Current Report Filing (8-k)

August 16 2016 - 11:37AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to

Section 13 or 15(d) of the Securities and Exchange Act of 1934

Date of Report (Date of earliest event reported): August 16,

2016

CARDIFF INTERNATIONAL, INC.

(Exact name of Registrant

as specified in its charter)

|

Nevada

|

000-49709

|

84-1044583

|

|

(State or other jurisdiction of incorporation)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

401 East Las Olas Blvd,

Unit 1400

Ft. Lauderdale, FL 33301

(Address of principal executive

offices, including zip code)

(844) 628-2100

(Registrant's telephone

number, including area code)

_____________________________________________________

(Former name or former address, if changed

since last report)

Check the appropriate box below if the 8-K filing is

intended to simultaneously satisfy the filing obligations of the registrant under any of the following provisions:

|

o

|

|

Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

o

|

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

o

|

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17

CFR 240.14d-2(b))

|

|

o

|

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17

CFR 240.13e-4(c)).

|

Completion of Acquisition or Disposition of Assets, Change

in Directors

Item 2.01 Completion of Acquisition or Disposition of Assets

The information provided in the Introductory Note of

this Current Report on Form 8-K is incorporated herein by reference.

On August 10th, 2016, Cardiff international, Inc. (CDIF) completed

the acquisition of FDR Enterprises, Inc.; Recippi’s Franchise Group, LLC; Refreshment Concepts, LLC all (DBA) Repicci’s

Italian Ice.

Repicci’s has over 40 franchises nationwide, where Repicci’s

products are enjoyed by millions of people in thousands of locations. The acquisitions are subject to completion of an independent

audit.

In connection with the closing of the acquisitions, on the effective

date of the signed Forward Acquisition Agreements, a Preferred “H” Class of stock was established with a value of $0.17

per share ("Repicci’s” Preferred “H” Class Stock) as consideration. The Preferred “H”

Class of stock has a par value $0.001 per share. The preferred share was adjusted as a result of the authorization and declaration

of a special distribution to the preferred Repicci’s stockholders at $0.17 per share with a conversion rate of 1 to 1.3 Common

Stock, payable to Repicci’s shareholders of record as of the close of business on August 10th, 2016 (the "Special Conversion").

The Special Conversion right is granted as a result of the pending closing of the sale of certain interests in assets of Repicci’s

designated by CDIF, which is dated August 10th, 2016. (the “Asset Sale”). Pursuant to the terms of the Acquisition Agreement.

Pending the independent audit, CDIF will issue 5,400,040 shares

of CDIF Preferred “H” Shares to Repicci’s shareholders as Stock Consideration as agreed to in the signed Forward

Acquisition Agreement. Based on the price of CDIF’s Common stock as of August 10th, 2016 at $0.17 per share, the acquisition

consideration represents an approximate value of $918,006.80. Upon completion of the independent audit any changes will be announced

in an amended 8K within the required 71 day period.

On August 10, 2016, our board of directors appointed Frank Repici

and Cam Crawford (Hereinafter Recipi/Crawford) to serve as Co-Managers of Repicci’s. Repici/Crawford were founders and owners

with extensive experience in this field.

There are no family relationships between Repici/Crawford and

any of our directors or executive officers.

SIGNATURE

Pursuant to the requirements of the Securities Exchange

Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

Cardiff International, Inc.

|

|

|

|

|

|

By:

|

/s/ Daniel Thompson

|

|

|

|

Daniel Thompson

Chairman

|

Dated:

August 16, 2016

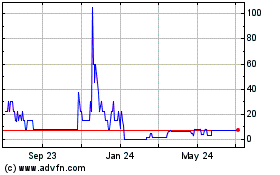

Cardiff Lexington (PK) (USOTC:CDIX)

Historical Stock Chart

From Mar 2024 to Apr 2024

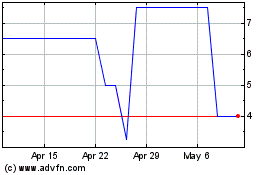

Cardiff Lexington (PK) (USOTC:CDIX)

Historical Stock Chart

From Apr 2023 to Apr 2024