– Advanced Two Programs into Phase 1 Clinical

Studies: ALN-TTRsc02 for Transthyretin-Mediated Amyloidosis and

ALN-HBV for Chronic Hepatitis B Virus Infection –

– Presented Clinical Data from Patisiran,

Revusiran, Fitusiran, and ALN-CC5 Programs –

– Maintained Strong Balance Sheet

with $1.28 Billion in Cash and Remains On Track to End

2016 with Greater than $1.0 Billion in Cash –

Alnylam Pharmaceuticals, Inc. (Nasdaq: ALNY), the leading RNAi

therapeutics company, today reported its consolidated financial

results for the second quarter 2016, and highlighted recent

progress in advancing its pipeline.

“We continue to advance our pipeline of now ten investigational

RNAi therapeutics, an entirely new and innovative class of

medicines, across a broad range of diseases. We believe our two

latest stage programs, patisiran and revusiran, have demonstrated

encouraging progress for patients with hATTR amyloidosis,” said

John Maraganore, Ph.D., Chief Executive Officer of Alnylam. “We

also recently presented new results in our hemophilia program

showing that a once-monthly, subcutaneous regimen of fitusiran can

achieve a median estimated annualized bleeding rate of zero in

hemophilia A and B patients. In addition, we presented encouraging

initial data in hemophilia patients with inhibitors. Through the

end of the year, we are anticipating a very data rich period marked

with over six planned clinical readouts – we look forward to

sharing our continued progress.”

Second Quarter 2016 and Recent Significant Corporate

Highlights

- Advanced investigational pipeline

programs in Genetic Medicine Strategic Therapeutic Area (STAr).

- Advanced investigational RNAi

therapeutic programs for the treatment of transthyrethin

(TTR)-mediated amyloidosis (ATTR amyloidosis).

- Reported positive initial 24-month data

from ongoing Phase 2 open-label extension (OLE) study with

patisiran for the treatment of hereditary ATTR amyloidosis with

polyneuropathy (hATTR-PN). Results showed that patisiran can

potentially halt or improve neuropathy progression. Patisiran

administration was also found to be generally well tolerated in

hATTR-PN patients out to 25 months, with no drug-related serious

adverse events (SAEs) reported through the data transfer date.

- Presented baseline demographic data

from APOLLO Phase 3 study of patisiran, revealing enrollment of a

globally representative patient population with a wide range of

disease severity and TTR mutations.

- Reported initial 12-month results from

ongoing Phase 2 OLE study with revusiran for the treatment of

hereditary ATTR amyloidosis with cardiomyopathy (hATTR-CM).

- Initiated Phase 1 clinical trial for

ALN-TTRsc02, an Enhanced Stabilization Chemistry (ESC)-GalNAc-siRNA

conjugate targeting TTR for the treatment of ATTR amyloidosis,

which is expected to enable a low volume, once quarterly,

subcutaneous dosing regimen.

- Reported positive interim clinical

results from Phase 1 study of fitusiran for the treatment of

hemophilia and rare bleeding disorders (RBD).

- Fitusiran achieved a median estimated

annualized bleeding rate (ABR) of zero in hemophilia patients

without inhibitors. In the initial low-dose cohort of patients with

inhibitors, fitusiran achieved antithrombin lowering, increased

thrombin generation, and preliminary evidence for reduced bleeding.

Fitusiran administration was generally well tolerated in patients

with and without inhibitors, with no SAEs related to study drug,

and no thromboembolic events or laboratory evidence (based on

D-dimer, platelet count, fibrinogen, and/or PT/INR) of pathologic

clot formation through the data transfer date.

- Continued dosing hemophilia patients in

ongoing Phase 1/2 OLE study, with patients currently having

received up to 13 months of dosing.

- The Company also updated its guidance

for Phase 3 initiation, and now plans to start studies in early

2017.

- Reported initial clinical results in

patients with paroxysmal nocturnal hemoglobinuria (PNH) from

ongoing Phase 1/2 study of ALN-CC5 for the treatment of

complement-mediated diseases.

- Initial data support the potential for

ALN-CC5 to reduce the dose and frequency of eculizumab, as well as

to improve disease control in eculizumab inadequate

responders.

- ALN-CC5 was generally well tolerated in

patients with PNH after multiple doses, with the majority of

adverse events (AEs) being mild or moderate in severity. There were

no drug related SAEs or discontinuations due to AEs in the study

through the data transfer date.

