UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

[X] QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SEC

CURITIES EXCHANGE ACT OF 1934

For the quarterly period ended

June 30, 2016

or

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the transition period from _________ to _________

Commission File Number

000-55178

Galenfeha, Inc.

(Exact name of registrant as specified in its

charter)

|

Nevada

|

46-2283393

|

|

(State or other jurisdiction of

|

(I.R.S. Employer

|

|

incorporation or organization)

|

Identification No.)

|

420 Throckmorton Street, Suite 200

Fort Worth,

Texas 76102

(Address of principal executive offices) (Zip code)

(800) 280-2404

(Registrant’s

telephone number, including area code)

N/A

(Former name, former address and

former fiscal year, if changed since last report)

Indicate by check mark whether the registrant

(1) has filed all reports required to be filed by Section 13 or

15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or

for such shorter period that registrant was required to file such reports), and

(2) has been subject to such filing requirements for the past 90 days.

Yes

[X] No [ ]

Indicate by check mark whether the registrant submitted

electronically and posted on its corporate web site, if any, every Interactive

Data File required to be submitted and posted pursuant to Rule 405 of Regulation

S-T (section 232.405 of this chapter) during the preceding 12 months (or for

such shorter period that the registrant was required to submit and post such

files).

Yes [X] No [ ]

Indicate by check mark whether the registrant is a large

accelerated filer, an accelerated filer, a non-accelerated filer or a smaller

reporting company. See the definitions of “large accelerated filer,”

“accelerated filer” and “smaller reporting company” in Rule 12b-2 of the

Exchange Act.

|

Large Accelerated Filer [ ]

|

Accelerated Filer [ ]

|

|

Non-Accelerated Filer [ ]

|

Smaller Reporting Company [X]

|

Indicate by check mark whether the registrant is a shell

company (as defined in Rule 12b-2 of the Exchange Act).

Yes [ ] No [X]

As of August 14, 2016, there were 86,126,100 shares of the

registrant’s common stock outstanding, each with a par value of $0.001.

TABLE OF CONTENTS

FORM 10-Q

FOR THE

QUARTERLY PERIOD ENDED JUNE 30, 2016

2

Galenfeha, Inc.

INDEX TO CONSOLIDATED FINANCIAL

STATEMENTS

(Unaudited)

3

Galenfeha, Inc.

CONSOLIDATED

BALANCE

SHEETS

(Unaudited)

|

|

|

June 30, 2016

|

|

|

December 31, 2015

|

|

|

|

|

|

|

|

|

|

|

ASSETS

|

|

|

|

|

|

|

|

CURRENT ASSETS

|

|

|

|

|

|

|

|

Cash

|

$

|

57,235

|

|

$

|

47,333

|

|

|

Accounts receivable

|

|

27,248

|

|

|

107,424

|

|

|

Accounts receivable from

related parties

|

|

-

|

|

|

336

|

|

|

Inventory

|

|

829,847

|

|

|

950,617

|

|

|

Prepaid inventory

|

|

22,715

|

|

|

-

|

|

|

Prepaid expenses

|

|

12,935

|

|

|

10,083

|

|

|

Total current assets

|

|

949,980

|

|

|

1,115,793

|

|

FIXED ASSETS, net of accumulated depreciation of

$31,303 and $21,419, respectively

|

|

177,502

|

|

|

187,386

|

|

|

OTHER ASSETS

|

|

|

|

|

|

|

|

Goodwill

|

|

389,839

|

|

|

389,839

|

|

Customer list, net of

accumulated amortization of

$9,728 and $5,928,

respectively

|

|

13,070

|

|

|

16,870

|

|

|

Deposits

|

|

1,000

|

|

|

1,000

|

|

|

Total other assets

|

|

403,909

|

|

|

407,709

|

|

|

TOTAL ASSETS

|

$

|

1,531,391

|

|

$

|

1,710,888

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY

|

|

|

|

|

|

|

|

CURRENT LIABILITIES

|

|

|

|

|

|

|

|

Accounts payable and accrued

liabilities

|

$

|

119,854

|

|

$

|

228,014

|

|

|

Accounts payable to

related parties

|

|

16,291

|

|

|

123,282

|

|

|

Current maturities of long term debt

|

|

9,888

|

|

|

95,771

|

|

Convertible

notes, net of unamortized discounts

of

$98,182 and $0, respectively

|

|

29,318

|

|

|

-

|

|

|

Line of credit

|

|

171,000

|

|

|

100,000

|

|

Related party

convertible note, net of

unamortized

discounts of $0

|

|

125,000

|

|

|

125,000

|

|

|

Related party short term debt

|

|

100,000

|

|

|

-

|

|

|

Derivative liabilities

|

|

902,616

|

|

|

-

|

|

|

Total current liabilities

|

|

1,473,967

|

|

|

672,067

|

|

|

LONG TERM DEBT

|

|

|

|

|

|

|

Convertible notes, net of

unamortized discount of

$173,211

and $0, respectively

|

|

32,489

|

|

|

-

|

|

|

Total liabilities

|

|

1,506,456

|

|

|

672,067

|

|

|

|

|

|

|

|

|

|

|

STOCKHOLDERS’ EQUITY

|

|

|

|

|

|

|

|

Common stock

|

|

|

|

|

|

|

Authorized: 500,000,000 common shares,

$0.001 par value,

86,126,100 issued and outstanding at June 30, 2016

and

December 31, 2015

|

|

86,126

|

|

|

86,126

|

|

|

Additional paid-in capital

|

|

3,150,012

|

|

|

3,162,529

|

|

|

Accumulated deficit

|

|

(3,211,203

|

)

|

|

(2,209,834

|

)

|

|

Total stockholders’ equity

|

|

24,935

|

|

|

1,038,821

|

|

|

TOTAL LIABILITIES AND STOCKHOLDERS’

EQUITY

|

$

|

1,531,391

|

|

$

|

1,710,888

|

|

The accompanying notes are an integral part of these unaudited

consolidated financial statements.

F-1

Galenfeha, Inc.

