Kraft Stake Boosts Berkshire -- WSJ

August 06 2016 - 3:03AM

Dow Jones News

By Maria Armental and Anupreeta Das

Berkshire Hathaway Inc.'s second-quarter profit rose on

investment gains tied to its stake in Kraft Heinz Co. and higher

underwriting profit at car insurer Geico Corp.

Results fell short of analysts' projections.

The conglomerate, led by renowned investor Warren Buffett, has

been turning to acquisitions as a way to drive profit. The

85-year-old Mr. Buffett has made it known he is open to buying more

but, true to his tenets, has also noted the importance of finding

the right manager.

Berkshire already pulls in income from a railroad, utilities,

industrial manufacturers, home builders, branded-food sellers and

even an auto dealership. In January, it folded into its stable

aircraft parts supplier Precision Castparts Corp., in what was its

largest acquisition to date.

At Berkshire's core is an insurance business, which brings in

billions of dollars of "float," the upfront premiums customers pay

and which Berkshire is able to invest for its own benefit.

Insurance float, the engine that has fueled Berkshire's

expansion, rose to $90 billion in the latest period, while

Berkshire's insurance underwriting business, which includes Geico

Corp., swung to a $337 million operating profit.

Insurance-investment income, meanwhile, edged up to $978

million, and operating profit at the noninsurance businesses --

which include the railroad, utilities and energy segments -- rose

13% to $1.89 billion.

Overall, Berkshire's net income rose 25% to $5 billion, or

$3,042 a Class A share, while operating profit, which excludes some

investment results, rose 18% to $4.61 billion, or $2,803 a Class A

share. Revenue rose 6% to $54.46 billion.

Analysts surveyed by Thomson Reuters had projected $2,910.8 a

share in operating profit on $56.47 billion in revenue.

Berkshire reported $394 million in investment gains, a

three-fold increase from the year-ago period, thanks in part to its

stake in Kraft.

Book value, Mr. Buffett's preferred yardstick for measuring net

worth, rose 2.9% to $160,009 per Class A equivalent share as of

June 30. Last year, Berkshire reported a 2.4% increase in book

value for the first six months of the year.

Class A shares closed Friday at $218,010, up 10% for the

year.

Write to Maria Armental at maria.armental@wsj.com and Anupreeta

Das at anupreeta.das@wsj.com

(END) Dow Jones Newswires

August 06, 2016 02:48 ET (06:48 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

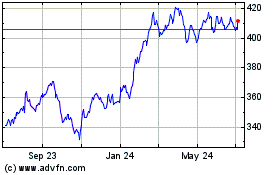

Berkshire Hathaway (NYSE:BRK.B)

Historical Stock Chart

From Mar 2024 to Apr 2024

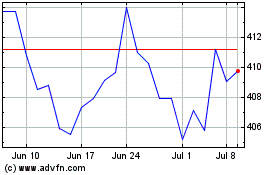

Berkshire Hathaway (NYSE:BRK.B)

Historical Stock Chart

From Apr 2023 to Apr 2024