

|

260 |

839 |

941 |

142 |

|

1,003 |

1,780 |

268 |

| General and administrative

expenses |

|

6,742 |

17,179 |

13,934 |

2,097 |

|

21,471 |

31,113 |

4,682 |

| YY

INC. |

| RECONCILIATION

OF GAAP AND NON-GAAP RESULTS |

| (All amounts in

thousands, except share, ADS and per ADS data) |

|

|

| |

|

Three Months Ended |

|

Six Months Ended |

| |

|

June

30,2015 |

|

March

31,2016 |

|

June

30,2016 |

|

June

30,2016 |

|

June 30,2015 |

|

June 30,2016 |

|

June 30,2016 |

| |

|

RMB |

|

RMB |

|

RMB |

|

US$ |

|

RMB |

|

RMB |

|

US$ |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating income |

|

307,719 |

|

256,676 |

|

443,862 |

|

66,787 |

|

551,944 |

|

700,538 |

|

105,410 |

| Share-based compensation

expenses |

|

11,589 |

|

53,930 |

|

41,489 |

|

6,243 |

|

43,433 |

|

95,419 |

|

14,358 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-GAAP operating

income |

|

319,308 |

|

310,606 |

|

485,351 |

|

73,030 |

|

595,377 |

|

795,957 |

|

119,768 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income attributable to

YY Inc. |

|

290,691 |

|

208,339 |

|

343,286 |

|

51,653 |

|

517,653 |

|

551,625 |

|

83,004 |

| Share-based compensation

expenses |

|

11,589 |

|

53,930 |

|

41,489 |

|

6,243 |

|

43,433 |

|

95,419 |

|

14,358 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-GAAP net

income attributable to YY Inc. |

|

302,280 |

|

262,269 |

|

384,775 |

|

57,896 |

|

561,086 |

|

647,044 |

|

97,362 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-GAAP net

income per ADS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| —Basic |

|

5.43 |

|

4.68 |

|

6.84 |

|

1.03 |

|

9.91 |

|

11.52 |

|

1.73 |

| —Diluted |

|

5.29 |

|

4.59 |

|

6.65 |

|

1.00 |

|

9.66 |

|

11.32 |

|

1.70 |

| Weighted average number of

ADS used in calculating Non-GAAP net income per ADS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| —Basic |

