Canterbury Park Holding Corporation (the “Company”)

(NASDAQ:CPHC) today announced financial results for its second

quarter and six month periods ended June 30, 2016.

The Company reported net revenues of $13,885,992 for the three

months ended June 30, 2016, a decrease of 6.5% from revenues of

$14,848,077 in the same 2015 period. This decrease consisted of a

$305,027, or 9.2%, decrease in Pari-mutuel revenues, a $380,836, or

5.2%, decrease in Card Casino revenues and a $294,551, or 11.7%,

decrease in Food and Beverage revenues. For the six months ended

June 30, 2016, the Company’s revenues were $24,279,303, a decrease

of 1.8% from revenues of $24,729,115 for the same period in 2015.

This decrease consisted of declines in Pari-mutuel, Card Casino and

Food and Beverage revenues of 6.0%, 0.7% and 6.2%,

respectively.

The Company’s operating expenses during the 2016 second quarter

were $9,988,467, a decrease of $3,890,642, or 28.0%, from second

quarter 2015 expenses of $13,879,109, and the Company’s operating

expenses during the six months ended June 30, 2016 were

$19,858,783, a decrease of $3,239,135, or 14.0%, from operating

expenses of $23,097,918 in the six months ended June 30, 2015. The

substantial decline in operating expenses in the quarter and six

months ended June 30, 2016 reflects a $3,990,519 pretax gain on

sale of land in the 2016 second quarter that was accounted for as a

reduction in operating expenses.

Reflecting the second quarter gain on sale of land and a tax

charge associated with this sale, the Company reported net income

of $2,274,900 for the three months ended June 30, 2016 compared to

net income of $571,650 in the same period in 2015, and net income

of $2,585,654 for the six months ended June 30, 2016 compared to

net income of $960,254 for the same period in 2015. Diluted income

per share for the second quarter of 2016 was $.53 compared to $.14

for the same period in 2015. Diluted income per share for the six

month period ended June 30, 2016 was $.60 compared to diluted

income per share of $.23 for the six month period ended June 30,

2015.

The Company generated adjusted EBITDA of $1,624,511 in the first

six months of 2016, a decrease of $1,178,396, or 42%, from the same

period a year ago.

Additional Financial

Information:Further detail regarding our results for the

second quarter and first six months of 2016 is presented in the

accompanying table, and additional information regarding the

Company’s financial results will be presented in the Company’s Form

10-Q Report that will be filed on August 15, 2016 with the

Securities and Exchange Commission.

Management Comments:“We had

a record second quarter as far as our bottom line results due to

the gain from the sale of land, but revenues and operating results

for the quarter did not meet our expectations,” stated Randy

Sampson, Canterbury Park’s President and CEO.

“Our pari-mutuel revenue from simulcast racing, consistent with

national trends, continues to erode due to a shift in consumer

preference to internet wagering platforms. In addition, our

decision to reduce the take-out rate on our live racing to the

lowest in the country to promote our racing product nationally has

not generated the increase in wagering volume we anticipated. The

take-out reduction, along with a reduction in the number of racing

days during the quarter from 26 to 23, resulted in a decline in

on-track pari-mutuel revenues of over 20%. In the card casino, our

second quarter results could not match last year’s record second

quarter revenues due mainly to a general softening of our regional

gaming market. Food and beverage results declined due to the

reduced live racing days and our inability to host a major concert

that we have hosted in the second quarter of previous years. While

the sale of our “Festival Fields” property precluded us from

hosting the concert this year, we are in the final stages of a

construction project to create a concert and event space in the

infield of the racetrack that we believe will provide much better

long term opportunities to grow this area of our business.”

Mr. Sampson added: “We are, nevertheless, pleased to report

strong bottom line results that reflect progress in our real estate

development efforts. Not only were we able to sell land that is not

part of our long range development plans at an attractive price,

but by combining the transaction with our purchase of 32 acres

adjacent to our parking lot that are a strategic fit for our

development plans, we were able to structure the sale as an IRS

Code Section 1031 tax deferred exchange transaction that allows a

majority of the approximately $3.9 million gain to be deferred for

income tax purposes.”

Mr. Sampson concluded: “We remain optimistic about the Company’s

prospects for the remainder of 2016. Due in large measure to our

Cooperative Marketing Agreement with the Shakopee Mdewakanton Sioux

Community, our current live meet is on track to be a record in

terms of attendance and handle. We are also seeing solid increases

in food and beverage and admissions revenues for the live racing

meet, partially resulting from growth in our catering and events

business. Finally, we believe the recent completion of our

corporate reorganization to create a holding company structure for

our business give us much greater flexibility to pursue the

continued development of our underutilized land and that, as our

real estate development matures, it will substantially contribute

to our bottom line results.”

Use of Non-GAAP Financial

Measures:To supplement our financial statements,

we also provide investors with EBITDA (defined below), which is a

non-GAAP measure. EBITDA represents earnings before interest

income, income tax expense, and depreciation and amortization.

EBITDA is not a measure of performance or liquidity calculated in

accordance with generally accepted accounting principles ("GAAP"),

and should not be considered an alternative to, or more meaningful

than, net income as an indicator of our operating performance, or

cash flows from operating activities as a measure of liquidity.

EBITDA has been presented as a supplemental disclosure because it

is a widely used measure of performance and basis for valuation of

companies in our industry. Moreover, other companies that provide

EBITDA information may calculate EBITDA differently than we do.

