UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 4, 2016

_______________

EOG RESOURCES, INC.

(Exact name of registrant as specified in its charter)

|

| | |

Delaware (State or other jurisdiction of incorporation) | 1-9743 (Commission File Number) | 47-0684736 (I.R.S. Employer Identification No.) |

1111 Bagby, Sky Lobby 2

Houston, Texas 77002

(Address of principal executive offices) (Zip Code)

713-651-7000

(Registrant's telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

EOG RESOURCES, INC.

Item 2.02 Results of Operations and Financial Condition.

On August 4, 2016, EOG Resources, Inc. issued a press release announcing second quarter 2016 financial and operational results and third quarter and full year 2016 forecast and benchmark commodity pricing information (see Item 7.01 below). A copy of this release is attached as Exhibit 99.1 to this filing and is incorporated herein by reference. This information shall not be deemed to be "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section, and is not incorporated by reference into any filing under the Securities Act of 1933, as amended, or Securities Exchange Act of 1934, as amended.

Item 7.01 Regulation FD Disclosure.

Accompanying the press release announcing second quarter 2016 financial and operational results attached hereto as Exhibit 99.1 is third quarter and full year 2016 forecast and benchmark commodity pricing information for EOG Resources, Inc., which information is incorporated herein by reference. This information shall not be deemed to be "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section, and is not incorporated by reference into any filing under the Securities Act of 1933, as amended, or Securities Exchange Act of 1934, as amended.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

99.1 Press Release of EOG Resources, Inc. dated August 4, 2016 (including the accompanying third quarter and full year 2016 forecast and benchmark commodity pricing information).

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | |

| | EOG RESOURCES, INC. (Registrant) |

| | |

| | |

| | |

Date: August 4, 2016 | By: | /s/ TIMOTHY K. DRIGGERS Timothy K. Driggers Executive Vice President and Chief Financial Officer (Principal Financial Officer and Duly Authorized Officer) |

EXHIBIT INDEX

|

| | |

Exhibit No. | | Description |

| | |

99.1 | - | Press Release of EOG Resources, Inc. dated August 4, 2016 (including the accompanying third quarter and full year 2016 forecast and benchmark commodity pricing information). |

EXHIBIT 99.1

|

| |

EOG Resources, Inc. | P.O. Box 4362, Houston, TX 77210-4362 |

News Release | |

For Further Information Contact: | Investors |

| Cedric W. Burgher |

| (713) 571-4658 |

| David J. Streit |

| (713) 571-4902 |

| Kimberly M. Ehmer |

| (713) 571-4676 |

| |

| Media |

| K Leonard |

| (713) 571-3870 |

EOG Resources Announces Second Quarter 2016 Results; Increases Premium Well Inventory by 34%

| |

• | Increases Net Premium Inventory to 4,300 Locations and Total Net Premium Resource Potential to 3.5 BnBoe |

| |

▪ | Premium Inventory Well-Level Rates of Return Exceed 30 Percent at $40 Crude Oil Price |

| |

• | Beats All U.S. Production and Operating Cost Targets |

| |

• | Raises 2016 U.S. Crude Oil Production Guidance |

| |

• | Announces $425 Million in Proceeds from Asset Sales |

| |

• | Provides Crude Oil Production Growth Outlook through 2020 |

FOR IMMEDIATE RELEASE: Thursday, August 4, 2016

HOUSTON - EOG Resources, Inc. (EOG) today reported a second quarter 2016 net loss of $292.6 million, or $0.53 per share. This compares to second quarter 2015 net income of $5.3 million, or $0.01 per share.

Adjusted non-GAAP net loss for the second quarter 2016 was $209.7 million, or $0.38 per share, compared to adjusted non-GAAP net income of $153.1 million, or $0.28 per share, for the same prior year period. Adjusted non-GAAP net income (loss) is calculated by matching hedge realizations to settlement months and making certain other adjustments in order to exclude non-recurring items. For a reconciliation of non-GAAP measures to GAAP measures, please refer to the attached tables.

Lower commodity prices more than offset significant well productivity improvements and cost reductions, resulting in decreases in adjusted non-GAAP net income, discretionary cash flow and EBITDAX during the second quarter 2016 compared to the second quarter 2015. For a reconciliation of non-GAAP measures to GAAP measures, please refer to the attached tables.

Operational Highlights

In the second quarter 2016, EOG increased its inventory of net premium drilling locations from 3,200 to 4,300. Premium inventory is defined by a direct after-tax rate of return hurdle rate of at least 30 percent assuming $40 flat crude oil prices. Total premium net resource potential increased from 2.0 billion barrels of oil equivalent (BnBoe) to 3.5 BnBoe. These additions were the result of advances in completion technology, precision targeting, longer laterals and cost reductions.

U.S. crude oil volumes of 265,400 barrels of oil per day (Bopd) in the second quarter 2016 exceeded the midpoint of the company’s guidance by 2 percent. Compared to the same prior year period, lease and well expenses decreased 23 percent, and transportation costs decreased 13 percent, both on a per-unit basis. Total general and administrative expenses decreased 5 percent compared to the second quarter 2015, excluding expenses related to a voluntary retirement program.

Exploration and development expenditures (excluding property acquisitions) decreased 49 percent, while total crude oil production declined by only 4 percent, in the second quarter 2016 compared to the same period last year. Total natural gas production for the second quarter 2016 decreased 5 percent versus the same prior year period.

“The benefits of EOG’s premium drilling strategy are beginning to show in our operating performance,” said William R. “Bill” Thomas, Chairman and Chief Executive Officer. “We are committed to focusing capital on our premium assets which we are confident will increasingly lead to break-out performance as prices improve. This quarter’s addition of 1.5 BnBoe of additional premium net resource potential further solidifies our ability to deliver premium returns over the long term.”

2016 Capital Plan Update and 2020 Crude Oil Production Outlook

As a result of cost reductions and efficiency improvements, EOG has increased its targeted number of well completions for 2016 from 270 to 350 net wells. Many of the additional well completions are scheduled for late 2016. In addition, due to increased drilling productivity, the company expects to drill 250 net wells, 50 more than in its original 2016 plans. This increase in activity will be accomplished while maintaining 2016 capital expenditure guidance of $2.4 to $2.6 billion, excluding acquisitions.

EOG can achieve significant production growth with balanced cash flow from 2017 through 2020, even in a moderate commodity price environment. Based on EOG’s long-term plan and assuming a flat $50 West Texas Intermediate crude oil price (WTI), EOG would expect 10 percent compound annual crude oil production growth through 2020. Assuming flat $60 WTI, EOG would expect 20 percent compound annual crude oil production growth through 2020.

“EOG’s long-term outlook reflects superior capital efficiency and continued capital discipline, hallmarks of the company since its founding,” Thomas said. “Our premium drilling strategy is the key to

our future success, and it is underpinned by EOG’s industry-leading asset quality, scale, technology, well performance and low-cost structure. Most importantly, EOG’s high-performance culture prioritizes rates of return over other performance metrics.”

South Texas Eagle Ford

The South Texas Eagle Ford, EOG’s largest high-return play, continues to lead the company in activity and production. In the second quarter, EOG increased its Eagle Ford premium inventory by 390 net drilling locations to almost 2,000 total. This large inventory of high-quality locations could be expanded significantly should additional cost reductions or improvements in well productivity be achieved. For example, EOG estimates that a 10 percent reduction in completed well costs or a 10 percent improvement in estimated recoverable reserves per well would more than double EOG’s premium inventory in the Eagle Ford.

In the second quarter, EOG completed 60 wells in the Eagle Ford with an average treated lateral length of 4,800 feet per well and an average 30-day initial production rate per well of 1,705 barrels of oil equivalent per day (Boed), or 1,340 Bopd, 175 barrels per day (Bpd) of natural gas liquids (NGLs) and 1.1 million cubic feet per day (MMcfd) of natural gas.

Delaware Basin

In the second quarter, EOG expanded its premium inventory in all three of its major Delaware Basin formations - the Wolfcamp, the Second Bone Spring and the Leonard. By organically adding more than 500 net premium drilling locations, EOG is well positioned for years of high-return growth in this world-class basin. EOG continues to improve well economics in the Delaware Basin through advances in well and completion designs, including recent breakthroughs that enable higher productivity with longer laterals.

In the Delaware Basin Wolfcamp, EOG completed 16 wells in the second quarter with an average treated lateral length of 6,500 feet per well, a 44 percent increase in lateral length from the prior quarter. The average 30-day initial production rate per well was 2,410 Boed, or 1,610 Bopd, 340 Bpd of NGLs and 2.8 MMcfd of natural gas. In the Delaware Basin Second Bone Spring, EOG completed nine wells in the second quarter with an average treated lateral length of 4,500 feet per well and an average 30-day initial production rate per well of 1,500 Boed, or 1,120 Bopd, 155 Bpd of NGLs and 1.4 MMcfd of natural gas.

Rockies and the Bakken

EOG is continuing to optimize its core Rockies and Bakken plays, adding 200 additional net premium drilling locations to its inventory in the DJ Basin Codell in Wyoming. The Codell is a liquids-rich sandstone formation that now has significant premium potential due to cost reductions and efficiencies along with the application of EOG’s precision targeting and completion technology.

