By Ellie Ismailidou and Sara Sjolin, MarketWatch

Energy stocks slump, Valeant jumps after confirming plans for

reorganization

U.S. stocks reversed early gains on Tuesday to trade in negative

territory, dragged lower as the energy and materials sectors

followed oil futures lower.

The S&P 500 index lost 2 points, or 0.1%, to 2,179, after

setting a record high of 2,187.69 earlier in the day. The gains in

consumer-staples and health-care stocks were offset by losses in

energy and materials sectors.

The Dow Jones Industrial Average was down 19 points, or 0.1%, at

18,510, supported by gains for Walt Disney Company(DIS) and Pfizer

Inc. (PFE) but weighed down by a 0.8% decline in Caterpillar Inc.

(CAT) and a 0.7% drop in American Express Co. (AXP). The blue-chip

gauge was below its all-time closing high of 18,595.03, hit July

20.

The Nasdaq Composite Index gained 7 points, or 0.1%, to 5,220,

trading just below its all-time closing high of 5,221.12 achieved

last Friday.

Also weighing on sentiment was a weaker-than-expected report on

U.S. productivity, which has now declined in three straight

quarters, according to new data released Tuesday

(http://www.marketwatch.com/story/productivity-declines-for-third-straight-quarter-2016-08-09).

Second-quarter productivity unexpectedly fell 0.5%, well below

expectations.

But a thirst for yield-rich assets continued to support demand

for stocks, analysts said, despite falling corporate earnings and

unsteady economic fundamentals.

"Investors are chasing [yield] anywhere they can find it. As

long as companies keep paying dividends, they're fine. But some are

paying out more than they're earning," said Lamar Villere, a

portfolio manager at investment manager Villere & Co.

Another reason for the sluggish but sustained advance is that

many investors are "hiding out" in the U.S. equity market, piling

into sectors traditionally viewed as safety plays in times of

uncertainty, such as utilities and telecom--two sectors that are

leading the market year-to-date. Telecom is up 19.4% year to date,

while utilities boast a 16.7% gain in 2016.

At the same time, the market has been "quite boring for nearly a

month now, which we can easily blow off as being part of the summer

doldrums," said Frank Cappelleri, technical analyst at Instinet, in

emailed comments.

Cappelleri said investors should view what has been muted summer

moves for stocks as a positive indication that the market is

settling into a new trading range, after breaking out to all-time

high levels.

"Low volatility is a classic trait of an uptrend. And uptrends

are boring whether they happen in August or a typically more

emotional period," Cappelleri said, pointing to the market's

seeming inaction in November 2014 as a "classic example" of a

"boring" market showing a positive uptrend.

Some investors were also holding on to lingering optimism

following the stellar jobs report released on Friday, which helped

propel the S&P 500 and the Nasdaq score record highs.

"This mood of optimism has seen a recovery in not only the

dollar, but also risk appetite, that has pulled equities and

commodities such as oil higher. But can these moves continue with a

stronger dollar?" said Richard Perry, analyst at Hantec Markets, in

a note.

Economic news: A flurry of data released on Tuesday painted a

mixed picture of the U.S. economy.

Wholesale inventories rose a revised 0.3% in June, up from the

initial estimate of no change, the Commerce Department said Tuesday

(http://www.marketwatch.com/story/us-wholesale-inventories-rise-revised-03-in-june-2016-08-09),

suggesting that inventories might not be as big a drag on

second-quarter growth as initially estimated.

The NFIB small-business index for July rose 0.1 point to 94.6

(http://www.marketwatch.com/story/small-business-sentiment-ekes-out-a-gain-nfib-says-2016-08-09),

continuing a winning streak that began after it touched a two-year

low.

There are no Federal Reserve speakers this week. The next big

event for the central bank will be Chairwoman Janet Yellen's

appearance at the Jackson Hole conference Aug. 26.

See:

Movers and shakers: Shares of Resolute Energy Corp.(REN) rallied

13.9% after the oil and gas company late Monday said its loss

narrowed in the second quarter.

Valeant Pharmaceuticals International Inc.(VRX.T) jumped 23.5%

after the drugmaker confirmed its full-year guidance and said it

would reorganize following another weak quarter

(http://www.marketwatch.com/story/valeant-loss-widens-as-company-plans-overhaul-2016-08-09).

Luxury retailer Coach Inc.(COH) posted fiscal fourth-quarter

earnings that beat expectations

(http://www.marketwatch.com/story/coachs-stock-surges-after-profit-north-american-sales-beat-expectations-2016-08-09),

but shares slumped 2.2%.

After the markets close on Tuesday, Walt Disney Co.(DIS), Fossil

Group Inc.(FOSL) and Yelp Inc.(YELP) are slated to report earnings

results.

Shares in Gap Inc.(GPS) lost 6.3% Tuesday after the clothing

retailer said revenue and same-stores sales slipped

(http://www.marketwatch.com/story/gap-shares-drop-after-sales-slip-same-store-sales-decline-2016-08-08)

in July.

Monster Worldwide Inc.(MWW) rallied 26.2% after Dutch staffing

provider Randstad Holding NV (RAND.AE) said it has agreed to buy

its rival for $3.40 a share in cash

(http://www.marketwatch.com/story/randstad-agrees-to-buy-monster-in-merger-worth-429-million-2016-08-09),

a 22.7% premium on Monday's closing price.

Other markets: Oil priced reversed and closed lower

(http://www.marketwatch.com/story/oil-prices-walk-back-from-sharp-rally-with-focus-on-us-data-2016-08-09)

after a sharp rally on Monday, falling 0.6%.

Metals lost ground across the board, while the dollar traded

mixed

(http://www.marketwatch.com/story/dollar-flattens-out-ahead-of-japan-holiday-2016-08-09)

against other major currencies. The pound slumped to $1.2976, after

data showed the U.K. trade deficit widened in June

(http://www.marketwatch.com/story/uk-trade-deficit-widened-before-brexit-vote-2016-08-09)

as imports hit a record high.

Stock markets in Europe shook off opening losses

(http://www.marketwatch.com/story/european-markets-gain-across-the-board-as-opec-meeting-cheers-oil-stocks-2016-08-09)

and ended higher, while Asian stocks ended mostly higher after

upbeat data from China

(http://www.marketwatch.com/story/asian-stocks-mostly-up-despite-weak-economic-news-from-china-2016-08-08).

(END) Dow Jones Newswires

August 09, 2016 15:13 ET (19:13 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

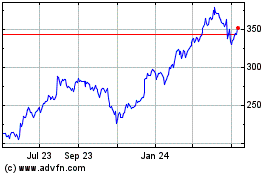

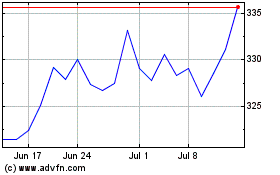

Caterpillar (NYSE:CAT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Caterpillar (NYSE:CAT)

Historical Stock Chart

From Apr 2023 to Apr 2024