Revenues grew $4.6 million for the second

quarter of 2016 above the $10.0 million reported for second quarter

of 2015. Net loss also improved by $1.4 million during the second

quarter of 2016 compared to the second quarter of 2015.

Luna Innovations Incorporated (NASDAQ: LUNA) today announced its

financial results for the three and six months ended June 30,

2016.

Following Luna's merger with Advanced Photonix, Inc. ("API") in

May 2015, for the three months ended June 30, 2016, revenues

increased by $4.6 million, net loss improved by $1.4 million, and

adjusted earnings before interest, taxes, depreciation and

amortization ("Adjusted EBITDA") decreased by $0.1 million,

compared to the three months ended June 30, 2015. A reconciliation

of net loss to Adjusted EBITDA can be found in the schedules

included in this release.

“We are pleased with the inter-divisional interactions and

financial results from the API merger. This quarter we had strong

growth in the sales of our high speed optical receivers and our

distributed fiber optic sensing test systems," said My Chung,

president and chief executive officer of Luna. "The second quarter

continued to deliver strong demand for our 100G optical receivers

for the long haul data transmission market, 2.5G avalanche

photodiodes for the fiber to the premise market and increasing

adoption of our ODiSI systems for the measurement of strain in

composite materials. We continue to believe that our focus on these

strategic initiatives will provide significant growth opportunities

for us, providing enhanced value to our customers and to our

stockholders."

Second Quarter Financial

Summary

Total revenues for the three months ended June 30, 2016, were

$14.6 million compared to $10.0 million for the three months ended

June 30, 2015. This reflects an 18% increase over the combined

revenues of $12.4 million for Luna and API for the second quarter

of 2015. Product and licensing revenues grew to $10.5 million for

the three months ended June 30, 2016, compared to $6.3 million for

the three months ended June 30, 2015. Products and licensing

revenues grew 22% compared to the combined products and licensing

revenues of $8.6 million for Luna and API combined for the second

quarter of 2015. Technology development revenues were $4.1 million

for the three months ended June 30, 2016, compared to $3.7 million

for the three months ended June 30, 2015. Technology development

revenues grew 5% compared to the combined technology development

revenues of $3.9 million for Luna and API for the three months

ended June 30, 2015.

Gross profit increased to $5.2 million, or 35% of total

revenues, for the three months ended June 30, 2016, compared to

gross profit of $4.2 million, or 42% of total revenues, for the

three months ended June 30, 2015. The decrease in the gross margin

percentage in the second quarter of 2016 resulted from a greater

proportion of revenues being generated from the sales of high speed

optical receiver ("HSOR") products, which typically have a lower

gross margin percentage than the test & measurement products of

Luna's historical business.

Selling, general and administrative expenses were $4.6 million

for the three months ended June 30, 2016, compared to $5.5 million

for the three months ended June 30, 2015. Selling, general and

administrative expenses for the three months ended June 30, 2016

included $0.5 million of amortization of intangible assets

recognized from the merger with API. Selling, general and

administrative expenses for the three months ended June 30, 2015

included $1.7 million in non-recurring merger-related expenses.

Research, development and engineering expenses increased to $1.2

million for the second quarter of 2016 compared to $0.8 million for

the second quarter of 2015. The operations of API were not included

in our research, development and engineering expenses prior to the

closing of our merger on May 8, 2015, resulting in this increase in

research development and engineering expense.

Operating loss improved to $(0.7) million for the three months

ended June 30, 2016, compared to an operating loss of $(2.1)

million for the three months ended June 30, 2015. Net loss

attributable to common stockholders improved to $(0.8) million for

the three months ended June 30, 2016, compared to a net loss

attributable to common stockholders of $(2.2) million for the three

months ended June 30, 2015. Adjusted EBITDA decreased to $0.4

million for the three months ended June 30, 2016 compared to $0.6

million for the three months ended June 30, 2015.

Year to Date Financial

Summary

For the six months ended June 30, 2016, total revenues were

$28.6 million compared to $15.4 million for the six months ended

June 30, 2015. Total revenues of $28.6 million for the six months

ended June 30, 2016 reflect an increase of 18% compared to total

combined revenues of $24.2 million for Luna and API for the six

months ended June 30, 2015.

