Franklin Street Properties Corp. Announces Acquisition of Pershing Park Plaza in Midtown Atlanta

August 10 2016 - 11:35AM

Business Wire

Franklin Street Properties Corp. (the “Company”, “FSP”, “our”

or “we”) (NYSE MKT: FSP), a real estate investment trust

(REIT), has acquired Pershing Park Plaza located at 1420 Peachtree

Street, NE in Atlanta, Georgia. Pershing Park Plaza is a nine-story

Class “A” office building that contains approximately 160,000

rentable square feet and is strategically located in Midtown

Atlanta.

The gross purchase price of Pershing Park Plaza was

approximately $45.5 million, or approximately $284 per rentable

square foot. The Company anticipates planned building capital

investments (excluding leasing costs) of approximately $1.8

million. Pershing Park Plaza is currently approximately 97% leased

to three tenants, with the largest being the international law firm

of Jones Day for approximately 88% of the rentable square

footage.

George J. Carter, Chairman and Chief Executive Officer,

commented as follows:

“We are pleased to expand our footprint further in Atlanta, with

our second investment in the dynamic Midtown submarket. We believe

that the acquisition of Pershing Park Plaza will provide additional

opportunities for value creation by growing our Midtown presence in

Atlanta to over 780,000 rentable square feet, when combined with

999 Peachtree Street. Pershing Park Plaza is a trophy quality

office property in a premier location that provides world-class

companies with walkable access to many of the finest cultural

attractions and amenities that Atlanta has to offer, as well as to

MARTA light rail.”

This press release, along with other news about FSP, is

available on the Internet at www.franklinstreetproperties.com. We

routinely post information that may be important to investors in

the Investor Relations section of our website. We encourage

investors to consult that section of our website regularly for

important information about us and, if they are interested in

automatically receiving news and information as soon as it is

posted, to sign up for E-mail Alerts.

About Franklin Street Properties Corp.

Franklin Street Properties Corp., based in Wakefield,

Massachusetts, is focused on investing in institutional-quality

office properties in the U.S. FSP’s strategy is to invest in select

urban infill and central business district (CBD) properties, with

primary emphasis on our top five markets of Atlanta, Dallas,

Denver, Houston, and Minneapolis. FSP seeks value-oriented

investments with an eye towards long-term growth and appreciation,

as well as current income. FSP is a Maryland corporation that

operates in a manner intended to qualify as a real estate

investment trust (REIT) for federal income tax purposes. To learn

more about FSP please visit our website at

www.franklinstreetproperties.com.

Forward-Looking Statements

Statements made in this press release that state FSP’s or

management’s intentions, beliefs, expectations, or predictions for

the future may be forward-looking statements within the meaning of

the Private Securities Litigation Reform Act of 1995. This press

release may also contain forward-looking statements based on

current judgments and current knowledge of management, which are

subject to certain risks, trends and uncertainties that could cause

actual results to differ materially from those indicated in such

forward-looking statements. Accordingly, readers are cautioned not

to place undue reliance on forward-looking statements. Investors

are cautioned that our forward-looking statements involve risks and

uncertainty, including without limitation, economic conditions in

the United States, disruptions in the debt markets, economic

conditions in the markets in which we own properties, risks of a

lessening of demand for the types of real estate owned by us,

changes in government regulations and regulatory uncertainty,

uncertainty about governmental fiscal policy, geopolitical events

and expenditures that cannot be anticipated such as utility rate

and usage increases, unanticipated repairs, additional staffing,

insurance increases and real estate tax valuation reassessments.

See the “Risk Factors” set forth in Part I, Item 1A of our Annual

Report on Form 10-K for the year ended December 31, 2015, as the

same may be updated from time to time in subsequent filings with

the United States Securities and Exchange Commission. Although we

believe the expectations reflected in the forward-looking

statements are reasonable, we cannot guarantee future results,

levels of activity, performance or achievements. We will not update

any of the forward-looking statements after the date of this press

release to conform them to actual results or to changes in our

expectations that occur after such date, other than as required by

law.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160810005804/en/

For Franklin Street Properties Corp.Georgia Touma,

877-686-9496Investor Relations

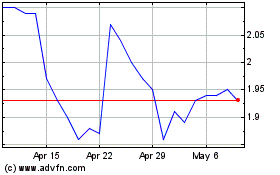

Franklin Street Properties (AMEX:FSP)

Historical Stock Chart

From Mar 2024 to Apr 2024

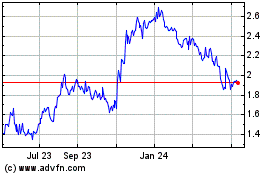

Franklin Street Properties (AMEX:FSP)

Historical Stock Chart

From Apr 2023 to Apr 2024