In the DJ Basin Codell in Wyoming, EOG completed the Jubilee 541-3502H well in the second quarter with average 30-day initial production rates of 1,190 Bopd, 130 Bpd of NGLs and 0.5 MMcfd of natural gas.

In the Powder River Basin Turner, EOG completed the Arbalest 73-06H, 272-06H and 66-0607H wells on the same pad during the second quarter with average 30-day initial production rates per well of 1,000 Bopd, 330 Bpd of NGLs and 3.8 MMcfd of natural gas.

In the North Dakota Bakken, EOG completed the Austin 421-2821H, 422-2821H and 423-2821H wells in a three-well pattern in the second quarter with average 30-day initial production rates per well of 1,100 Bopd, 90 Bpd of NGLs and 0.5 MMcfd of natural gas. Also in the North Dakota Bakken, EOG completed the West Clark 103-0136H and 104-0136H wells in a two-well pattern with average 30-day initial production rates per well of 1,210 Bopd, 390 Bpd of NGLs and 1.8 MMcfd of natural gas.

In the Three Forks, EOG completed the West Clark 117-0136H well in the second quarter with average 30-day initial production rates of 1,290 Bopd, 380 Bpd of NGLs and 1.8 MMcfd of natural gas.

Hedging Activity

For the period March 1 through August 31, 2016, EOG had natural gas financial price swap contracts in place for 60,000 million British thermal units (MMBtu) per day at a weighted average price of $2.49 per MMBtu.

For the period September 1 through November 30, 2016, EOG sold natural gas call option contracts for 43,750 MMBtu per day at an average strike price of $3.45 per MMBtu. For the period March 1 through November 30, 2017, EOG sold natural gas call option contracts for 43,750 MMBtu per day at an average strike price of $3.45 per MMBtu. For the period March 1 through November 30, 2018, EOG sold natural gas call option contracts for 12,500 MMBtu per day at an average strike price of $3.32 per MMBtu.

For the period March 1 through November 30, 2017, EOG purchased natural gas put option contracts for 35,000 MMBtu per day at an average strike price of $2.90 per MMBtu. For the period March 1 through November 30, 2018, EOG purchased natural gas put option contracts for 10,000 MMBtu per day at an average strike price of $2.90 per MMBtu.

A comprehensive summary of natural gas derivative contracts is provided in the attached tables.

Capital Structure and Asset Sales

At June 30, 2016, EOG’s total debt outstanding was $7.0 billion with a debt-to-total capitalization ratio of 37 percent. Taking into account cash on the balance sheet of $780 million at the end of the second quarter, EOG’s net debt was $6.2 billion with a net debt-to-total capitalization ratio of 34 percent. For a reconciliation of non-GAAP measures to GAAP measures, please refer to the attached tables.

Proceeds from asset sales this year to date total $425 million. This includes proceeds from two transactions that closed in the third quarter 2016. The assets were divested in more than a dozen separate transactions of non-core natural gas and liquids-rich properties. Associated production of the divested assets was 45 MMcfd of natural gas, 3,300 Bopd and 3,700 Bpd of NGLs. Sales of additional non-core assets are in progress and anticipated to close in 2016.

Conference Call August 5, 2016

EOG’s second quarter 2016 results conference call will be available via live audio webcast at 9 a.m. Central time (10 a.m. Eastern time) on Friday, August 5, 2016. To listen, log on to the Investors Overview page on the EOG website at http://investors.eogresources.com/overview. The webcast will be archived on EOG’s website through August 19, 2016.

EOG Resources, Inc. is one of the largest independent (non-integrated) crude oil and natural gas companies in the United States with proved reserves in the United States, Trinidad, the United Kingdom and China. EOG Resources, Inc. is listed on the New York Stock Exchange and is traded under the ticker symbol "EOG." For additional information about EOG, please visit www.eogresources.com.

This press release includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements, other than statements of historical facts, including, among others, statements and projections regarding EOG's future financial position, operations, performance, business strategy, returns, budgets, reserves, levels of production and costs, statements regarding future commodity prices and statements regarding the plans and objectives of EOG's management for future operations, are forward-looking statements. EOG typically uses words such as "expect," "anticipate," "estimate," "project," "strategy," "intend," "plan," "target," "goal," "may," "will," "should" and "believe" or the negative of those terms or other variations or comparable terminology to identify its forward-looking statements. In particular, statements, express or implied, concerning EOG's future operating results and returns or EOG's ability to replace or increase reserves, increase production, reduce or otherwise control operating and capital costs, generate income or cash flows or pay dividends are forward-looking statements. Forward-looking statements are not guarantees of performance. Although EOG believes the expectations reflected in its forward-looking statements are reasonable and are based on reasonable assumptions, no assurance can be given that these assumptions are accurate or that any of these expectations will be achieved (in full or at all) or will prove to have been correct. Moreover, EOG's forward-looking statements may be affected by known, unknown or currently unforeseen risks, events or circumstances that may be outside EOG's control. Important factors that could cause EOG's actual results to differ materially from the expectations reflected in EOG's forward-looking statements include, among others:

| |

• | the timing, extent and duration of changes in prices for, supplies of, and demand for, crude oil and condensate, natural gas liquids, natural gas and related commodities; |

| |

• | the extent to which EOG is successful in its efforts to acquire or discover additional reserves; |

| |

• | the extent to which EOG is successful in its efforts to economically develop its acreage in, produce reserves and achieve anticipated production levels from, and maximize reserve recovery from, its existing and future crude oil and natural gas exploration and development projects; |

| |

• | the extent to which EOG is successful in its efforts to market its crude oil and condensate, natural gas liquids, natural gas and related commodity production; |

| |

• | the availability, proximity and capacity of, and costs associated with, appropriate gathering, processing, compression, transportation and refining facilities; |

| |

• | the availability, cost, terms and timing of issuance or execution of, and competition for, mineral licenses and leases and governmental and other permits and rights-of-way, and EOG’s ability to retain mineral licenses and leases; |

| |

• | the impact of, and changes in, government policies, laws and regulations, including tax laws and regulations; environmental, health and safety laws and regulations relating to air emissions, disposal of produced water, drilling fluids and other wastes, hydraulic fracturing and access to and use of water; laws and regulations imposing conditions or restrictions on drilling and completion operations and on the transportation of crude oil and natural gas; laws and regulations with respect to derivatives and hedging activities; and laws and regulations with respect to the import and export of crude oil, natural gas and related commodities; |

| |

• | EOG's ability to effectively integrate acquired crude oil and natural gas properties into its operations, fully identify existing and potential problems with respect to such properties and accurately estimate reserves, production and costs with respect to such properties; |

| |

• | the extent to which EOG's third-party-operated crude oil and natural gas properties are operated successfully and economically; |

| |

• | competition in the oil and gas exploration and production industry for the acquisition of licenses, leases and properties, employees and other personnel, facilities, equipment, materials and services; |

| |

• | the availability and cost of employees and other personnel, facilities, equipment, materials (such as water) and services; |

| |

• | the accuracy of reserve estimates, which by their nature involve the exercise of professional judgment and may therefore be imprecise; |

| |

• | weather, including its impact on crude oil and natural gas demand, and weather-related delays in drilling and in the installation and operation (by EOG or third parties) of production, gathering, processing, refining, compression and transportation facilities; |

| |

• | the ability of EOG's customers and other contractual counterparties to satisfy their obligations to EOG and, related thereto, to access the credit and capital markets to obtain financing needed to satisfy their obligations to EOG; |

| |

• | EOG's ability to access the commercial paper market and other credit and capital markets to obtain financing on terms it deems acceptable, if at all, and to otherwise satisfy its capital expenditure requirements; |

| |

• | the extent and effect of any hedging activities engaged in by EOG; |

| |

• | the timing and extent of changes in foreign currency exchange rates, interest rates, inflation rates, global and domestic financial market conditions and global and domestic general economic conditions; |

| |

• | political conditions and developments around the world (such as political instability and armed conflict), including in the areas in which EOG operates; |

| |

• | the use of competing energy sources and the development of alternative energy sources; |

| |

• | the extent to which EOG incurs uninsured losses and liabilities or losses and liabilities in excess of its insurance coverage; |

| |

• | acts of war and terrorism and responses to these acts; |

| |

• | physical, electronic and cyber security breaches; and |

| |

• | the other factors described under ITEM 1A, Risk Factors, on pages 13 through 21 of EOG’s Annual Report on Form 10-K for the fiscal year ended December 31, 2015, and any updates to those factors set forth in EOG's subsequent Quarterly Reports on Form 10-Q or Current Reports on Form 8-K. |

In light of these risks, uncertainties and assumptions, the events anticipated by EOG's forward-looking statements may not occur, and, if any of such events do, we may not have anticipated the timing of their occurrence or the duration and extent of their impact on our actual results. Accordingly, you should not place any undue reliance on any of EOG's forward-looking statements. EOG's forward-looking statements speak only as of the date made, and EOG undertakes no obligation, other than as required by applicable law, to update or revise its forward-looking statements, whether as a result of new information, subsequent events, anticipated or unanticipated circumstances or otherwise.