CONSOLIDATED

STATEMENTS OF

OPERATIONS

(Unaudited)

|

|

|

For the Three

|

|

|

For the Three

|

|

|

For the Six

|

|

|

For the Six

|

|

|

|

|

Months Ended

|

|

|

Months Ended

|

|

|

Months Ended

|

|

|

Months Ended

|

|

|

|

|

June 30, 2016

|

|

|

June 30, 2015

|

|

|

June 30, 2016

|

|

|

June 30, 2015

|

|

|

Revenues:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Third Parties

|

$

|

85,372

|

|

$

|

29,989

|

|

$

|

371,411

|

|

$

|

29,989

|

|

|

Related Parties

|

|

19,002

|

|

|

212,795

|

|

|

36,384

|

|

|

529,497

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of Sales

|

|

72,582

|

|

|

110,770

|

|

|

292,164

|

|

|

305,596

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross Profit

|

|

31,792

|

|

|

132,014

|

|

|

115,631

|

|

|

253,890

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating Expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

General and administrative

|

|

64,292

|

|

|

118,370

|

|

|

157,600

|

|

|

157,782

|

|

|

Payroll expenses

|

|

107,710

|

|

|

159,440

|

|

|

216,740

|

|

|

270,488

|

|

|

Professional fees

|

|

18,376

|

|

|

27,716

|

|

|

36,671

|

|

|

30,629

|

|

|

Engineering research and development

|

|

(39

|

)

|

|

97,475

|

|

|

(21,213

|

)

|

|

99,076

|

|

|

Depreciation and amortization expense

|

|

6,842

|

|

|

4,957

|

|

|

13,684

|

|

|

9,804

|

|

|

Total

operating expenses

|

|

197,181

|

|

|

407,958

|

|

|

403,482

|

|

|

567,779

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss from continuing operations

|

|

(165,389

|

)

|

|

(275,944

|

)

|

|

(287,851

|

)

|

|

(313,889

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other (expense) income

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gain (loss) on sale of assets

|

|

-

|

|

|

(5,317

|

)

|

|

-

|

|

|

(5,317

|

)

|

|

Interest income

|

|

3

|

|

|

25

|

|

|

6

|

|

|

40

|

|

|

Miscellaneous income

|

|

2,682

|

|

|

-

|

|

|

2,682

|

|

|

-

|

|

|

Interest expense

|

|

(57,491

|

)

|

|

(33,583

|

)

|

|

(67,315

|

)

|

|

(68,407

|

)

|

|

Loss on derivative instruments

|

|

(475,311

|

)

|

|

-

|

|

|

(648,891

|

)

|

|

-

|

|

|

Total other

(expense)

|

|

(530,117

|

)

|

|

(38,875

|

)

|

|

(713,518

|

)

|

|

(73,684

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss

|

$

|

(695,506

|

)

|

$

|

(314,819

|

)

|

$

|

(1,001,369

|

)

|

$

|

(387,573

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss per share, basic and diluted

|

$

|

(0.01

|

)

|

$

|

(0.00

|

)

|

$

|

(0.01

|

)

|

$

|

(0.00

|

)

|

Weighted average number of common

shares outstanding,

basic and diluted

|

|

86,126,100

|

|

|

86,700,770

|

|

|

86,126,100

|

|

|

82,594,198

|

|

The accompanying notes are an integral part of these unaudited

consolidated financial statements.

F-2

Galenfeha, Inc.

CONSOLIDATED

STATEMENT OF

CHANGES IN STOCKHOLDERS’ EQUITY

(Unaudited)

|

|

|

|

|

|

|

|

|

Additional

|

|

|

|

|

|

|

|

|

|

|

Common Stock

|

|

|

Paid-in

|

|

|

Accumulated

|

|

|

|

|

|

|

|

Shares

|

|

|

Amount

|

|

|

Capital

|

|

|

Deficit

|

|

|

Total

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance – December 31, 2015

|

|

86,126,100

|

|

|

86,126

|

|

|

3,162,529

|

|

|

(2,209,834

|

)

|

|

1,038,821

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reclass of conversion option to derivative

liabilities

|

|

-

|

|

|

-

|

|

|

(6,175

|

)

|

|

-

|

|

|

(6,175

|

)

|

|

Options expense

|

|

-

|

|

|

-

|

|

|

43,444

|

|

|

-

|

|

|

43,444

|

|

|

Revaluation of common shares issued for

services

|

|

-

|

|

|

-

|

|

|

(23,041

|

)

|

|

-

|

|

|

(23,041

|

)

|

|

Non-vested options returned and cancelled

|

|

-

|

|

|

-

|

|

|

(26,745

|

)

|

|

-

|

|

|

(26,745

|

)

|

|

Net loss

|

|

-

|

|

|

-

|

|

|

-

|

|

|

(1,001,369

|

)

|

|

(1,001,369

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance – June 30, 2016

|

|

86,126,100

|

|

$

|

86,126

|

|

$

|

3,150,012

|

|

$

|

(3,211,203

|

)

|

$

|

24,935

|

|

The accompanying notes are an integral part of these unaudited

consolidated financial statements.

F-3

Galenfeha, Inc.

CONSOLIDATED

STATEMENTS OF

CASH FLOWS

(Unaudited)

|

|

|

Six Months

|

|

|

Six Months

|

|

|

|

|

Ended

|

|

|

Ended

|

|

|

|

|

June 30, 2016

|

|

|

June 30, 2015

|

|

|

|

|

|

|

|

|

|

|

OPERATING ACTIVITIES

|

|

|

|

|

|

|

|

Net loss

|

$

|

(1,001,369

|

)

|

$

|

(387,573

|

)

|

|

Adjustments to reconcile net loss to

net cash used in operating activities:

|

|

|

|

|

|

|

|

Depreciation and amortization

|

|

13,684

|

|

|

9,804

|

|

|

Non-vested options forfeited

|

|

(26,745

|

)

|

|

-

|

|

|

Common shares issued for services

|

|

(23,041

|

)

|

|

95,000

|

|

|

Options expense

|

|

43,444

|

|

|

-

|

|

|

Loss on disposal of assets

|

|

-

|

|

|

5,317

|

|

|

Loss on derivative instruments

|

|

648,891

|

|

|

-

|

|

|

Amortization of debt discounts on convertible

notes

|

|

61,806

|

|

|

-

|

|

|

Changes in Operating Assets

and Liabilities:

|

|

|

|

|

|

|

|

(Increase) Decrease in accounts

receivable

|

|

80,176

|

|

|

(78,530

|

)

|

|

(Increase)

Decrease in accounts receivable from related party

|

|

336

|

|

|

-

|

|

|

(Increase) Decrease in inventory

|

|

120,770

|

|

|

(159,890

|

)

|

|

(Increase)

