First Railcar of Isobutanol Shipped to

Musket Corporation- Gevo to Host Conference Call Today at

4:30 p.m. EDT/2:30 MDT -

Gevo, Inc. (NASDAQ:GEVO) today announced financial results for the

three months ended June 30, 2016. Key highlights for the quarter

included:

- Gevo produced approximately 80,000 gallons of isobutanol during

the quarter.

- Gevo entered into an agreement with Musket Corporation to

supply isobutanol as a “non-ethanol” oxygenate, which has been

identified as an unmet need in the market, for blending with

gasoline. Musket is a major, national fuel distributor under

the umbrella of the Love’s Family of Companies, one of the largest

fuel retailers in the U.S. Initial target markets are

expected to include the marine and off-road markets in Arizona,

Nevada, and Utah. Musket has taken delivery of its first railcar of

isobutanol and is moving it through their distribution system.

- The first two commercial flights using Gevo’s renewable alcohol

to jet fuel (ATJ) took place on June 7, 2016. The flights

originated in Seattle and flew to San Francisco International

Airport and Ronald Reagan Washington National Airport,

respectively. The two Alaska Airlines flights utilized a 20 percent

ATJ fuel blend.

- Gevo entered into an agreement with Clariant Corp., one of the

world’s leading specialty chemical companies, to develop catalysts

to enable Gevo’s Ethanol-To-Olefins (ETO) technology. Gevo’s ETO

technology, which uses ethanol as a feedstock, produces tailored

mixes of propylene, isobutylene and hydrogen, which are valuable as

standalone molecules, or as feedstocks to produce downstream

derivative products such as diesel fuel, chemical intermediates,

and polymers that would be drop-in replacements for their

fossil-based equivalents. Clariant is committed to the development

and scale-up of the catalyst.

- On June 15, 2016, Gevo closed a best efforts public offering of

21,080,456 shares of common stock at a public offering price of

$0.45 per share. The gross proceeds to Gevo from this

offering were approximately $9.5 million.

- During the quarter, Gevo received proceeds of approximately

$10.8 million through the exercise of warrants. Approximately 36.3

million shares were issued as result of these exercises.

- On April 1, 2016, Gevo completed the sale of 3,721,429 Series C

units and 6,571,429 Series D units pursuant to an underwritten

public offering. Gevo received gross proceeds of

approximately $3.5 million, not including future proceeds from the

exercise of any of the warrants associated with the units.

Outlook for 2016

As previously disclosed, Gevo restarted production of isobutanol

at its production facility in Luverne, Minnesota in March

2016. All operations, including the distillation system, are

now up and running. During 2016, Gevo has produced

approximately 168,000 gallons of isobutanol and one fermentation

batch surpassed 20,000 gallons of isobutanol, slightly exceeding

the high end of the range of our previously announced goal of

18,000-20,000 gallons per batch. The fermentation process is

working well.

It has, however, taken Gevo longer than expected to complete

installation of some additional distillation system equipment that

was needed after initial operation of

the distillation system began in March 2016.

As a result, the onset of the production rate ramp-up was delayed

and therefore the total annual 2016 production volume is projected

to be lower than previously projected.

For the reasons discussed above, Gevo is changing its previously

issued guidance in terms of production gallons in 2016 to the

following:

- Gevo now expects isobutanol production at its production

facility in Luverne to be in a range of 500,000 to 650,000 gallons

in 2016.

At this time, based upon the results at Luverne, Gevo re-affirms

that it is on track to meet the other components of its previously

issued 2016 guidance as follows. Gevo expects to:

- Decrease the variable cost of producing isobutanol at its

Luverne production facility to a range of $3.00-$3.50/gallon

(assumes corn price of $3.65 per bushel and nets the value of the

isobutanol distiller's grains (the "iDGs™"), enabling isobutanol to

be produced at a positive contribution margin, based on an expected

average selling price for isobutanol of between

$3.50-$4.50/gallon.

- Increase sales of isobutanol into core markets such as the

renewable ATJ fuel, marina, off-road, isooctane and solvents

markets.

- Achieve an average quarterly corporate-wide EBITDA burn rate

(excluding stock-based compensation) of $3.5-$4.5 million.

Corporate-wide EBITDA burn rate is calculated by adding back

depreciation and non-cash stock compensation to GAAP Loss From

Operations.

