Coherus BioSciences, Inc. (Nasdaq:CHRS), today reported financial

results and reviewed corporate events for the second quarter ended

June 30, 2016.

Corporate Highlights for the Second Quarter 2016

Include:

- Immunology (anti-TNF) therapeutic franchise:

- CHS-1420 (adalimumab (HUMIRA®) biosimilar)

- Received favorable decision from the Patent Trial and Review

Board (PTAB) for the United States Patent and Trademark Office

(USPTO) instituting Coherus' petition for Inter Partes Review (IPR)

of AbbVie’s U.S. patent 8,889,135 (“the ‘135 patent”), 9,017,680

and 9,073,987 (patents ‘680 and ‘987, respectively), which are all

related to the dosing regimen for AbbVie’s Humira (adalimumab) to

treat rheumatoid arthritis.

- Issued patents from the USPTO for U.S. patents 9,340,611;

9,340,612 and 9,346,880 generally concerning the formulations of

adalimumab, the active biologic ingredient in Coherus’ Humira

biosimilar.

- CHS-0214 (etanercept (Enbrel®) biosimilar)

- Completed enrollment on two Phase 1 bridging studies.

- Multiple sclerosis therapeutic franchise:

- CHS-131 (new chemical entity therapeutic)

- Reported a positive Phase 2b randomized, double-blind,

placebo-controlled clinical study.

- Demonstrated approximately a 50 percent statistically

significant decrease in the incidence of new contrast-enhancing

lesions over six months when compared to placebo.

Financial highlights for the Second Quarter 2016

include:

- Announced the pricing of an underwritten public offering

totaling 4,025,000 shares of its common stock at a price to the

public of $18.00 per share before deducting the

underwriting discount, resulting in $69.0 million to Coherus net of

all fees. All of the shares of the common stock sold in the

offering were offered by Coherus.

- Received $30.0 million milestone payment from Baxalta related

to the last patient, last visit in the global CHS-0214 Phase 3

trials.

Second Quarter and year-to-date 2016 Financial

Results

Total revenue for the second quarter of 2016

was $14.1 million, as compared to $6.9 million in the second

quarter of 2015. Total revenue for the six months ended June

30, 2016 was $26.4 million, as compared to $12.7 million for the

same period in 2015. The increase over the same period in

2015 was due to increased recognition of Baxalta collaboration

revenue as a result of receiving four development milestone

payments totaling $130.0 million since March 31, 2015.

Research and development (R&D) expenses for

the second quarter of 2016 were $65.5 million compared to $56.9

million for the same period in 2015. R&D expenses for the

six months ended June 30, 2016 were $130.9 million, as compared to

$93.4 million for the same period in 2015. Increases in

R&D expenses were mainly attributable to proceeding with

clinical activities associated with our Phase 3 clinical study in

psoriasis for CHS-1420, advances in other product candidates in our

pipeline, and hiring additional personnel to support both

late-development and early-stage activities, and were offset by a

decrease in costs related to BLA-enabling studies for CHS-1701.

General and administrative (G&A) expenses

for the second quarter of 2016 were $11.3 million,

compared to $8.8 million for the same period in 2015. G&A

expenses for the six months ended June 30, 2016 were $22.7 million,

as compared to $14.9 million for the same period in 2015.

Changes in G&A expenses were mainly attributable to

hiring employees to support legal, pre-commercial and accounting

activities, costs associated with stock options granted since the

first quarter of 2015, legal fees to support the intellectual

property strategy, and accounting fees and services related to

compliance with Section 404 of the Sarbanes-Oxley Act of

2002.

Net loss attributable to Coherus for the second

quarter of 2016 was $70.0 million, or $1.72 per share, compared to

$58.8 million, or $1.56 per share, for the same period in 2015.

Cash and cash equivalents

totaled $220.9 million as of June 30, 2016, compared to $179.6

million as of March 31, 2016. Cash used in operations was

$27.4 million in the second quarter of 2016 as compared to $76.3

million in the first quarter of 2016. Excluding the $30.0

million milestone payment received from Baxalta, cash used in

operations was approximately 25% less in the second quarter

compared to the first quarter of 2016.

Guidance for the Second Half of 2016:

- Oncology therapeutic franchise:

- CHS-1701 (pegfilgrastim (Neulasta®) biosimilar)

- Reported in July positive follow-on

pharmacokinetic/pharmacodynamic (PK/PD) study.

