Staples Swings To Loss, to Close 50 Stores This Year

August 17 2016 - 7:40AM

Dow Jones News

Staples Inc. said it swung to a loss in the latest period on

nearly $1 billion in charges, hurt in part by its failed plan to

merge with Office Depot Inc.

The charges were primarily related to the impairment of European

goodwill and other assets, as well as costs associated with the

termination of the Office Depot merger agreement. Staples paid

smaller rival Office Depot a $250 million breakup fee. Excluding

such items, earnings met the company's forecast for the

quarter.

Staples' results have been hurt recently amid a declining market

as an increasingly digital workplace continues to dent sales. Sales

at existing stores fell 5% in the quarter, below the 3.1% decline

analysts polled by Consensus Metrix expected. Comparable sales,

which includes stores and Staples.com but excludes currency

impacts, declined 4%.

In February 2015, Staples agreed to buy Office Depot for about

$6.3 billion. The U.S. Federal Trade Commission argued the tie-up

would mean higher prices and fewer options for big companies that

buy office supplies in bulk. After a federal judge in May blocked

the retailer's attempt to acquire Office Depot, longtime Staples

leader Ron Sargent agreed to resign as chief executive.

Interim Chief Executive Shira Goodman said the company was

"dramatically changing our mind-set and operating model" to

reposition the company. In North America, the company closed five

stores during the quarter amid its continuing plan to close about

50 North American stores this year.

For the current quarter, Staples expects adjusted earnings of 32

cents to 35 cents a share. Analysts, polled by Thomson Reuters,

anticipated 35 cents a share.

In all for the July quarter, Staples posted a loss of $766

million, or $1.18 a share, compared with a year-earlier's profit of

$36 million, or 6 cents a share. Excluding items, earnings were

flat at 12 cents a share, in line with the company's guidance for

earnings between 11 cents and 13 cents.

Revenue slipped 4% to $4.75 billion. Excluding the impact of

store closures, foreign exchange effects and the sale of Staples

print solutions, the company said revenue slipped 2%. Analysts

projected revenue of $4.77 billion.

Earlier this month, Office Depot said it swung to a profit in

the latest period, helped in large part by the $250 million breakup

fee it had received from Staples. The earnings result, excluding

the one-time fee and other special items, declined from a year ago

and missed Wall Street expectations. The company also said it would

close an additional 300 stores.

Shares of Staples were inactive in premarket trading.

Write to Joshua Jamerson at joshua.jamerson@wsj.com

(END) Dow Jones Newswires

August 17, 2016 07:25 ET (11:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

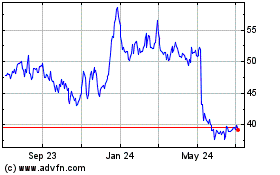

ODP (NASDAQ:ODP)

Historical Stock Chart

From Mar 2024 to Apr 2024

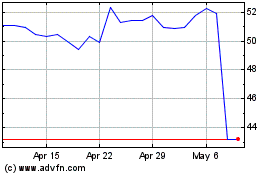

ODP (NASDAQ:ODP)

Historical Stock Chart

From Apr 2023 to Apr 2024