Through the balance of 2016 and into 2017, Gevo will be focused

on optimization work to improve the Luverne production facility at

its current scale, but more importantly with a view towards

significantly expanding the Luverne production facility. Gevo

plans to optimize the overall production processes with the intent

of improving robustness and consistency of production, increasing

production volumes, and potentially producing specific grades of

isobutanol tailored for specific applications. This

optimization work could result in Gevo needing to add more

equipment (tanks, controls, pumps, distillation columns, etc.),

systems or processes in the future at the Luverne production

facility.

Despite the production ramp-up delays described above, Gevo

expects that by the end of 2016 to have the capability to be at a

production run rate equivalent to 1.5 million gallons per year at

its Luverne production facility. Although Gevo expects to

have this production capability, Gevo currently expects to run at a

rate less than 1.5 million gallons per year during 2017 as it

scales up and tests new process improvements to further reduce

costs and optimize production in general at the Luverne production

facility with a view towards significantly expanding production

capacity in the future.

“The first half of 2016 has been a significant inflection point

for Gevo. We have achieved a number of key milestones year-to date,

including restarting isobutanol production at Luverne,

demonstrating successful commercial airline flights using our fuel,

signing a key distribution agreement with Musket targeting the

specialty fuel markets, and strengthening our balance sheet to

include $22.6 million in cash as of the end of the second quarter,”

said Dr. Patrick Gruber, Gevo’s Chief Executive Officer.

“I am pleased that all operations, including the distillation

system, at our plant in Luverne are up and running and that the

fermentations are going well. In fact, we are seeing up to

20,000 gallons of isobutanol per batch, and we remain on track to

achieve our cost targets. While the technologies are working,

we still need to continue the plant optimization learning curve,

turning our attention to shortening batch cycle times and, given

the importance of jet and isooctane, tailoring specific grades for

those applications, particularly as it relates to the design of a

large scale hydrocarbon plant,” said Dr. Patrick Gruber, Gevo’s

Chief Executive Officer.

“On the market and sales front we have made good progress.

Conducting commercial airline flights using our ATJ was a

tremendous milestone. While all the testing had previously

been completed during the six years of work with ASTM

International, flying actual flights with our jet fuel demonstrates

to people that this really can be done commercially. We are

grateful to Alaska Airlines for being a good partner and we

continue to have positive conversations with several potential

customers in the aviation industry. We also made further

progress in the development of the gasoline blendstock

markets. We are extremely pleased to have a national player

such as Musket as a partner, and it is good to see they are already

distributing isobutanol-blended fuel into their customer network,”

added Dr. Gruber.

Financial Highlights

Revenues for the second quarter of 2016 were $8.1 million

compared with $8.9 million in the same period in 2015. During the

second quarter of 2016, revenues derived at the Luverne plant were

$7.2 million, a decrease of approximately $0.8 million from the

same period in 2015. This was primarily a result of lower ethanol

production, ethanol prices and distiller grain prices in the 2nd

quarter of 2016 versus the same period in 2015.

During the second quarter of 2016, hydrocarbon revenues were

$0.7 million, flat as compared to the same period in 2015. Gevo’s

hydrocarbon revenues were comprised of sales of jet fuel, isooctane

and isooctene.

Gevo generated grant revenue of $0.2 million during the second

quarter of 2016, also flat as compared to the same period in 2015.

Gevo’s grant revenue is primarily generated through the work it is

doing with the Northwest Advanced Renewables Alliance to produce

isobutanol from cellulosic feedstocks, such as wood waste, which

can then be converted into Gevo’s ATJ.

Cost of goods sold was flat during the three months ended June

30, 2016, compared with the same quarter in 2015. Cost of goods

sold included approximately $8.5 million associated with the

production of ethanol, isobutanol and related products

and approximately $1.5 million in depreciation expense.

Gross loss was $1.9 million for the three months ended June 30,

2016.

Research and development expense decreased by approximately $0.3

million during the three months ended June 30, 2016, compared with

the same quarter in 2015, due primarily to a reduction in employee

related expenses.

Selling, general and administrative expense decreased by $1.6

million during the three months ended June 30, 2016, compared with

the same quarter in 2015, due primarily to a decrease of $1.3

million in litigation legal expenses.

Loss from operations in the second quarter of 2016 was $5.5

million, compared with $6.5 million in the same quarter in

2015.