Decrease in prepaid expenses and other assets

|

|

(25,567

|

)

|

|

(342,867

|

)

|

|

Increase (Decrease) in accounts

payable and accrued liabilities

|

|

(108,160

|

)

|

|

196,949

|

|

|

Increase

(Decrease) in accounts payable to related parties

|

|

(106,991

|

)

|

|

-

|

|

|

Net cash used in operating activities

|

|

(322,766

|

)

|

|

(661,790

|

)

|

|

|

|

|

|

|

|

|

|

INVESTING ACTIVITIES

|

|

|

|

|

|

|

|

Proceeds from sale of assets

|

|

-

|

|

|

47,016

|

|

|

Purchase of fixed assets

|

|

-

|

|

|

(22,367

|

)

|

|

Cash paid for acquisition of

subsidiary

|

|

-

|

|

|

(154,887

|

)

|

|

Net cash used in financing activities

|

|

-

|

|

|

(130,238

|

)

|

|

|

|

|

|

|

|

|

|

FINANCING ACTIVITIES

|

|

|

|

|

|

|

|

Proceeds from line of credit/notes

payable

|

|

82,371

|

|

|

70,895

|

|

|

Payments on notes payable

|

|

(88,980

|

)

|

|

(56,825

|

)

|

|

Proceeds from convertible debentures,

net of original issue discounts

|

|

247,550

|

|

|

-

|

|

|

Proceeds from related party promissory

note

|

|

100,000

|

|

|

-

|

|

|

Payment on promissory

notes

|

|

-

|

|

|

(125,000

|

)

|

|

Payments on finance contracts

|

|

(8,273

|

)

|

|

-

|

|

|

Proceeds from sale of common stock

|

|

-

|

|

|

1,162,200

|

|

|

Net cash provided by financing activities

|

|

332,668

|

|

|

1,051,270

|

|

|

|

|

|

|

|

|

|

|

INCREASE IN CASH

|

|

9,902

|

|

|

259,242

|

|

|

CASH AT BEGINNING OF PERIOD

|

|

47,333

|

|

|

94,668

|

|

|

CASH AT END OF PERIOD

|

$

|

57,235

|

|

$

|

353,910

|

|

|

|

|

|

|

|

|

|

|

SUPPLEMENTAL INFORMATION

|

|

|

|

|

|

|

|

Cash paid for:

|

|

|

|

|

|

|

|

Interest expense

|

$

|

3,557

|

|

$

|

6,421

|

|

|

Income taxes

|

|

-

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

NONCASH INVESTING AND FINANCING ACTIVITIES

|

|

|

|

|

|

|

|

Common stock issued for acquisition of subsidiary

|

$

|

-

|

|

$

|

191,750

|

|

|

Debt discount due to derivative

liabilities

|

|

247,550

|

|

|

-

|

|

|

Reclass of conversion option from equity to

derivative liabilities

|

|

6,175

|

|

|

-

|

|

The accompanying notes are an integral part of these unaudited

consolidated financial statements.

F-4

Galenfeha, Inc.

Notes to Unaudited Consolidated

Financial Statements

June 30, 2016

NOTE 1 - BASIS OF PRESENTATION

The accompanying financial statements have been prepared by the

Company without audit. In the opinion of management, all adjustments (which

include only normal recurring adjustments) necessary to present fairly the

financial position, results of operations, and cash flows at June 30, 2016, and

for all periods presented herein, have been made.

Certain information and footnote disclosures normally included

in financial statements prepared in accordance with accounting principles

generally accepted in the United States of America have been omitted. It is

suggested that these unaudited interim financial statements be read in

conjunction with the financial statements and notes thereto included in the

Company’s December 31, 2015 audited financial statements included in its Form

10-K filed with the Securities and Exchange Commission. The results of

operations for the three and six months ended June 30, 2016 and the same period

last year are not necessarily indicative of the operating results for the full

years.

NOTE 2 - GOING CONCERN

The accompanying financial statements have been prepared

assuming that the Company will continue as a going concern. The Company has

incurred net losses and net cash used in operations since inception. These

conditions raise substantial doubt about the Company’s ability to continue as a

going concern. The Company’s ability to continue as a going concern is dependent

upon the Company’s ability to achieve a level of profitability. The Company

intends on financing its future development activities and its working capital

needs largely from the sale of public equity securities with some additional

funding from other traditional financing sources, including term notes until

such time that funds provided by operations are sufficient to fund working

capital requirements. The financial statements of the Company do not include any

adjustments relating to the recoverability and classification of recorded

assets, or the amounts and classifications of liabilities that might be

necessary should the Company be unable to continue as a going concern.

NOTE 3 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

CONCENTRATIONS

During the six months ended June 30, 2016, 9% of sales were to

a single related party customer. In addition, one other third party customer

contributed to 48% of total revenue for six months ended June 30, 2016. For the

six months ended June 30, 2015, 95% of sales were to a single related party

customer. During the three months ended June 30, 2016, 18% of sales were to a

single related party customer. In addition, one other third party customer

contributed to 54% of total revenue for three months ended June 30, 2016. For

the three months ended June 30, 2015, 95% of sales were to a single related

party customer.

As of June 30, 2016, accounts receivable from one related party

customer comprised 51% of total accounts receivable before it netted with

accounts payable due to the same related party and accounts receivable from one

third party customer comprised 31% of accounts receivable. As of December 31,

2015, accounts receivable from one third party customer comprised 81% of

accounts receivable, while another third-party customer comprised 12% of

accounts receivable.

INVENTORIES

Inventories are stated at the lower of cost, determined on a

first-in, first-out basis (“FIFO”), or market, including direct material costs

and direct and indirect manufacturing costs. Inventory consists of the following

amounts as of June 30, 2016 and December 31, 2015.

|

|

|

June 30, 2016

|

|

|

December 31, 2015

|

|

|

Raw Materials

|

$

|

265,824

|

|

$

|

311,673

|

|

|

Work In Process

|

|

-

|

|

|

-

|

|

|

Finished Goods

|

|

564,023

|

|

|

638,944

|

|

|

|

|

|

|

|

-

|

|

|

Total Inventory

|

$

|

829,847

|

|

$

|

950,617

|

|

FAIR VALUE ACCOUNTING

As required by the Fair Value Measurements and Disclosures

Topic of the FASB ASC, fair value is measured based on a three-tier fair value

hierarchy, which prioritizes the inputs used in measuring fair value as follows:

(Level 1) observable inputs such as quoted prices in active markets; (Level 2)

inputs, other than the quoted prices in active markets, that are observable

either directly or indirectly; and (Level 3) unobservable inputs in which there

is little or no market data, which require the reporting entity to develop its

own assumptions.

F-5

The three levels of the fair value hierarchy are described

below:

Level 1 Unadjusted quoted prices in active markets that are

accessible at the measurement date for identical, unrestricted assets or

liabilities;

Level 2 Quoted prices in markets that are not active, or inputs

that are observable, either directly or indirectly, for substantially the full

term of the asset or liability;

Level 3 Prices or valuation techniques that require inputs that

are both significant to the fair value measurement and unobservable (supported

by little or no market activity).

