Current Report Filing (8-k)

August 11 2016 - 8:04AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported):

August 10, 2016

CELLDEX THERAPEUTICS, INC.

(Exact Name of Registrant as Specified in its Charter)

|

Delaware

|

|

000-15006

|

|

13-3191702

|

|

(State or Other Jurisdiction

|

|

(Commission File Number)

|

|

(IRS Employer

|

|

of Incorporation)

|

|

|

|

Identification No.)

|

|

Perryville III Building, 53 Frontage Road, Suite 220,

|

|

|

|

Hampton, New Jersey

|

|

08827

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code:

(908) 200-7500

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

o

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On August 10, 2016, Celldex Therapeutics, Inc. (the “Company” or “Celldex”) promoted Elizabeth Crowley, age 45, to the newly created position of Senior Vice President and Chief Product Development Officer. Ms. Crowley served as Senior Vice President, Product Development of Celldex from July 2014 to August 2016. Ms. Crowley joined Celldex in 2009 as Vice President, Clinical Development. Prior to that, she held several senior level roles at CuraGen Corporation, most recently serving as the Vice President of Development Operations, responsible for strategic and operational development activities of the oncology and oncology supportive care portfolio, regulatory affairs, clinical operations and data management. Ms. Crowley started her career at Bayer Corporation in 1992, holding various positions providing leadership of clinical research and project management prior to completing her tenure there as the Director of Global Study Audit Management, assuring the highest standards for program execution. Ms. Crowley received her BS in Chemistry with a concentration in Business from Boston College.

Concurrent with Ms. Crowley’s promotion, Ms. Crowley and the Company entered into an amended and restated employment agreement dated as of August 10, 2016 (the “Employment Agreement”). The Employment Agreement provides, among other things, for: (i) an initial term through December 31, 2016 (the “Initial Term”), subject to automatic renewal for successive one year terms unless either party provides ninety (90) days prior written notice of its intent not to renew; (ii) an annual base salary of $331,719.75; (iii) eligibility for an annual bonus having a target of 35% of her then base salary; and (iv) in the event that her employment is terminated without “cause” or she resigns “for good reason” (each as defined in the Employment Agreement), or her employment is terminated at the end of the Initial Term as the result of the Company providing notice of non-renewal: (x) a lump sum cash severance payment equal to 100% of the Executive’s then-base salary (not including bonus), (y) in the event she timely elects to continue her health insurance employee benefits pursuant to COBRA, monthly payments equal to the applicable COBRA costs for a period of eighteen months (the “Supplemental Payments”), and (z) accelerated vesting of 25% of her unvested options, restricted stock and/or equity awards and (iv) in the event of termination without “cause” or resignation “for good reason” by the Executive within one year immediately following a Change in Control (as defined in the Employment Agreement): (w) accelerated vesting of any unvested Equity Awards (as defined in the Employment Agreement), (x) a lump sum cash payment equal to twenty-four (24) times Executive’s highest monthly base compensation (not including bonus) during the twenty-four month period prior to the date of termination, (y) 150% of the highest annual discretionary bonus received by the Executive during the two full fiscal years prior to the date of termination and (z) the Supplemental Payments.

The foregoing description of the Employment Agreement is intended to be a summary and is qualified in its entirety by reference to such document, which is attached as Exhibit 10.1 and is incorporated by reference herein.

Item 9.01. Financial Statements and Exhibits.

|

(d) Exhibits

|

|

|

|

10.1

|

|

Amended and Restated Employment Agreement, dated August 10, 2016, by and between Elizabeth Crowley and Celldex Therapeutics., Inc.

|

|

99.1

|

|

Press Release dated August 11, 2016

|

2

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

CELLDEX THERAPEUTICS, INC.

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Avery W. Catlin

|

|

|

|

Name: Avery W. Catlin

|

|

|

|

Title: Senior Vice President / Chief Financial

Officer

|

Dated: August 11, 2016

3

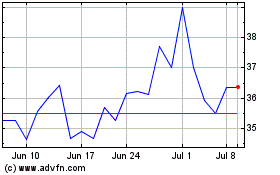

Celldex Therapeutics (NASDAQ:CLDX)

Historical Stock Chart

From Mar 2024 to Apr 2024

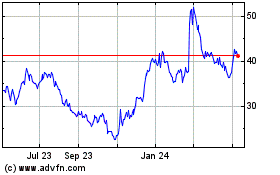

Celldex Therapeutics (NASDAQ:CLDX)

Historical Stock Chart

From Apr 2023 to Apr 2024