Non-GAAP cash EBITDA loss in the second quarter of 2016 was $3.6

million, compared with $4.6 million in the same quarter in

2015.

Interest expense in the second quarter of 2016 was $2.2 million,

which was an increase of $0.2 million over the same quarter last

year.

During the three months ended June 30, 2016, the estimated fair

value of the derivative warrant liability decreased by $10.6

million, resulting in a non-cash loss from change in fair value of

derivative warrant liability, primarily associated with the

increase in the price of Gevo’s common stock in the quarter.

During the three months ended June 30, 2016, Gevo also incurred

a $0.9 million non-cash loss on the extinguishment of warrant

liabilities, associated with adjustments to the exercise prices on

certain of Gevo’s Series D and Series H warrants.

Gevo also incurred a non-cash loss of $0.9 million during the

quarter due to the quarterly mark-to-market valuation of the 2017

Notes.

During the three months ended June 30, 2016, there was no change

in the value of the embedded derivatives in the convertible notes

issued in 2012 (the 2022 Notes), as the derivatives have had no

meaningful value since the third quarter of 2014. No holders

of the 2022 Notes converted or exchanged any notes during the

quarter.

During the three months ended June 30, 2016, we reported a $1.5

million loss associated with the April equity issuance primarily as

a result of the estimated fair value of the common stock and

warrants issued being greater than the consideration received in

exchange.

The net loss for the second quarter of 2016 was $21.5 million,

compared with $14.4 million during the same period in 2015.

The non-GAAP adjusted net loss for the second quarter of 2016

was $7.5 million, compared with $8.6 million during the same period

in 2015.

The cash position at June 30, 2016 was $22.6 million.

Webcast and Conference Call Information

Hosting today’s conference call at 4:30 p.m. EDT (2:30 p.m. MDT)

will be Dr. Patrick Gruber, Chief Executive Officer, Mike Willis,

Chief Financial Officer, and Geoff Williams, General Counsel. They

will review Gevo’s financial results and provide an update on

recent corporate highlights.

To participate in the conference call, please dial 1(847)

585-4405 (inside the U.S.) or 1(888) 771-4371 (outside the U.S.)

and reference the access code 43066415. A replay of the call and

webcast will be available two hours after the conference call ends

on August 9, 2016. To access the replay, please dial 1(630)

652-3042 (inside the US) or 1(888) 843-7419 (outside the US) and

reference the access code 43066415#. The archived webcast will be

available in the Investor Relations section of Gevo's website at

www.gevo.com.

About Gevo

Gevo is a leading renewable technology, chemical products, and

next generation biofuels company. Gevo has developed proprietary

technology that uses a combination of synthetic biology, metabolic

engineering, chemistry and chemical engineering to focus primarily

on the production of isobutanol, as well as related products from

renewable feedstocks. Gevo’s strategy is to commercialize biobased

alternatives to petroleum-based products to allow for the

optimization of fermentation facilities’ assets, with the ultimate

goal of maximizing cash flows from the operation of those assets.

Gevo produces isobutanol, ethanol and high-value animal feed at its

fermentation plant in Luverne, Minnesota. Gevo has also developed

technology to produce hydrocarbon products from renewable alcohols.

Gevo currently operates a biorefinery in Silsbee, Texas, in

collaboration with South Hampton Resources Inc., to produce

renewable jet fuel, octane, and ingredients for plastics like

polyester. Gevo has a marquee list of partners including The

Coca-Cola Company, Toray Industries Inc. and Total SA, among

others. Gevo is committed to a sustainable bio-based economy that

meets society’s needs for plentiful food and clean air and

water.

Forward-Looking Statements

Certain statements in this press release may constitute

"forward-looking statements" within the meaning of the Private

Securities Litigation Reform Act of 1995. These forward-looking

statements relate to a variety of matters, including, without

limitation, statements related to the ability of Gevo to produce

isobutanol at Gevo’s Luverne, Minnesota production facility, Gevo’s

ability to achieve its production and cost guidance, Gevo’s ability

to secure new customer relationships across core markets, and other

statements that are not purely statements of historical fact.

These forward-looking statements are made on the basis of the

current beliefs, expectations and assumptions of the management of

Gevo and are subject to significant risks and uncertainty.