The following table sets forth by level with the fair value

hierarchy the Company’s assets and liabilities measured at fair value as of June

30, 2016:

|

|

|

Level 1

|

|

|

Level 2

|

|

|

Level 3

|

|

|

Total

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Assets

|

|

|

|

|

|

|

|

|

|

|

|

|

|

None

|

$

|

—

|

|

$

|

—

|

|

$

|

—

|

|

$

|

—

|

|

|

Liabilities

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Derivative liabilities

|

$

|

—

|

|

$

|

—

|

|

$

|

902,616

|

|

$

|

902,616

|

|

NOTE 4 – PROPERTY AND EQUIPMENT

Property and equipment are stated at cost, less accumulated

depreciation. Depreciation is recorded using the straight-line method over the

estimated useful lives of the related assets, ranging from three to forty years.

A summary is as follows:

|

|

|

June

30, 2016

|

|

|

December 31, 2015

|

|

|

Manufacturing assets

|

$

|

168,015

|

|

$

|

168,015

|

|

|

Vehicles

|

|

-

|

|

|

-

|

|

|

Furniture and equipment

|

|

19,318

|

|

|

19,318

|

|

|

Improvements

|

|

21,472

|

|

|

21,472

|

|

|

|

|

208,805

|

|

|

208,805

|

|

|

|

|

|

|

|

|

|

|

Less accumulated depreciation

|

|

(31,303

|

)

|

|

(21,419

|

)

|

|

|

|

|

|

|

|

|

|

Property and equipment, net

|

$

|

177,502

|

|

$

|

187,386

|

|

Depreciation expense related to property and equipment was

$9,883 and $9,804 for the six months ended June 30, 2016 and 2015, respectively

and $4,942 and $4,957 for the three months ended June 30, 2016 and 2015,

respectively.

NOTE 5 – NOTES PAYABLE

On May 12, 2016, the Company incurred a loan of $5,625 relating

to the renewal of their commercial general liability insurance. The note has an

interest rate of 8.00%, payable in payments of $583 for 10 months. Additionally

in May of 2016, the Company incurred a loan of $5,746 relating to the renewal of

their workers compensation, commercial property, and commercial automobile

insurance. The note has an interest rate of 0.00%, payable in payments of $936

and $1,223 in months one and two, respectively, and $599 per month for the

remaining six months. The outstanding balance on these finance agreements was

$9,888 and $6,791, as of June 30, 2016 and December 31, 2015, respectively.

In August 2015, the Company incurred a loan of $78,593 that is

secured by a customer purchase order. The loan has an interest rate of 4.75%

payable in four payment of $19,843 with the first payment due on December 28,

2015. Since the prior customer purchase orders had been fulfilled and paid, the

loan of $78,593 was repaid by a second loan of $88,980 on December 28, 2015

which was secured by current customer purchase orders. The second loan of

$88,980 has an interest rate of 4.75% and is payable in one principal payment of

$88,980 plus accrued interest on April 28, 2016. The outstanding balance on this

loan was $0 and $88,980 as of June 30, 2016 and December 31, 2015, respectively.

The Company also took out a line of credit of $100,000 on

August 5, 2015 which is payable on demand. The line of credit is secured by all

present and future inventory, all present and future accounts receivable, other

receivables, contract rights, instruments, documents, notes, and all other

similar obligation and indebtedness that may now and in the future be owed to

the Company, and all general intangibles. On January 15, 2016 the Company’s line

of credit was increased from $100,000 to $200,000. The Company withdrew an

additional $70,000 in funds from the line of credit and paid loan origination

and documentation fees of $1,000 at closing to bring the total outstanding line

of credit balance to $171,000 as of January 15, 2016. Under the terms of the new

agreement the loan is a fixed rate (4.75%) revolving line of credit loan to the

Company for $200,000 due on January 15, 2017.

F-6

Additionally, the line of credit is secured by a deposit

account held at the Grantor’s institution which had a cash balance of $1,081 and

$11,499 as of June 30, 2016 and December 31, 2015, respectively. Interest only

payments were made during the six months ended June 30, 2016. The outstanding

balance on the line of credit was $171,000 and $100,000 as of June 30, 2016 and

December 31, 2015, respectively.

The current maturities and five year debt schedule for the

notes is as follows:

|

2016

|

$

|

-

|

|

|

2017

|

|

171,000

|

|

|

2018

|

|

-

|

|

|

2019

|

|

-

|

|

|

2020

|

|

-

|

|

|

Total current notes payable

|

$

|

171,000

|

|

NOTE 7 – CONVERTIBLE LOANS

At June 30, 2016 and December 31, 2015, convertible loans

consisted on the following:

|

|

|

June

30, 2016

|

|

|

December 31, 2015

|

|

|

February 2016 Note

|

$

|

82,500

|

|

|

-

|

|

|

March 2016 Note

|

|

123,200

|

|

|

|

|

|

April 2016 Note

|

|

75,000

|

|

|

-

|

|

|

May 2016 Note

|

|

52,500

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total notes payable

|

|

333,200

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

Less: Unamortized debt discounts

|

|

(271,393

|

)

|

|

-

|

|

|

|

|

|

|

|

|

|

|

Total convertible loans, net

|

|

61,807

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

Less: current portion of convertible loans

|

|

(29,318

|

)

|

|

-

|

|

|

|

|

|

|

|

|

|

|

Long-term convertible loans, net

|

$

|

32,489

|

|

|

-

|

|

February 2016 Note

Effective February 29, 2016 the Company entered into a

Convertible Promissory Note (“Vista Note”) with Vista Capital Investments, LLC

pursuant to which the Company issued Vista Capital Investments, LLC a

convertible note in the amount of $275,000 with an original issue discount in

the amount of $25,000. The principal amount due Vista Capital Investments, LLC

is based on the consideration paid. The maturity date is two years from the

effective date of each payment. On February 29, 2016 the Company received

consideration of $75,000 for which an original issue discount of $7,500 was

recorded. In addition, the Company recognized a discount of $5,625 on fees paid

upon entering into this agreement. There were no additional borrowings under the

Vista Note during the six months ended June 30, 2016. The Vista Note carries an

interest rate of 6% which shall be applied on the issuance date to the original

principal amount. Accrued interest due under the Vista Note totaled $16,500 at

June 30, 2016.