- The Company announces today that the

European Medicines Agency (EMA) has granted Orphan Drug Designation

to ALN-AS1 for the treatment of acute hepatic porphyrias.

- The Company also announces today the

publication of pre-clinical data with ALN-GO1 for the treatment of

primary hyperoxaluria type 1 (PH1) in the Journal of the American

Society of Nephrology (Liebow et al., J Am Soc Nephrol, 2016;

doi:10.1681/ASN.2016030338).

- Advanced investigational pipeline

programs in Cardio-Metabolic Disease STAr.

- The Medicines Company announced

completion of enrollment in its Phase 2 ORION-1 study for ALN-PCSsc

(also known as PCSK9si). The trial enrolled 501 patients with

atherosclerotic cardiovascular disease (ASCVD), exceeding the

original enrollment target of 480 patients.

- Advanced investigational pipeline

programs in Hepatic Infectious Disease STAr.

- Initiated Phase 1/2 clinical trial with

ALN-HBV for the treatment of hepatitis B virus (HBV)

infection.

- Broke ground on new manufacturing

facility in Norton, Massachusetts. The 200,000 square foot,

state-of-the-art facility is being built to support the Company’s

expanding development pipeline and transition toward commercial

stage.

- Expanded Management Team with

appointments of Adrian Dana, M.D., Vice President of Drug Safety

and Pharmacovigilance; Brendan Martin, General Manager, UK and

Ireland; Jeffrey Miller, Vice President, General Manager, CC5

Program; and Andrew Slugg, Vice President of Regulatory

Affairs.

Upcoming Events in 2H 2016

- Alnylam announces today that it plans

to present clinical data at these upcoming conferences:

- Complete data from Parts A and B

(single and multiple ascending dose, respectively) of the ongoing

Phase 1 clinical trial of ALN-AS1 in patients who are asymptomatic

“high excreters” (ASHE) at the 2016 Society for the Study of Inborn

Errors of Metabolism (SSIEM) Annual Symposium, being held September

6 – 9, 2016 in Rome, Italy, in an oral presentation on Wednesday,

September 7, at 2:15 pm Central European Summer Time (8:15 am

ET).

- Initial clinical results from the

ongoing Phase 1/2 study of ALN-GO1 at the 17th Congress of the

International Pediatric Nephrology Association (IPNA), being held

September 20 – 24, 2016 in Iguaçu, Brazil, in an oral presentation

on Saturday, September 24, at 3:25 pm Brasília Time (2:25 pm

ET).

- Initial Phase 1/2 data for ALN-AAT at

the 12th Annual Meeting of the Oligonucleotide Therapeutics Society

(OTS), being held September 25 – 28, 2016 in Montreal, Canada;

- Alnylam also announces today that it

plans to host an R&D Day on the morning of Friday, December 16,

2016 at the Westin New York at Times Square in New York City.

- In addition, in the second half of

2016, Alnylam plans to:

- Complete enrollment in ENDEAVOUR Phase

3 study of revusiran;

- Present additional clinical data from

the fitusiran Phase 1 study and initial data from the Phase 1/2 OLE

study;

- Start a new Phase 2 trial with ALN-CC5

in inadequate eculizumab responder PNH patients;

- Present additional clinical data from

the ongoing Phase 1/2 trial of ALN-CC5 in PNH patients;

- Present initial ALN-AS1 data in

recurrent attack porphyria patients;

- Present initial ALN-TTRsc02 Phase 1

data;

- File a Clinical Trial Application for a

new Genetic Medicine program; and

- Consistent with guidance from The

Medicines Company, present initial Phase 2 data for ALN-PCSsc.