- Initiate commercial partnering discussions for certain ex-U.S.

territories.

- Anticipated submission of Marketing Authorization Application

(MAA) in the fourth quarter.

- Immunology (anti-TNF) therapeutic franchise:

- CHS-0214 (etanercept biosimilar)

- Complete two Phase 1 bridging studies.

- Expect MAA acceptance in conjunction with partner Baxalta (now

part of Shire) in late 2016.

- CHS-1420 (adalimumab biosimilar)

- Reported in August positive interim Phase 3 clinical trial in

psoriasis at 16-weeks.

- Complete Phase 3 clinical trial in psoriasis in Q4 2016.

- Expect a 351(k) BLA acceptance in the U.S. late Q4/Q1

2017.

- Continue to advance intellectual property strategy.

- Partnering discussions for the immunology (anti-TNF)

therapeutic franchise have begun, targeting an agreement in the

first half of 2017.

- File one investigational new drug (IND) application for a

second wave biosimilar candidate.

Conference Call Information

When: Tuesday, August 9, 2016 at 4:30 p.m. ETDial-in: (844)

452-6826 (toll free) or (765) 507-2587 (International) Conference

ID: 46774291Webcast: http://investors.coherus.com

Please join the conference call at least 10 minutes early to

register. The webcast will be archived on the Coherus website

for one year.

About Coherus BioSciences, Inc. Coherus is a

leading global biosimilar platform company that develops and

commercializes high-quality therapeutics for major regulated

markets. Biosimilars are intended for use in place of existing,

branded biologics to treat a range of chronic and often

life-threatening diseases, with the potential to reduce costs and

expand patient access. Composed of a team of proven industry

veterans with world-class expertise in process science, analytical

characterization, protein production and clinical-regulatory

development, Coherus is positioned as a leader in the global

biosimilar marketplace. Coherus is advancing three late-stage

clinical products towards commercialization, CHS-1701

(pegfilgrastim biosimilar), CHS-0214 (etanercept biosimilar) and

CHS-1420 (adalimumab biosimilar), as well as developing a robust

pipeline of future products in four therapeutic areas, oncology,

immunology (anti-TNF), ophthalmology and multiple sclerosis. For

additional information, please visit www.coherus.com.

Forward-Looking StatementsExcept for the

historical information contained herein, the matters set forth in

this press release, including statements regarding Coherus’ plans,

potential opportunities, expectations, projections, goals,

objectives, milestones, strategies, product pipeline, clinical

studies, product development, release of data and the potential

benefits of its products under development are forward-looking

statements within the meaning of the "safe harbor" provisions of

the Private Securities Litigation Reform Act of 1995, including

Coherus’ ability to initiate and complete partnering discussions

and receive MAA acceptance for CHS-1701, complete bridging studies

and MAA acceptance for CHS-0214, complete trials and receive BLA

acceptance, and complete a partnering agreement for CHS-1420. Such

forward-looking statements involve substantial risks and

uncertainties that could cause our clinical development programs,

future results, performance or achievements to differ significantly

from those expressed or implied by the forward-looking statements.

Such risks and uncertainties include, among others, the

uncertainties inherent in the clinical drug development process,

including the regulatory approval process, the timing of our

regulatory filings and other matters that could affect the

availability or commercial potential of our biosimilar drug

candidates, as well as possible patent litigation. Coherus

undertakes no obligation to update or revise any forward-looking

statements. For a further description of the risks and

uncertainties that could cause actual results to differ from those

expressed in these forward-looking statements, as well as risks

relating to Coherus’ business in general, see Coherus’ Quarterly

Report on Form 10-Q for the quarter ended March 31, 2016, filed

with the Securities and Exchange Commission on May 9, 2016 and its

future periodic reports to be filed with the Securities and

Exchange Commission.