Investors are cautioned not to place undue reliance on any such

forward-looking statements. All such forward-looking statements

speak only as of the date they are made, and Gevo undertakes no

obligation to update or revise these statements, whether as a

result of new information, future events or otherwise. Although

Gevo believes that the expectations reflected in these

forward-looking statements are reasonable, these statements involve

many risks and uncertainties that may cause actual results to

differ materially from what may be expressed or implied in these

forward-looking statements. For a further discussion of risks and

uncertainties that could cause actual results to differ from those

expressed in these forward-looking statements, as well as risks

relating to the business of Gevo in general, see the risk

disclosures in the Annual Report on Form 10-K of Gevo for the year

ended December 31, 2015, and in subsequent reports on Forms 10-Q

and 8-K and other filings made with the U.S. Securities and

Exchange Commission by Gevo.

Non-GAAP Financial Information

This press release contains financial measures that do not

comply with U.S. generally accepted accounting principles (GAAP),

non-GAAP cash EBITDA and adjusted loss per share. On a non-GAAP

basis, non-GAAP cash EBITDA excludes non-cash items such as

depreciation and stock-based compensation. On a non-GAAP basis,

non-GAAP adjusted loss per share excludes non-cash gains and/or

losses recognized in the quarter due to the changes in the fair

value of certain of our financial instruments, such as warrants,

convertible debt and embedded derivatives. Management believes

these measures are useful to supplements to its GAAP financial

statements with this non-GAAP information because management uses

such information internally for its operating, budgeting and

financial planning purposes. These non-GAAP financial measures also

facilitate management's internal comparisons to Gevo’s historical

performance as well as comparisons to the operating results of

other companies. In addition, Gevo believes these non-GAAP

financial measures are useful to investors because they allow for

greater transparency into the indicators used by management as a

basis for its financial and operational decision making. Non-GAAP

information is not prepared under a comprehensive set of accounting

rules and therefore, should only be read in conjunction with

financial information reported under U.S. GAAP when understanding

Gevo’s operating performance. A reconciliation between GAAP and

non-GAAP financial information is provided in the financial

statement tables below.

Reverse Stock Split

On April 15, 2015, our Board of Directors approved a reverse

split of our common stock, par value $0.01, at a ratio of

one-for-fifteen. This reverse stock split became

effective on April 20, 2015 and, unless otherwise indicated, all

share amounts, per share data, share prices, exercise prices and

conversion rates set forth in this press release and the

accompanying consolidated financial statements have, where

applicable, been adjusted to reflect this reverse stock split.

| |

|

|

|

|

| Gevo, Inc. |

|

|

|

|

| Condensed Consolidated Statements of Operations

Information |

|

|

|

|

| (Unaudited, in thousands, except share and per share

amounts) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended June 30, |

|

Six Months Ended June 30, |

|

|

|

2016 |

|

|

|

2015 |

|

|

|

2016 |

|

|

|

2015 |

|

| Revenue and

cost of goods sold |

|

|

|

|

|

|

|

| Ethanol

sales and related products, net |

$ |

7,168 |

|

|

$ |

7,955 |

|

|

$ |

12,925 |

|

|

$ |

13,053 |

|

|

Hydrocarbon revenue |

|

713 |

|

|

|

740 |

|

|

|

1,011 |

|

|

|

1,257 |

|

| Grant and

other revenue |

|

232 |

|

|

|

229 |

|

|

|

497 |

|

|

|

513 |

|

| Total revenues |

|

8,113 |

|

|

|

8,924 |

|

|

|

14,433 |

|

|

|

14,823 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of goods

sold |

|

9,989 |

|

|

|

9,898 |

|

|

|

19,212 |

|

|

|

19,132 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross

loss |

|

(1,876 |

) |

|

|

(974 |

) |

|

|

(4,779 |

) |

|

|

(4,309 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating

expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Research

and development expense |

|

1,469 |

|

|

|

1,765 |

|

|

|

2,513 |

|

|

|

3,487 |

|

| Selling,

general and administrative expense |

|

2,147 |

|

|

|

3,792 |

|

|

|

4,066 |

|

|

|

8,271 |

|

| Total operating

expenses |

|

3,616 |

|

|

|

5,557 |

|

|

|

6,579 |

|

|

|

11,758 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss from

operations |

|

(5,492 |

) |

|

|

(6,531 |

) |

|

|

(11,358 |

) |

|

|

(16,067 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other (expense)

