Coty Swings to a Loss as it Continues to Book Merger Costs -- Update

August 16 2016 - 11:23AM

Dow Jones News

By Sharon Terlep and Lisa Beilfuss

Beauty-products maker Coty Inc. swung to a quarterly loss as

charges associated with recent acquisitions more than offset

improving sales in its fragrance business.

The New York company has been aggressively hunting deals to

improve its business and grow its footprint. Last year Coty said it

would snap up much of Procter & Gamble's beauty business,

including labels such as CoverGirl makeup, Gucci fragrances and

Clairol hair dye, for about $13 billion. Coty said Tuesday that it

still expects to close the transaction in October, at which point

Camillo Pane will take the reins from interim chief executive Bart

Becht.

In addition to the P&G deal, the company in 2015 completed

its purchase of Bourjois cosmetics from Chanel and bought several

Brazilian skin-care brands. Late last year, Coty struck a deal to

buy digital marketing firm Beamly in a bid to ramp up its

e-commerce business.

Mr. Becht said Tuesday the company is making good progress

folding in the new businesses and expects the integration to be

complete by next spring. He said cost savings and increased revenue

from the deals will outweigh acquisition costs.

"We've built a much stronger financial business, with a higher

margin structure," Mr. Becht said in an interview. "Clearly we

would like to see more top-line growth, which we are focused

on."

Recent acquisitions helped push sales in Coty's latest quarter

up 5.5%, more than analysts expected. But at the same time, costs

stemming from closing the deals and integrating the new brands have

piled up, resulting in back-to-back quarterly losses. Acquisition

and restructuring-related expenses totaled $83.3 million in the

June period, up from $51.2 million a year earlier.

Shares of Coty fell 6.3% to $27.89 in Tuesday morning trade.

Looking ahead, Coty said it is too early to give guidance for

the newly-started fiscal year including the P&G beauty brands.

The company said revenue for its stand-alone businesses are

expected to return to growth in the first half of 2017. "We

continue our work on building a healthier and better Coty

stand-alone business," said Mr. Becht, suggesting the company's

color cosmetic and skin-care segments would turn around after

declining in fiscal 2016.

For the June quarter, Coty reported a loss of $31 million, or 9

cents a share, compared with a year-earlier profit of $21 million,

or 5 cents a share. Excluding acquisition-related costs, among

other items, the company reported a profit of 13 cents a share, up

8% from the year-ago quarter.

Revenue was $1.08 billion, thanks in part to $95.5 million in

new revenue from Coty's Brazilian brand acquisitions. Sales in the

perfume business rose 2% from a year ago, while its color cosmetics

business declined 4%.

The struggling perfume business notched the biggest increase in

years, though analysts questioned whether the growth came at the

expense of pricing and margins. Pricing in the fourth quarter

wasn't as strong as in previous quarters, when sales fell. "We

still have work to do from a fragrance point of view," Mr. Becht

said.

Write to Sharon Terlep at sharon.terlep@wsj.com and Lisa

Beilfuss at lisa.beilfuss@wsj.com

(END) Dow Jones Newswires

August 16, 2016 11:08 ET (15:08 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

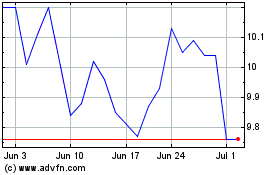

Coty (NYSE:COTY)

Historical Stock Chart

From Mar 2024 to Apr 2024

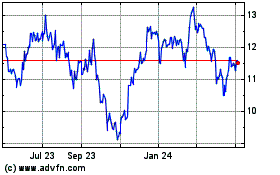

Coty (NYSE:COTY)

Historical Stock Chart

From Apr 2023 to Apr 2024