Carlsberg Profit Climbs as Restructuring Offsets Beer Drop

August 17 2016 - 4:50AM

Dow Jones News

Denmark's Carlsberg A/S turned in a 25% jump in half-year net

profit, with the recent sale and swap of beer assets as part of a

corporate restructuring offsetting a decline in beer volumes and

revenue.

The brewer has been plagued by lackluster earnings amid pressure

from declining Eastern European markets and a weak ruble, and it

said beer markets in the region continue to be hit by the

challenging macro environment, especially in Ukraine and Russia.

Volumes were flat but the Russian beer market fell by 2% and the

Ukrainian market declined 6%, it said Wednesday.

The Russian ruble remains Carlsberg's biggest single currency

exposure, and although its dependency on Russia has declined—the

country represented 16% of operating profit before not allocated

costs in the first half—the company expects a negative translation

impact of around 600 million Danish kroner ($91 million) in 2016,

up from a previous estimate of 550 million kroner, it said.

Earlier this year the company laid out a seven-year plan to

position itself for growth by transforming its Russian business,

focusing on premium brands in big cities and expanding both its

nonalcoholic and craft beer portfolios while keeping beer at the

core of its business. This plan is progressing and Carlsberg said

it is currently developing action plans for 2017.

First-half net profit climbed to 1.87 billion kroner from 1.50

billion kroner in the same period last year. Sales slipped to 31.24

billion kroner from 32.4 billion kroner, reflecting lower beer

volumes and the effect of weaker Eastern European, Chinese, British

and Norwegian currencies.

Analysts polled by FactSet had expected net profit of 1.38

billion kroner on sales of 31.56 billion kroner.

In an effort to become more efficient, the company has said it

would merge all its existing profit improvement initiatives into a

new single program, which will generate total net benefits of 1.5

billion kroner to 2 billion kroner by 2018. Half of the benefits

will be reinvested while the other half will go toward improving

earnings.

The company said Wednesday it still expects to post

low-single-digit percentage organic operating profit growth in

2016, despite likely higher spending on its strategy in the second

half.

Total beverage volumes declined by 1% organically, with slack

demand in the U.K., Finland, Poland and China. Beer volumes

weakened, falling 2% organically.

The company booked a one-off profit of 406 million kroner in the

quarter from the sale of Danish Malting Group and an asset swap

related to Xinjiang Wusu Group, China. The brewer also took

impairment and restructuring charges for its operations in the

U.K., China and India.

Write to Dominic Chopping at dominic.chopping@wsj.com

(END) Dow Jones Newswires

August 17, 2016 04:35 ET (08:35 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

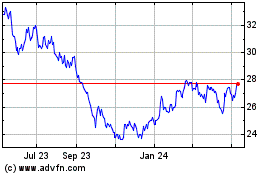

Carlsburg AS (PK) (USOTC:CABGY)

Historical Stock Chart

From Mar 2024 to Apr 2024

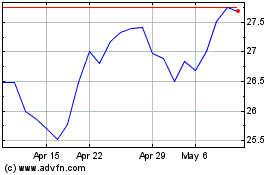

Carlsburg AS (PK) (USOTC:CABGY)

Historical Stock Chart

From Apr 2023 to Apr 2024