Enbrel® and Neulasta® are registered trademarks of Amgen

Inc.HUMIRA® is a registered trademark of AbbVie Inc.

| Coherus

BioSciences, Inc. |

|

| Condensed

Consolidated Statements of Operations |

|

| (in thousands,

except share and per share data) |

|

| |

|

|

|

|

|

|

|

|

| |

Three Months Ended |

|

Six Months Ended |

|

| |

June 30, |

|

June 30, |

|

| |

|

2016 |

|

|

|

2015 |

|

|

|

2016 |

|

|

|

2015 |

|

|

| |

(unaudited) |

|

(unaudited) |

|

| Revenue: |

|

|

|

|

|

|

|

|

|

Collaboration and license revenue |

$ |

14,068 |

|

|

$ |

6,866 |

|

|

$ |

26,427 |

|

|

$ |

12,676 |

|

|

| Total

revenue |

|

14,068 |

|

|

|

6,866 |

|

|

|

26,427 |

|

|

|

12,676 |

|

|

| Operating

expenses: |

|

|

|

|

|

|

|

|

| Research

and development |

|

65,544 |

|

|

|

56,944 |

|

|

|

130,857 |

|

|

|

93,411 |

|

|

| General

and administrative |

|

11,260 |

|

|

|

8,817 |

|

|

|

22,658 |

|

|

|

14,908 |

|

|

| Total

operating expenses |

|

76,804 |

|

|

|

65,761 |

|

|

|

153,515 |

|

|

|

108,319 |

|

|

| Loss from

operations |

|

(62,736 |

) |

|

|

(58,895 |

) |

|

|

(127,088 |

) |

|

|

(95,643 |

) |

|

| Interest expense |

|

(2,354 |

) |

|

|

— |

|

|

|

(3,191 |

) |

|

|

— |

|

|

| Other expense, net |

|

(5,060 |

) |

|

|

(139 |

) |

|

|

(5,409 |

) |

|

|

(4,230 |

) |

|

| Net loss |

|

(70,150 |

) |

|

|

(59,034 |

) |

|

|

(135,688 |

) |

|

|

(99,873 |

) |

|

| Net loss attributable

to non-controlling interest |

|

183 |

|

|

|

224 |

|

|

|

333 |

|

|

|

338 |

|

|

| Net loss attributable

to Coherus |

$ |

(69,967 |

) |

|

$ |

(58,810 |

) |

|

$ |

(135,355 |

) |

|

$ |

(99,535 |

) |

|

| |

|

|

|

|

|

|

|

|

| Net loss per share

attributable to Coherus, basic and diluted |

$ |

(1.72 |

) |

|

$ |

(1.56 |

) |

|

$ |

(3.39 |

) |

|

$ |

(2.80 |

) |

|

| Weighted-average number

of shares used in computing net loss per share attributable to

Coherus, basic and diluted |

|

40,698,309 |

|

|

|

37,672,748 |

|

|

|

39,897,142 |

|

|

|

35,536,889 |

|

|

| |

|

|

|

|

|

|

|

|

| Coherus

BioSciences, Inc. |

|

| Condensed

Consolidated Balance Sheets |

|

| (in thousands) |

|

| |

|

|

|

|

| |

June 30, |

|

December 31, |

|

| |

|

2016 |

|

|

|

2015 |

|

|

| |

(unaudited) |

|

|

|

| Assets |

|

|

|

|

| Cash and cash

equivalents |

$ |

220,916 |

|

|

$ |

158,226 |

|

|

| Other assets |

|

30,185 |

|

|

|

54,158 |

|

|

| Total assets |

$ |

251,101 |

|

|

$ |

212,384 |

|

|

| Liabilities and

Stockholders’ Deficit |

|

|

|

|

| Deferred revenue |

|

88,050 |

|

|

|

94,959 |

|

|

| Convertible notes |

|

99,627 |

|

|

|

— |

|

|

| Other liabilities |

|

125,372 |

|

|

|

124,354 |

|

|

| Total stockholders'

deficit |

|

(61,948 |

) |

|

|

(6,929 |

) |

|

| Total liabilities and

stockholders’ deficit |

$ |

251,101 |

|

|

$ |

212,384 |

|

|

| |

|

|

|

|

CONTACT:

Patrick O’Brien

Senior Vice President, Investor Relations

Coherus BioSciences, Inc.

pobrien@coherus.com

+1 (650) 649-3527

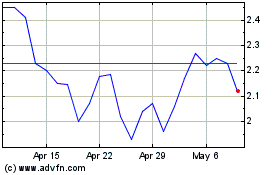

Coherus BioSciences (NASDAQ:CHRS)

Historical Stock Chart

From Mar 2024 to Apr 2024

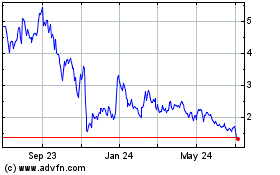

Coherus BioSciences (NASDAQ:CHRS)

Historical Stock Chart

From Apr 2023 to Apr 2024