Gross profit increased to $10.0 million, or 35% of total

revenues, for the six months ended June 30, 2016 compared to $6.5

million, or 42% of total revenues, for the first six months of

2015. The decline in the gross margin percentage is attributable to

a greater proportion of revenues being generated from the sales of

HSOR products, which typically carry a lower gross margin than the

test & measurement products of Luna's historical business.

Selling, general and administrative expenses decreased to $9.2

million for the six months ended June 30, 2016 compared to $10.1

million for the six months ended June 30, 2015. Selling, general

and administrative expenses for the first six months of 2015

included $3.6 million of non-recurring merger-related expenses.

Research, development and engineering expenses were $2.8 million

for the six months ended June 30, 2016 compared to $1.1 million for

the first six months of 2015. The operations of API were not

included in our research, development, and engineering expenses

prior to the closing of our merger on May 8, 2015, resulting in

this increase in research, development and engineering expense.

Net loss attributable to common stockholders was $(2.3) million

for the six months ended June 30, 2016 compared to net income

attributable to common stockholders of $(4.8) million for the six

months ended June 30, 2015. Adjusted EBITDA improved to $0.3

million for the six months ended June 30, 2016 compared to $0.2

million for the six months ended June 30, 2015.

Non-GAAP Measures

In evaluating the operating performance of its business, Luna’s

management considers Adjusted EBITDA, which excludes certain

charges and credits that are required by generally accepted

accounting principles (“GAAP”). Adjusted EBITDA provides useful

information to both management and investors by excluding the

effect of certain non-cash expenses and items that Luna believes

may not be indicative of its operating performance, because either

they are unusual and Luna does not expect them to recur in the

ordinary course of its business or they are unrelated to the

ongoing operation of the business in the ordinary course, including

expenses incurred in connection with Luna's merger with API.

Adjusted EBITDA should be considered in addition to results

prepared in accordance with GAAP, but should not be considered a

substitute for, or superior to, GAAP results. Adjusted EBITDA has

been reconciled to the nearest GAAP measure in the table following

the financial statements attached to this press release.

Conference Call

Information

As previously announced, Luna will conduct an investor

conference call at 5:00 p.m. (EDT) today to discuss its financial

results for the three and six months ended June 30, 2016 and recent

business developments. The call can be accessed by dialing

844.578.9643 domestically or 270.823.1522 internationally prior to

the start of the call. The participant access code is

60786823. Investors are advised to dial in at least five

minutes prior to the call to register. The conference call will

also be webcast live over the Internet. The webcast can be accessed

by logging on to the “Investor Relations” section of the Luna

website, www.lunainc.com, prior to the

event. The webcast will be archived under the “Webcasts and

Presentations” section of the Luna website for at least 30 days

following the conference call.

About Luna

Luna Innovations Incorporated (www.lunainc.com) develops high

speed optics and high performance fiber optic test products that

provide unique capabilities for the aerospace, automotive, energy,

defense, and telecommunications industries. Luna develops,

manufactures and markets high definition fiber optic sensing

products and fiber optic test and measurement instrumentation, and

packages optoelectronic semiconductors into HSOR products, custom

optoelectronic subsystems (Optoelectronics products) and Terahertz

(THz) instrumentation. Luna is organized into two business

segments, which work closely together to turn ideas into products:

a Technology Development segment and a Products and Licensing

segment. Luna's business model is designed to accelerate the

process of bringing new and innovative technologies to market.

Forward-Looking

Statements

The statements in this release that are not historical facts

constitute “forward-looking statements” made pursuant to the safe

harbor provision of the Private Securities Litigation Reform Act of

1995 that involve risks and uncertainties. These statements include

Luna's expectations regarding Luna’s future financial performance,

continuing synergies following the merger with API, and potential

growth opportunities. Management cautions the reader that these

forward-looking statements are only predictions and are subject to

a number of both known and unknown risks and uncertainties, and

actual results, performance, and/or achievements of Luna may differ

materially from the future results, performance, and/or

achievements expressed or implied by these forward-looking

statements as a result of a number of factors. These factors

include, without limitation, failure of demand for Luna's products

and services to meet expectations, integration or other operational

issues related to the merger, technological challenges and those

risks and uncertainties set forth in Luna’s periodic reports and

other filings with the Securities and Exchange Commission ("SEC").