The United States Securities and Exchange Commission (SEC) permits oil and gas companies, in their filings with the SEC, to disclose not only “proved” reserves (i.e., quantities of oil and gas that are estimated to be recoverable with a high degree of confidence), but also “probable” reserves (i.e., quantities of oil and gas that are as likely as not to be recovered) as well as “possible” reserves (i.e., additional quantities of oil and gas that might be recovered, but with a lower probability than probable reserves). Statements of reserves are only estimates and may not correspond to the ultimate quantities of oil and gas recovered. Any reserve estimates provided in this press release that are not specifically designated as being estimates of proved reserves may include "potential" reserves and/or other estimated reserves not necessarily calculated in accordance with, or contemplated by, the SEC’s latest reserve reporting guidelines. Investors are urged to consider closely the disclosure in EOG’s Annual Report on Form 10-K for the fiscal year ended December 31, 2015, available from EOG at P.O. Box 4362, Houston, Texas 77210-4362 (Attn: Investor Relations). You can also obtain this report from the SEC by calling 1-800-SEC-0330 or from the SEC's website at www.sec.gov. In addition, reconciliation and calculation schedules for non-GAAP financial measures can be found on the EOG website at www.eogresources.com.

###

|

| | | | | | | | | | | | | | | |

EOG RESOURCES, INC. Financial Report (Unaudited; in millions, except per share data) |

|

| Three Months Ended | | Six Months Ended |

| June 30, | | June 30, |

| 2016 | | 2015 | | 2016 | | 2015 |

| | | | | | | | | | | |

Net Operating Revenues | $ | 1,775.7 |

| | $ | 2,469.7 |

| | $ | 3,130.1 |

| | $ | 4,788.2 |

|

Net Income (Loss) | $ | (292.6 | ) | | $ | 5.3 |

| | $ | (764.3 | ) | | $ | (164.5 | ) |

Net Income (Loss) Per Share | | | | | | | | | | | |

Basic | $ | (0.53 | ) | | $ | 0.01 |

| | $ | (1.40 | ) | | $ | (0.30 | ) |

Diluted | $ | (0.53 | ) | | $ | 0.01 |

| | $ | (1.40 | ) | | $ | (0.30 | ) |

Average Number of Common Shares | | | | | | | | | | | |

Basic | | 547.3 |

| | | 545.5 |

| | | 547.0 |

| | | 545.2 |

|

Diluted | | 547.3 |

| | | 549.7 |

| | | 547.0 |

| | | 545.2 |

|

| | | | | | | | | | | |

|

| | | | | | | | | | | | | | | |

Summary Income Statements (Unaudited; in thousands, except per share data) |

|

| Three Months Ended | | Six Months Ended |

| June 30, | | June 30, |

| 2016 | | 2015 | | 2016 | | 2015 |

Net Operating Revenues | | | | | | | |

Crude Oil and Condensate | $ | 1,059,690 |

| | $ | 1,452,756 |

| | $ | 1,813,401 |

| | $ | 2,713,000 |

|

Natural Gas Liquids | | 111,643 |

| | | 103,930 |

| | | 186,962 |

| | | 215,920 |

|

Natural Gas | | 155,983 |

| | | 274,038 |

| | | 321,486 |

| | | 561,820 |

|

Gains (Losses) on Mark-to-Market Commodity Derivative Contracts | | (44,373 | ) | | | (48,493 | ) | | | (38,938 | ) | | | 27,715 |

|

Gathering, Processing and Marketing | | 485,256 |

| | | 678,356 |

| | | 819,209 |

| | | 1,248,626 |

|

Losses on Asset Dispositions, Net | | (15,550 | ) | | | (5,564 | ) | | | (6,403 | ) | | | (3,957 | ) |

Other, Net | | 23,091 |

| | | 14,678 |

| | | 34,372 |

| | | 25,115 |

|

Total | | 1,775,740 |

| | | 2,469,701 |

| | | 3,130,089 |

| | | 4,788,239 |

|

Operating Expenses | | | | | | | | | | | |

Lease and Well | | 218,393 |

| | | 289,664 |

| | | 459,258 |

| | | 651,145 |

|

Transportation Costs | | 179,471 |

| | | 209,833 |

| | | 369,925 |

| | | 438,145 |

|

Gathering and Processing Costs | | 29,226 |

| | | 34,997 |

| | | 57,750 |

| | | 71,006 |

|

Exploration Costs | | 30,559 |

| | | 43,755 |

| | | 60,388 |

| | | 83,204 |

|

Dry Hole Costs | | (172 | ) | | | (551 | ) | | | 74 |

| | | 14,119 |

|

Impairments | | 72,714 |

| | | 68,519 |

| | | 144,331 |

| | | 137,955 |

|

Marketing Costs | | 480,046 |

| | | 670,169 |

| | | 820,900 |

| | | 1,308,831 |

|

Depreciation, Depletion and Amortization | | 862,491 |

| | | 909,227 |

| | | 1,791,382 |

| | | 1,822,015 |

|

General and Administrative | | 97,705 |

| | | 82,324 |

| | | 198,236 |

| | | 166,621 |

|

Taxes Other Than Income | | 93,480 |

| | | 122,138 |

| | | 154,159 |

| | | 228,567 |

|

Total | | 2,063,913 |

| | | 2,430,075 |

| | | 4,056,403 |

| | | 4,921,608 |

|

|

Operating Income (Loss) | | (288,173 | ) | | | 39,626 |

| | | (926,314 | ) | | | (133,369 | ) |

|

Other Income (Expense), Net | | (20,996 | ) | | | 9,380 |

| | | (25,433 | ) | | | (611 | ) |

|

Income (Loss) Before Interest Expense and Income Taxes | | (309,169 | ) | | | 49,006 |

| | | (951,747 | ) | | | (133,980 | ) |

|

Interest Expense, Net | | 71,108 |

| | | 60,484 |

| | | 139,498 |

| | | 113,829 |

|

|

Loss Before Income Taxes | | (380,277 | ) | | | (11,478 | ) | | | (1,091,245 | ) | | | (247,809 | ) |

|

Income Tax Benefit | | (87,719 | ) | | | (16,746 | ) | | | (326,911 | ) | | | (83,329 | ) |

