Chesapeake Energy Works on $1 Billion of Financing to Buy Back Debt

August 15 2016 - 8:17AM

Dow Jones News

By Austen Hufford

Chesapeake Energy Corp. said Monday it is working with banks to

take out a $1 billion line of credit in order to retire debt.

The company said it had engaged Goldman Sachs, Citigroup and

MUFG to assist with arranging a secured five-year term loan for $1

billion. In tandem, it said it had launched two sets of tender

offers, each to buy back $500 million of notes.

Chesapeake has been working in recent months to clean up its

finances as energy prices remain low. Earlier this month it paid

nearly $340 million to exit the Barnett Shale in Texas and reduce

its financial commitments there.

Chesapeake also said recently that it intends to sell more than

$2 billion in assets this year.

Oklahoma City-based Chesapeake develops oil and natural gas

assets in the U.S.

Chesapeake shares, which have risen 24% in the past three

months, rose 1.6% in premarket trading.

Write to Austen Hufford at austen.hufford@wsj.com

(END) Dow Jones Newswires

August 15, 2016 08:02 ET (12:02 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

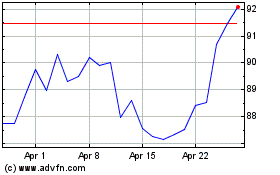

Chesapeake Energy (NASDAQ:CHK)

Historical Stock Chart

From Mar 2024 to Apr 2024

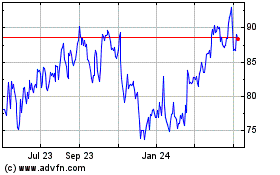

Chesapeake Energy (NASDAQ:CHK)

Historical Stock Chart

From Apr 2023 to Apr 2024