The Vista Note provides Vista Capital Investments, LLC the

right at any time, to convert the outstanding balance (including accrued and

unpaid interest) into shares of the Company’s common stock at 70% of the lowest

trade price in the 25 trading days previous to the conversion, additional

discounts may apply in the case that conversion shares are not deliverable or if

the shares are ineligible. As a result of the derivatives calculation (see Note

8) an additional discount of $52,875 was recorded. Amortization of the debt

discount totaled $13,787 for the six months ended June 30, 2016. The principal

balance due, net of the amortized discount under the Vista Note was $13,787 at

June 30, 2016.

March 2016 Note

Effective March 2, 2016 the Company entered into a Convertible

Promissory Note (“JMJ Note”) with JMJ Financial pursuant to which the Company

issued JMJ Financial a convertible note in the amount of $500,000 with an

original issue discount in the amount of $50,000. The principal amount due JMJ

is based on the consideration paid. The maturity date is two years from the

effective date of each payment. On March 2, 2016 the Company received

consideration of $100,000 for which an original issue discount of $10,000 was

recorded. In addition, the Company recognized a discount of $7,500 on fees paid

upon entering into this agreement There were no additional borrowings under the

JMJ Note during the six months ended June 30, 2016. The Company has not

currently made any principal payments on the JMJ Note. If the Company doesn’t

repay the JMJ Note on or before 90 days from the effective date the Company may not make further payments on this JMJ Note prior to

the maturity date and a one-time interest charge of 12% will be applied to the

principal amount. Since no payments were made on the note on or before 90 days

from the effective date of the note, accrued interest due was recorded in the

amount of $13,200 at June 30, 2016.

F-7

The JMJ Note provides JMJ Financial the right at any time, to

convert the outstanding balance (including accrued and unpaid interest) into

shares of the Company’s common stock at 60% of the lowest trade price in the 25

trading days previous to the conversion, additional discounts may apply in the

case that conversion shares are not deliverable or if the shares are ineligible.

As a result of the derivatives calculation (see Note 8) an additional discount

of $92,500 was recorded. Amortization of the debt discount totaled $18,701 for

the six months ended June 30, 2016. The principal balance due, net of the

amortized discount under the JMJ Note was $18,701 at June 30, 2016.

April 2016 Note

Effective April 22, 2016 the Company entered into a Convertible

Promissory Note (“Auctus Note”) with Auctus Fund, LLC pursuant to which the

Company issued Auctus Fund, LLC a convertible note in the amount of $75,000. The

maturity date is January 22, 2017. On April 22, 2016 the Company received

consideration of $75,000. In addition, the Company recognized a discount of

$6,750 on fees paid upon entering into this agreement. The Auctus Note carries

an interest rate of 10% which shall be applied on the issuance date to the

original principal amount. Interest paid under the Auctus Note totaled $5,625 at

June 30, 2016.

The Auctus Note provides Auctus Fund, LLC the right at any

time, to convert the outstanding balance (including accrued and unpaid interest)

into shares of the Company’s common stock at 60% of the lowest trade price in

the 25 trading days previous to the conversion, additional discounts may apply

in the case that conversion shares are not deliverable or if the shares are

ineligible. As a result of the derivatives calculation (see Note 8) an

additional discount of $62,625 was recorded. Amortization of the debt discount

totaled $18,818 for the six months ended June 30, 2016. The principal balance

due, net of the amortized discount under the Auctus Note was $18,818 at June 30,

2016.

May 2016 Note

Effective April 18, 2016 the Company entered into a Convertible

Promissory Note (“Adar Note”) with Adar Bays, LLC pursuant to which the Company

issued Adar Bays, LLC a convertible note in the amount of $52,500 with an

original issue discount in the amount of $2,500. The maturity date is April 18,

2017. On May 12, 2016 the Company received consideration of $50,000 for which an

original issue discount of $2,500 was recorded. In addition, the Company

recognized a discount of $6,250 on fees paid upon entering into this agreement.

The Adar Note carries an interest rate of 8% which shall be applied on the

issuance date to the original principal amount. Accrued interest due under the

Adar Note totaled $4,200 at June 30, 2016.

The Adar Note provides Adar Bays, LLC the right at any time, to

convert the outstanding balance (including accrued and unpaid interest) into

shares of the Company’s common stock at 60% of the lowest trade price in the 20

trading days previous to the conversion, additional discounts may apply in the

case that conversion shares are not deliverable or if the shares are ineligible.

As a result of the derivatives calculation (see Note 8) an additional discount

of $39,550 was recorded. Amortization of the debt discount totaled $10,500 for

the six months ended June 30, 2016. The principal balance due, net of the

amortized discount under the Adar Note was $10,500 at June 30, 2016.

NOTE 7 – CONVERTIBLE LOANS – RELATED PARTY

The Company issued a convertible promissory note to a related

party in 2014 for $250,000 (see Note 12). The note is convertible into common

stock of the Company at $0.50 per share. The intrinsic value of the beneficial

conversion feature was determined to be $125,000 at the commitment date and the

discount is being amortized over the one year life of the promissory note. As of

June 30, 2016, $125,000 of the discount has been amortized as interest expense.

Interest amortized for the six months ended June 30, 2016 and 2015 was $0 and

$61,986, respectively. The Company repaid $125,000 under this note during the

twelve months ended December 31, 2015 and the outstanding balance was $125,000

as of June 30, 2016.

This conversion option was accounted for as a derivative

liability during the six months ended June 30, 2016 resulting in a

reclassification of the fair value of the derivative liability of $6,175 from

equity (see Note 8).

NOTE 8 – DERIVATIVE LIABILITY

During the six months ended June 30, 2016, the Company

identified conversion features embedded within its convertible debt. The Company

has determined that the conversion feature of the Notes represents an embedded

derivative since the Notes are convertible into a variable number of shares upon

conversion. Accordingly, the embedded conversion feature must be bifurcated from

the debt host and accounted for as a derivative liability. Therefore, the fair

value of the derivative instruments have been recorded as liabilities on the

balance sheet with the corresponding amount recorded as discounts to the Notes.

Such discounts will be accreted from the issuance date to the maturity date of

the Notes. The change in the fair value of the derivative liabilities will be

recorded in other income or expenses in the statement of operations at the end

of each period, with the offset to the derivative liabilities on the balance

sheet. The fair value of the embedded derivative liabilities were determined

using the Black-Scholes valuation model on the issuance dates with the

assumptions in the table below.