income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest

expense |

|

(2,246 |

) |

|

|

(2,029 |

) |

|

|

(4,396 |

) |

|

|

(4,064 |

) |

| Gain on

conversion of debt |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

285 |

|

|

(Loss)/Gain on extinguishment of warrant liability |

|

(923 |

) |

|

|

1,775 |

|

|

|

(923 |

) |

|

|

1,775 |

|

|

(Loss)/Gain from change in fair value of the 2017 Notes |

|

(940 |

) |

|

|

(340 |

) |

|

|

(1,775 |

) |

|

|

3,425 |

|

|

(Loss)/Gain from change in fair value of derivative warrant

liability |

|

(10,573 |

) |

|

|

(7,247 |

) |

|

|

(5,325 |

) |

|

|

(7,080 |

) |

| Loss on

issuance of equity |

|

(1,519 |

) |

|

|

- |

|

|

|

(1,519 |

) |

|

|

- |

|

| Other

income |

|

206 |

|

|

|

2 |

|

|

|

206 |

|

|

|

13 |

|

| Total

other expense, net |

|

(15,995 |

) |

|

|

(7,839 |

) |

|

|

(13,732 |

) |

|

|

(5,646 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss |

$ |

(21,487 |

) |

|

$ |

(14,370 |

) |

|

$ |

(25,090 |

) |

|

$ |

(21,713 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss per share -

basic and diluted |

$ |

(0.44 |

) |

|

$ |

(1.10 |

) |

|

$ |

(0.70 |

) |

|

$ |

(2.03 |

) |

| Weighted-average number

of common shares |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

outstanding - basic and diluted |

|

49,085,638 |

|

|

|

13,009,434 |

|

|

|

36,050,983 |

|

|

|

10,673,891 |

|

|

Gevo, Inc. |

|

|

|

| Condensed

Consolidated Balance Sheet Information |

|

|

|

| (Unaudited, in

thousands) |

|

|

|

| |

|

|

|

| |

June 30, |

|

December

31, |

| |

|

2016 |

|

|

|

2015 |

|

|

Assets |

|

|

|

| Current assets: |

|

|

|

| Cash and

cash equivalents |

$ |

22,617 |

|

|

$ |

17,031 |

|

| Accounts

receivable |

|

1,674 |

|

|

|

1,391 |

|

|

Inventories |

|

2,885 |

|

|

|

3,487 |

|

| Prepaid

expenses and other current assets |

|

884 |

|

|

|

731 |

|

| Total

current assets |

|

28,060 |

|

|

|

22,640 |

|

|

|

|

|

|

|

|

|

|

| Property,

plant and equipment, net |

|

77,773 |

|

|

|

76,777 |

|

| Deposits

and other assets |

|

3,414 |

|

|

|

3,414 |

|

| Total

assets |

$ |

109,247 |

|

|

$ |

102,831 |

|

| |

|

|

|

|

|

|

|

|

Liabilities |

|

|

|

|

|

|

|

| Current

liabilities: |

|

|

|

|

|

|

|

| Accounts

payable, accrued liabilities and other current liabilities |

$ |

4,703 |

|

|

$ |

7,476 |

|

|

Derivative warrant liability |

|

6,150 |

|

|

|

10,493 |

|

| Current

portion of secured debt, net |

|

324 |

|

|

|

330 |

|

| Current

portion 2017 Notes recorded at fair value |

|

23,340 |

|

|

|

- |

|

| Total

current liabilities |

|

34,517 |

|

|

|

18,299 |

|

| Long-term portion of

secured debt, net |

|

- |

|

|

|

153 |

|

| Long term

portion 2017 Notes recorded at fair value |

|

- |

|

|

|

21,565 |

|

| 2022

Notes, net |

|

16,545 |

|

|

|

14,341 |

|

| Other

long-term liabilities |

|

- |

|

|

|

147 |

|

| Total

liabilities |

|

51,062 |

|

|

|

54,505 |

|

| |

|

|

|

|

|

|

|

| Total

stockholders’ equity |

|

58,185 |

|

|

|

48,326 |

|

| Total liabilities and

stockholders' equity |

$ |

109,247 |

|

|

$ |

102,831 |

|

| Gevo,

Inc. |

|

|

|

| Condensed

Consolidated Cash Flow Information |

|

|

|

| (Unaudited, in

thousands) |

|

|

|

| |

|

|

|

| |

Six Months Ended June 30, |

