TJX Raises Yearly Outlook, but Third-Quarter View Disappoints

August 16 2016 - 10:10AM

Dow Jones News

TJX Cos., the parent of T.J. Maxx and other off-price retailers,

raised its annual guidance as it continued to attract strong

customer traffic, helping quarterly earnings beat expectations.

But shares of the Framingham, Mass., company, which hit an all

time high on Monday, fell 3.7% to $79.75 premarket as its outlook

for the current quarter landed below expectations.

TJX buys many of its goods through closeouts and sells them at

discounted prices. This has helped the parent of T.J. Maxx,

Marshalls and HomeGoods to continue to report mostly higher

earnings and sales. In contrast, department stores have been

reporting weaker profits and sales as shoppers turn to lower-price

competitors and online operators such as Amazon.com.

In contrast to some other retailers that have been closing

stores, TJX has been expanding its footprint, increasing its store

count by 14 in the latest quarter to bring its total to 3,675.

For its fiscal year ending in January, TJX raised its per-share

earnings estimate to $3.39 to $3.43 on comparable-sales growth of

3% to 4%, from its previous estimate for per-share profit of $3.35

to $3.42 and comparable-sales growth of 2% to 3%.

But for the current quarter, the company forecast per-share

earnings of 83 cents to 85 cents. Analysts expected per-share

profit of 90 cents, according to FactSet.

For the quarter ended July 30, TJX reported a profit of $562.2

million, or 84 cents a share, up from $549.3 million, or 80 cents a

share, a year earlier. Revenue increased 7% to $7.88 billion.

Analysts had expected per-share earnings of 81 cents and revenue

of $7.85 billion, according to FactSet.

Gross margin rose to 29.4% from 29.1% amid stronger merchandise

margins and inventory hedging gains.

Sales at established stores rose 4%, above expectations for an

increase of 2% to 3%.

Combined comparable sales for T.J. Maxx and Marshalls improved

4% . At HomeGood, comparable sales grew 5%. In its TJX Canada

business comparable sales grew 9%. In its TJX International unit,

which includes Europe and Australia, comparable sales improved by

2%.

Fellow off-price retailer Ross Stores Inc. is set to report its

quarterly results on Thursday.

Write to Tess Stynes at tess.stynes@wsj.com

(END) Dow Jones Newswires

August 16, 2016 09:55 ET (13:55 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

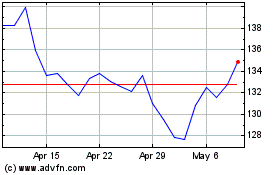

Ross Stores (NASDAQ:ROST)

Historical Stock Chart

From Mar 2024 to Apr 2024

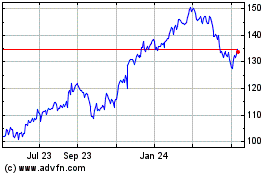

Ross Stores (NASDAQ:ROST)

Historical Stock Chart

From Apr 2023 to Apr 2024