Upcoming RNAi Roundtables

- Alnylam plans to continue hosting its

series of online "RNAi Roundtables" in August, September, and

October. Upcoming events include:

- Fitusiran for the treatment of

hemophilia and rare bleeding disordersMonday, August 22, 10:30

– 11:45 am ET

- Akin Akinc, Ph.D., Vice President,

General Manager, Fitusiran

- Benny Sorensen, M.D., Ph.D., Senior

Director, Clinical Research

- Guest Speaker: Brian O’Mahony, Chief

Executive, Irish Haemophilia Society Ltd. and person living with

severe hemophilia B

- ALN-CC5 for the treatment of

complement-mediated diseasesWednesday, August 31, 11:00 am –

12:00 pm ET

- Jeff Miller, Vice President, General

Manager, CC5 Program

- Pushkal Garg, M.D., Senior Vice

President, Clinical Development

- Guest Speaker: Anita Hill, M.D.,

Ph.D., MRCP, FRCPath, Consultant Haematologist for Leeds

Teaching Hospitals NHS Trust, UK, and Lead for the National

PNH Service in England

- ALN-AS1 for the treatment of acute

hepatic porphyriasTuesday, September 13, 11:30 am – 12:45 pm ET

- John Maraganore, Ph.D., Chief Executive

Officer

- William Querbes, Ph.D., Associate

Director, Research

- Guest Speaker: Ariel Lager, living with

Acute Intermittent Porphyria

- ALN-GO1 for the treatment of primary

hyperoxaluria type 1 (PH1)Tuesday, September 27, 10:00 – 11:00

am ET

- Barry Greene, President and Chief

Operating Officer

- David Erbe, Ph.D., Director,

Research

- Guest Speaker: Sally-Anne Hulton, M.D.,

FRCPCH, MRCP, FCP, MBBCh, Consultant Paediatric Nephrologist and

Clinical Lead, Birmingham Children’s Hospital NHS Trust

- Guest Speaker: Jennifer Lawrence, M.D.

(mother of George Tidmore, a PH1 patient)

- ALN-HBV for the treatment of

hepatitis B virus (HBV) infectionTuesday, October 11, 9:00 am –

10:00 am ET

- Barry Greene, President and Chief

Operating Officer

- Laura Sepp-Lorenzino, Ph.D., Vice

President, Entrepreneur-in-Residence

- Guest Speaker: Heiner Wedemeyer, M.D.,

Managing Senior Physician and Assistant Professor in the Department

of Gastroenterology, Hepatology and Endocrinology at Hannover

Medical School

Additional details for the RNAi Roundtables will be provided at

www.alnylam.com/roundtables.

Financials

“Alnylam continues to maintain a strong balance sheet, ending

the second quarter of 2016 with approximately $1.28 billion in

cash,” said Michael Mason, Vice President, Finance and Treasurer.

“Our financial strength allows us to continue to invest in a broad

pipeline of investigational RNAi therapeutics across our three

STArs, aligned with achievement of our ‘Alnylam 2020’ goals. As for

financial guidance this year, we remain on track to end 2016 with

greater than $1.0 billion in cash, including $150.0 million in

restricted investments.”

Cash and Investments

At June 30, 2016, Alnylam had cash, cash equivalents and

marketable securities, and restricted investments of $1.28 billion,

as compared to $1.28 billion at December 31, 2015.

Credit Agreements

In April 2016, Alnylam entered into $150.0 million of term loan

agreements, related to the build out of the Company’s new

manufacturing facility, that mature in April 2021. Interest on the

borrowings is calculated based on LIBOR plus 0.45 percent. The

obligations under the term loan agreements are secured by cash

collateral in an amount equal to, at any given time, at least 100

percent of the principal amount of all term loans outstanding under

the agreements at such time.

GAAP Net Loss

The net loss according to accounting principles generally

accepted in the U.S. (GAAP) for the second quarter of 2016 was

$90.1 million, or $1.05 per share on both a basic and diluted basis

(including $15.8 million, or $0.18 per share of non-cash

stock-based compensation expense), as compared to a net loss of

$71.8 million, or $0.85 per share on both a basic and diluted basis

(including $10.2 million, or $0.12 per share of non-cash

stock-based compensation expense), for the same period in the

previous year.

Revenues

Revenues were $8.7 million in the second quarter of 2016 and

2015. Revenues for the second quarter of 2016 included $5.4 million

from the company’s alliance with Sanofi Genzyme and $3.3 million

from the company’s alliance with The Medicines Company. The company

expects net revenues from collaborators to increase during the

second half of 2016 due to an expected increase in expense

reimbursement from Sanofi Genzyme.