| |

|

2016 |

|

|

|

2015 |

|

| Operating

Activities |

|

|

|

|

|

|

|

| Net loss |

$ |

(25,090 |

) |

|

$ |

(21,713 |

) |

| Adjustments to

reconcile net loss to net cash used in operating activities: |

|

|

|

|

|

|

|

|

Loss/(Gain) from change in fair value of derivative warrant

liability |

|

5,325 |

|

|

|

7,080 |

|

|

Loss/(Gain) from change in fair value of the 2017 Notes |

|

1,775 |

|

|

|

(3,425 |

) |

|

Loss/(Gain) on conversion of debt |

|

- |

|

|

|

(285 |

) |

| Gain on

extinguishment of warrant liability |

|

923 |

|

|

|

(1,775 |

) |

| Loss on

equity issuance |

|

1,519 |

|

|

|

- |

|

|

Stock-based compensation |

|

542 |

|

|

|

698 |

|

|

Depreciation and amortization |

|

3,282 |

|

|

|

3,281 |

|

| Non-cash

interest expense |

|

2,130 |

|

|

|

1,767 |

|

| Other

non-cash expenses |

|

- |

|

|

|

- |

|

| Changes in operating

assets and liabilities: |

|

|

|

|

|

|

|

| Accounts

receivable |

|

(283 |

) |

|

|

42 |

|

|

Inventories |

|

602 |

|

|

|

1,389 |

|

| Prepaid

expenses and other current assets |

|

(153 |

) |

|

|

160 |

|

| Accounts

payable, accrued expenses, and long-term liabilities |

|

(1,937 |

) |

|

|

(2,104 |

) |

| Net cash

used in operating activities |

|

(11,365 |

) |

|

|

(14,885 |

) |

| |

|

|

|

|

|

|

|

| Investing

Activities |

|

|

|

|

|

|

|

| Acquisitions of

property, plant and equipment |

|

(4,847 |

) |

|

|

(175 |

) |

| Proceeds from

sales tax refund for property, plant and equipment |

|

- |

|

|

|

144 |

|

| Net cash

used in investing activities |

|

(4,847 |

) |

|

|

(31 |

) |

| |

|

|

|

|

|

|

|

| Financing

Activities |

|

|

|

|

|

|

|

| Payments

on secured debt |

|

(84 |

) |

|

|

(131 |

) |

| Debt and

equity offering costs |

|

(1,997 |

) |

|

|

(2,785 |

) |

| Proceeds

from issuance of common stock and common stock units |

|

13,023 |

|

|

|

23,850 |

|

| Proceeds

from the exercise of warrants |

|

10,856 |

|

|

|

10,151 |

|

| Net cash

provided by financing activities |

|

21,798 |

|

|

|

31,085 |

|

| |

|

|

|

|

|

|

|

| Net increase (decrease)

in cash and cash equivalents |

|

5,586 |

|

|

|

16,169 |

|

| |

|

|

|

|

|

|

|

| Cash and cash

equivalents |

|

|

|

|

|

|

|

| Beginning

of period |

|

17,031 |

|

|

|

6,359 |

|

| End of

period |

$ |

22,617 |

|

|

$ |

22,528 |

|

|

Gevo, Inc. |

|

|

|

|

|

Reconciliation of GAAP to Non-GAAP Financial

Information |

|

|

|

|

| (Unaudited, in

thousands) |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

Three Months Ended June 30, |

|

Six Months Ended June 30, |

| Non-GAAP Cash

EBITDA: |

|

2016 |

|

|

|

2015 |

|

|

|

2016 |

|

|

|

2015 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gevo Development, LLC /

Agri-Energy, LLC |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss from

operations |

$ |

(2,936 |

) |

|

$ |

(2,091 |

) |

|

$ |

(6,494 |

) |

|

$ |

(6,403 |

) |

|

Depreciation and amortization |

|

1,497 |

|

|

|

1,417 |

|

|

|

2,949 |

|

|

|

2,868 |

|

| Non-cash

stock-based compensation |

|

3 |

|

|

|

- |

|

|

|

8 |

|

|

|

(2 |

) |

| Non-GAAP cash

EBITDA |

$ |

(1,436 |

) |

|

$ |

(674 |

) |

|

$ |

(3,537 |

) |

|

$ |

(3,537 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gevo, Inc. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss from