|

Net Income (Loss) | $ | (292,558 | ) | | $ | 5,268 |

| | $ | (764,334 | ) | | $ | (164,480 | ) |

|

Dividends Declared per Common Share | $ | 0.1675 |

| | $ | 0.1675 |

| | $ | 0.3350 |

| | $ | 0.3350 |

|

| | | | | | | | | | | |

| | | | | | | | | | | |

|

| | | | | | | | | | | | | | | |

EOG RESOURCES, INC. Operating Highlights (Unaudited) |

|

| Three Months Ended | | Six Months Ended |

| June 30, | | June 30, |

| 2016 | | 2015 | | 2016 | | 2015 |

Wellhead Volumes and Prices | | | |

Crude Oil and Condensate Volumes (MBbld) (A) | | | |

United States | | 265.4 |

| | | 276.5 |

| | | 265.6 |

| | | 287.5 |

|

Trinidad | | 0.8 |

| | | 0.7 |

| | | 0.8 |

| | | 0.9 |

|

Other International (B) | | 1.5 |

| | | 0.3 |

| | | 1.4 |

| | | 0.2 |

|

Total | | 267.7 |

| | | 277.5 |

| | | 267.8 |

| | | 288.6 |

|

|

Average Crude Oil and Condensate Prices ($/Bbl) (C) | | | | | | | | | | | |

United States | $ | 43.87 |

| | $ | 57.47 |

| | $ | 37.36 |

| | $ | 51.91 |

|

Trinidad | | 35.91 |

| | | 49.53 |

| | | 29.83 |

| | | 44.03 |

|

Other International (B) | | — |

| | | 62.40 |

| | | — |

| | | 56.67 |

|

Composite | | 43.65 |

| | | 57.45 |

| | | 37.23 |

| | | 51.89 |

|

|

Natural Gas Liquids Volumes (MBbld) (A) | | | | | | | | | | | |

United States | | 84.3 |

| | | 73.4 |

| | | 81.8 |

| | | 75.4 |

|

Other International (B) | | — |

| | | 0.1 |

| | | — |

| | | 0.1 |

|

Total | | 84.3 |

| | | 73.5 |

| | | 81.8 |

| | | 75.5 |

|

|

Average Natural Gas Liquids Prices ($/Bbl) (C) | | | | | | | | | | | |

United States | $ | 14.56 |

| | $ | 15.55 |

| | $ | 12.54 |

| | $ | 15.83 |

|

Other International (B) | | — |

| | | 7.81 |

| | | — |

| | | 5.80 |

|

Composite | | 14.56 |

| | | 15.54 |

| | | 12.54 |

| | | 15.82 |

|

|

Natural Gas Volumes (MMcfd) (A) | | | | | | | | | | | |

United States | | 820 |

| | | 891 |

| | | 825 |

| | | 898 |

|

Trinidad | | 349 |

| | | 334 |

| | | 355 |

| | | 336 |

|

Other International (B) | | 25 |

| | | 32 |

| | | 25 |

| | | 31 |

|

Total | | 1,194 |

| | | 1,257 |

| | | 1,205 |

| | | 1,265 |

|

|

Average Natural Gas Prices ($/Mcf) (C) | | | | | | | | | | | |

United States | $ | 1.18 |

| | $ | 2.11 |

| | $ | 1.22 |

| | $ | 2.19 |

|

Trinidad | | 1.89 |

| | | 3.05 |

| | | 1.88 |

| | | 3.07 |

|

Other International (B) | | 3.35 |

| | | 3.49 |

| | | 3.49 |

| | | 3.39 |

|

Composite | | 1.44 |

| | | 2.40 |

| | | 1.47 |

| | | 2.45 |

|

|

Crude Oil Equivalent Volumes (MBoed) (D) | | | | | | | | | | | |

United States | | 486.3 |

| | | 498.3 |

| | | 484.9 |

| | | 512.6 |

|

Trinidad | | 59.0 |

| | | 56.5 |

| | | 59.9 |

| | | 56.8 |

|

Other International (B) | | 5.8 |

| | | 5.7 |

| | | 5.6 |

| | | 5.5 |

|

Total | | 551.1 |

| | | 560.5 |

| | | 550.4 |

| | | 574.9 |

|

|

Total MMBoe (D) | | 50.1 |

| | | 51.0 |

| | | 100.2 |

| | | 104.1 |

|

| |

(A) | Thousand barrels per day or million cubic feet per day, as applicable. |

| |

(B) | Other International includes EOG's United Kingdom, China, Canada and Argentina operations. |

| |

(C) | Dollars per barrel or per thousand cubic feet, as applicable. Excludes the impact of financial commodity derivative instruments. |

| |

(D) | Thousand barrels of oil equivalent per day or million barrels of oil equivalent, as applicable; includes crude oil and condensate, natural gas liquids and natural gas. Crude oil equivalent volumes are determined using a ratio of 1.0 barrel of crude oil and condensate or natural gas liquids to 6.0 thousand cubic feet of natural gas. MMBoe is calculated by multiplying the MBoed amount by the number of days in the period and then dividing that amount by one thousand. |

|

| | | | | | | |

EOG RESOURCES, INC. Summary Balance Sheets (Unaudited; in thousands, except share data) |

|

| June 30, | | December 31, |

| 2016 | | 2015 |

ASSETS |

Current Assets | | | | | |

Cash and Cash Equivalents | $ | 779,722 |

| | $ | 718,506 |

|

Accounts Receivable, Net | | 935,592 |

| | | 930,610 |

|

Inventories | | 495,826 |

| | | 598,935 |

|

Income Taxes Receivable | | 4,880 |

| | | 40,704 |

|

Deferred Income Taxes | | 46,712 |

| | | 147,812 |

|

Other | | 187,389 |

| | | 155,677 |

|

Total | | 2,450,121 |

| | | 2,592,244 |

|

|

Property, Plant and Equipment | | | | | |

Oil and Gas Properties (Successful Efforts Method) | | 51,355,620 |

| | | 50,613,241 |

|

Other Property, Plant and Equipment | | 4,001,132 |

| | | 3,986,610 |

|

Total Property, Plant and Equipment | | 55,356,752 |

| | | 54,599,851 |

|

Less: Accumulated Depreciation, Depletion and Amortization | | (32,143,873 | ) | | | (30,389,130 | ) |

Total Property, Plant and Equipment, Net | | 23,212,879 |

| | | 24,210,721 |

|

Other Assets | | 167,538 |

| | | 167,505 |

|

Total Assets | $ | 25,830,538 |

| | $ | 26,970,470 |

|

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY |

Current Liabilities | | | | | |

Accounts Payable | $ | 1,305,651 |

| | $ | 1,471,953 |

|

Accrued Taxes Payable | | 138,395 |

| | | 93,618 |

|

Dividends Payable | | 91,679 |

| | | 91,546 |

|

Liabilities from Price Risk Management Activities | | 1,315 |

| | | — |

|

Current Portion of Long-Term Debt | | 6,579 |

| | | 6,579 |

|

Other | | 168,642 |

| | | 155,591 |

|

Total | | 1,712,261 |

| | | 1,819,287 |

|

| | | | | |

| | | | | |

Long-Term Debt | | 6,979,286 |

| | | 6,648,911 |

|

Other Liabilities | | 978,513 |

| | | 971,335 |

|

Deferred Income Taxes | | 4,103,777 |

| | | 4,587,902 |

|

Commitments and Contingencies | | | | | |

| | | | | |

Stockholders' Equity | | | | | |

Common Stock, $0.01 Par, 640,000,000 Shares Authorized and 551,004,831 Shares Issued at June 30, 2016 and 550,150,823 Shares Issued at December 31, 2015 | | 205,510 |

| | | 205,502 |

|

Additional Paid in Capital | | 2,982,047 |

| | | 2,923,461 |

|

Accumulated Other Comprehensive Loss | | (25,264 | ) | | | (33,338 | ) |

Retained Earnings | | 8,923,666 |

| | | 9,870,816 |

|

Common Stock Held in Treasury, 375,869 Shares at June 30, 2016 and 292,179 Shares at December 31, 2015 | | (29,258 | ) | | | (23,406 | ) |

Total Stockholders' Equity | | 12,056,701 |

| | | 12,943,035 |

|

Total Liabilities and Stockholders' Equity | $ | 25,830,538 |

| | $ | 26,970,470 |

|

|

| | | | | | | |

EOG RESOURCES, INC. Summary Statements of Cash Flows (Unaudited; in thousands) |

| Six Months Ended |

| June 30, |

| 2016 | | 2015 |

Cash Flows from Operating Activities | | | | | |

Reconciliation of Net Loss to Net Cash Provided by Operating Activities: | | | | | |

Net Loss | $ | (764,334 | ) | | $ | (164,480 | ) |

Items Not Requiring (Providing) Cash | | | | | |

Depreciation, Depletion and Amortization | | 1,791,382 |

| | | 1,822,015 |

|

Impairments | | 144,331 |

| | | 137,955 |

|

Stock-Based Compensation Expenses | | 59,471 |

| | | 61,650 |

|

Deferred Income Taxes | | (384,294 | ) | | | (154,803 | ) |

Losses on Asset Dispositions, Net | | 6,403 |

| | | 3,957 |

|

Other, Net | | 29,991 |

| | | 6,787 |

|

Dry Hole Costs | | 74 |

| | | 14,119 |

|

Mark-to-Market Commodity Derivative Contracts | | | | | |

Total (Gains) Losses | | 38,938 |

| | | (27,715 | ) |

Net Cash Received from Settlements of Commodity Derivative Contracts | | 2,852 |

| | | 561,142 |

|

Excess Tax Benefits from Stock-Based Compensation | | (11,811 | ) | | | (16,393 | ) |

Other, Net | | 5,008 |

| | | 6,346 |

|

Changes in Components of Working Capital and Other Assets and Liabilities | | | | | |

Accounts Receivable | | (22,572 | ) | | | 298,183 |

|

Inventories | | 95,813 |

| | | 37,609 |

|

Accounts Payable | | (203,358 | ) | | | (999,644 | ) |

Accrued Taxes Payable | | 93,320 |

| | | 64,124 |

|

Other Assets | | (33,589 | ) | | | 76,114 |

|

Other Liabilities | | 1,565 |

| | | (48,848 | ) |

Changes in Components of Working Capital Associated with Investing and Financing Activities | | (54,453 | ) | | | 169,802 |

|

Net Cash Provided by Operating Activities | | 794,737 |

| | | 1,847,920 |

|

| | | | | |

Investing Cash Flows | | | | | |

Additions to Oil and Gas Properties | | (1,143,549 | ) | | | (2,611,848 | ) |

Additions to Other Property, Plant and Equipment | | (44,584 | ) | | | (201,597 | ) |

Proceeds from Sales of Assets | | 252,529 |

| | | 116,166 |

|

Changes in Components of Working Capital Associated with Investing Activities | | 54,477 |

| | | (169,903 | ) |

Net Cash Used in Investing Activities | | (881,127 | ) | | | (2,867,182 | ) |

| | | | | |

Financing Cash Flows | | | | | |

Net Commercial Paper Repayments | | (259,718 | ) | | | — |

|

Long-Term Debt Borrowings | | 991,097 |

| | | 990,225 |

|

Long-Term Debt Repayments | | (400,000 | ) | | | (500,000 | ) |

Dividends Paid | | (184,036 | ) | | | (183,130 | ) |

Excess Tax Benefits from Stock-Based Compensation | | 11,811 |

| | | 16,393 |

|

Treasury Stock Purchased | | (28,755 | ) | | | (26,362 | ) |

Proceeds from Stock Options Exercised and Employee Stock Purchase Plan | | 10,624 |

| | | 14,484 |

|

Debt Issuance Costs | | (1,602 | ) | | | (1,585 | ) |

Repayment of Capital Lease Obligation | | (3,150 | ) | | | (3,053 | ) |

Other, Net | | (24 | ) | | | 101 |

|

Net Cash Provided by Financing Activities | | 136,247 |

| | | 307,073 |

|

| | | | | |

Effect of Exchange Rate Changes on Cash | | 11,359 |

| | | (7,629 | ) |

| | | | | |

Increase (Decrease) in Cash and Cash Equivalents | | 61,216 |

| | | (719,818 | ) |

Cash and Cash Equivalents at Beginning of Period | | 718,506 |

| | | 2,087,213 |

|

Cash and Cash Equivalents at End of Period | $ | 779,722 |

| | $ | 1,367,395 |

|

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

EOG RESOURCES, INC. Quantitative Reconciliation of Adjusted Net Income (Loss) (Non-GAAP) to Net Income (Loss) (GAAP) (Unaudited; in thousands, except per share data) |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