|

55,629,042 |

|

56,063,449 |

|

56,244,094 |

|

56,244,094 |

|

56,603,338 |

|

56,153,766 |

|

56,153,766 |

| —Diluted |

|

60,544,579 |

|

57,137,915 |

|

60,761,097 |

|

60,761,097 |

|

58,106,597 |

|

57,141,627 |

|

57,141,627 |

| YY

INC. |

| UNAUDITED

SEGMENT REPORT |

| (All amounts in

thousands, except share, ADS and per ADS data) |

|

|

| |

|

Three Months Ended |

|

|

|

June 30,

2016 |

|

|

|

|

| |

|

YY IVAS |

|

Others |

YY IVASand others |

Huyabroadcasting |

100Education |

Total |

Total |

| |

|

RMB |

|

RMB |

RMB |

RMB |

RMB |

RMB |

US$ |

| |

|

|

|

|

|

|

|

|

|

| Net

revenues |

|

|

|

|

|

|

|

|

|

| Internet value-added

service |

|

|

|

|

|

|

|

|

|

| —Online music and

entertainment |

|

1,098,311 |

|

- |

|

1,098,311 |

|

|

- |

|

|

- |

|

|

1,098,311 |

|

|

165,261 |

|

| —Online dating |

|

271,116 |

|

- |

|

271,116 |

|

|

- |

|

|

- |

|

|

271,116 |

|

|

40,794 |

|

| —Online games |

|

188,261 |

|

- |

|

188,261 |

|

|

- |

|

|

- |

|

|

188,261 |

|

|

28,327 |

|

| —Other IVAS |

|

232,244 |

|

- |

|

232,244 |

|

|

143,077 |

|

|

- |

|

|

375,321 |

|

|

56,474 |

|

| Other revenues |

|

- |

|

17,131 |

|

17,131 |

|

|

- |

|

|

30,637 |

|

|

47,768 |

|

|

7,188 |

|

| |

|

|

|

|

|

|

|

|

|

| Total net

revenue |

|

1,789,932 |

|

17,131 |

|

1,807,063 |

|

|

143,077 |

|

|

30,637 |

|

|

1,980,777 |

|

|

298,044 |

|

| |

|

|

|

|

|

|

|

|

|

| Cost of revenues(1) |

|

|

|

|

|

(965,291 |

) |

|

(216,606 |

) |

|

(26,443 |

) |

|

(1,208,340 |

) |

|

(181,817 |

) |

| |

|

|

|

|

|

|

|

|

|

| Gross profit

(loss) |

|

|

|

|

|

841,772 |

|

|

(73,529 |

) |

|

4,194 |

|

|

772,437 |

|

|

116,227 |

|

| |

|

|

|

|

|

|

|

|

|

| Operating

expenses(1) |

|

|

|

|

|

|

|

|

|

| Research and development

expenses |

|

|

|

|

|

(130,170 |

) |

|

(33,811 |

) |

|

(8,247 |

) |

|

(172,228 |

) |

|

(25,915 |

) |

| Sales and marketing

expenses |

|

|

|

|

|

(63,038 |

) |

|

(12,247 |

) |

|

(13,414 |

) |

|

(88,699 |

) |

|

(13,346 |

) |

| General and administrative

expenses |

|

|

|

|

|

(76,169 |

) |

|

(11,115 |

) |

|

(2,871 |

) |

|

(90,155 |

) |

|

(13,566 |

) |

| |

|

|

|

|

|

|

|

|

|

| Total operating

expenses |

|

|

|

|

|

(269,377 |

) |

|

(57,173 |

) |

|

(24,532 |

) |

|

(351,082 |

) |

|

(52,827 |

) |

| Other income |

|

|

|

|

|

22,507 |

|

|

- |

|

|

- |

|

|

22,507 |

|

|

3,387 |

|

| |

|

|

|

|

|

|

|

|

|

| Operating income

(loss) |

|

|

|

|

|

594,902 |

|

|

(130,702 |

) |

|

(20,338 |

) |

|

443,862 |

|

|

66,787 |

|

(1) Share-based compensation was allocated in cost of

revenues and operating expenses as follows:

| |

|

Three Months Ended |

| |

|

June 30,

2016 |

| |

|

|

|

|

|

|

|

|

| |

|

YY IVASand others |

Huyabroadcasting |

100Education |

|

Total |

|

Total |

| |

|

RMB |

RMB |

RMB |

|

RMB |

|

US$ |

| |

|

|

|

|

|

|

|

|

| Cost of revenues |

|

|

(1,432 |

) |

1,441 |

|

132 |

|

|

141 |

|

21 |

| Research and development

expenses |

|

|

17,976 |

|

6,501 |

|

1,996 |

|

|

26,473 |

|

3,983 |

| Sales and marketing

expenses |

|

|

729 |

|

212 |

|

- |

|

|

941 |

|

142 |

| General and administrative

expenses |

|

|

10,227 |

|

3,807 |

|

(100 |

) |

|

13,934 |

|

2,097 |

| YY

INC. |

| RECONCILIATION

OF GAAP AND NON-GAAP RESULTS OF UNAUDITED SEGMENT

REPORT |

| (All amounts in

thousands, except share, ADS and per ADS data) |

| |

| |

|

Three Months Ended |

| |

|

June 30,

2016 |

| |

|

|

|

|

|

|

|

|

|

| |

|

|

YY IVASand others |

Huya

broadcasting |

100Education |

|

Total |

|

Total |

| |

|

|

RMB |

RMB |

RMB |

|

RMB |

|

US$ |

| |

|

|

|

|

|

|

|

|

| Operating

income (loss) |

|

594,902 |

|

(130,702 |

) |

|

(20,338 |

) |

|

443,862 |

|

66,787 |

| Share-based

compensation expenses |

|

27,500 |

|

11,961 |

|

|

2,028 |

|

|

41,489 |

|

6,243 |

| |

|

|

|

|

|

|

|

|

|

Non-GAAP operating income (loss) |

|

622,402 |

|

(118,741 |

) |

|

(18,310 |

) |

|

485,351 |

|

73,030 |

| YY

INC. |

|

UNAUDITED SEGMENT REPORT |

| (All amounts in

thousands, except share, ADS and per ADS data) |

|

|

| |

|

Three Months Ended |

|

|

|

March 31, 2016 |

|

|

|

|

| |

|

YY IVAS |

|

Others |

YY IVASand others |

Huyabroadcasting |

100Education |

Total |

Total |

| |

|

RMB |

|

RMB |

RMB |

RMB |

RMB |

RMB |

US$ |

| |

|

|

|

|

|

|

|

|

|

| Net

revenues |

|

|

|

|

|

|

|

|

|

| Internet value-added

service |

|

|

|

|

|

|

|

|

|

| —Online music and

entertainment |

|

919,084 |

|

- |

|

919,084 |

|

|

- |

|

|

- |

|

|

919,084 |

|

|

142,538 |

|

| —Online dating |

|

211,226 |

|

- |

|

211,226 |

|

|

- |

|

|

- |

|

|

211,226 |

|

|

32,758 |

|

| —Online games |

|

171,110 |

|

- |

|

171,110 |

|

|

- |

|

|

- |

|

|

171,110 |

|

|

26,537 |

|

| —Other IVAS |

|

192,754 |

|

- |

|

192,754 |

|

|

117,674 |

|

|

- |

|

|

310,428 |

|

|

48,143 |

|

| Other revenues |

|

- |

|

16,282 |

|

16,282 |

|

|

- |

|

|

21,188 |

|

|

37,470 |

|

|

5,811 |

|

| |

|

|

|

|

|

|

|

|

|

| Total net

revenue |

|

1,494,174 |

|

16,282 |

|

1,510,456 |

|

|

117,674 |

|

|

21,188 |

|

|

1,649,318 |

|

|

255,787 |

|

| |

|

|

|

|

|

|

|

|

|

| Cost of revenues(1) |

|

|

|

|

|

(844,273 |

) |

|

(193,066 |

) |

|

(23,192 |

) |

|

(1,060,531 |

) |

|

(164,474 |

) |

| |

|

|

|

|

|

|

|

|

|

| Gross

profit (loss) |

|

|

|

|

|

666,183 |

|

|

(75,392 |

) |

|

(2,004 |

) |

|

588,787 |

|

|

91,313 |

|

| |

|

|

|

|

|

|

|

|

|

| Operating

expenses(1) |

|

|

|

|

|

|

|

|

|

| Research and development

expenses |

|

|

|

|

|

(143,351 |

) |

|

(24,257 |

) |

|

(12,040 |

) |

|

(179,648 |

) |

|

(27,861 |

) |

| Sales and marketing

expenses |

|

|

|

|

|

(52,558 |

) |

|

(10,788 |

) |

|

(14,615 |

) |

|

(77,961 |

) |

|

(12,091 |

) |

| General and administrative

expenses |

|

|

|

|

|

(68,658 |

) |

|

(11,333 |

) |

|

(3,416 |

) |

|

(83,407 |

) |

|

(12,935 |

) |

| |

|

|

|

|

|

|

|

|

|

| Total operating

expenses |

|

|

|

|

|

(264,567 |

) |

|

(46,378 |

) |

|

(30,071 |

) |

|

(341,016 |

) |

|

(52,887 |

) |

| Other income |

|

|

|

|

|

8,905 |

|

|

- |

|

|

- |

|

|

8,905 |

|

|

1,381 |

|

| |

|

|

|

|

|

|

|

|

|

| Operating

income (loss) |

|

|

|

|

|

410,521 |

|

|

(121,770 |

) |

|

(32,075 |

) |

|

256,676 |

|

|

39,807 |

|

(2) Share-based compensation was allocated in cost of

revenues and operating expenses as follows:

| |

Three Months Ended |

| |

March 31, 2016 |

| |

|

|

|

|

|

|

|

|

|

|

| |

|

YY IVASand others |

|

Huyabroadcasting |

|

100Education |

|

Total |

|

Total |

| |

|

RMB |

|

RMB |

|

RMB |

|

RMB |

|

US$ |

| |

|

|

|

|

|

|

|

|

|

|

| Cost of revenues |

|

7,802 |

|

723 |

|

87 |

|

8,612 |

|

1,336 |

| Research and development

expenses |

|

22,008 |

|

2,876 |

|

2,416 |

|

27,300 |

|

4,234 |

| Sales and marketing

expenses |

|

803 |

|

36 |

|

- |

|

839 |

|

130 |

| General and administrative

expenses |

|

13,015 |

|

4,157 |

|

7 |

|

17,179 |

|

2,664 |

| YY

INC. |

| RECONCILIATION

OF GAAP AND NON-GAAP RESULTS OF UNAUDITED

SEGMENT REPORT |

| (All amounts in

thousands, except share, ADS and per ADS data) |

| |

| |

|

|

Three Months Ended |

|

| |

|

|

March 31, 2016 |

|

| |

|

|

|

|

|

|

|

|

| |

|

|

YY IVASand others |

Huyabroadcasting |

100Education |

Total |

Total |

|

| |

|

|

RMB |

RMB |

RMB |

RMB |

US$ |

|

| |

|

|

|

|

|

|

|

|

| Operating

income (loss) |

|

410,521 |

|

(121,770 |

) |

|

(32,075 |

) |

256,676 |

|

39,807 |

|

| Share-based

compensation expenses |

|

43,628 |

|

7,792 |

|

|

2,510 |

|

53,930 |

|

8,364 |

|

| |

|

|

|

|

|

|

|

|

|

Non-GAAP operating income

(loss) |

|

454,149 |

|

(113,978 |

) |

|

(29,565 |

) |

310,606 |

|

48,171 |

|

| YY

INC. |

| UNAUDITED

SEGMENT REPORT |

| (All amounts in

thousands, except share, ADS and per ADS data) |

|

|

| |

|

Three Months Ended |

|

|

|

June 30,

2015 |

|

|

|

|

| |

|

YY IVAS |

|

Others |

YY IVASand others |

Huyabroadcasting |

100Education |

Total |

Total |

| |

|

RMB |

|

RMB |

RMB |

RMB |

RMB |

RMB |

US$ |

| |

|

|

|

|

|

|

|

|

|

| Net

revenues |

|

|

|

|

|

|

|

|

|

| Internet value-added

service |

|

|

|

|

|

|

|

|

|

| —Online music and

entertainment |

|

730,693 |

|

- |

|

730,693 |

|

|

- |

|

|

- |

|

|

730,693 |

|

|

117,854 |

|

| —Online dating |

|

157,348 |

|

- |

|

157,348 |

|

|

- |

|

|

- |

|

|

157,348 |

|

|

25,379 |

|

| —Online games |

|

199,404 |

|

- |

|

199,404 |

|

|

- |

|

|

- |

|

|

199,404 |

|

|

32,162 |

|

| —Other IVAS |

|

127,260 |

|

- |

|

127,260 |

|

|

85,325 |

|

|

- |

|

|

212,585 |

|

|

34,288 |

|

| Other revenues |

|

- |

|

31,977 |

|

31,977 |

|

|

|

|

|

25,174 |

|

|

57,151 |

|

|

9,218 |

|

| |

|

|

|

|

|

|

|

|

|

| Total net

revenue |

|

1,214,705 |

|

31,977 |

|

1,246,682 |

|

|

85,325 |

|

|

25,174 |

|

|

1,357,181 |

|

|

218,901 |

|

| |

|

|

|

|

|

|

|

|

|

| Cost of revenues(1) |

|

|

|

|

|

(646,399 |

) |

|

(157,638 |

) |

|

(29,244 |

) |

|

(833,281 |

) |

|

(134,400 |

) |

| |

|

|

|

|

|

|

|

|

|

| Gross profit

(loss) |

|

|

|

|

|

600,283 |

|

|

(72,313 |

) |

|

(4,070 |

) |

|

523,900 |

|

|

84,501 |

|

| |

|

|

|

|

|

|

|

|

|