F-8

The change in fair value of the Company’s derivative

liabilities for the six months ended June 30, 2016 is as follows:

|

December 31, 2015 fair value

|

$

|

-

|

|

|

Additions recognized as derivative loss at inception

|

|

380,283

|

|

|

Additions recognized as note discount

at inception

|

|

247,550

|

|

|

Reclass from equity to derivative liability

|

|

6,175

|

|

|

Loss on change in fair value

|

|

268,608

|

|

|

June 30, 2016 fair value

|

$

|

902,616

|

|

The loss on the change in fair value of derivative liabilities

for the six months ending June 30, 2016 totaled $648,891

The fair value at the issuance and remeasurement dates for the

convertible debt treated as derivative liabilities are based upon the following

estimates and assumptions made by management for the six months ended June 30,

2016:

|

Exercise prices

|

See Notes 6 and

7

|

|

Expected dividends

|

0%

|

|

Expected volatility

|

188%-400%

|

|

Expected term

|

See Notes 6 and 7

|

|

Discount rate

|

.45%-.85%

|

NOTE 9 - SHAREHOLDERS’ EQUITY

COMMON STOCK

The authorized common stock of the Company consists of

500,000,000 shares with a par value of $0.001.

As of June 30, 2016 and December 31, 2015, 86,126,100 shares of

the Company’s common stock were issued and outstanding.

In October 2014, the Company entered into an agreement for the

issuance of 1,000,000 common shares for CAD/CAM Engineering Design Services for

GLFH1200 series battery development. The shares vest in equal installments of

250,000 each year following the date of the agreement. On May 1, 2015, the

Company issued 250,000 shares under this award. Since inception through June 30,

2016, $118,311 was expensed under this award and $14,189 remains to be expensed

over the remaining service period. This nonemployee award is valued upon

completion of services. The fair value of the award as of the reporting date of

June 30, 2016 resulted in a reduction to expense during the six months ended

June 30, 2016 of $23,041.

NOTE 10 - OPTIONS

During the year ended December 31, 2015, the Company granted an

aggregate of 2,050,000 options to a military sales representative and three

employees. Col. Ashton Naylor (Ret) received 100,000 options exercisable at

$0.25 per share, Chris Watkins received 750,000 options exercisable at $0.25 per

share, Jeff Roach received 1,000,000 options exercisable at $0.20 per share, and

Brian Nallin received 200,000 options exercisable at $0.20 per share. These

options expire on April 1, 2016; June 11, 2020, February 1, 2017, and December

31, 2017 respectively. The options granted to Brian Nallin vest immediately and

the other options vest in equal tranches over periods ranging from 2 to 5 years.

The aggregate fair value of the option grants was determined to be $430,839

using the Black-Scholes Option Pricing Model and the following assumptions:

volatilities between 218% and 396%, risk free rates between .27% and 1.74%,

expected terms between 1 and 5 years and zero expected dividends. The fair value

of the award is being expensed over the vesting periods. $295,553 was expensed

during the year ended December 31, 2015, $24,703 was expensed during the three

months ended March 31, 2016, and $18,741 was expensed during the three months

ended June 30, 2016. Jeff Roach and Brian Nallin both voluntarily terminated

employment with the Company on February 12, 2016 resulting in Jeff returning

non-vested options back to the Company. This resulted in a reversal of prior

period share based compensation and option expense of $26,745 during the three

months ended March 31, 2016. As of June 30, 2016, $74,655 remains to be expensed

over the remaining vesting period.

As of June 30, 2016, there were 1,700,000 options outstanding

of which 1,250,000 were exercisable. The range of exercise prices and remaining

weighted average life of the options outstanding at June 30, 2016 were $0.20 to

$0.25 and 2.18 years, respectively. The aggregate intrinsic value of the

outstanding options at June 30, 2016 was $0.

F-9

NOTE 11 - COMMITMENTS AND CONTINGENCIES

The Company entered into a lease agreement for office and

research facilities in Louisiana. One lease is for $10,200 per year for 24

months beginning May 1, 2014. Beginning in May of 2016 this lease is now month

to month and is $850 per month. The second lease is $2,600 per month for 24

months beginning on November 1, 2014.

Additionally, the Company leases space in Fort Worth, Texas for

corporate facilities for $99 monthly or $1,188 per year. The terms of this lease

are also month to month.

|

Year Ended

|

|

Amount

|

|

|

2016

|

$

|

18,200

|

|

|

2017

|

|

-

|

|

|

2018

|

|

-

|

|

|

2019

|

|

-

|

|

|

2020

|

|

-

|

|

|

|

$

|

18,200

|

|

From time to time the Company may be a party to litigation

matters involving claims against the Company. Management believes that there are

no current matters that would have a material effect on the Company’s financial

position or results of operations.

NOTE 12 – RELATED PARTY TRANSACTIONS

On November 1, 2014, the Company entered into a Convertible

Promissory Note Agreement with Ray Moore Sr., a related party, in the amount of

$250,000. The note bears an interest rate of 7% per annum until paid in full.

Repayment of the loan is due on or before November 7, 2015. The lender shall

have the right to convert this indebtedness to equity shares of Galenfeha at the

rate of one share per $.50 of indebtedness for a total of 500,000 shares upon

the expiration date, or at any time the Lender desired for the relieve of

indebtedness of Maker. As of June 30, 2016, the principal and interest due on

the note is $136,699 (the accrued interest of $11,699 is presented as accounts

payable to related parties in the consolidated balance sheet).

On May 12, 2016, the Company entered into a Promissory Note

Agreement with Diane Moore, a related party, in the amount of $100,000. The note

bears an interest rate of 5% per annum until the balance is pain in full.

Repayment of the loan is due on or before December 31, 2016.

Falcon Resources, LLC & MarionAv, LLC are two companies

owned by Board Member, Trey Moore, and CEO/President, Lucien Marioneaux, Jr.,

respectively. These related party entities provide flight services to employees

and directors of the Company. The total amount paid for flight services to

Falcon Resources and MarionAv, LLC for the six months ending June 30, 2016

totaled $6,600 and $1,240, respectively. As of June 30, 2016, the Company had

outstanding accounts payable balances to Falcon Resources, LLC totaling $6,600

and MarionAv, LLC totaling $1,240.

Galenfeha sells a portion of its finished goods to Fleaux

Services, LLC, a company owned by Board Member, Trey Moore. During the three and

six months ended June 30, 2016, sales to the related company totaled $19,002 and

$36,384, respectively. As of June 30, 2016, the Company had outstanding

receivables from the related party company of $28,018. As of June 30, 2016, the

Company had an outstanding accounts payable balance to Fleaux Services, LLC

totaling $31,009. The net related party accounts payable balance due to Fleaux

Services totaled $2,991 for the six months ended June 30, 2016. During the six

months ended June 30, 2016, the Company paid Fleaux Services, LLC $16,152 for

inventory and shop supply purchases.