The following chart adjusts the three-month and six-month periods ended June 30, 2016 and 2015 reported Net Income (Loss) (GAAP) to reflect actual net cash received from (payments for) settlements of commodity derivative contracts by eliminating the unrealized mark-to-market (gains) losses from these transactions, to eliminate the net losses on asset dispositions in 2015 and 2016, to eliminate the impact of the Texas margin tax rate reduction in 2015, to add back severance costs associated with EOG's North American operations in 2015, to eliminate the impact of the Trinidad tax settlement in 2016 and to add back certain voluntary retirement expense in 2016. EOG believes this presentation may be useful to investors who follow the practice of some industry analysts who adjust reported company earnings to match hedge realizations to production settlement months and make certain other adjustments to exclude non-recurring items. EOG management uses this information for purposes of comparing its financial performance with the financial performance of other companies in the industry. |

| | | | | | | | | | | | |

| | Three Months Ended | | | Three Months Ended |

| | June 30, 2016 | | | June 30, 2015 |

| | | | | | | | | | | | |

| | Before Tax | | | Income Tax Impact | | | After Tax | | | Diluted Earnings per Share | | | Before Tax | | | Income Tax Impact | | | After Tax | | | Diluted Earnings per Share |

Reported Net Income (Loss) (GAAP) | $ | (380,277 | ) | | $ | 87,719 |

| | $ | (292,558 | ) | | $ | (0.53 | ) | | $ | (11,478 | ) | | $ | 16,746 |

| | $ | 5,268 |

| | $ | 0.01 |

|

Adjustments: | | | | | | | | | | | | | | | | | | | | | | | |

(Gains) Losses on Mark-to-Market Commodity Derivative Contracts | | 44,373 |

| | | (15,819 | ) | | | 28,554 |

| | | 0.05 |

| | | 48,493 |

| | | (17,288 | ) | | | 31,205 |

| | | 0.06 |

|

Net Cash Received from (Payments for) Settlements of Commodity Derivative Contracts | | (14,835 | ) | | | 5,289 |

| | | (9,546 | ) | | | (0.01 | ) | | | 193,435 |

| | | (68,960 | ) | | | 124,475 |

| | | 0.23 |

|

Add: Net Losses on Asset Dispositions | | 15,550 |

| | | (7,378 | ) | | | 8,172 |

| | | 0.01 |

| | | 5,564 |

| | | 570 |

| | | 6,134 |

| | | 0.01 |

|

Less: Texas Margin Tax Rate Reduction | | — |

| | | — |

| | | — |

| | | — |

| | | — |

| | | (19,500 | ) | | | (19,500 | ) | | | (0.04 | ) |

Add: Severance Costs | | — |

| | | — |

| | | — |

| | | — |

| | | 8,505 |

| | | (3,032 | ) | | | 5,473 |

| | | 0.01 |

|

Add: Trinidad Tax Settlement | | — |

| | | 43,000 |

| | | 43,000 |

| | | 0.08 |

| | | — |

| | | — |

| | | — |

| | | — |

|

Add: Voluntary Retirement Expense | | 19,663 |

| | | (7,010 | ) | | | 12,653 |

| | | 0.02 |

| | | — |

| | | — |

| | | — |

| | | — |

|

Adjustments to Net Income (Loss) | | 64,751 |

| | | 18,082 |

| | | 82,833 |

| | | 0.15 |

| | | 255,997 |

| | | (108,210 | ) | | | 147,787 |

| | | 0.27 |

|

| | | | | | | | | | | | | | | | | | | | | | | |

Adjusted Net Income (Loss) (Non-GAAP) | $ | (315,526 | ) | | $ | 105,801 |

| | $ | (209,725 | ) | | $ | (0.38 | ) | | $ | 244,519 |

| | $ | (91,464 | ) | | $ | 153,055 |

| | $ | 0.28 |

|

| | | | | | | | | | | | | | | | | | | | | | | |

Average Number of Common Shares (GAAP) | | | | | | | | | | | | | | | | | | | | | | | |

Basic | | | | | | | | | | | 547,335 |

| | | | | | | | | | | | 545,504 |

|

Diluted | | | | | | | | | | | 547,335 |

| | | | | | | | | | | | 549,683 |

|

| | | | | | | | | | | | | | | | | | | | | | | |

Average Number of Common Shares (Non-GAAP) | | | | | | | | | | | | | | | | | | | | | | | |

Basic | | | | | | | | | | | 547,335 |

| | | | | | | | | | | | 545,504 |

|

Diluted | | | | | | | | | | | 547,335 |

| | | | | | | | | | | | 549,683 |

|

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Six Months Ended | | | | | | Six Months Ended |

| | June 30, 2016 | | | | | | June 30, 2015 |

| | | | | | | | | | | | | | | | | | | | | | | |

| | Before Tax | | | Income Tax Impact | | | After Tax | | | Diluted Earnings per Share | | | Before Tax | | | Income Tax Impact | | | After Tax | | | Diluted Earnings per Share |

Reported Net Income (Loss) (GAAP) | $ | (1,091,245 | ) | | $ | 326,911 |

| | $ | (764,334 | ) | | $ | (1.40 | ) | | $ | (247,809 | ) | | $ | 83,329 |

| | $ | (164,480 | ) | | $ | (0.30 | ) |

Adjustments: | | | | | | | | | | | | | | | | | | | | | | | |

(Gains) Losses on Mark-to-Market Commodity Derivative Contracts | | 38,938 |

| | | (13,881 | ) | | | 25,057 |

| | | 0.05 |

| | | (27,715 | ) | | | 9,880 |

| | | (17,835 | ) | | | (0.03 | ) |

Net Cash Received from (Payments for) Settlements of Commodity Derivative Contracts | | 2,852 |

| | | (1,017 | ) | | | 1,835 |

| | | — |

| | | 561,142 |

| | | (200,047 | ) | | | 361,095 |

| | | 0.66 |

|

Add: Net Losses on Asset Dispositions | | 6,403 |

| | | (4,168 | ) | | | 2,235 |

| | | — |

| | | 3,957 |

| | | 1,166 |

| | | 5,123 |

| | | 0.01 |

|

Less: Texas Margin Tax Rate Reduction | | — |

| | | — |

| | | — |

| | | — |

| | | — |

| | | (19,500 | ) | | | (19,500 | ) | | | (0.04 | ) |

Add: Severance Costs | | — |

| | | — |

| | | — |

| | | — |

| | | 8,505 |

| | | (3,032 | ) | | | 5,473 |

| | | 0.01 |

|

Add: Trinidad Tax Settlement | | — |

| | | 43,000 |

| | | 43,000 |

| | | 0.08 |

| | | — |

| | | — |

| | | — |

| | | — |

|

Add: Voluntary Retirement Expense | | 42,054 |

| | | (14,992 | ) | | | 27,062 |

| | | 0.05 |

| | | — |

| | | — |

| | | — |

| | | — |

|

Adjustments to Net Income (Loss) | | 90,247 |

| | | 8,942 |

| | | 99,189 |

| | | 0.18 |

| | | 545,889 |

| | | (211,533 | ) | | | 334,356 |

| | | 0.61 |

|

| | | | | | | | | | | | | | | | | | | | | | | |

Adjusted Net Income (Loss) (Non-GAAP) | $ | (1,000,998 | ) | | $ | 335,853 |

| | $ | (665,145 | ) | | $ | (1.22 | ) | | $ | 298,080 |

| | $ | (128,204 | ) | | $ | 169,876 |

| | $ | 0.31 |

|

| | | | | | | | | | | | | | | | | | | | | | | |

Average Number of Common Shares (GAAP) | | | | | | | | | | | | | | | | | | | | | | | |

Basic | | | | | | | | | | | 547,029 |

| | | | | | | | | | | | 545,245 |

|

Diluted | | | | | | | | | | | 547,029 |

| | | | | | | | | | | | 545,245 |

|

| | | | | | | | | | | | | | | | | | | | | | | |

Average Number of Common Shares (Non-GAAP) | | | | | | | | | | | | | | | | | | | | | | | |