| Operating

expenses(1) |

|

|

|

|

|

|

|

|

|

| Research and development

expenses |

|

|

|

|

|

(97,301 |

) |

|

(14,644 |

) |

|

(8,180 |

) |

|

(120,125 |

) |

|

(19,375 |

) |

| Sales and marketing

expenses |

|

|

|

|

|

(51,623 |

) |

|

(2,460 |

) |

|

(8,996 |

) |

|

(63,079 |

) |

|

(10,174 |

) |

| General and administrative

expenses |

|

|

|

|

|

(47,546 |

) |

|

(4,372 |

) |

|

(11,925 |

) |

|

(63,843 |

) |

|

(10,297 |

) |

| Goodwill impairment |

|

|

|

|

|

- |

|

|

- |

|

|

(110,699 |

) |

|

(110,699 |

) |

|

(17,855 |

) |

| Fair value change of

contingent consideration |

|

|

|

|

|

(1,552 |

) |

|

- |

|

|

111,547 |

|

|

109,995 |

|

|

17,741 |

|

| |

|

|

|

|

|

|

|

|

|

| Total operating

expenses |

|

|

|

|

|

(198,022 |

) |

|

(21,476 |

) |

|

(28,253 |

) |

|

(247,751 |

) |

|

(39,960 |

) |

| Other income |

|

|

|

|

|

31,570 |

|

|

- |

|

|

- |

|

|

31,570 |

|

|

5,092 |

|

| |

|

|

|

|

|

|

|

|

|

| Operating income

(loss) |

|

|

|

|

|

433,831 |

|

|

(93,789 |

) |

|

(32,323 |

) |

|

307,719 |

|

|

49,633 |

|

(3) Share-based compensation was allocated in cost of

revenues and operating expenses as follows:

| |

|

Three Months Ended |

| |

|

June 30,

2015 |

| |

|

|

|

|

|

|

|

|

| |

|

YY IVASand others |

Huyabroadcasting |

100Education |

|

Total |

|

Total |

| |

|

RMB |

RMB |

RMB |

|

RMB |

|

US$ |

| |

|

|

|

|

|

|

|

|

| Cost of revenues |

|

1,935 |

|

(22 |

) |

|

24 |

|

|

1,937 |

|

312 |

| Research and development

expenses |

|

2,051 |

|

10 |

|

|

589 |

|

|

2,650 |

|

427 |

| Sales and marketing

expenses |

|

263 |

|

(3 |

) |

|

- |

|

|

260 |

|

42 |

| General and administrative

expenses |

|

6,565 |

|

195 |

|

|

(18 |

) |

|

6,742 |

|

1,087 |

| YY

INC. |

| RECONCILIATION

OF GAAP AND NON-GAAP RESULTS OF UNAUDITED SEGMENT

REPORT |

| (All amounts in

thousands, except share, ADS and per ADS data) |

| |

| |

|

|

Three Months Ended |

| |

|

|

June 30,

2015 |

| |

|

|

|

|

|

|

|

|

|

| |

|

|

YY IVASand others |

Huya

broadcasting |

100Education |

|

Total |

|

Total |

| |

|

|

RMB |

RMB |

RMB |

|

RMB |

|

US$ |

| |

|

|

|

|

|

|

|

|

| Operating

income (loss) |

|

433,831 |

|

(93,789 |

) |

|

(32,323 |

) |

|

307,719 |

|

49,633 |

| Share-based

compensation expenses |

|

10,814 |

|

180 |

|

|

595 |

|

|

11,589 |

|

1,868 |

| |

|

|

|

|

|

|

|

|

|

Non-GAAP operating income (loss) |

|

444,645 |

|

(93,609 |

) |

|

(31,728 |

) |

|

319,308 |

|

51,501 |

Investor Relations Contact

YY Inc.

Yuffie Fu

Tel: +86 (20) 2916-2000

Email:IR@YY.com

ICR, Inc.

Jessie Fan

Tel: +1 (646) 915-1611

Email:IR@YY.com

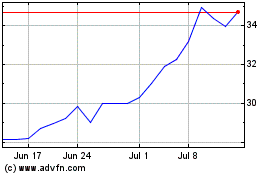

JOYY (NASDAQ:YY)

Historical Stock Chart

From Mar 2024 to Apr 2024

JOYY (NASDAQ:YY)

Historical Stock Chart

From Apr 2023 to Apr 2024