Research and Development Expenses

Research and development (R&D) expenses were $83.2 million

in the second quarter of 2016, which included $9.3 million of

non-cash stock-based compensation, as compared to $67.0 million in

the second quarter of 2015, which included $6.1 million of non-cash

stock-based compensation. The increase in R&D expenses for the

quarter ended June 30, 2016 as compared to the prior year period

was due primarily to higher compensation and related expenses and

non-cash stock-based compensation expenses resulting from a

significant increase in headcount during the period as the company

continues to advance and expand its development pipeline. In

addition, clinical trial and manufacturing and external services

expenses increased during the quarter ended June 30, 2016 as

compared to the quarter ended June 30, 2015 as a result of the

significant advancement of the company’s Genetic Medicine pipeline.

The company expects that R&D expenses during the second half of

2016 will increase compared to the first half of 2016 as it

continues to develop its pipeline and advance its product

candidates into clinical trials, but that such expenses will be

variable on a quarterly basis depending on the timing of

manufacturing batches, clinical trial enrollment, and non-cash

stock-based compensation expenses.

General and Administrative Expenses

General and administrative (G&A) expenses were $18.0 million

in the second quarter of 2016, which included $6.5 million of

non-cash stock-based compensation, as compared to $14.6 million in

the second quarter of 2015, which included $4.0 million of non-cash

stock-based compensation. The increase in G&A expenses for the

quarter ended June 30, 2016 as compared to the prior year period

was due primarily to an increase in compensation and related

expenses and non-cash stock-based compensation expense due to an

increase in headcount. The company expects that G&A expenses

during the second half of 2016 will remain relatively consistent

with the first half of 2016.

Conference Call Information

Management will provide an update on the company, discuss second

quarter 2016 results, and discuss expectations for the future via

conference call on Thursday, August 4, 2016 at 4:30 p.m.

ET. To access the call, please dial 877-312-7507 (domestic) or

631-813-4828 (international) five minutes prior to the start time

and refer to conference ID 56306704. A replay of the call will be

available beginning at 7:30 p.m. ET on August 4, 2016. To

access the replay, please dial 855-859-2056 (domestic) or

404-537-3406 (international), and refer to conference 56306704.

Sanofi Genzyme Alliance

In January 2014, Alnylam and Sanofi Genzyme, the specialty

care global business unit of Sanofi, formed an alliance to

accelerate and expand the development and commercialization of RNAi

therapeutics across the world. The alliance is structured as a

multi-product geographic alliance in the field of rare diseases.

Alnylam retains product rights in North

America and Western Europe, while Sanofi Genzyme obtained

the right to access certain programs in Alnylam's current and

future Genetic Medicines pipeline in the rest of the world (ROW)

through the end of 2019, together with certain broader

co-development/co-commercialization rights and global rights for

certain products. In the case of patisiran, Alnylam will advance

the product in North America and Western Europe,

while Sanofi Genzyme will advance the product in the ROW. In the

case of revusiran, Alnylam and Sanofi Genzyme will

co-develop/co-commercialize the product in North America and

Western Europe, while Sanofi Genzyme will advance the product in

the ROW. In the case of fitusiran, Sanofi Genzyme has elected to

opt into the program for its ROW rights, while retaining its

further opt-in right to co-develop and co-promote fitusiran with

Alnylam in North America and Western Europe, subject to certain

restrictions.

About RNAi

RNAi (RNA interference) is a revolution in biology, representing

a breakthrough in understanding how genes are turned on and off in

cells, and a completely new approach to drug discovery and

development. Its discovery has been heralded as “a major scientific

breakthrough that happens once every decade or so,” and represents

one of the most promising and rapidly advancing frontiers in

biology and drug discovery today which was awarded the 2006 Nobel

Prize for Physiology or Medicine. RNAi is a natural process of gene

silencing that occurs in organisms ranging from plants to mammals.

By harnessing the natural biological process of RNAi occurring in

our cells, the creation of a major new class of medicines, known as

RNAi therapeutics, is on the horizon. Small interfering RNA

(siRNA), the molecules that mediate RNAi and comprise Alnylam's

RNAi therapeutic platform, target the cause of diseases by potently

silencing specific mRNAs, thereby preventing disease-causing

proteins from being made. RNAi therapeutics have the potential to

treat disease and help patients in a fundamentally new way.

About LNP Technology

Alnylam has licenses to Arbutus LNP intellectual property for

use in RNAi therapeutic products using LNP technology.