Basic | | | | | | | | | | | 547,029 |

| | | | | | | | | | | | 545,245 |

|

Diluted | | | | | | | | | | | 547,029 |

| | | | | | | | | | | | 549,505 |

|

|

| | | | | | | | | | | | | | | |

EOG RESOURCES, INC. Quantitative Reconciliation of Discretionary Cash Flow (Non-GAAP) to Net Cash Provided by Operating Activities (GAAP) (Unaudited; in thousands) |

|

The following chart reconciles the three-month and six-month periods ended June 30, 2016 and 2015 Net Cash Provided by Operating Activities (GAAP) to Discretionary Cash Flow (Non-GAAP). EOG believes this presentation may be useful to investors who follow the practice of some industry analysts who adjust Net Cash Provided by Operating Activities for Exploration Costs (excluding Stock-Based Compensation Expenses), Excess Tax Benefits from Stock-Based Compensation, Changes in Components of Working Capital and Other Assets and Liabilities, and Changes in Components of Working Capital Associated with Investing and Financing Activities. EOG management uses this information for comparative purposes within the industry. |

|

| Three Months Ended | | Six Months Ended |

| June 30, | | June 30, |

| 2016 | | 2015 | | 2016 | | 2015 |

|

Net Cash Provided by Operating Activities (GAAP) | $ | 503,146 |

| | $ | 887,373 |

| | $ | 794,737 |

| | $ | 1,847,920 |

|

| | | | | | | | | | | |

Adjustments: | | | | | | | | | | | |

Exploration Costs (excluding Stock-Based Compensation Expenses) | | 25,527 |

| | | 37,870 |

| | | 48,884 |

| | | 69,967 |

|

Excess Tax Benefits from Stock-Based Compensation | | 11,811 |

| | | 7,535 |

| | | 11,811 |

| | | 16,393 |

|

Changes in Components of Working Capital and Other Assets and Liabilities | | | | | | | | | | | |

Accounts Receivable | | 154,970 |

| | | 54,917 |

| | | 22,572 |

| | | (298,183 | ) |

Inventories | | (38,235 | ) | | | (99,781 | ) | | | (95,813 | ) | | | (37,609 | ) |

Accounts Payable | | (86,269 | ) | | | 321,769 |

| | | 203,358 |

| | | 999,644 |

|

Accrued Taxes Payable | | (90,860 | ) | | | (62,019 | ) | | | (93,320 | ) | | | (64,124 | ) |

Other Assets | | 37,535 |

| | | (16,938 | ) | | | 33,589 |

| | | (76,114 | ) |

Other Liabilities | | 6,427 |

| | | 16,993 |

| | | (1,565 | ) | | | 48,848 |

|

Changes in Components of Working Capital Associated with Investing and Financing Activities | | 56,681 |

| | | 90,190 |

| | | 54,453 |

| | | (169,802 | ) |

| | | | | | | | | | | |

Discretionary Cash Flow (Non-GAAP) | $ | 580,733 |

| | $ | 1,237,909 |

| | $ | 978,706 |

| | $ | 2,336,940 |

|

| | | | | | | | | | | |

Discretionary Cash Flow (Non-GAAP) - Percentage Decrease | | -53 | % | | | | | | -58 | % | | | |

|

| | | | | | | | | | | | | | | |

EOG RESOURCES, INC. Quantitative Reconciliation of Adjusted Earnings Before Interest Expense, Income Taxes, Depreciation, Depletion and Amortization, Exploration Costs, Dry Hole Costs, Impairments and Additional Items (Adjusted EBITDAX) (Non-GAAP) to Net Income (Loss) (GAAP) (Unaudited; in thousands) |

| | | | | | | | | | | |

The following chart adjusts the three-month and six-month periods ended June 30, 2016 and 2015 reported Net Income (Loss) (GAAP) to Earnings Before Net Interest Expense, Income Taxes, Depreciation, Depletion and Amortization, Exploration Costs, Dry Hole Costs and Impairments (EBITDAX) (Non-GAAP) and further adjusts such amount to reflect actual net cash received from (payments for) settlements of commodity derivative contracts by eliminating the unrealized mark-to-market (MTM) (gains) losses from these transactions and to eliminate the net losses on asset dispositions. EOG believes this presentation may be useful to investors who follow the practice of some industry analysts who adjust reported Net Income (Loss) (GAAP) to add back Interest Expense, Income Taxes, Depreciation, Depletion and Amortization, Exploration Costs, Dry Hole Costs and Impairments and further adjust such amount to match hedge realizations to production settlement months and make certain other adjustments to exclude non-recurring items. EOG management uses this information for purposes of comparing its financial performance with the financial performance of other companies in the industry. |

| | | | | | | | | | | |

| Three Months Ended | | Six Months Ended |

| June 30, | | June 30, |

| 2016 | | 2015 | | 2016 | | 2015 |

| | | | | | | | | | | |

Net Income (Loss) (GAAP) | $ | (292,558 | ) | | $ | 5,268 |

| | $ | (764,334 | ) | | $ | (164,480 | ) |

| | | | | | | | | | | |

Adjustments: | | | | | | | | | | | |

Interest Expense, Net | | 71,108 |

| | | 60,484 |

| | | 139,498 |

| | | 113,829 |

|

Income Tax Benefit | | (87,719 | ) | | | (16,746 | ) | | | (326,911 | ) | | | (83,329 | ) |

Depreciation, Depletion and Amortization | | 862,491 |

| | | 909,227 |

| | | 1,791,382 |

| | | 1,822,015 |

|

Exploration Costs | | 30,559 |

| | | 43,755 |

| | | 60,388 |

| | | 83,204 |

|

Dry Hole Costs | | (172 | ) | | | (551 | ) | | | 74 |

| | | 14,119 |

|

Impairments | | 72,714 |

| | | 68,519 |

| | | 144,331 |

| | | 137,955 |

|

EBITDAX (Non-GAAP) | | 656,423 |

| | | 1,069,956 |

| | | 1,044,428 |

| | | 1,923,313 |

|

Total (Gains) Losses on MTM Commodity Derivative Contracts | | 44,373 |

| | | 48,493 |

| | | 38,938 |

| | | (27,715 | ) |

Net Cash Received from (Payments for)Settlements of Commodity Derivative Contracts | | (14,835 | ) | | | 193,435 |

| | | 2,852 |

| | | 561,142 |

|

Losses on Asset Dispositions, Net | | 15,550 |

| | | 5,564 |

| | | 6,403 |

| | | 3,957 |

|

| | | | | | | | | | | |

Adjusted EBITDAX (Non-GAAP) | $ | 701,511 |

| | $ | 1,317,448 |

| | $ | 1,092,621 |

| | $ | 2,460,697 |

|

| | | | | | | | | | | |

Adjusted EBITDAX (Non-GAAP) - Percentage Decrease | | -47 | % | | | | | | -56 | % | | | |

|

| | | | | | | |

EOG RESOURCES, INC. Quantitative Reconciliation of Net Debt (Non-GAAP) and Total Capitalization (Non-GAAP) as Used in the Calculation of the Net Debt-to-Total Capitalization Ratio (Non-GAAP) to Current and Long-Term Debt (GAAP) and Total Capitalization (GAAP) (Unaudited; in millions, except ratio data) |

| | |

The following chart reconciles Current and Long-Term Debt (GAAP) to Net Debt (Non-GAAP) and Total Capitalization (GAAP) to Total Capitalization (Non-GAAP), as used in the Net Debt-to-Total Capitalization ratio calculation. A portion of the cash is associated with international subsidiaries; tax considerations may impact debt paydown. EOG believes this presentation may be useful to investors who follow the practice of some industry analysts who utilize Net Debt and Total Capitalization (Non-GAAP) in their Net Debt-to-Total Capitalization ratio calculation. EOG management uses this information for comparative purposes within the industry. |

| | |

| At | | At |

| June 30, | | December 31, |

| 2016 | | 2015 |

| | |

Total Stockholders' Equity - (a) | $ | 12,057 |

| | $ | 12,943 |

|

| | | | | |

Current and Long-Term Debt (GAAP) - (b) | | 6,986 |

| | | 6,655 |

|

Less: Cash | | (780 | ) | | | (719 | ) |

Net Debt (Non-GAAP) - (c) | | 6,206 |

| | | 5,936 |

|

| | | | | |

Total Capitalization (GAAP) - (a) + (b) | $ | 19,043 |

| | $ | 19,598 |

|

| | | | | |

Total Capitalization (Non-GAAP) - (a) + (c) | $ | 18,263 |

| | $ | 18,879 |

|

| | | | | |

Debt-to-Total Capitalization (GAAP) - (b) / [(a) + (b)] | | 37 | % | | | 34 | % |

| | | | | |

Net Debt-to-Total Capitalization (Non-GAAP) - (c) / [(a) + (c)] | | 34 | % | | | 31 | % |

|

| | | | | | | | | | | | | |

EOG RESOURCES, INC. Natural Gas Financial Commodity Derivative Contracts |

|

Presented below is a comprehensive summary of EOG's natural gas derivative contracts at August 4, 2016, with notional volumes expressed in MMBtud and prices expressed in $/MMBtu. EOG accounts for financial commodity derivative contracts using the mark-to-market accounting method. |

