U.S. Regulator Expected to Get Access to Alibaba, Baidu Financials

August 05 2016 - 3:20AM

Dow Jones News

A long-running dispute between the U.S. and China over the

ability to vet auditors of Chinese companies listed on American

exchanges could be edging toward a breakthrough.

Two big U.S.-listed Chinese companies—Alibaba Group Holding Ltd.

and Baidu Inc.—and their outside auditors are preparing for audit

inspections by officials from the Public Company Accounting

Oversight Board, the U.S. audit-industry regulator. The PCAOB is

expected to gain access in coming months to audit firms' records of

the work they did to review Alibaba's and Baidu's books, according

to people familiar with the situation. That could be a prelude to

fuller PCAOB inspections of the audit firms, a move long blocked by

the Chinese government.

PricewaterhouseCoopers' Hong Kong affiliate is Alibaba's

auditor; Ernst & Young's Beijing affiliate is Baidu's

auditor.

The ability to check auditors of foreign firms listed in the

U.S. is important to ensure auditing standards are upheld and

investors in U.S. markets are protected, experts say. U.S.

regulators have been particularly eager to vet how Chinese

companies have been audited, after a wave of alleged accounting

fraud and investor complaints about lack of financial transparency

at smaller U.S.-listed Chinese firms starting around 2011.

"It's critical for investors in the U.S. market that the PCAOB

is able to inspect Chinese audit firms," said Joseph Carcello, a

University of Tennessee accounting professor.

The PCAOB has long attempted to inspect the performance of

China-based firms that audit many U.S.-traded Chinese companies,

the way the accounting board regularly inspects other audit firms.

But to date, the Chinese government has refused to allow the

inspections, citing sovereignty concerns: The Chinese government

has indicated the information contained in audits of Chinese

companies could be considered "state secrets."

The new developments may be a move toward resolving that

yearslong dispute, which has been marked by seeming steps toward

agreement followed by reversals. Most recently, the PCAOB last year

said publicly it was close to an agreement to proceed with

inspections, only to have negotiations break down.

One person at a Big Four accounting firm said that the firm has

been preparing for years for the possibility that the PCAOB will

inspect its working papers for U.S.-listed Chinese companies. The

firm has been conducting mock reviews of PCAOB audits for the past

few years, going over questions and grading the employees on how

well they answered, the person said.

It is still possible the Alibaba- and Baidu-related inspections

might not proceed. The audit documents provided to the PCAOB may be

heavily redacted and the board may face other restrictions in

conducting the inspections, said the people familiar with the

situation, raising questions about whether the board will be

allowed to conduct the thorough inspections it is seeking.

The move toward inspections is a "good first step" in thawing

relations between U.S. and Chinese regulators, said Paul Gillis, an

accounting professor at Peking University's Guanghua School of

Management. "But that doesn't mean that the inspections will be

meaningful."

Mr. Gillis says he expects audit work papers to be moved to Hong

Kong for inspection, a way to ease the Chinese government's

concerns about foreign regulators working on Chinese soil.

The PCAOB wouldn't confirm the move toward inspections, saying

only that it continues "to work toward obtaining access to the

information we need in order to conduct the necessary inspections

of registered firms in China and Hong Kong." The auditing regulator

said it doesn't comment on specific audits.

PwC in Hong Kong didn't immediately respond to a request for

comment. E&Y's affiliate in Beijing declined to comment. The

China Securities Regulatory Commission had no immediate

comment.

PCAOB inspections are meant to assess the performance and

compliance with auditing rules of firms that audit U.S.-traded

companies. They are done on a regular basis and aren't a sign the

auditors or the companies have done anything wrong. But an

inspection would come at a sensitive time for Alibaba in

particular, as the U.S. Securities and Exchange Commission is

investigating the accounting practices of the e-commerce giant.

Alibaba and Baidu are among the biggest U.S.-listed Chinese

companies. More than 130 Chinese companies trade on the Nasdaq

Stock Market alone.

U.S. and Chinese regulators reached an agreement in 2013 to give

the U.S. access to audit documents of U.S.-traded Chinese companies

that are under investigation for potential wrongdoing, by routing

the documents through Chinese regulators. But that agreement

doesn't cover documents sought in connection with audit-firm

inspections.

In theory, the impasse over inspections could lead the U.S. to

bar audit firms that haven't been PCAOB-inspected from auditing

U.S.-traded companies, which would force those companies to find an

acceptable auditor or be delisted. U.S. regulators have continually

held back from such a step, however.

The Chinese "are trying to do whatever is necessary to prevent a

disaster, which is their companies being delisted," said Mr.

Gillis. "U.S. regulators are trying to make this problem go

away."

Alyssa Abkowitz contributed to this article.

Write to Kathy Chu at kathy.chu@wsj.com, Chao Deng at

Chao.Deng@wsj.com and Michael Rapoport at

Michael.Rapoport@wsj.com

(END) Dow Jones Newswires

August 05, 2016 03:05 ET (07:05 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

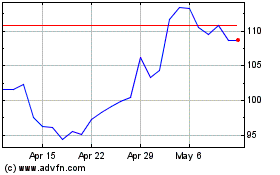

Baidu (NASDAQ:BIDU)

Historical Stock Chart

From Mar 2024 to Apr 2024

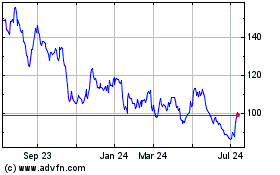

Baidu (NASDAQ:BIDU)

Historical Stock Chart

From Apr 2023 to Apr 2024