About Alnylam Pharmaceuticals

Alnylam is a biopharmaceutical company developing novel

therapeutics based on RNA interference, or RNAi. The company is

leading the translation of RNAi as a new class of innovative

medicines. Alnylam's pipeline of investigational RNAi therapeutics

is focused in 3 Strategic Therapeutic Areas (STArs): Genetic

Medicines, with a broad pipeline of RNAi therapeutics for the

treatment of rare diseases; Cardio-Metabolic Disease, with a

pipeline of RNAi therapeutics toward genetically validated,

liver-expressed disease targets for unmet needs in cardiovascular

and metabolic diseases; and Hepatic Infectious Disease, with a

pipeline of RNAi therapeutics that address the major global health

challenges of hepatic infectious diseases. In early 2015, Alnylam

launched its "Alnylam 2020" guidance for the advancement and

commercialization of RNAi therapeutics as a whole new class of

innovative medicines. Specifically, by the end of 2020, Alnylam

expects to achieve a company profile with 3 marketed products, 10

RNAi therapeutic clinical programs - including 4 in late stages of

development - across its 3 STArs. The company's demonstrated

commitment to RNAi therapeutics has enabled it to form major

alliances with leading companies including Ionis, Novartis, Roche,

Takeda, Merck, Monsanto, The Medicines Company, and Sanofi Genzyme.

In addition, Alnylam holds an equity position in Regulus

Therapeutics Inc., a company focused on discovery, development, and

commercialization of microRNA therapeutics. Alnylam scientists and

collaborators have published their research on RNAi therapeutics in

over 200 peer-reviewed papers, including many in the world's top

scientific journals such as Nature, Nature Medicine, Nature

Biotechnology, Cell, New England Journal of Medicine, and The

Lancet. Founded in 2002, Alnylam maintains headquarters in

Cambridge, Massachusetts. For more information about Alnylam's

pipeline of investigational RNAi therapeutics, please visit

www.alnylam.com.

Alnylam Forward-Looking Statements

Various statements in this release concerning Alnylam's future

expectations, plans and prospects, including without limitation,

Alnylam's views with respect to the potential for RNAi

therapeutics, including patisiran, revusiran, fitusiran, ALN-CC5,

ALN-AS1, ALN-AAT, ALN-GO1, ALN-PCSsc, and ALN-HBV, its expectations

for the timing of filing of regulatory documents, its expectations

regarding the timing of clinical studies and the presentation of

clinical data, including for the ENDEAVOUR Phase 3 trial of

revusiran and its studies for fitusiran, ALN-CC5, ALN-AS1, ALN-AAT,

ALN-GO1 and ALN-TTRsc02, as well as The Medicines Company’s study

of ALN-PCSsc, its expected cash position as of December 31, 2016,

its expectations regarding its STAr pipeline growth strategy, its

“Alnylam 2020” guidance for the advancement and commercialization

of RNAi therapeutics, and its plans regarding the pursuit of

pre-clinical programs and commercialization of RNAi therapeutics,

constitute forward-looking statements for the purposes of the safe

harbor provisions under The Private Securities Litigation Reform

Act of 1995. Actual results and future plans may differ materially

from those indicated by these forward-looking statements as a

result of various important risks, uncertainties and other factors,

including, without limitation, Alnylam's ability to discover and

develop novel drug candidates and delivery approaches, successfully

demonstrate the efficacy and safety of its product candidates, the

pre-clinical and clinical results for its product candidates, which

may not be replicated or continue to occur in other subjects or in

additional studies or otherwise support further development of

product candidates for a specified indication or at all, actions or

advice of regulatory agencies, which may affect the design,

initiation, timing, continuation and/or progress of clinical trials

or result in the need for additional pre-clinical and/or clinical

testing, delays, interruptions or failures in the manufacture and

supply of our product candidates, obtaining, maintaining and

protecting intellectual property, Alnylam's ability to enforce its

intellectual property rights against third parties and defend its

patent portfolio against challenges from third parties, obtaining

and maintaining regulatory approval, pricing and reimbursement for

products, progress in establishing a commercial and ex-United

States infrastructure, competition from others using technology

similar to Alnylam's and others developing products for similar

uses, Alnylam's ability to manage its growth and operating

expenses, obtain additional funding to support its business

activities, and establish and maintain strategic business alliances

and new business initiatives, Alnylam's dependence on third parties

for development, manufacture and distribution of products, the

outcome of litigation, the risk of government investigations, and

unexpected expenditures, as well as those risks more fully

discussed in the "Risk Factors" filed with Alnylam's most recent

Quarterly Report on Form 10-Q filed with the Securities and

Exchange Commission (SEC) and in other filings that Alnylam

makes with the SEC. In addition, any forward-looking

statements represent Alnylam's views only as of today and should

not be relied upon as representing its views as of any subsequent

date. Alnylam explicitly disclaims any obligation, except to the

extent required by law, to update any forward-looking

statements.