|

Natural Gas Option Contracts |

| Call Options Sold | | Put Options Purchased |

| Volume (MMBtud) | | Weighted

Average Price

($/MMBtu) | | Volume (MMBtud) | | Weighted

Average Price

($/MMBtu) |

2016 | | | | | | | |

September 1, 2016 through November 30, 2016 | 43,750 |

| | $ | 3.45 |

| | — |

| | $ | — |

|

| | | | | | | |

2017 | | | | | | | |

March 1, 2017 through November 30, 2017 | 43,750 |

| | $ | 3.45 |

| | 35,000 |

| | $ | 2.90 |

|

| | | | | | | |

2018 | | | | | | | |

March 1, 2018 through November 30, 2018 | 12,500 |

| | $ | 3.32 |

| | 10,000 |

| | $ | 2.90 |

|

|

| | |

Definitions |

MMBtud | | Million British thermal units per day |

$/MMBtu | | Dollars per million British thermal units |

|

|

EOG RESOURCES, INC. |

Direct After-Tax Rate of Return (ATROR) |

|

The calculation of our direct after-tax rate of return (ATROR) with respect to our capital expenditure program for a particular play or well is based on the estimated proved reserves ("net" to EOG’s interest) for all wells in such play or such well (as the case may be), the estimated net present value (NPV) of the future net cash flows from such reserves (for which we utilize certain assumptions regarding future commodity prices and operating costs) and our direct net costs incurred in drilling or acquiring (as the case may be) such wells or well (as the case may be). As such, our direct ATROR with respect to our capital expenditures for a particular play or well cannot be calculated from our consolidated financial statements. |

|

Direct ATROR |

Based on Cash Flow and Time Value of Money |

- Estimated future commodity prices and operating costs |

- Costs incurred to drill, complete and equip a well, including facilities |

Excludes Indirect Capital |

- Gathering and Processing and other Midstream |

- Land, Seismic, Geological and Geophysical |

|

Payback ~12 Months on 100% Direct ATROR Wells |

First Five Years ~1/2 Estimated Ultimate Recovery Produced but ~3/4 of NPV Captured |

|

|

Return on Equity / Return on Capital Employed |

Based on GAAP Accrual Accounting |

Includes All Indirect Capital and Growth Capital for Infrastructure |

- Eagle Ford, Bakken, Permian Facilities |

- Gathering and Processing |

Includes Legacy Gas Capital and Capital from Mature Wells |

|

| | | | | | | | | | | | | | | |

EOG RESOURCES, INC. Quantitative Reconciliation of After-Tax Net Interest Expense (Non-GAAP), Adjusted Net Income (Non-GAAP), Net Debt (Non-GAAP) and Total Capitalization (Non-GAAP) as used in the Calculations of Return on Capital Employed (Non-GAAP) and Return on Equity (Non-GAAP) to Net Interest Expense (GAAP), Net Income (Loss) (GAAP), Current and Long-Term (GAAP) and Total Capitalization (GAAP), Respectively (Unaudited; in millions, except ratio data) |

| | | | | | | |

The following chart reconciles Net Interest Expense (GAAP), Net Income (Loss) (GAAP), Current and Long-Term Debt (GAAP) and Total Capitalization (GAAP) to After-Tax Net Interest Expense (Non-GAAP), Adjusted Net Income (Non-GAAP), Net Debt (Non-GAAP) and Total Capitalization (Non-GAAP), respectively, as used in the Return on Capital Employed (ROCE) and Return on Equity (ROE) calculations. EOG believes this presentation may be useful to investors who follow the practice of some industry analysts who utilize After-Tax Net Interest Expense, Adjusted Net Income, Net Debt and Total Capitalization (Non-GAAP) in their ROCE and ROE calculations. EOG management uses this information for purposes of comparing its financial performance with the financial performance of other companies in the industry. |

| 2015 | | 2014 | | 2013 | | 2012 |

Return on Capital Employed (ROCE) (Non-GAAP) | | | | | | | |

| | | | | | | |

Net Interest Expense (GAAP) | $ | 237 |

| | $ | 201 |

| | $ | 235 |

| | |

Tax Benefit Imputed (based on 35%) | (83 | ) | | (70 | ) | | (82 | ) | | |

After-Tax Net Interest Expense (Non-GAAP) - (a) | $ | 154 |

| | $ | 131 |

| | $ | 153 |

| | |

| | | | | | | |

Net Income (Loss) (GAAP) - (b) | $ | (4,525 | ) | | $ | 2,915 |

| | $ | 2,197 |

| | |

Adjustments to Net Income (Loss), Net of Tax (See Accompanying Schedules) | 4,559 |

| (a) | (199 | ) | (b) | 49 |

| (c) | |

Adjusted Net Income (Non-GAAP) - (c) | $ | 34 |

| | $ | 2,716 |

| | $ | 2,246 |

| | |

| | | | | | | |

Total Stockholders' Equity - (d) | $ | 12,943 |

| | $ | 17,713 |

| | $ | 15,418 |

| | $ | 13,285 |

|

| | | | | | | |

Average Total Stockholders' Equity * - (e) | $ | 15,328 |

| | $ | 16,566 |

| | $ | 14,352 |

| | |

| | | | | | | |

Current and Long-Term Debt (GAAP) - (f) | $ | 6,660 |

| | $ | 5,910 |

| | $ | 5,913 |

| | $ | 6,312 |

|

Less: Cash | (719 | ) | | (2,087 | ) | | (1,318 | ) | | (876 | ) |

Net Debt (Non-GAAP) - (g) | $ | 5,941 |

| | $ | 3,823 |

| | $ | 4,595 |

| | $ | 5,436 |

|

| | | | | | | |

Total Capitalization (GAAP) - (d) + (f) | $ | 19,603 |

| | $ | 23,623 |

| | $ | 21,331 |

| | $ | 19,597 |

|

| | | | | | | |

Total Capitalization (Non-GAAP) - (d) + (g) | $ | 18,884 |

| | $ | 21,536 |

| | $ | 20,013 |

| | $ | 18,721 |

|

| | | | | | | |

Average Total Capitalization (Non-GAAP) * - (h) | $ | 20,210 |

| | $ | 20,775 |

| | $ | 19,367 |

| | |

| | | | | | | |

ROCE (GAAP Net Income) - [(a) + (b)] / (h) | -21.6 | % | | 14.7 | % | | 12.1 | % | | |

| | | | | | | |

ROCE (Non-GAAP Adjusted Net Income) - [(a) + (c)] / (h) | 0.9 | % | | 13.7 | % | | 12.4 | % | | |

| | | | | | | |

Return on Equity (ROE) (Non-GAAP) | | | | | | | |

| | | | | | | |

ROE (GAAP Net Income) - (b) / (e) | -29.5 | % | | 17.6 | % | | 15.3 | % | | |

| | | | | | | |

ROE (Non-GAAP Adjusted Net Income) - (c) / (e) | 0.2 | % | | 16.4 | % | | 15.6 | % | | |

| | | | | | | |

* Average for the current and immediately preceding year | | | | | | | |

Adjustments to Net Income (Loss) (GAAP)

|

| | | | | | | | | | | |

(a) See below schedule for detail of adjustments to Net Income (Loss) (GAAP) in 2015: |

| Year Ended December 31, 2015 |

| Before Tax | | Income Tax Impact | | After Tax |

Adjustments: | | | | | |

Add: Mark-to-Market Commodity Derivative Contracts Impact | $ | 668 |

| | $ | (238 | ) | | $ | 430 |

|

Add: Impairments of Certain Assets | 6,308 |

| | (2,183 | ) | | 4,125 |

|

Less: Texas Margin Tax Rate Reduction | (20 | ) | | — |

| | (20 | ) |

Add: Legal Settlement - Early Leasehold Termination | 19 |

| | (6 | ) | | 13 |

|

Add: Severance Costs | 9 |

| | (3 | ) | | 6 |

|

Add: Net Losses on Asset Dispositions | 9 |

| | (4 | ) | | 5 |

|

Total | $ | 6,993 |

| | $ | (2,434 | ) | | $ | 4,559 |

|

|

| | | | | | | | | | | |

(b) See below schedule for detail of adjustments to Net Income (Loss) (GAAP) in 2014: |

| Year Ended December 31, 2014 |

| Before Tax | | Income Tax Impact | | After Tax |

Adjustments: | | | | | |

Less: Mark-to-Market Commodity Derivative Contracts Impact | $ | (800 | ) | | $ | 285 |

| | $ | (515 | ) |

Add: Impairments of Certain Assets | 824 |

| | (271 | ) | | 553 |

|

Less: Net Gains on Asset Dispositions | (508 | ) | | 21 |

| | (487 | ) |

Add: Tax Expense Related to the Repatriation of Accumulated Foreign Earnings in Future Years | 250 |

| | — |

| | 250 |

|

Total | $ | (234 | ) | | $ | 35 |

| | $ | (199 | ) |

|

| | | | | | | | | | | |

(c) See below schedule for detail of adjustments to Net Income (Loss) (GAAP) in 2013: |