Galenfeha purchases component parts used in the assembly of

inventory items from River Cities Machine, LLC, a company owned by

CEO/President, Lucien Marioneaux, Jr. During the six months ended June 30, 2016

purchases from the related company totaled $960. As of June 30, 2016, the

Company had an outstanding accounts payable balance to River Cities Machine, LLC

totaling $960.

Other outstanding accounts payable balances to related parties

totaled $4,500 as of June 30, 2016. The amounts are unsecured, due on demand and

bear no interest.

NOTE 13 – UNCERTAIN TAX POSITIONS

The Company received a letter on May 17, 2016 from the

Caddo-Shreveport Sales and Use Tax Commission informing them of a parish sales

and use tax audit scheduled to begin on June 28, 2016. The audit period covered

is January 1, 2013 through May 31, 2016. The audit is currently under way and no

judgments or assessments have been issued. Management is of the opinion that

this audit will not result in any material change in the Company’s financial

results.

F-10

Item 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL

CONDITION AND RESULTS OF OPERATIONS

The following discussion and analysis should be read in

conjunction with the consolidated financial statements and related notes

included in this report and those in our Form 10-K filed with the Securities and

Exchange Commission on March 30, 2016. This discussion contains forward-looking

statements that involve risks and uncertainties. Our actual results may differ

materially from those anticipated in such forward-looking statements as a result

of certain factors, including but not limited to, those described under “Risk

Factors” included in Part II, Item IA of this report.

Background Overview

Galenfeha incorporated in the State of Nevada on March 14,

2013, as a for-profit company with a fiscal year end of December 31. Our

executive office is located at 420 Throckmorton Street, Suite 200, Ft. Worth

Texas 76102, and the Company’s manufacturing facility is located at 9204 Linwood

Avenue, Suite 104, Shreveport, LA. 71106. Our Telephone numbers are Toll free

1-800-280-2404

, International

1-817-945-6448

, and our facsimile

number is

817-887-1455

. Our email address is

info@galenfeha.com

and our website address is

www.galenfeha.com

.

In 2014, GLFH developed new battery technology primarily

designed to operate automation and measurement computers in remote oil field

locations. Such technology provides an environmentally friendly, inherently

safe, internally temperature regulated, uninterruptible power supply for oil and

gas well location automation and measurement equipment. Throughout 2014 this

battery system proved effective in rigorous field-testing and was placed in to

marketable production, now known as LiFePO4 battery systems.

During initial production, GLFH developed a private label,

unique, user interface driven, real-time battery state of charge and asset

tracking system that is internally integrated within the Company’s line of

LiFePO4 battery systems. The system communicates the current battery

performance, and operates as a Cloud driven database to collect and collate

individual client information and uses unique ESN numeric identifiers to

reference each client’s specific asset performance and inventory. Asset-tracking

utilizes a combination of CDMA technologies coupled with satellite geo-location

referencing to accurately monitor and track the battery system in the event of

theft.

Early third quarter 2014, GLFH began shipping its patent

pending battery systems to a multi-state distributor in Shreveport, Louisiana.

The battery system saw rapid acceptance within the industry, thus increasing oil

and gas demand through the remainder of 2014.

In 2015, GLFH began researching the use of this battery

technology outside of the oil and gas industry. In conjunction with alternative

markets, GLFH successfully tested a proof-of-concept model for use in zero

emission recreational vehicles such as golf carts and an off-road UTV

gas/electric hybrid platform. Additionally, GLFH sought additional product lines

to its battery systems to increase revenue while establishing a synergy among

products such that each product line could add value to the other.

GLFH acquired DayLight Pump, LLC, a chemical injection pump

manufacturing company, in early 2015 and all operations and manufacturing were

relocated to Shreveport, Louisiana. Following slight enhancements to the

DayLight Pump design, and following rigorous field-testing, DayLight Pumps, as

we know them today were manufactured and placed into final production. As

planned, these chemical injection stations incorporate the GLFH LiFePO4 battery

systems, at various levels. DayLight Pumps with GLFH LiFePO4 battery systems

were introduced into the commercial market mid-2015.

GLFH realized growth in overall product sales in 2015 for

reasons threefold: 1.) Increased market acceptance of our products, 2.)

Embedding the battery technology within our chemical injection pump systems

which not only serves to further validate product viability but also assisted in

expanding beyond automation and measurement to the production sector of the

petroleum industry, 3.) Introduction of our technology outside the petroleum

industry in to additional markets. 2015 goals were met regarding zero emissions

vehicle testing, the successful acquisition of Daylight Pump, LLC, as well as

the initial design of a second-generation battery management system. Chemical

injection pumps and accessories showed significant increase gross revenue, as

desired and the company was able to branch out of the oil and gas market to the

United States Armed Forces in the testing of GLFH LiFePO4 battery systems for

use in automated range targeting systems. Armed Forces testing was completed

mid-year 2015 with two facilities performing simultaneous field-testing which

ultimately proved successful. Third quarter 2015 saw the first shipment of GLFH

LiFePO4 battery systems to Fort Campbell. Such a milestone is of note as it

represents a first not only for GLFH, but also the acceptance and usage of the

LiFePO4 chemistry by the United States Government.

2015 also proved successful in that a solidified distribution

network was established with a number of national and long-standing regional

distribution partners opening the GLFH product line to nationwide distribution.

Promptly following the establishment of the distribution network, hands-on

product training sessions were conducted personally with each distribution hub

while initial stocking orders were placed and shipped across the nation.

Since the Company’s inception, the Company has accomplished key

milestones outlined in its 2014-2015 statement of work. A majority of the monies

spent to date have been for initial financing actives related to creating a

public company, product development, including research and field-testing as

well as for the purchase of inventory and ordinary day-to-day operations. We

anticipate that in 2016, the Company will increase profitability, and that cash

flow will be such as to allow for the production of additional inventory items

to reduce lead-times for product sales, continued market growth and the

development of those products desired within our market sectors which may add to

the synergies already enjoyed.

4

Liquidity

Assets

At June 30, 2016, we had total assets of $1,531,391, of which

$57,235 was in cash.

Results of Operations for the Three Months ending June 30,

2016

Revenues

Revenues for the three months ended June 30, 2016 and 2015 were

$104,374, and $242,784, respectively. Of the $104,374; $85,372 were to third

parties and $19,002 were to related parties. Of the $242,784; $29,989 were to

third parties and $212,795 were to related parties. The decrease is from the

Company loosing distribution contracts with oil and gas supply companies due to

lack of demand in the oil and gas industry. However, sales from third parties

increased significantly compared to the prior year because of less dependence on

related parties of the Company.