Such filings are available on the SEC’s website at www.sec.gov and

on Luna’s website at www.lunainc.com. The statements made in this

release are based on information available to Luna as of the date

of this release and Luna undertakes no obligation to update any of

the forward-looking statements after the date of this release.

Luna Innovations Incorporated Consolidated

Statements of Operations

Three Months Ended June

30,

Six Months Ended June

30,

2016 2015 2016 2015

(unaudited) (unaudited) Revenues:

Technology development $ 4,137,382 $ 3,728,271 $ 7,860,644 $

6,603,786 Products and licensing 10,509,522

6,297,475 20,773,273 8,761,062

Total revenues 14,646,904 10,025,746

28,633,917 15,364,848 Cost of revenues:

Technology development 3,181,447 2,576,145 6,061,282 4,659,769

Products and licensing 6,294,607 3,252,627

12,558,180 4,219,317 Total cost

of revenues 9,476,054 5,828,772

18,619,462 8,879,086 Gross profit

5,170,850 4,196,974 10,014,455

6,485,762 Operating expense: Selling, general and

administrative 4,581,776 5,518,656 9,227,060 10,087,609 Research,

development and engineering 1,240,655 801,221

2,791,146 1,136,111 Total

operating expense 5,822,431 6,319,877

12,018,206 11,223,720 Operating loss

(651,581 ) (2,122,903 ) (2,003,751 )

(4,737,958 ) Other income (expense): Other (expense) income, net

(39,489 ) 4,264 (35,545 ) 4,109 Interest expense (78,906 )

(49,966 ) (165,079 ) (59,103 ) Total other

expense (118,395 ) (45,702 ) (200,624 )

(54,994 ) Loss before income taxes (769,976 ) (2,168,605 )

(2,204,375 ) (4,792,952 ) Income tax expense 1,000

— 26,175 2,808 Net loss

(770,976 ) (2,168,605 ) (2,230,550 ) (4,795,760 ) Preferred stock

dividend 24,580 20,021 45,790

46,581 Net loss attributable to common

stockholders $ (795,556 ) $ (2,188,626 ) $ (2,276,340 ) $

(4,842,341 ) Net loss per share attributable to common

stockholders: Basic and diluted $ (0.03 ) $ (0.10 ) $ (0.08 ) $

(0.26 ) Weighted average common shares and common equivalent shares

outstanding: Basic and diluted 27,557,960

21,997,768 27,517,792 18,577,006

Luna Innovations Incorporated Consolidated

Balance Sheets June 30, 2016

December 31,2015

(unaudited) Assets Current assets: Cash and cash

equivalents $ 13,807,799 $ 17,464,040 Accounts receivable, net

11,151,791 11,034,557 Inventory 8,389,095 8,863,167 Prepaid

expenses and other current assets 1,694,810

1,388,439 Total current assets 35,043,495 38,750,203

Property and equipment, net 7,362,464 6,614,238 Intangible assets,

net 9,490,702 10,404,312 Goodwill 2,348,331 2,274,112 Other assets

88,948 88,948

Total

assets $ 54,333,940 $ 58,131,813

Liabilities and stockholders’ equity Liabilities: Current

Liabilities: Current portion of long-term debt obligations $

1,833,333 $ 1,833,333 Current portion of capital lease obligations

50,335 31,459 Accounts payable 3,889,383 4,054,425 Accrued

liabilities 7,524,569 8,304,686 Deferred revenue 1,027,929

1,109,759 Total current liabilities

14,325,549 15,333,662 Long-term deferred rent 1,481,824 1,564,229

Long-term debt obligations 3,375,000 4,291,667 Long-term capital

lease obligations 141,457 35,237

Total liabilities 19,323,830

21,224,795 Commitments and contingencies Stockholders’

equity: Preferred stock, par value $0.001, 1,321,514 shares

authorized, issued and outstanding at June 30, 2016 and December

31, 2015 1,322 1,322 Common stock, par value $0.001, 100,000,000

shares authorized, 27,988,103 and 27,644,832 shares issued,

27,692,776 and 27,477,181 shares outstanding at June 30, 2016 and

December 31, 2015 28,241 28,178 Treasury stock at cost, 300,327 and

167,652 shares at June 30, 2016 and December 31, 2015 (341,320 )