| Year Ended December 31, 2013 |

| Before Tax | | Income Tax Impact | | After Tax |

Adjustments: | | | | | |

Add: Mark-to-Market Commodity Derivative Contracts Impact | $ | 283 |

| | $ | (101 | ) | | $ | 182 |

|

Add: Impairments of Certain Assets | 7 |

| | (3 | ) | | 4 |

|

Less: Net Gains on Asset Dispositions | (198 | ) | | 61 |

| | (137 | ) |

Total | $ | 92 |

| | $ | (43 | ) | | $ | 49 |

|

|

| | | | | | | | | | | | | | | | | | | |

EOG RESOURCES, INC. Third Quarter and Full Year 2016 Forecast and Benchmark Commodity Pricing |

|

(a) Third Quarter and Full Year 2016 Forecast |

|

The forecast items for the third quarter and full year 2016 set forth below for EOG Resources, Inc. (EOG) are based on current available information and expectations as of the date of the accompanying press release. EOG undertakes no obligation, other than as required by applicable law, to update or revise this forecast, whether as a result of new information, subsequent events, anticipated or unanticipated circumstances or otherwise. This forecast, which should be read in conjunction with the accompanying press release and EOG's related Current Report on Form 8-K filing, replaces and supersedes any previously issued guidance or forecast. |

|

(b) Benchmark Commodity Pricing |

|

EOG bases United States and Trinidad crude oil and condensate price differentials upon the West Texas Intermediate crude oil price at Cushing, Oklahoma, using the simple average of the NYMEX settlement prices for each trading day within the applicable calendar month. |

|

EOG bases United States natural gas price differentials upon the natural gas price at Henry Hub, Louisiana, using the simple average of the NYMEX settlement prices for the last three trading days of the applicable month. |

|

| | Estimated Ranges (Unaudited) |

| | 3Q 2016 | | | Full Year 2016 |

Daily Production | | | | | | | | | | | |

Crude Oil and Condensate Volumes (MBbld) | | | | | | | | | | | |

United States | | 264.0 |

| - | | 272.0 |

| | | 266.0 |

| - | | 270.0 |

|

Trinidad | | 0.4 |

| - | | 0.8 |

| | | 0.6 |

| - | | 0.8 |

|

Other International | | 4.0 |

| - | | 8.0 |

| | | 3.0 |

| - | | 5.0 |

|

Total | | 268.4 |

| - | | 280.8 |

| | | 269.6 |

| - | | 275.8 |

|

|

Natural Gas Liquids Volumes (MBbld) | | | | | | | | | | | |

Total | | 75.0 |

| - | | 79.0 |

| | | 76.0 |

| - | | 80.0 |

|

| | | | | | | | | | | |

Natural Gas Volumes (MMcfd) | | | | | | | | | | | |

United States | | 740 |

| - | | 760 |

| | | 775 |

| - | | 795 |

|

Trinidad | | 325 |

| - | | 355 |

| | | 330 |

| - | | 355 |

|

Other International | | 20 |

| - | | 24 |

| | | 22 |

| - | | 24 |

|

Total | | 1,085 |

| - | | 1,139 |

| | | 1,127 |

| - | | 1,174 |

|

|

Crude Oil Equivalent Volumes (MBoed) | | | | | | | | | | | |

United States | | 462.3 |

| - | | 477.7 |

| | | 471.2 |

| - | | 482.5 |

|

Trinidad | | 54.6 |

| - | | 60.0 |

| | | 55.6 |

| - | | 60.0 |

|

Other International | | 7.3 |

| - | | 12.0 |

| | | 6.7 |

| - | | 9.0 |

|

Total | | 524.2 |

| - | | 549.7 |

| | | 533.5 |

| - | | 551.5 |

|

|

|

| | | | | | | | | | | | | | | | | | | |

| Estimated Ranges (Unaudited) |

| 3Q 2016 | | Full Year 2016 |

Operating Costs | | | | | | | | | | | |

Unit Costs ($/Boe) | | | | | | | | | | | |

Lease and Well | $ | 4.50 |

| - | $ | 5.00 |

| | $ | 4.50 |

| - | $ | 5.00 |

|

Transportation Costs | $ | 3.75 |

| - | $ | 4.25 |

| | $ | 3.70 |

| - | $ | 4.00 |

|

Depreciation, Depletion and Amortization | $ | 17.45 |

| - | $ | 17.85 |

| | $ | 17.65 |

| - | $ | 18.00 |

|

| | | | | | | | | | | | | | | |

Expenses ($MM) | | | | | | | | | | | |

Exploration, Dry Hole and Impairment | $ | 105 |

| - | $ | 125 |

| | $ | 415 |

| - | $ | 460 |

|

General and Administrative | $ | 85 |

| - | $ | 95 |

| | $ | 320 |

| - | $ | 340 |

|

Gathering and Processing | $ | 28 |

| - | $ | 32 |

| | $ | 112 |

| - | $ | 122 |

|

Capitalized Interest | $ | 6 |

| - | $ | 8 |

| | $ | 30 |

| - | $ | 33 |

|

Net Interest | $ | 69 |

| - | $ | 71 |

| | $ | 277 |

| - | $ | 283 |

|

| | | | | | | | | | | | | | | |

Taxes Other Than Income (% of Wellhead Revenue) | | 6.3 | % | - | | 6.7 | % | | | 6.4 | % | - | | 6.6 | % |

| | | | | | | | | | | | | | | |

Income Taxes | | | | | | | | | | | |

Effective Rate | | 28 | % | - | | 33 | % | | | 28 | % | - | | 33 | % |

Current Taxes ($MM) | $ | (15 | ) | - | $ | 0 |

| | $ | 50 |

| - | $ | 70 |

|

| | | | | | | | | | | |

Capital Expenditures (Excluding Acquisitions, $MM) | | | | | | | | | | | |

Exploration and Development, Excluding Facilities | | | | | | | $ | 1,925 |

| - | $ | 2,025 |

|

Exploration and Development Facilities | | | | | | | $ | 350 |

| - | $ | 400 |

|

Gathering, Processing and Other | | | | | | | $ | 125 |

| - | $ | 175 |

|

| | | | | | | | | | | | | | | |

Pricing - (Refer to Benchmark Commodity Pricing in text) | | | | | | | | | | | |

Crude Oil and Condensate ($/Bbl) | | | | | | | | | | | |

Differentials | | | | | | | | | | | |

United States - above (below) WTI | $ | (3.00 | ) | - | $ | (1.00 | ) | | $ | (2.65 | ) | - | $ | (1.65 | ) |

Trinidad - above (below) WTI | $ | (10.50 | ) | - | $ | (9.50 | ) | | $ | (10.80 | ) | - | $ | (10.30 | ) |

Other International - above (below) WTI | $ | (5.00 | ) | - | $ | (3.00 | ) | | $ | (5.15 | ) | - | $ | (4.15 | ) |

| | | | | | | | | | | |

Natural Gas Liquids | | | | | | | | | | | |

Realizations as % of WTI | | 30 | % | - | | 34 | % | | | 31 | % | - | | 33 | % |

| | | | | | | | | | | |

Natural Gas ($/Mcf) | | | | | | | | | | | |

Differentials | | | | | | | | | | | |

United States - above (below) NYMEX Henry Hub | $ | (1.15 | ) | - | $ | (0.50 | ) | | $ | (0.90 | ) | - | $ | (0.70 | ) |

| | | | | | | | | | | | | | | |

Realizations | | | | | | | | | | | |

Trinidad | $ | 1.70 |

| - | $ | 2.30 |

| | $ | 1.85 |

| - | $ | 2.20 |

|

Other International | $ | 3.00 |

| - | $ | 4.25 |

| | $ | 3.30 |

| - | $ | 3.80 |

|

|

Definitions | | | | | | | | | | | |

$/Bbl | | U.S. Dollars per barrel | | | | | | | | | | | |

$/Boe | | U.S. Dollars per barrel of oil equivalent | | | | | | | | | | | |

$/Mcf | | U.S. Dollars per thousand cubic feet | | | | | | | | | | | |

$MM | | U.S. Dollars in millions | | | | | | | | | | | |

MBbld | | Thousand barrels per day | | | | | | | | | | | |

MBoed | | Thousand barrels of oil equivalent per day | | | | | | | | | | | |

MMcfd | | Million cubic feet per day | | | | | | | | | | | |

NYMEX | | New York Mercantile Exchange | | | | | | | | | | | |

WTI | | West Texas Intermediate | | | | | | | | | | | |

This regulatory filing also includes additional resources:

eog8kpressrelease080416.pdf

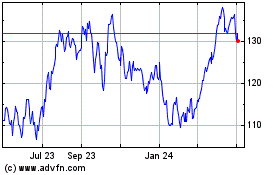

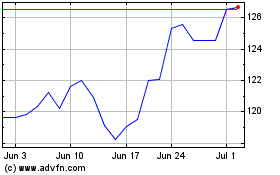

EOG Resources (NYSE:EOG)

Historical Stock Chart

From Mar 2024 to Apr 2024

EOG Resources (NYSE:EOG)

Historical Stock Chart

From Apr 2023 to Apr 2024