Companies Worldwide are Optimistic about Future Trade Activity with the U.S., According to New Research from the Economist In...

August 16 2016 - 9:00AM

Business Wire

Forty-three percent expect trade to increase by

more than 10% over the next five years

Global companies are positive about plans for future trade

activity with the U.S., according to new research conducted by the

Economist Intelligence Unit on behalf of American Express. The

research found that two-thirds of survey respondents (66%)

anticipate that their company’s trade with the U.S. will increase

over the next five years and more than four-in-ten (43%) expect an

increase of more than 10%.

The research, entitled Terms of Trade: Understanding Trade

Dynamics in the U.S., is a survey of 531 executives at companies

worldwide examining global trading relationships, looking at how

companies trade, the challenges they face and how they expect

international trade with the U.S. to change based on recent

trends.

While opportunities for trade abound, international trade is not

without difficulties. Companies trading with the U.S. face a number

of challenges to navigate. Exchange-rate volatility presents the

largest issue for companies, with more than four-in-ten respondents

(41%) citing this as a concern. Nearly one-third of respondents

cite transport costs and delays, trade-related infrastructure and

making payments as their top challenges (32%, each).

The survey catalogued payment-related challenges to

international trade, including: currency fluctuation (61%), which

caused the greatest challenge, process inefficiencies and limited

payment visibility (each, 52%), bank fees (51%), and limited or no

terms (50%) and banking hours (50%).

“Optimism about the outlook for global trade presents

opportunities for U.S. businesses looking to export

internationally,” said Guillermo Brenes, Vice President of Global

Currency Solutions at American Express. “The survey shows that a

number of the challenges to international trade are within the span

of a company’s control, so there are practical ways in which

companies can improve upon their own trade experience.”

Quality of U.S. Trade-related Infrastructure Ranks

High

Survey respondents gave high marks on the overall quality of

trade-related infrastructure in the U.S. Over two-thirds of survey

respondents (69%) rate the U.S. infrastructure as “very good” or

“excellent,” and only 2% consider it to be “poor.” The

trade-related infrastructure companies rely on most includes:

- Digital communication technology

(42%)

- Port facilities (31%)

- Road network (26%)

- Cold transport and storage facilities

(25%)

- Warehousing (26%)

- Rail network (16%)

- Air links (13%)

- Other specialized transport and storage

(7%)

Survey methodology:

The findings are based on an executive survey of 531 companies

that trade with the US, conducted by The EIU in March and April

2016, as well as desk research and interviews with experts.

The survey sample is global, spanning Asia-Pacific (49%), Europe

(22%), North America (19%) and South America (9%). Nearly half of

those surveyed are C-level executives, and another 40% hold senior

executive positions (SVP, VP, director, head of business unit, head

of department). The firms in the survey are split almost evenly

between those with an annual revenue of US$250m-500m and those with

US$500m-1bn in annual revenue. Of the 23 sectors covered, the

best-represented are financial services, manufacturing, consumer

goods and services, IT and retail.

About The Economist Intelligence Unit

The Economist Intelligence Unit is the world leader in global

business intelligence. It is the business-to-business arm of The

Economist Group, which publishes The Economist newspaper. The

Economist Intelligence Unit helps executives make better decisions

by providing timely, reliable and impartial analysis on worldwide

market trends and business strategies. More information can be

found at www.eiu.com or www.twitter.com/theeiu.

About American Express Global Commercial Payments

Through its Global Commercial Payments division, American

Express (NYSE:AXP) offers a suite of payment and

lending products that help businesses and organizations of all

sizes gain financial savings, control and efficiency. Global

Commercial Payments provides solutions for travel and everyday

business spending, cross border payments, global currency

solutions, and business financing.

To learn more about Global Commercial Payments visit

business.americanexpress.com

About American Express

American Express is a global services company, providing

customers with access to products, insights and experiences that

enrich lives and build business success. Learn more

at americanexpress.com and connect with us

on facebook.com/americanexpress,

foursquare.com/americanexpress, linkedin.com/company/american-express,

twitter.com/americanexpress,

and youtube.com/americanexpress.

Key links to products and services: charge and credit cards,

business credit cards, Plenti rewards program, travel services,

gift cards, prepaid cards, merchant services, corporate card and

business travel.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160816005199/en/

M BoothLauren Arthur, 212-539-3282laurena@mbooth.comAmerican

ExpressMelissa Filipek,

212-640-8658melissa.j.filipek@aexp.comEconomist Intelligence

UnitIrene Mia, 44-20-7576-8280irenemia@economist.com

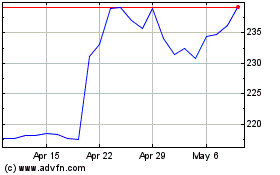

American Express (NYSE:AXP)

Historical Stock Chart

From Mar 2024 to Apr 2024

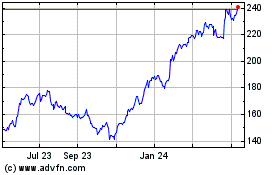

American Express (NYSE:AXP)

Historical Stock Chart

From Apr 2023 to Apr 2024