operations |

$ |

(2,556 |

) |

|

$ |

(4,440 |

) |

|

$ |

(4,864 |

) |

|

$ |

(9,664 |

) |

|

Depreciation and amortization |

|

164 |

|

|

|

202 |

|

|

|

332 |

|

|

|

413 |

|

| Non-cash

stock-based compensation |

|

181 |

|

|

|

296 |

|

|

|

534 |

|

|

|

700 |

|

| Non-GAAP cash

EBITDA |

$ |

(2,211 |

) |

|

$ |

(3,942 |

) |

|

$ |

(3,998 |

) |

|

$ |

(8,551 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gevo Consolidated |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss from

operations |

$ |

(5,492 |

) |

|

$ |

(6,531 |

) |

|

$ |

(11,358 |

) |

|

$ |

(16,067 |

) |

|

Depreciation and amortization |

|

1,661 |

|

|

|

1,619 |

|

|

|

3,281 |

|

|

|

3,281 |

|

| Non-cash

stock-based compensation |

|

184 |

|

|

|

296 |

|

|

|

542 |

|

|

|

698 |

|

| Non-GAAP cash

EBITDA |

$ |

(3,647 |

) |

|

$ |

(4,616 |

) |

|

$ |

(7,535 |

) |

|

$ |

(12,088 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-GAAP

Adjusted Net Loss: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gevo Consolidated |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net

Loss |

|

(21,487 |

) |

|

|

(14,370 |

) |

|

|

(25,090 |

) |

|

|

(21,713 |

) |

| Gain on

conversion of debt |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

285 |

|

|

(Loss)/Gain on extinguishment of warrant liability |

|

(923 |

) |

|

|

1,775 |

|

|

|

(923 |

) |

|

|

1,775 |

|

|

(Loss)/Gain from change in fair value of the 2017 Notes |

|

(940 |

) |

|

|

(340 |

) |

|

|

(1,775 |

) |

|

|

3,425 |

|

|

(Loss)/Gain from change in fair value of derivative warrant

liability |

|

(10,573 |

) |

|

|

(7,247 |

) |

|

|

(5,325 |

) |

|

|

(7,080 |

) |

| Loss on

issuance of equity |

|

(1,519 |

) |

|

|

- |

|

|

|

(1,519 |

) |

|

|

- |

|

| Non-GAAP

Net Loss |

$ |

(7,532 |

) |

|

$ |

(8,558 |

) |

|

$ |

(15,548 |

) |

|

$ |

(20,118 |

) |

| Weighted-average number

of common shares outstanding - basic and diluted |

|

49,085,638 |

|

|

|

13,009,434 |

|

|

|

36,050,983 |

|

|

|

10,673,891 |

|

| Non-GAAP Adjusted Net

loss per share - basic and diluted |

$ |

(0.15 |

) |

|

$ |

(0.66 |

) |

|

$ |

(0.43 |

) |

|

$ |

(1.88 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

[1] Adjusted net loss per share is calculated by adding back

non-cash gains and/or losses recognized in the quarter due to the

changes in the fair value of certain of our financial instruments,

such as warrants, convertible debt and embedded derivatives; a

reconciliation of adjusted net loss per share to net loss per share

is provided in the financial statement tables following this

release.

[2]Cash EBITDA loss is calculated by adding back depreciation

and non-cash stock compensation to GAAP Loss From Operations; a

reconciliation of cash EBITDA loss to GAAP loss from operations is

provided in the financial statement tables following this

release.

Media Contact

David Rodewald

The David James Agency, LLC

+1 805-494-9508

gevo@davidjamesagency.com

Investor Contact

Shawn M. Severson

EnergyTech Investor, LLC

+1 415-233-7094

shawn@energytechinvestor.com

@ShawnEnergyTech

www.energytechinvestor.com

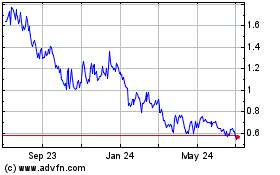

Gevo (NASDAQ:GEVO)

Historical Stock Chart

From Mar 2024 to Apr 2024

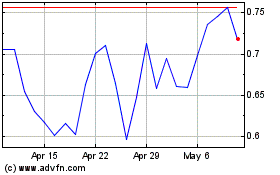

Gevo (NASDAQ:GEVO)

Historical Stock Chart

From Apr 2023 to Apr 2024