During the six months ended June 30, 2016, Adjusted EBITDA excluded

the gain on sale of land.

About Canterbury

Park:Canterbury Park Holding Corporation (the

Company) owns and operates Canterbury Park Racetrack and Card

Casino, Minnesota’s only thoroughbred and quarter horse racing

facility. The Company’s 69-day 2016 live race meet began on May

20th and ends September 17th. In addition, Canterbury Park’s Card

Casino hosts “unbanked” card games 24 hours a day, seven days a

week, offering both poker and table games. The Company also

conducts year-round wagering on simulcast horse racing and hosts a

variety of other entertainment and special events at its facility

in Shakopee, Minnesota. For more information about the Company,

please visit us at www.canterburypark.com.

The Company was incorporated as a Minnesota corporation in

October 2015. The Company is a successor corporation to another

corporation, also named Canterbury Park Holding Corporation, that

was incorporated in 1994 (“CPHC”). Effective June 30, 2016 CPHC’s

business and operations were reorganized into a holding company

structure (the “Reorganization”) pursuant to an Agreement and Plan

of Merger dated as of March 1, 2016 that was approved by CPHC’s

shareholders on June 28, 2016. Pursuant to the Reorganization:

- The Company replaced CPHC as the public

company owned by CPHC’s shareholders, with each shareholder at June

30, 2016 having the same percentage ownership in Company (and,

indirectly, in all property and other assets then owned by CPHC)

immediately after the Reorganization as that shareholder had

immediately before the Reorganization.

- The Company became the holding company

for and parent company of two subsidiaries, Canterbury Park

Entertainment LLC (“EntertainmentCo”) and Canterbury Development

LLC (“DevelopmentCo”).

- EntertainmentCo is the surviving

business entity in a merger with CPHC pursuant to the

Reorganization and it became the direct owner of all land,

facilities, and substantially all other assets related to the

CPHC’s pari-mutuel wagering, Card Casino, concessions and other

related businesses (“Racetrack Operations”) and EntertainmentCo

continues to conduct these businesses consistent with CPHC’s past

practices and will continue to be subject to direct regulation by

the Minnesota Racing Commission (“MRC”).

- DevelopmentCo will continue CPHC’s

efforts to commercially develop approximately 140 acres of land

currently owned or controlled that is not needed for our Racetrack

Operations. DevelopmentCo is not subject to direct regulation by

the MRC.

For purposes of this press release, when the term “Company” is

used with reference to information covering or related to periods

up to and including June 30, 2016, such term refers to the

operations of CPHC prior to the Reorganization.

Cautionary

Statement:From time to time, in press releases

and in other communications to shareholders or the investing

public, Canterbury Park Holding Corporation may make

forward-looking statements concerning possible or anticipated

future financial performance, business activities or plans based on

management’s beliefs and assumptions. These forward looking

statements are typically preceded by the words such as "believes,"

"expects," "anticipates," "intends" or similar expressions.

Shareholders and the investing public should understand that these

forward-looking statements are subject to risks and uncertainties,

including those disclosed in our periodic filings with the

Securities and Exchange Commission, which could cause actual

performance, activities or plans after the date the statements are

made to differ significantly from those indicated in the

forward-looking statements when made.

CANTERBURY PARK

HOLDING CORPORATION’S

SUMMARY OF

OPERATING RESULTS

(UNAUDITED)

Three Months Three Months

Six Months Six Months Ended Ended Ended Ended

June 30, 2016 June 30, 2015 June 30,

2016 June 30, 2015 Operating Revenues, (net)

$13,885,992 $14,848,077 $24,279,303 $24,719,115 Operating

Expenses $9,988,467 $13,879,109 $19,858,783 $ $23,097,918

Non-Operating Income, (net) ($49,970 ) $688 ($49,025 ) $1,305

Income before Income Taxes $3,847,555 $969,656 $4,371,495

$1,632,502 Income Tax Expense ($1,572,655 ) ($398,006 )

($1,785,841 ) ($672,248 ) Net Income $2,274,900 $571,650

$2,585,654 $960,254 Basic Net Income Per Common Share

$0.53

$0.14

$0.61

$0.23

Diluted Net Income Per Common Share

$0.53

$0.14

$0.60

$0.23

RECONCILIATION OF

NET INCOME TO ADJUSTED EBITDA

Six Months Six Months Ended Ended June 30, 2016 June 30,

2015 NET INCOME $ 2,585,654 $ 960,254 Interest

(income) expense 49,025 (1,305 ) Income tax expense

1,785,841 672,248 Depreciation 1,194,510

1,171,710 EBITDA $ 5,615,030 $ 2,802,907

Gain on disposal of land (3,990,519)0 Adjusted EBITDA

$ 1,624,511 $ 2,802,907

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160815005867/en/

Canterbury Park Holding CorporationRandy Sampson,

952-445-7223

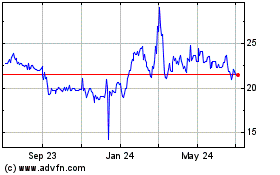

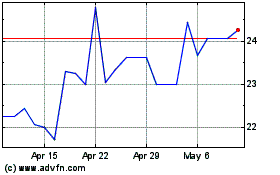

Canterbury Park (NASDAQ:CPHC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Canterbury Park (NASDAQ:CPHC)

Historical Stock Chart

From Apr 2023 to Apr 2024