(184,934 ) Additional paid-in capital 81,997,662 81,461,907

Accumulated deficit (46,675,795 ) (44,399,455

)

Total stockholders’ equity 35,010,110

36,907,018

Total liabilities and stockholders’

equity $ 54,333,940 $ 58,131,813

Luna Innovations Incorporated Consolidated

Statements of Cash Flows Six Months Ended June

30, 2016 2015 (unaudited) Cash

flows used in operating activities Net loss $ (2,230,550

) $ (4,795,760 ) Adjustments to reconcile net loss to net cash used

in operating activities Depreciation and amortization 1,861,603

824,251 Share-based compensation 465,028 571,439 Bad debt expense

50,515 10,375 Change in assets and liabilities Accounts receivable

(167,749 ) (335,811 ) Inventory 474,072 (1,345,687 ) Other current

assets (306,371 ) (358,794 ) Accounts payable and accrued expenses

(1,076,784 ) (1,271,686 ) Deferred revenue (81,830 )

(154,189 ) Net cash used in operating activities

(1,012,066 ) (6,855,862 )

Cash flows (used in)

provided by investing activities Acquisition of property and

equipment (1,294,775 ) (50,175 ) Intangible property costs (244,198

) (123,578 ) Cash acquired in business combination —

374,517 Net cash (used in) provided by

investing activities (1,538,973 ) 200,764

Cash flows (used in) provided by financing activities

Payments on capital lease obligations (32,149 ) (36,406 ) Payments

of debt obligations (916,667 ) (5,962,355 ) Repurchase of common

stock (156,386 ) (33,113 ) Proceeds from term loan — 6,000,000

Proceeds from the exercise of options —

82,516 Net cash (used in) provided by financing activities

(1,105,202 ) 50,642

Net decrease in

cash or cash equivalents (3,656,241 ) (6,604,456 ) Cash and

cash equivalents-beginning of period 17,464,040

14,116,969 Cash and cash equivalents-end of

period $ 13,807,799 $ 7,512,513

Luna Innovations Incorporated Reconciliation of Net Loss

to EBITDA and Adjusted EBITDA

Three Months Ended June

30,

Six Months Ended June

30,

2016 2015 2016 2015

(unaudited) (unaudited) Net loss $ (770,976 )

$ (2,168,605 ) $ (2,230,550 ) $ (4,795,760 ) Interest

expense 78,906 49,966 165,079 59,103 Tax expense 1,000 — 26,175

2,808 Depreciation and amortization 921,804

659,170 1,861,603 824,251

EBITDA 230,734 (1,459,469 ) (177,693 ) (3,909,598 )

Share-based compensation 206,225 300,362 465,028 571,439

Non-recurring merger-related charges —

1,740,286 — 3,541,502

Adjusted EBITDA $ 436,959 $ 581,179 $ 287,335

$ 203,343

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160809006235/en/

Investor Contact:Luna Innovations IncorporatedDale

Messick, CFO1-540-769-8400IR@lunainc.com

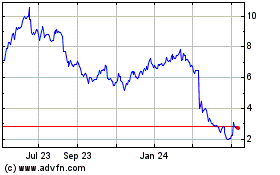

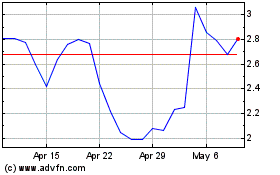

Luna Innovations (NASDAQ:LUNA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Luna Innovations (NASDAQ:LUNA)

Historical Stock Chart

From Apr 2023 to Apr 2024