Cost of Revenues

Cost of Revenues for the three months ended June 30, 2016 and

2015 were $72,582 and $110,770, respectively. Costs were cost of materials and

manufacturing supplies with the decrease due to lack of sales compared with the

prior period..

Operating Expense

Total operating expenses for the three months ended June 30,

2016 and 2015 were $197,181 and $407,958, respectively. Expenses decreased as

the Company has decreased its workforce and lowered overhead costs because of

the downturn in the oil and gas industry.

Net Operating Loss and Net Loss

Net operating loss for the three months ended June 30, 2016 and

2015 was $165,389 and $275,944 respectively. The Company realized a lower net

loss because of reduced payroll costs and corresponding share based compensation

relating to employee stock options, reduced option expense for initial research

and development engineering services, and lower advertising costs.

Net loss for the three months ended June 30, 2016 and 2015 was

$695,506 and $314,819 respectively. The Company realized a higher net loss

because of increased interest and amortization expense relating to amortization

of debt discounts on convertible promissory notes, and fair market value

adjustments on derivative contracts associated with procuring additional

financing.

Results of Operations for the Six Months ending June 30,

2016

Revenues

Revenues for the six months ended June 30, 2016 and 2015 were

$407,795, and $559,486, respectively. Of the $407,795; $371,411 were to third

parties and $36,384 were to related parties. Of the $559,486; $29,989 were to

third parties and $529,497 were to related parties. The decrease is from the

Company loosing distribution contracts with oil and gas supply companies due to

lack of demand in the oil and gas industry. However, sales from third parties

increased significantly compared to the prior year because of less dependence on

related parties of the Company.

Cost of Revenues

Cost of Revenues for the six months ended June 30, 2016 and

2015 were $292,164 and $305,596, respectively. Costs were cost of materials and

manufacturing supplies with the decrease due to lack of sales compared with the

prior period.

Operating Expense

Total operating expenses for the six months ended June 30, 2016

and 2015 were $403,482 and $567,779, respectively. Expenses decreased as the

Company has decreased its workforce and lowered overhead costs because of the

downturn in the oil and gas industry.

Net Operating Loss and Net Loss

Net operating loss for the six months ended June 30, 2016 and

2015 was $287,851 and $313,889 respectively. The Company realized a lower net

loss because of reduced payroll costs and corresponding share based compensation

relating to employee stock options, reduced option expense for initial research

and development engineering services, and lower advertising costs.

Net loss for the six months ended June 30, 2016 and 2015 was

$1,001,369 and $387,573 respectively. The Company realized a higher net loss

because of increased interest and amortization expense relating to amortization

of debt discounts on convertible promissory notes, and fair market value

adjustments on derivative contracts associated with procuring additional

financing.

5

Equity Distribution

Since our incorporation, we have raised capital through private

sales of our common equity. As of June 30, 2016, we have issued 86,126,100

shares of our common stock to various shareholders,

Off-Balance Sheet Arrangements

We have no significant off-balance sheet arrangements that have

or are reasonably likely to have a current or future effect on our financial

condition, changes in financial condition, revenues or expenses, results of

operations, liquidity, capital expenditures or capital resources that is

material to investors.

Item 3. Quantitative & Qualitative Disclosures about

Market Risks

Not applicable.

Item 4. CONTROLS AND PROCEDURES

(a) Evaluation of Disclosure Controls and Procedures

As of the end of period covered by this report, the Company

carried out an evaluation, with the participation of the Company's Chief

Executive Officer and Principal Financial Officer, of the effectiveness of the

Company's disclosure controls and procedures pursuant to Securities Exchange Act

Rule 13a-15. Based upon that evaluation, the Company's Chief Executive Officer

and Principal Financial Officer concluded that the Company's disclosure controls

and procedures were not effective in ensuring that information required to be

disclosed by the Company in the reports that it files or submits under the

Securities Exchange Act is recorded, processed, summarized and reported, within

the time periods specified in the SEC's rules and forms.

(b) Changes in internal controls over financial reporting.

No changes were made to the Company's internal controls in the

quarterly period covered by this report that have materially affected, or are

reasonably likely materially to affect, the Company’s internal control over

financial reporting.

PART II. OTHER INFORMATION

Item 1. LEGAL PROCEEDINGS

None

Item 1A. Risk Factors

A description of the risks associated with our business,

financial condition and results of operations is set forth in our Annual Report

on Form 10-K for the fiscal year ended December 31, 2015, filed with the SEC on

March 30, 2016. These factors continue to be meaningful for your evaluation of

the Company and we urge you to review and consider the risk factors presented in

the Annual Report on Form 10-K. We believe there have been no changes that

constitute material changes from these risk factors.

Item 2. UNREGISTERED SALES OF EQUITY SECURITIES AND USE OF

PROCEEDS

None

Item 3. DEFAULTS UPON SENIOR SECURITEIES

None

Item 4. MINE SAFETY DISCLOSURES

Not applicable

Item 5. OTHER INFORMATION

None

Item 6. EXHIBITS

(a) Exhibits:

6

** XBRL (Extensible Business Reporting Language) information is

furnished and not filed or a part of a registration statement or prospectus for

purposes of Sections 11 or 12 of the Securities Act of 1933, as amended, is

deemed not filed for purposes of Section 18 of the Securities Exchange Act of

1934, as amended, and otherwise is not subject to liability under these

sections.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of

1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned thereunto duly authorized.

|

|

Galenfeha, Inc.

|

|

|

|

|

|

|

|

|

|

Date: August 12, 2016

|

By:

|

/s/

Lucien Marioneaux

|

|

|

Name:

|

Lucien Marioneaux

|

|

|

|

President and Chief Executive Officer

|

|

|

|

(Principal Financial Officer, Principal

|

|

|

|

Accounting Officer)

|

7

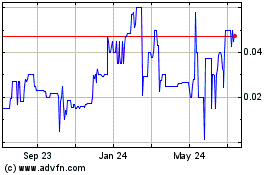

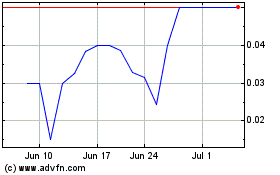

Galenfeha (PK) (USOTC:GLFH)

Historical Stock Chart

From Mar 2024 to Apr 2024

Galenfeha (PK) (USOTC:GLFH)

Historical Stock Chart

From Apr 2023 to Apr 2024