The scientific information discussed in this news release

relating to Alnylam’s investigational therapeutics is preliminary

and investigative. None of Alnylam’s investigational therapeutics

have been approved by the U.S. Food and Drug Administration,

European Medicines Agency, or any other regulatory authority and no

conclusions can or should be drawn regarding the safety or

effectiveness of these therapeutics.

ALNYLAM PHARMACEUTICALS, INC.

UNAUDITED CONDENSED CONSOLIDATED

STATEMENTS OF COMPREHENSIVE LOSS

(In thousands, except per share

amounts)

Three Months EndedJune

30,

Six Months EndedJune 30,

2016 2015

2016 2015 Net

revenues from collaborators $ 8,709 $ 8,685 $ 16,054 $ 27,222

Operating expenses: Research and development 83,172

67,007 179,445 125,042 General and administrative 17,987

14,622 39,087 27,346 Total operating expenses

101,159 81,629 218,532 152,388 Loss

from operations (92,450) (72,944) (202,478)

(125,166)

Other income: Interest income 2,092 1,619

3,905 2,633 Other income (expense) 229 (27)

5,470 (27) Total other income 2,321 1,592

9,375 2,606 Loss before income taxes (90,129)

(71,352) (193,103) (122,560) Provision for income taxes —

(431) — — Net loss $ (90,129) $ (71,783) $

(193,103) $ (122,560) Net loss per common share - basic and diluted

$ (1.05) $ (0.85) $ (2.26) $ (1.47) Weighted-average common shares

used to compute basic and diluted net loss per common share

85,545 84,353 85,411 83,219

Comprehensive loss: Net loss $ (90,129) $ (71,783) $

(193,103) $ (122,560) Unrealized loss on marketable securities, net

of tax (18,331) (33,623) (26,555) (30,001)

Reclassification adjustment for realized

gain on marketable securities included in net loss

(954) — (6,110) — Comprehensive loss $

(109,414) $ (105,406) $ (225,768) $ (152,561)

ALNYLAM PHARMACEUTICALS, INC.

UNAUDITED CONDENSED CONSOLIDATED

BALANCE SHEETS

(In thousands, except share

amounts)

June 30, December 31,

2016

2015 Cash, cash equivalents and marketable securities $

1,130,299 $ 1,280,951 Restricted investments 150,000 — Billed and

unbilled collaboration receivables 9,514 8,298 Prepaid expenses and

other assets 23,623 18,030 Property and equipment, net 55,394

27,812 Investment in equity securities of Regulus Therapeutics Inc.

13,332 51,419

Total

assets $ 1,382,162 $ 1,386,510

Accounts payable, accrued expenses and other liabilities $ 52,152 $

46,886 Total deferred revenue 73,695 68,317 Total deferred rent

7,833 6,593 Long term debt 150,000 — Total stockholders’ equity

(85.6 million and 85.1 million common shares issued and outstanding

and at June 30, 2016 and December 31, 2015, respectively)

1,098,482 1,264,714

Total

liabilities and stockholders' equity $ 1,382,162

$ 1,386,510

This selected financial information should be read in

conjunction with the consolidated financial statements and notes

thereto included in Alnylam’s Annual Report on Form 10-K which

includes the audited financial statements for the year ended

December 31, 2015.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160804006243/en/

Alnylam Pharmaceuticals, Inc.(Investors and

Media)Christine Regan Lindenboom, 617-682-4340or(Investors)Josh

Brodsky, 617-551-8276

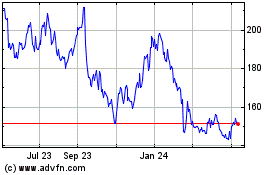

Alnylam Pharmaceuticals (NASDAQ:ALNY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Alnylam Pharmaceuticals (NASDAQ:ALNY)

Historical Stock Chart

From Apr 2023 to Apr 2024